- Home

- »

- Biotechnology

- »

-

Cord Blood Banking Services Market Size Report, 2030GVR Report cover

![Cord Blood Banking Services Market Size, Share & Trends Report]()

Cord Blood Banking Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Collection & Transportation, Processing), By Bank (Private, Public, Hybrid), By Component, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-611-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cord Blood Banking Services Market

The global cord blood banking services market was estimated at USD 26.99 billion in 2024 and is projected to reach USD 41.36 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The cord blood banking market is expected to experience significant changes owing to advancements in technology and increased awareness of the healing capabilities of cord blood stem cells.

Key Market Trends & Insights

- North America dominated the global cord blood banking services market with the largest revenue share of 42.5% in 2023.

- By service, the processing segment led the market, holding the largest revenue share in 2023.

- By component, the cord tissue segment is projected to expand at a significant CAGR from 2024 to 2030.

- By application, the cancer segment held the highest revenue share in 2023.

- By end use, the research institutes segment is projected to expand at the fastest CAGR from 2024 to 2030.

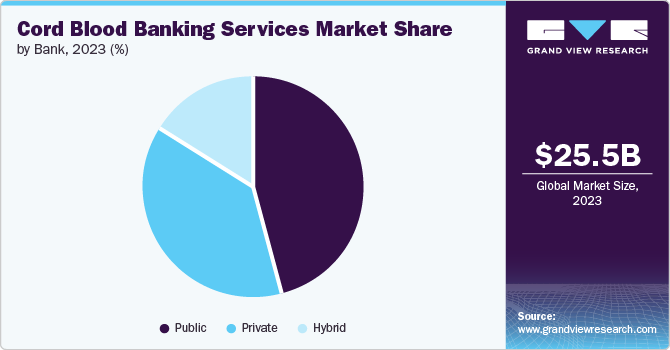

- By bank, the private segment held the highest revenue share of 45.5 in 2023.

Market Size & Forecast

- 2024 Market Size: USD 26.99 Billion

- 2030 Projected Market Size: USD 41.36 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2023

As personalized medicine gains more attention, there is a noticeable surge in the request for private cord blood banking services, enabling families to preserve a valuable biological asset for future medical interventions.

The increasing awareness of the benefits of cord blood containing stem cells is a significant factor fueling the growth of the cord blood banking service market. The rise in research and development activities in the biotechnology sector, coupled with the expanding applications of cord blood and stem cells in genetic disease treatment for curing various chronic diseases, is driving market growth. The widespread availability of service providers globally and the growing focus of federal agencies on establishing public banking units are additional factors influencing the market.

In addition, improved healthcare facilities, urban development, digitalization, increased awareness, and research and development, contribute to the growth of the cord blood banking service market. Moreover, the increasing prevalence of genetic disorders and advancements in biotechnology offer lucrative prospects for market participants.

Service Insights

In 2023, the processing segment dominated the market, attributed to the clinical trials, increasing research on cord blood and a rising incidence of hematological disorders contributing to the industry growth.

The storage segment is expected to witness a significant growth over the forecast period, owing to the increase in awareness among parents and the rising demand for storage of blood cord in public and private cord blood bank by parents to donate their newborn babies’ cord to hospitals for further use.

Component Insights

The cord blood segment dominated the market in 2023, owing to the rising awareness and adoption of stem cell therapies for a range of medical illness, including hematological disorders, immune system disorders and various type of cancer.

The cord tissue segment is expected to witness a significant growth over the forecast period. The growth is mainly driven by increasing awareness and interest of regenerative medicines and the potential of mesenchymal stem cells (MSC). Moreover, technological advancements and ongoing research in processing and storage techniques for cord tissue contribute to the expansion in cord blood banking services market.

Application Insights

Cancer dominated the market and accounted for largest share in 2023. Cord blood stems cells transplant has been proven effective in treating various diseases like leukemia, lymphoma and other chronic diseases which is anticipated to drive growth. Moreover, the rise in the prevalence of cancer is fueling the cord blood banking services market.

