- Home

- »

- Next Generation Technologies

- »

-

Crypto ATM Market Size And Share Analysis Report, 2030GVR Report cover

![Crypto ATM Market Size, Share & Trends Report]()

Crypto ATM Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (One Way, Two Way), By Offering (Hardware, Software), By Coin Type (Bitcoin, Dogecoin, Ethereum, Litecoin), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-699-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crypto ATM Market Summary

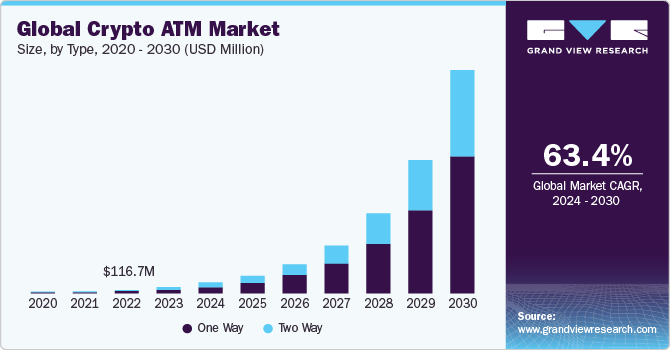

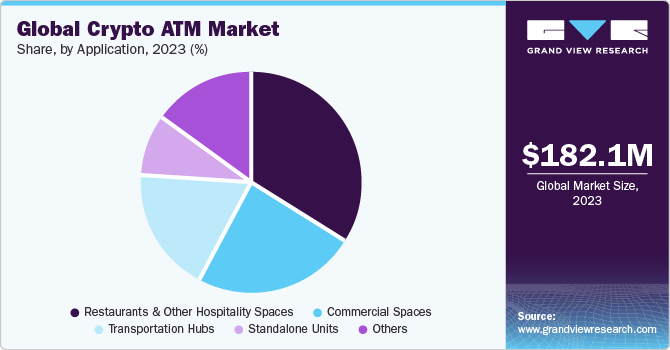

The global crypto ATM market size was estimated at USD 182.1 million in 2023 and is projected to reach USD 5.45 billion by 2030, growing at a CAGR of 63.4% from 2024 to 2030. The market's growth can be attributed to the rising popularity of digital currencies among individuals without conventional banking services who prefer cash transactions.

Key Market Trends & Insights

- The crypto ATM market in North America dominated the global industry in 2023 and accounted for a share of 45.8%.

- The U.S. crypto ATM market is expected to grow at a significant CAGR of 60.5% from 2024 to 2030.

- By type, the one-way segment led the market and accounted for a share of 66.9% in 2023.

- By application, the restaurants & other hospitality spaces segment dominated the market in 2023.

- By offering, the hardware segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 182.1 Million

- 2030 Projected Market Size: USD 5.45 Billion

- CAGR (2024-2030): 63.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Crypto ATMs provide a convenient way for users to purchase cryptocurrencies using physical cash. Furthermore, these ATMs provide the flexibility to send money globally without requiring a bank account, convert digital assets into traditional currency, and allow for cash withdrawals via ATMs. In addition, the increasing acceptance of cryptocurrencies in various countries contributes significantly to the favorable prospects of the crypto ATM market.

The resurgence of crypto ATMs across the globe is also one of the major factors anticipated to propel market growth. For instance, as of July 2023, according to Coin ATM Radar, an online Bitcoin ATM map, the net change in the number of Crypto ATMs had been positive in the past three months. The crypto ATM net numbers reported were 1,694 in May 2023, 560 in June 2023, and 387 in July 2023. Moreover, installing crypto ATMs in public places, such as airports, is expected to drive market growth. Crypto ATMs add to the flexibility of options available to customers.

Companies in the crypto ATM sector are focusing on developing innovative technologies to provide faster withdrawal and minimize fees. For instance, in November 2023, Athena Bitcoin Global, a Bitcoin ATM operator, and Genesis Coin, a Bitcoin ATM software platform provider, announced their partnership to enable Lightning Network technology for their technology infrastructure across Latin America and EI Salvador. The introduction of Lightning Network as an alternative presents a significant improvement for customers utilizing Chivo-branded and Athena Bitcoin kiosks in the region, offering swifter withdrawals and reduced fees. This upgrade will be deployed gradually, commencing with the integration into Chivo Bitcoin ATMs in El Salvador. By the end of December 2023, a hundred machines had been equipped with Lightning Network capabilities, and the remaining kiosks will follow suit in the first quarter of 2024.

