- Home

- »

- Next Generation Technologies

- »

-

Corporate Learning Management System Market Report, 2030GVR Report cover

![Corporate Learning Management System Market Size, Share & Trends Report]()

Corporate Learning Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-590-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Corporate Learning Management System Market Summary

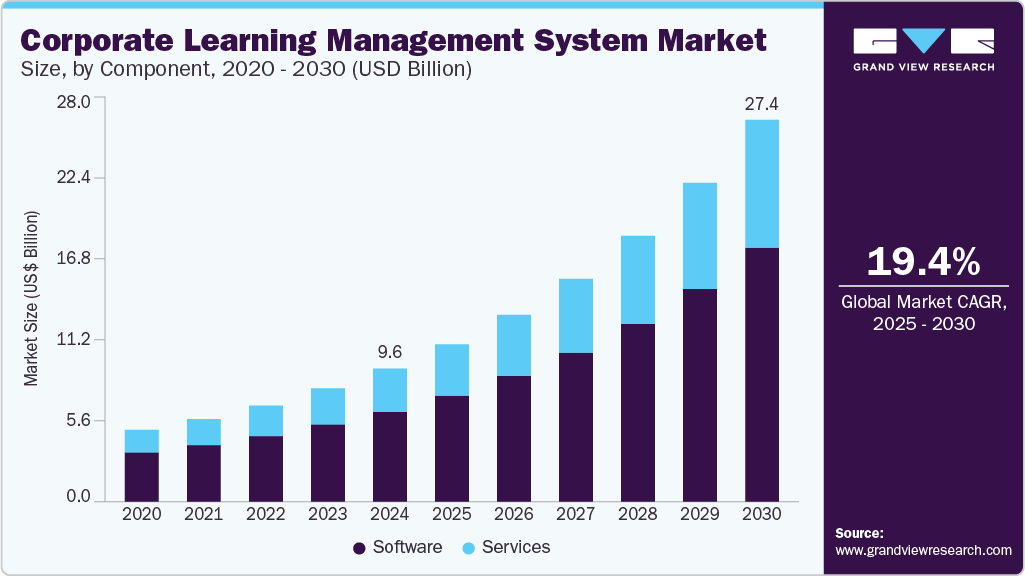

The global corporate learning management system market size was estimated at USD 9.57 billion in 2024 and is projected to reach USD 27.43 billion by 2030, growing at a CAGR of 19.4% from 2025 to 2030. The corporate learning management system industry is witnessing significant growth as organizations increasingly invest in digital training infrastructure to support employee development.