Blood disorder is expected to witness the fastest CAGR over the forecast period. With the increasing prevalence of blood-related disorders such as e leukemia, sickle cell anemia, and thalassemia, blood disorders have emerged as a significant segment in the cord blood banking services market.

End-use Insights

Hospitals dominated the market in 2023. The major key drivers are the increasing awareness of the importance of cord blood banking, rising disposable income and the infrastructural & technological developments of hospitals. The use of cord blood for treating life threatening diseases such as blood cancer and blood disorder has contributed to the growth of hospitals market share in the past.

Research institutes are expected to witness the fastest CAGR during the forecast period. Research institutes contribute to the development of innovative stem cell therapies and clinical protocols, providing new opportunities for cord blood banks.

Bank Insights

The private segment dominated the market and accounted for the largest market revenue share of 45.5% in 2023. When parents store their baby’s cord blood in private cord blood bank, they pay the charged amount and ongoing storage fees, and it is saved for their use. One of the major factors driving the market is, parents are over charged for the collection and storage of cord blood banks.

The public segment is expected to witness significant growth during the forecast period. The American Academy of Pediatrics recommends parents to donate cord blood banks to public unless a close family member is a potential recipient for cord blood stem cell transplantation.

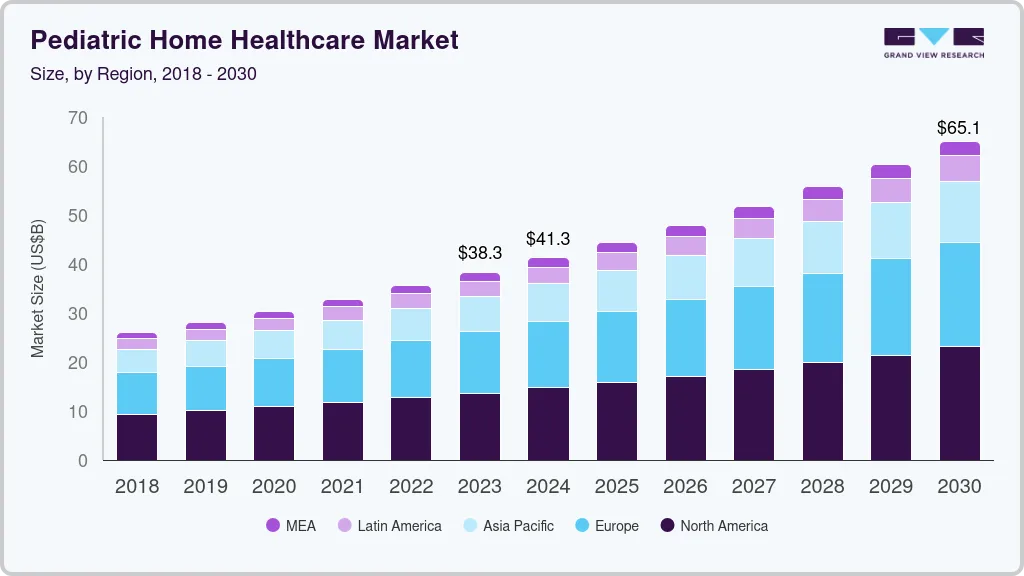

Regional Insights and Trends

In 2023, North America cord blood banking services market dominated the global market with a revenue share of 42.5%, owing to the availability of well-developed health infrastructure, rising awareness associated with available services and growing healthcare expenditure of the countries such as the U.S. & Canada. The rise in the prevalence of cancers such as leukemia and lymphomas as contributing to this growth. According to American cancer society, in 2024, about 20,800 people will be diagnosed with leukemia and about 11,220 people may die from leukemia and most of these cases will be in adult.