The shift in consumer behavior towards more convenient and accessible ways to buy and sell digital assets through crypto ATMs is also a major factor contributing to the market's growth. These Crypto ATMs offer user-friendly methods for individuals to buy and sell cryptocurrencies using fiat currency. The market has witnessed a proliferation of these machines across diverse locations, including shopping malls, convenience stores, and financial districts, thereby contributing to the mainstream acceptance of cryptocurrencies.As consumers increasingly prioritize simplicity and immediacy in their financial interactions, the widespread adoption of crypto ATMs reflects a fundamental shift towards more accessible means of engaging with digital assets.

However, the lack of knowledge about blockchain technology and cryptocurrency in some parts of the globe is anticipated to restrain the market's growth. As traditional financial institutions grapple with evolving regulatory frameworks and face challenges in adapting to the fast-paced crypto ecosystem, individuals and businesses are turning to crypto ATMs for their simplicity and accessibility. This trend suggests a democratization of financial services, allowing a broader demographic to participate in the crypto space without the need for extensive technical knowledge or reliance on traditional banking channels. Furthermore, the proliferation of crypto ATMs is not only facilitating greater inclusivity but also fostering a more decentralized financial landscape, fundamentally reshaping the way people interact with money worldwide.

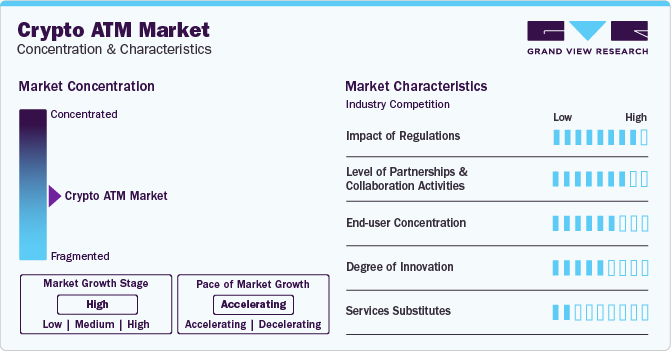

Market Concentration & Characteristics

The industry growth stage is high, and the pace of its growth is accelerating. Ongoing technological advancements, particularly in blockchain and digital currency infrastructure, are reshaping the landscape of crypto ATMs. These innovations contribute to making cryptocurrency transactions more seamless, accessible, and user-friendly for individuals and businesses. Key drivers of innovation within the crypto ATM sector include improvements in security protocols, expanded data analytics capabilities, and the integration of cutting-edge technologies into transaction processes.

The crypto ATM industry is characterized by a high level of product launch activities by the leading and emerging players. Leading companies are actively launching new crypto ATM offerings to provide convenient access to digital assets and solidify their industry position globally.

Governments in several countries are proactively implementing regulations and offering incentives to encourage the widespread adoption of crypto ATMs. This strategic approach aims to promote financial inclusion, enhance digital financial services, and ensure a secure and regulated environment for cryptocurrency transactions.

The crypto ATM industry has some indirect substitutes in the form of online cryptocurrency exchanges and peer-to-peer trading platforms. However, the unique aspect of physical accessibility to cryptocurrencies through ATMs positions it as a distinctive and evolving sector. As demand for crypto ATM solutions grows and technological advancements continue, there is potential for alternative methods of accessing cryptocurrencies to emerge, presenting innovative ways to facilitate digital asset transactions seamlessly.

The crypto ATM industry displays a high level of integration into various locations, reflecting the increasing deployment of cryptocurrency services within diverse settings. Businesses and public spaces are adopting crypto ATMs as they seamlessly integrate digital asset transactions into everyday activities. This integration eliminates the need for users to rely solely on online platforms, providing a more cohesive and user-friendly experience for those seeking to buy or sell cryptocurrencies.

Type Insights

The one-way segment led the market and accounted for a share of 66.9% in 2023. Leading cryptocurrencies, such as Bitcoin, are gaining popularity as a hedge to traditional currency. Moreover, the ability to make profits through capital appreciation and staking is expected to drive cryptocurrency purchases. A rise in the purchase of cryptocurrency is expected to drive the segment's growth as one-way ATMs allow users to purchase cryptocurrencies securely. Furthermore, according to the Coin ATM Finder, more than 66% of the crypto ATMs are one-way ATMs, which bodes well for the segment's growth.

The two-way segment growth is expected to be driven by the growing demand from customers for two-way crypto ATMs. According to GENERAL BYTES s.r.o., a manufacturer of crypto ATMs, two-way machines dominate the crypto ATMs outside of the U.S. and Canada. For instance, Europe has around 70% of all ATMs installed as two-way ATMs. Furthermore, the increasing launches of two-way ATMs worldwide are anticipated to drive the segment's growth.