Key Market Trends & Insights

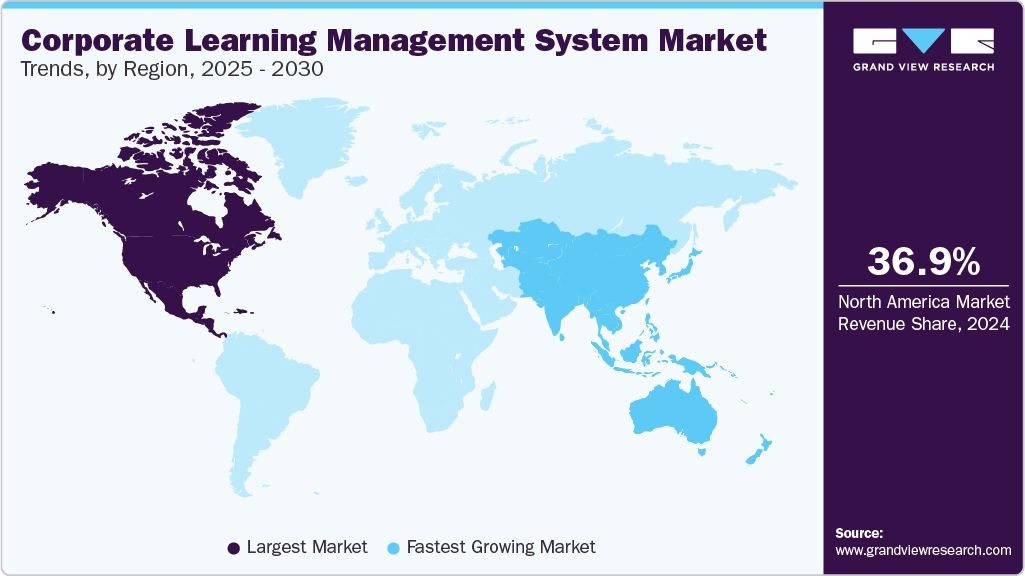

- North America accounted for the highest share of the corporate learning management system (LMS) market, with over 36.9% of the global revenue share in 2024.

- The Asia Pacific corporate learning management system (LMS) industry is anticipated to register the fastest CAGR over the forecast period.

- Based on component, the software segment led the corporate LMS market in 2024, accounting for over 67.9% share of the global revenue.

- Based on deployment, the cloud segment held the largest revenue share in 2024.

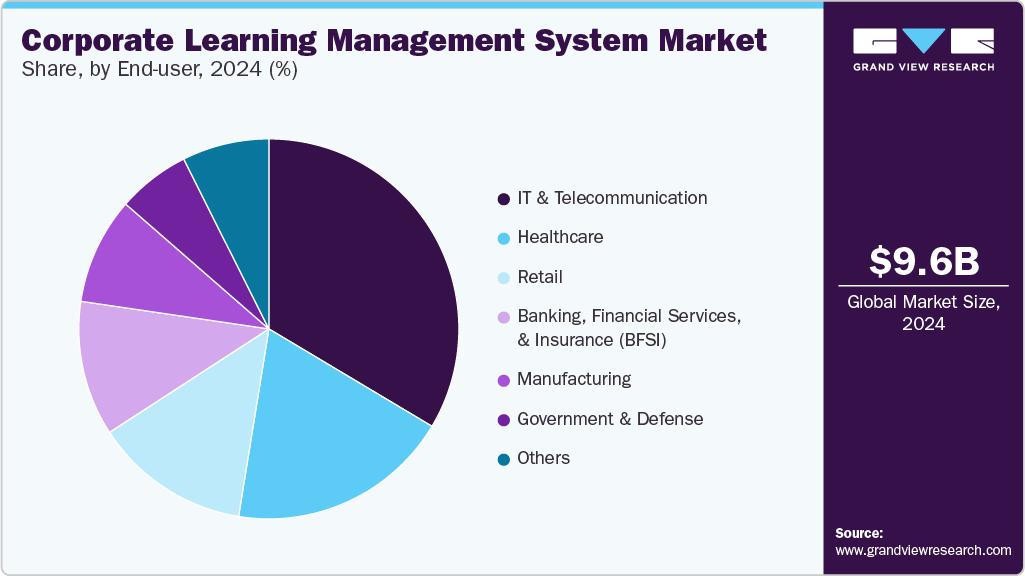

- Based on end-user, the IT and telecommunication segment dominated the market with a significant revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.57 Billion

- 2030 Projected Market Size: USD 27.43 Billion

- CAGR (2025-2030): 19.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The shift toward remote and hybrid work models has accelerated the adoption of cloud-based learning management system (LMS) platforms, allowing companies to deliver consistent and accessible training to distributed teams. This trend is particularly strong in industries with strict compliance requirements or rapidly changing skill needs, such as healthcare, finance, IT, and manufacturing.

Corporate LMS adoption in the corporate sector is a growing need for upskilling and reskilling. As automation and digital transformation reshape job roles, companies are leveraging LMS tools to close skill gaps and align employee capabilities with evolving business demands. The LMS has evolved from a static course repository into a dynamic platform that supports interactive, personalized, and performance-driven learning experiences.

