- Home

- »

- Advanced Interior Materials

- »

-

Copper Pipes And Tubes Market Size & Share Report, 2030GVR Report cover

![Copper Pipes And Tubes Market Size, Share & Trends Report]()

Copper Pipes And Tubes Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Plumbing, HVAC, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-434-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Pipes And Tubes Market Summary

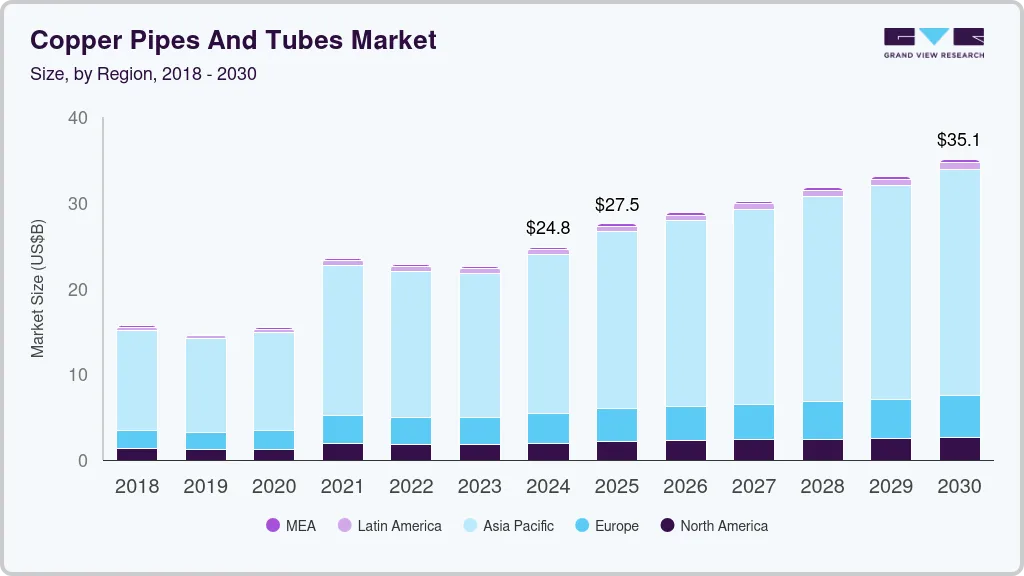

The global copper pipes and tubes market size was estimated at USD 24,805.1 million in 2024 and is estimated to grow at a CAGR of 4.9% from 2025 to 2030. Growing urbanization and industrialization in emerging economies on account of rising construction and infrastructure projects is expected to drive the market growth over the coming years.

Key Market Trends & Insights

- North America smart airports market dominated with the highest 45.18% share in 2023.

- By application, the HVAC held the largest revenue share of over 39% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 24,805.1 Million

- 2030 Projected Market Size: USD 35,052.7 Million

- CAGR (2025-2030): 4.9%

- North America: Largest market in 2023

Copper tubes and pipes are extensively used in building construction for plumbing, heating, and cooling systems due to their superior conductivity, durability, and resistance to corrosion. The expansion of commercial and residential buildings, alongside government initiatives to upgrade infrastructure is likely to drive the demand for copper tubes and pipes over the next 6 years.

Drivers, Opportunities & Restraints

The global push for energy-efficient solutions and advancements in Heating, Ventilation, and Air Conditioning (HVAC) is expected to fuel the demand for copper tubes and pipes. Copper's excellent thermal conductivity makes it a preferred choice for HVAC applications, contributing to more energy-efficient and sustainable cooling and heating systems. Additionally, rising focus on green buildings and energy-saving practices, use of copper pipes & tubes is expected to grow over the coming years.

The renewable energy sector also presents a significant opportunity for the copper tubes and pipes market. Copper's excellent conductivity makes it indispensable in the manufacturing of solar and wind energy systems. With government focus on greener energy sources, the demand for copper tubes and pipes in these applications is likely to increase over the coming years.

Price volatility for copper is one of the key challenge for market. Being a widely traded commodity, the price of copper can fluctuate due to various factors such as changes in mining output, global economic conditions, and trade policies. This volatility can make it difficult for manufacturers to predict costs and plan budgets, impacting their profitability. Moreover, advancements in materials technology, products like plastic and composite pipes are increasingly being used as substitutes for copper, particularly in plumbing applications.

Price Trends of Copper

The average LME price of copper witnessed a decline of 4.6% in June 2024 compared to the previous month to reach USD 9,677/ton, reversing the upward run of 7.0% that the red metal witnessed since March 2024. This decline can be attributed to building inventory levels at the London Metal Exchange and the Shanghai Futures Exchange. This is likely due to the Chinese Lunar New Year holiday, which resulted in a strong buildup of seasonal inventories, resulting in the highest levels of stock holding since 2020. The high inventory levels at the LME indicate a well-supplied market amid strong demand conditions, implying that the bearish trend in copper prices may not continue into the third quarter.

Application Insights

“HVAC held the largest revenue share of over 39% in 2023.”

Copper pipes and tubes are used in critical role in the HVAC systems due to their excellent thermal conductivity properties. They are ideal material to use in refrigerant lines in air conditioning systems, where they facilitate the efficient transfer of heat. Moreover, copper's resistance to corrosion extends the life of HVAC systems, ensuring they operate efficiently over long periods. The antimicrobial properties of copper also contribute to healthier indoor air quality by inhibiting the growth of bacteria, viruses, and other pathogens within the systems.