Application Insights

The restaurants & other hospitality spaces segment dominated the market in 2023. Restaurants and bars increasingly invest in crypto ATMs to generate extra income by hosting crypto ATMs. The crypto ATM allows users to buy and sell cryptocurrencies like fiat currency ATMs, increasing footfall at public places, including restaurants, bars, and cafes. By installing ATMs on their premises, hotels and restaurants aim to cater to tech-savvy customers who prefer the security afforded by digital currencies. Moreover, the adoption of cryptocurrency ATMs aligns with broader efforts to innovate within the hospitality sector, enhancing the overall guest experience and thereby contributing to the growth of the segment.

The growth of the commercial spaces segment can be attributed to the usage of crypto ATMs at commercial places, which is expected to increase customer convenience and payment options. For instance, in April 2023, Jackson Food Stores, a prominent convenience store chain, announced installing online Bitcoin ATMs in 80 of its outlets in the U.S. The crypto ATMs would enable customers to use cash to purchase Bitcoin and would be installed in every state where Jackson Food Stores operates.

Offering Insights

The hardware segment dominated the market in 2023. Crypto ATM providers sell hardware that can be integrated with existing traditional ATMs. This integration allows financial institutions and businesses to expand their services by offering cryptocurrency buying and selling capabilities alongside traditional banking services. Moreover, the rising demand for hardware components from cryptographic ATM manufacturers to build ATMs is further expected to contribute to the segment’s growth.

The growing concern about reducing the risks of fraudulent activities is a significant factor driving the software segment's growth. Crypto ATM manufacturers are partnering with the compliance solution offering companies to improve the KYC process. Moreover, crypto ATM providers are leveraging partnerships with software companies to improve accessibility. For instance, in June 2023, crypto ATM company Bitcoinmat partnered with smart contract platform provider Callisto Network to improve accessibility to cryptocurrency assets.

Coin Type Insights

The Bitcoin segment dominated the market in 2023. The growing popularity of Bitcoin, owing to its rising acceptance as a payment method, is anticipated to drive the segment's growth. For instance, in August 2023, Binance, a provider of blockchain and cryptocurrency infrastructure, launched Binance Pay, offering local merchants a fresh payment alternative poised to attract novel customers, reduce costs, and increase processing speed. Binance Pay represents a contactless, borderless, and secure method for cryptocurrency payments, accommodating over 70 digital currencies, such as bitcoin (BTC), BNB, ether (ETH), and USDT. Users encounter zero fees, while merchants and service providers can embrace a payment solution that swiftly transfers funds from one wallet to another in mere seconds.

Litecoin can be mined using personal computers, and the Litecoin blockchain can handle higher transaction volume than Bitcoin, which is anticipated to propel the demand for Litecoin cryptocurrency. The ability to handle high transaction volume results in merchants getting faster confirmation times, influencing several merchants to accept Litecoin in payment. Moreover, in 2023, as per the Crypto Payments Growth report, Litecoin continued to sustain its popularity, retaining the third most utilized currency position, comprising 9.5% of total transactions, aligning with its dominant presence in 2022. Furthermore, there was a notable 39.7% annual surge in the volume of payments conducted with Litecoin.

Regional Insights

The crypto ATM market in North America dominated the global industry in 2023 and accounted for a share of 45.8%. The presence of the players, such as Covault and Coinme across the region is anticipated to drive regional growth. Crypto ATMs in North America offer support for multiple cryptocurrencies beyond Bitcoin. Users can access digital assets like Ethereum, Litecoin, and Bitcoin Cash. Furthermore, the U.S. has many cryptocurrency owners, which bodes well for the regional market's growth. For instance, according to Coinbase, 20% of Americans own cryptocurrency.

U.S. Crypto ATM Market Trends

The U.S. crypto ATM market is expected to grow at a significant CAGR of 60.5% from 2024 to 2030. The U.S. has seen a surge in blockchain-related developments, ranging from decentralized applications (dApps) to blockchain-based financial services, thereby contributing to the country's growth.

The crypto ATM market in Canada is expected to grow at a significant CAGR from 2024 to 2030. The market in Canada is experiencing a notable uptrend, driven by an increasing demand for convenient and accessible avenues for cryptocurrency transactions.

Asia Pacific Crypto ATM Market Trends

The Asia Pacific crypto ATM market is expected to grow at the highest CAGR over the forecast period. The regional market growth can be attributed to the rising expansion of companies in Asia Pacific. For instance, in October 2023, Localcoin, a Bitcoin ATM manufacturer, announced its international expansion across Australia. The company launched an initial set of 35 machines in prominent strategic locations in October. This strategic maneuver signifies Localcoin's expansion beyond North American borders, positioning it not only as a frontrunner in Canada but also aiming to establish a significant presence in the global cryptocurrency space. Furthermore, the growing awareness of cryptocurrency among consumers in Asia Pacific is expected to propel regional market growth.