Moreover, modern corporate LMS platforms are increasingly integrated with technologies like artificial intelligence and analytics to deliver tailored learning paths, track employee progress, and provide insights into training effectiveness. These features enable HR and L&D departments to design more strategic and impactful learning programs. Mobile learning and microlearning are also shaping the future of corporate training. Employees prefer short, flexible content that can be accessed on demand, especially via mobile devices. LMS providers are responding with mobile-optimized platforms and engaging formats such as video modules, simulations, and gamified lessons.

Component Insights

The software segment led the corporate LMS market in 2024, accounting for over 67.9% share of the global revenue. The segment is growing due to enhanced technological features in chatbot software, like mobile platform compatibility, cloud-based deployment, interference engine, multilingual capabilities, Natural Language Processing (NLP), Application Programming Interface (API), and single point of search.Compared to rule-based chatbots, artificial intelligence software-powered chatbots are the most sophisticated since machine-learning chatbots are typically more conversational, data-driven, and predictive. No matter how the inquiries are expressed, the AI software-based chatbots cannot only comprehend the patient's intent but also provide precise responses. For instance, they can schedule consultations and use a symptom checker to diagnose the illness.

The service segment is expected to grow at a CAGR of 20.2% over the forecast period. The service component in corporate language learning management plays a critical role in ensuring the effectiveness, scalability, and personalization of language programs. It includes instructional support, content customization, progress tracking, and administrative coordination. Services such as onboarding, needs analysis, and learner assessments help tailor learning paths to business goals. Continuous support via tutors, coaches, or AI-driven platforms fosters engagement and retention. Integration with HR systems enables performance alignment and reporting. Technical support ensures smooth delivery across platforms. Additionally, periodic reviews and feedback loops enhance program relevance. These services collectively improve learning outcomes and ROI for corporations.

Deployment Insights

The cloud segment held the largest revenue share of the corporate learning management system (LMS) industry in 2024. Cloud deployment in corporate language learning management enables scalable, on-demand access to training resources across global teams. It facilitates centralized content delivery, ensuring consistent learning experiences regardless of location. With real-time data analytics, HR and L&D teams can track learner progress, assess engagement, and tailor content. Integration with enterprise systems (e.g., HRIS, CRM) enhances automation and efficiency. Cloud platforms also support mobile learning, crucial for remote or hybrid workplaces. Enhanced data security and compliance features meet corporate governance standards. Cost-effectiveness arises from reduced infrastructure needs and pay-as-you-go models. Overall, cloud deployment accelerates language skill development while aligning with corporate digital transformation strategies.

The on-premises segment is expected to grow at a significant CAGR over the forecast period. On-premise deployment in corporate language learning management offers full control over data security, making it ideal for organizations with strict compliance or regulatory needs. It allows for extensive customization to align with internal systems and specific training workflows. Companies maintain direct ownership of infrastructure, enabling tailored updates and integration. However, it requires significant IT resources for maintenance, support, and scalability. Offline access may be more reliable in locations with limited internet connection. While it provides strong internal data governance, initial setup costs are higher compared to cloud solutions. It suits large enterprises with complex IT environments or sensitive data handling. Overall, it prioritizes security and control over flexibility and scalability.

End User Insights

The IT and telecommunication segment dominated the corporate learning management system (LMS) market with a significant revenue share in 2024. The need for seamless global collaboration and customer service drives the growth. Multinational teams rely on language skills to enhance cross-border communication and reduce misinterpretations in technical documentation and client interactions. These organizations often adopt AI-powered and cloud-based learning platforms for scalability, personalization, and real-time progress tracking. Integration with internal HR and LMS systems allows tailored training paths aligned with job roles and regional needs. Cybersecurity awareness has also prompted secure language learning environments. Moreover, upskilling in English and other key languages supports competitive positioning in outsourcing and global support functions. Mobile-accessible content and microlearning formats are preferred to suit dynamic work schedules. Overall, language learning fosters agility, operational efficiency, and stronger client engagement.

