- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Corn And Corn Starch Derivatives Market Size Report, 2030GVR Report cover

![Corn And Corn Starch Derivatives Market Size, Share & Trends Report]()

Corn And Corn Starch Derivatives Market Size, Share & Trends Analysis Report By Product (Corn Starch, Corn Starch Derivatives, Corn Oil, Corn Flour, Corn Meal/Flakes/Grits), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-020-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

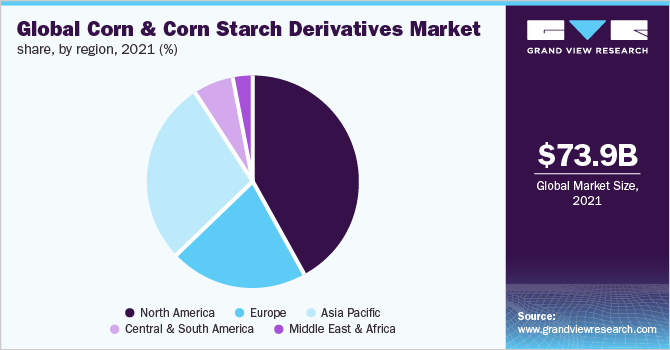

The global corn and corn starch derivatives market size was valued at USD 73,961.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2022 to 2030. This is owing to the rising demand for processed food products. Corn starch derivatives possess a wide range of functionalities, owing to which they are used as a texture agent, thickener, emulsifier, and many more in various food products. Thus, increasing product innovation and rising consumer expectations for better food items are poised to propel the demand for starch derivatives in the forecast period. Corn starch is widely used in different industries such as food and beverage, adhesives, oil-well drilling, paper and printing, laundry, air flotation, pharmaceuticals, foundry, and textiles. Factors such as population growth and industrial development are accelerating the demand for industrial starch in the market.

COVID-19 had a moderate impact on the market; lockdowns enforced by governments and trade restrictions affected the availability of raw materials, thus creating a supply chain disruption in the market. During the pandemic, fluctuations in raw material prices were witnessed, causing ample margin pressure for paper packaging producers. The North American containerboard industry witnessed several rounds of price increases, owing to the increasing price of raw materials such as starch and fiber.

Growing urbanization and changing lifestyle have increased the demand for healthy snacks and corn-based baked products to be consumed in leisure time. It is also used as a thickening agent in food items such as sauces, gravies, soups, and custards. This factor is influencing food manufacturers to introduce new products in the market to fulfill consumer demand, driving the product demand in the foreseeable timeframe. Furthermore, the availability of corn-based bakery products with an extended shelf life as well as accessibility to freezer storage conditions in retail bakeries is further driving the demand for the corn starch market.

Cornmeal is considered one of the staples and traditional food among Americans. It is used to provide puffiness to corn products such as corn-based pancakes, tortillas, and cornbread. Moreover, cornmeal and flakes are highly used in beer production in the U.S. In North America, corn is used as a common adjunct in mass beer production, as well as used up to 20% of the grist. Thus, the increasing number of breweries in the U.S. is also expected to propel market growth in the forecast period.

Product Insights

The corn starch derivatives segment had the largest market share in 2021, accounting for 60.9% of the global revenue. Corn syrup is used to retain moisture in food items as well as used as a sweetener to enhance the flavor. It also enhances the texture and volume, as well as improves the stability and shelf life of the food items, owing to which it is highly used in the food & beverage industry as well as the pharmaceutical industry.

Maltodextrin is a kind of carbohydrate that is frequently used as a sugar-free ingredient in food products owing to its low glycemic index. Thus, products loaded with maltodextrin (sugar) can be legally claimed to be sugar-free, and this factor is raising its demand in the forecast period. Moreover, the increasing number of diabetes patients across the globe, coupled with the rising health cautiousness among consumers, is raising the demand for sugar-free products, thus further accelerating the product demand.

The demand for modified starch in the corn & corn starch derivatives industry is anticipated to expand at a CAGR of 5.3% between 2022 and 2030. Modified starch provides maximum adhesive performance as well as superior strength at a very low cost for various applications. It is used in laminating paper-to-paper as well as paper-to-polymer. Thus, the increasing demand for paper bags to have a sustainable environment is expected to propel the demand for modified starch in the foreseeable timeframe.

Application Insights

The food and beverage segment dominated the market and accounted for a revenue share of 73.3% in 2021. Paper and board held a significant market share in the application segment and accounted for a substantial revenue share in 2021. Corn starch is broadly used as raw material in various industries. It is one of the important raw materials in paper making industry and is used as a filler and sizing agent. Corn starch is used to manufacture folding cartons, graphic paper, containerboard, and many more. Its adhesive property helps to bind liner board and corrugated medium, as well as helps in the conversion of sheets into boxes.

The U.S. is one of the leading producers of corn, owing to which domestic paper and board industry prefer to use corn starch instead of any other raw material such as tapioca, potato, etc. Currently, corn starch is used for 95% of paper packaging in the US, because of local availability. Moreover, the developing global packaging industry is also affecting market growth positively. In developed nations, shifting of rural population to urban cities for jobs or study purposes is raising the demand for packaging products, and this factor has raised the product demand in the market.