U.S Cord Blood Banking Services Market Trends

In 2023, the U.S. cord blood banking services emerged as a frontrunner, capturing a significant market of 9.57 billion, owing to the expanding application of cord blood & stem cells in treating various disease, increasing public awareness regarding the advantages of cord blood banking and a growing number of services providers in market. Furthermore, rising research and development activity by various research institutes present in the country is likely to contribute to the market growth.

Europe Cord Blood Banking Services Market Trends

The Europe cord blood banking services market held a significant market share in 2023. This growth can be attributed to a rising prevalence of chronic disease such as cancer and diabetes and the presence of well-established network of cord blood banks in the region.

The cord blood banking services market in Germany holds a prominent position in the Europe region. The growth of the cord blood banking industry is being fueled by higher rates of genetic abnormalities, supportive government regulations, increasing disposable income and healthcare expenditure.

The UK cord blood banking services market is expected to grow rapidly in the coming years owing to the presence of key companies in the region and high technological advancements.

Asia Pacific Cord Blood Banking Services Market Trends

The cord blood banking services market in Asia Pacific is projected to witness the fastest CAGR of 9.0% during the forecast period. The growth is driven by growing awareness of stem cell storage and improved healthcare policies in the region. Malaysia, India, Indonesia, and China have shown promising growth prospects for the cord blood banking services market. Efforts such as placing notice boards and charts in numerous hospitals and healthcare centers in these countries have significantly raised awareness on these services.

The China cord blood banking services market held the largest market share in 2023 owing to growing awareness among Chinese parents about the potential of stem cell therapies for various diseases. This is fueled by rising rates of chronic illness like cancer and diabetes. In addition, the presence of established cord blood banks with advanced storage facilities creates a robust infrastructure to support market growth.

India cord blood banking services market is expected to witness the fastest CAGR during the forecast period, owing to the growing disposable income and increasing awareness about the potential of cord blood banking for future medical needs. Furthermore, the rising burden of chronic disease such as cancer and blood disorders in India increases the demand for stem cell therapies.

Key Cord Blood Banking Services Company Insights

Some of the key companies in the cord blood banking services market include Global Cord Blood Corporation; CSG-BIO; Cryo-Cell International; California Cryobank Stem Cell Services LLC; CBR Systems Inc.

-

CBR Systems Inc has led the industry in technical innovations and provided families with access to current treatments and experimental stem cell therapies for conditions that have no cure.

Key Cord Blood Banking Services Companies:

The following are the leading companies in the cord blood banking services market. These companies collectively hold the largest market share and dictate industry trends.

- Global Cord Blood Corporation

- CBR Systems Inc.

- Cryo-Cell International

- Cordlife Group Limited

- AlphaCord LLC

- CSG-BIO

- California Cryobank Stem Cell Services LLC

- Cord Blood Foundation (Smart Cells International)

- Singapore Cord Blood Bank

- FamiCord

Recent Developments

-

In March 2024, Cryo-Cell announced the spin-off of Celle Corp. (its subsidiary) to maximize shareholder value.

-

In April 2022, Global Cord Blood Corporation announced that it would acquire Cellenkos, Inc. It was expected to be a 100% acquisition along with the rights to develop & commercialize its future and existing products except for the products related to Cellenkos’s existing collaboration with Incyte Corporation.

Cord Blood Banking Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.70 billion

Revenue forecast in 2030

USD 41.36 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, bank, component, application, end-use region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Global Cord Blood Corporation; CBR Systems Inc.; Cryo-Cell International; Cordlife Group Limited; AlphaCord LLC; CSG-BIO; California Cryobank Stem Cell Services LLC; Cord Blood Foundation (Smart Cells International); Singapore Cord Blood Bank; FamiCord;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cord Blood Banking Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cord blood banking services market report based on service, bank, component, application, end-use, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Collection & Transportation

-

Processing

-

Analysis

-

Storage

-

-

Bank Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cord Blood

-

Cord Tissue

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Genetic Disorders

-

Blood Disorders

-

Immune Deficiencies

-

Metabolic Disorders

-

Other Applications

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.