The healthcare segment is expected to witness significant growth over the forecast period. In the healthcare sector, Language Learning Management Systems (LLMS) are increasingly adopted to enhance communication between staff and patients from diverse linguistic backgrounds. These systems support compliance with regulatory requirements related to patient care and safety. For multinational healthcare providers, LLMS ensures consistent training across regions. It also facilitates the onboarding of non-native employees and improves staff collaboration. With medical terminology being complex, specialized language modules are vital. Hospitals use LLMS to reduce interpretation errors and improve patient satisfaction. Moreover, the rise in telehealth demands clear communication, further emphasizing language training. LLMS in healthcare also aids in meeting accreditation standards and boosting overall operational efficiency.

Regional Insights

North America accounted for the highest share of the corporate learning management system (LMS) market, with over 36.9% of the global revenue share in 2024. The corporate LMS market in North America is experiencing prominent growth, driven by increasing globalization, multilingual workforce demands, and the need for consistent brand messaging across regions. Corporations are investing in LMS solutions to streamline translation workflows, enhance cross-border collaboration, and comply with localization standards. The rise of e-learning, remote work, and AI-powered language tools further accelerates adoption. Key sectors fueling this growth include technology, healthcare, and legal services.

Europe Corporate Learning Management System Market Trends

The corporate learning management system (LMS) industry in Europe is being shaped by the continent's emphasis on cultural preservation and multilingual inclusivity. European companies are prioritizing seamless communication with diverse internal teams and external stakeholders, leading to a rise in centralized language platforms. The EU’s support for digital language infrastructure, especially under initiatives like CEF eTranslation, is also propelling adoption. Additionally, regional enterprises are leveraging LMS tools to expand into non-English-speaking markets more efficiently.

Asia Pacific Corporate Learning Management System Market Trends

The Asia Pacific corporate learning management system (LMS) industry is anticipated to register the fastest CAGR over the forecast period. Corporate LMS is experiencing steady growth, driven by increasing globalization, multilingual workforces, and cross-border business operations. Companies are adopting LMS to enhance communication efficiency, compliance, and employee training across diverse linguistic regions. The rise of remote and hybrid work models further fuels demand for scalable digital language solutions. Additionally, regulatory requirements and diversity initiatives are prompting firms to invest in structured language management strategies.

Key Corporate Learning Management System Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Teledyne FLIR designs, develops, manufactures, markets, and distributes SWIR technologies that enhance perception and awareness. The company brings innovative sensing solutions into daily life through thermal imaging, visible-light imaging, video analytics, measurement and diagnostics, and advanced threat detection systems. Teledyne FLIR offers a diversified portfolio that serves a number of applications in government & defense, industrial, and commercial markets. The company’s products help first responders and military personnel protect and save lives, promote efficiency within the trades, and innovate consumer-facing technologies.

-

Hamamatsu Photonics develops and manufactures advanced optical sensors, including high-speed and high-sensitivity photomultiplier tubes. The company produces photodiodes, photo ICs, image sensors, and various opto-semiconductor devices. It also creates specialized systems for life science, medical, and semiconductor industries. Additionally, Hamamatsu designs high-power semiconductor lasers and conducts fundamental and applied research on light. The Global Strategic Challenge Center drives long-term strategic initiatives to ensure sustainable growth.

Key Corporate Learning Management System Companies:

The following are the leading companies in the corporate learning management system market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Adobe

- Oracle

- SAP

- Hermes Logistics Technologies

- McGraw Hill

- Emphasis

- Xerox Corporation

- Berlitz Corporation

- Speexx

- Blackboard Inc.

Recent Developments

-

In March 2024, Accenture launched Accenture LearnVantage, a comprehensive technology learning and training platform designed to help clients and their employees rapidly reskill and upskill in technology, data, and AI. Backed by a $1 billion investment over three years and the acquisition of Udacity, LearnVantage delivers personalized, AI-powered learning experiences and industry-specific training at scale. The platform collaborates with leading technology and learning partners to address critical skills gaps, empowering organizations to achieve greater business value in the AI economy.