Regional Insights

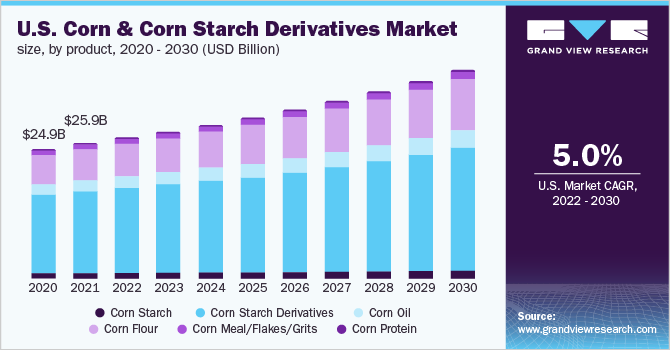

The market size of corn and corn starch derivatives in North America stood at USD 31,293.2 million in 2021 and is anticipated to expand at a CAGR of 5.0% over the forecast period. Changing lifestyles have created a demand for alternatives to traditional homemade food items, driving the demand for processed and packaged foods. The rising demand for ready-to-eat meals and innovation in bakery products is anticipated to boost market growth. Moreover, the increasing adoption of cornmeal in the animal feed industry is further propelling the market growth during the forecast period.

According to the U.S. Energy Information Administration, since 2008, ethanol usage has increased in the country largely due to the fuel blending requirements of the Renewable Fuel Standard program. This factor raised the importance of ethanol in the country owing to increasing gasoline demand. According to Renewable Fuels Association, the U.S.'s existing ethanol production capacity is approximately 17,436 million gallons per year. In this, the majority of the ethanol produced is from corn starch due to the abundant availability of raw materials. This factor has raised the demand for corn starch in the domestic market.

Europe's corn and corn starch derivatives market was valued at USD 15,502.4 million in 2021 and is expected to reach USD 25,158.1 million by 2030, expanding at a CAGR of 5.6% over the forecast period. Corn starch is used to produce bioplastics as it exhibits properties similar to available commercial packaging materials. Thus, a shifting preference among Europeans due to environmental concerns and rising demand for bioplastics in flexible packaging is expected to propel the market growth in the forecast period. However, the availability of cheaper alternatives is likely to hinder the market’s growth.

Key Companies & Market Share Insights

The corn and corn starch derivatives market is fragmented in nature with the key players focused on increasing the consumer base in various applications. These expansion plans include innovative product launches as well as increasing the production capacity to cater to the increasing product demand. Some of the key players include ADM, Cargill, Ingredion, Tate & Lyle, Agrana Group, Roquette Frères, and Wacker Chemie AG. For instance, in December 2022, ADM announced that it will invest to expand its starch production at its Marshall, Minnesota facility. This expansion will help the company to cater to the fast-growing demand from the food and beverage sectors, as well as help support the continued expansion of the company’s BioSolutions platform. Some of the key companies in the global corn and corn starch derivatives market include:

-

ADM

-

Cargill

-

Ingredion

-

Tate & Lyle

-

Agrana Group

-

Roquette Frères

-

Wacker Chemie AG

-

National Starch & Chemical Company

-

Ashland

-

Fibersol

Corn And Corn Starch Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 77,430.6 million

Revenue forecast in 2030

USD 118.0 billion

Growth rate

CAGR of 5.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Thailand; Australia & New Zealand; Brazil; South Africa

Key companies profiled

ADM; Cargill; Ingredion; Tate & Lyle; Agrana Group; Roquette Frères; Wacker Chemie AG; National Starch and Chemical Company; Ashland; Fibersol.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corn And Corn Starch Derivatives Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global corn and corn starch derivatives market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Corn Starch

-

Corn Starch Derivatives

-

Modified Starch

-

Corn Syrup

-

Maltodextrin

-

Corn Ethanol

-

Others

-

-

Corn Oil

-

Corn Flour

-

Corn Meal/Flakes/Grits

-

Corn Protein

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverage

-

Animal feed

-

Paper And Board

-

Pharmaceutical

-

Biodiesel

-

Textiles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Corn & Corn Starch Derivatives market size was estimated at USD 73,961.8 million in 2021 and is expected to reach USD 77,430.6 million in 2022.

b. The global Corn & Corn Starch Derivatives market is expected to grow at a compound annual growth rate of 5.4% from 2022 to 2030 to reach USD 118 billion by 2030.

b. North America dominated the market with a share of 42.3% in 2021. The rising demand for ready-to-eat meals and innovation in bakery products is anticipated to boost the market growth

b. Some of the key players in Corn & Corn Starch Derivatives market include ADM, Cargill, Ingredion, Tate & Lyle, Agrana Group, Roquette Frères, and Wacker Chemie AG.

b. Growing urbanization and changing lifestyle have increased the demand for healthy snacks and corn-based baked products consumed in leisure time. It is also used as a thickening agent in food items such as sauces, gravies, soups, and custards. This factor is influencing food manufacturers to introduce new products in the market to fulfill consumer demand, driving the product demand in the foreseeable timeframe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."