Copper pipes and tubes also found use in marine industry due to their natural resistance to biofouling and corrosion, particularly in saltwater environments. This resistance makes them ideal for use in shipbuilding and repair, particularly in systems such as seawater cooling, firefighting, hydraulic, and fuel lines, where durability and reliability are paramount. With growing focus on defense and expansion of shipbuilding industry, demand for copper tubes & pipes is expected to grow over the coming years.

Regional Insights

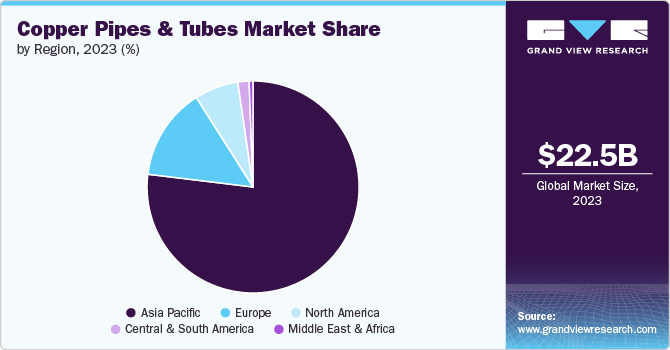

“Asia Pacific held over 77% revenue share of the global copper pipes and tubes market.”

Factors such as evolving construction norms and advancements in technology is likely to drive the demand for copper pipes & tubes in North America over the coming years. The market caters to a broad spectrum of industries such as construction, plumbing, HVAC and refrigeration.

U.S. Copper Pipes And Tubes Market Trends

The copper pipes and tubes market in the U.S. is likely to observe lucrative growth in the coming years, influenced by the rising demand in industries such as construction, HVAC, and plumbing. Manufacturers in the U.S. are focusing on innovations and eco-friendly solutions to cater to the growing market demands. This is anticipated to benefit the demand for copper products in the country.

Asia Pacific Copper Pipes And Tubes Market Trends

Asia Pacific is likely to observe significant growth in the copper tubes and pipes market, driven by the expanding construction industry, increasing urbanization, and rising demand for air conditioning systems in countries like China, India, and Japan. The rapid industrialization across the region further propels the demand for copper tubes used in various industrial applications due to their excellent thermal conductivity, resistance to corrosion, and high ductility.

Europe Copper Pipes & Tubes Market Trends

European producers are continuously innovating to align with stringent regulatory standards and environmental considerations, this is anticipated to benefit the market growth. Rise in urbanization, green building practices, and the integration of renewable energy systems are anticipated to provide boost to the Europe copper pipes & tubes market.

Key Copper Pipes And Tubes Company Insights

Some of key market participants include Mueller Industries Inc.; MM Kembla; Cambridge-Lee Industries LLC.; and LUVATA.

-

Mueller Industries Inc. specializes in the manufacture and distribution of copper, brass, aluminum, and plastic products, primarily used in the plumbing, HVAC, refrigeration, and industrial markets.

-

The Wieland Group is a leading company specializing in the production and processing of copper and copper-alloy products. The company was established in 1820. It provides solutions to automotive, electronics, and construction industries, focusing on sustainability and advanced technology.

Key Copper Pipes And Tubes Companies:

The following are the leading companies in the copper pipes and tubes market. These companies collectively hold the largest market share and dictate industry trends.

- Cambridge-Lee Industries LLC

- Cerro Flow Products LLC

- KME Group S.p.A.

- Kobe Steel

- LUVATA

- MetTube Berhad

- MM Kembla

- Mueller Industries Inc.

- Shanghai Metal Corporation

- Wieland Group

Recent Developments

-

In March 2024, Adani Enterprises announced USD 1.2 billion investment for copper plant. The company aims to setup 1 million ton capacity plant in 2 phases. The first phase has started and will produce 0.5 million tons of refined copper. The company has goals to reach full capacity of 1 million tons by FY 2029. The company also has plans to establish a subsidiary Kutch Copper Tubes to broaden its copper tubes portfolio and serve industries such as HVAC and plumbing.

Copper Pipes And Tubes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27,546.1 million

Revenue forecast in 2030

USD 35,052.7 million

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil

Key companies profiled

Mueller Industries Inc.; Wieland Group; Cambridge-Lee Industries LLC; Kobe Steel; MetTube Berhad; KME Group S.p.A.; MM Kembla; LUVATA; Cerro Flow Products LLC; Shanghai Metal Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Pipes And Tubes Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global copper pipes and tubes market report based on application and region:

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Plumbing

-

HVAC

-

Electrical & Electronics

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global copper pipes and tubes market size was estimated at USD 22.52 billion in 2023 and is expected to reach USD 24.81 billion in 2024.

b. The global copper pipes and tubes market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 35.05 billion by 2030.

b. By application, HVAC dominated the market with a revenue share of over 39.0% in 2023.

b. Some of the key vendors of the global copper pipes and tubes market are Mueller Industries Inc., Wieland Group, Cambridge-Lee Industries LLC, Kobe Steel, MetTube Berhad, KME Group S.p.A., MM Kembla, LUVATA, Cerro Flow Products LLC and Shanghai Metal Corporation

b. The key factor driving the growth of the global copper pipes and tubes market is the rising investments in energy-related industries and growing need for energy efficiency in HVAC systems

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.