-

In September 2023, Hermes Logistics Technologies launched the Hermes Learning Management System (LMS), the first digital training platform tailored for the air cargo industry. This innovative LMS centralizes training content, enabling users to enhance digital proficiency, streamline onboarding, and optimize software implementation. Already praised by customers like Groundforce Portugal, the LMS sets a new standard for efficient, cost-effective training in air cargo operations.

Corporate Learning Management System Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11.32 billion

Revenue forecast in 2030

USD 27.43 billion

Growth Rate

CAGR of 19.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Accenture; Adobe; Oracle; SAP; Hermes Logistics Technologies; McGraw Hill; Emphasis; Xerox Corporation; Berlitz Corporation; Speexx; Blackboard Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corporate Learning Management System Market Report Segmentation

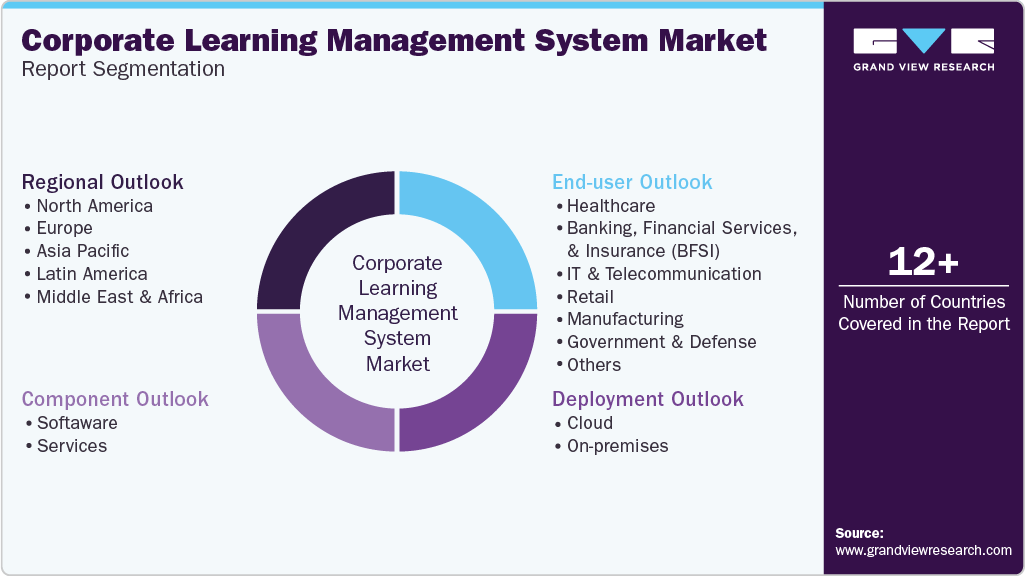

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global corporate learning management system market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunication

-

Retail

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE (United Arab Emirates)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global corporate learning management system market size was estimated at USD 9,572.9 million in 2024 and is expected to reach USD 27,426.3 million in 2025.

b. The global corporate learning management system market is expected to grow at a compound annual growth rate of 19.4% from 2025 to 2030 to reach USD 27,426.3 million by 2030.

b. North America dominated the corporate learning management system market with a share of 36.97% in 2024. The corporate Learning Management System (LMS) market is witnessing significant growth as organizations increasingly invest in digital training infrastructure to support employee development. The shift toward remote and hybrid work models has accelerated the adoption of cloud-based LMS platforms, allowing companies to deliver consistent and accessible training to distributed teams

b. Some key players operating in the corporate LMS market include Accenture; Adobe; Oracle; SAP; Hermes Logistics Technologies; McGraw Hill; Emphasis; Xerox Corporation; Berlitz Corporation; Speexx; Blackboard Inc.

b. Key factors that are driving the market growth include corporate LMS adoption in the corporate sector is the growing need for upskilling and reskilling. As automation and digital transformation reshape job roles, companies are leveraging LMS tools to close skill gaps and align employee capabilities with evolving business demands

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.