The crypto ATM market in Australia is expected to grow at a significant CAGR of 71.6% from 2024 to 2030. The market growth in Australia is driven by increasing investments in crypto ATM infrastructure and favorable government initiatives.

The Thailand crypto ATM market is anticipated to grow at a significant CAGR from 2024 to 2030. A surge in cryptocurrency adoption and increasing awareness among the Thai population contribute significantly to the growing demand for accessible digital asset services.

Europe Crypto ATM Market Trends

The crypto ATM market in Europe is expected to grow at a significant CAGR from 2024 to 2030 due to positive regulatory policies observed in nations like the UK, Germany, and France, coupled with substantial investments in blockchain technologies.

The Germany crypto ATM market is expected to grow at a significant CAGR of 66.1% from 2024 to 2030. The strategic placement of crypto ATMs in major urban hubs underscores the market's response to the rising demand for convenient access to digital assets in Germany.

The crypto ATM market in France is expected to grow at a significant CAGR from 2024 to 2030. The rising interest in decentralized finance and the broader adoption of cryptocurrencies fuel the demand for accessible on-ramps like crypto ATMs in France.

MEA Crypto ATM Market Trends

The Middle East & Africa (MEA) crypto ATM market is expected to grow at a significant CAGR from 2024 to 2030. The uptake of cryptocurrency ATMs in MEA is on the rise, mirroring a rising enthusiasm for digital assets. These ATMs offer convenient access for users to trade cryptocurrencies, indicating a growing interest in decentralized finance.

The crypto ATM market in South Africa is expected to grow at a significant CAGR from 2024 to 2030. Crypto ATMs in South Africa provide enhanced accessibility, thereby serving as vital entry points for users to interact with cryptocurrencies, signaling a notable shift towards decentralized financial options across the country.

Key Crypto ATM Company Insights

Some of the key players operating in the market include Genesis Coin Inc., GENERAL BYTES s.r.o.; and Lamassu Industries AG.

-

General Bytes s.r.o., a key player in the financial technology sector, distinguishes itself through its innovative solutions in the field of cryptocurrency and blockchain technology. Focused on providing advanced and user-friendly products, General Bytes specializes in developing cryptocurrency ATMs and point-of-sale terminals. The company's forward-thinking approach leverages cutting-edge technologies, including blockchain and decentralized finance, to redefine the landscape of digital transactions

-

Lamassu Industries AG, one of the prominent players, facilitates convenient exchanges between fiat currency and Bitcoin. With a focus on user-friendly design and robust security measures, Lamassu Industries AG’s ATMs have achieved better growth, expanding their presence in shopping centers, airports, and financial hubs worldwide. This widespread deployment underscores the company’s pivotal role in promoting mainstream adoption of cryptocurrencies by enhancing accessibility and usability for both new and seasoned users

ChainBytes LLC., Bitstop, and Covault are some of the emerging market companies in the crypto ATM market.

-

Covault stands out as an emerging company in the digital currency sector, specializing in solutions related to cryptocurrency ATM networks. Their focus revolves around ensuring convenient and secure access to various digital assets for both individual and corporate users. Through their platform, Covault aims to simplify cryptocurrency transactions while maintaining a strong commitment to security and accessibility

-

Bitstop is a company specializing in solutions related to Bitcoin ATMs. Its focus revolves around providing accessible avenues for individuals and businesses to engage with cryptocurrencies seamlessly. Bitstop likely prioritizes compliance and security, ensuring its ATMs adhere to regulatory standards and offer robust protection against potential risks

Key Crypto ATM Companies:

The following are the leading companies in the crypto ATM market. These companies collectively hold the largest market share and dictate industry trends.

- GENERAL BYTES s.r.o.

- Genesis Coin Inc.

- Lamassu Industries AG

- bitcovault.com

- Bitaccess Inc

- Coinme

- Coinsource

- Bitstop

- Byte Federal, Inc

- Cryptomat

Recent Developments

-

In September 2023, Olliv, a prominent fintech company driven by cryptocurrency, announced its official expansion into New Zealand, becoming the country's first Bitcoin ATM operator. Renowned for its network of 4,500 Bitcoin ATMs, the company had planned to broaden its presence within Aotearoa throughout 2023, advancing its mission to elevate individuals to reach their full potential by linking them to the global digital economy

-

In August 2023, Byte Federal, Inc., a Bitcoin ATM network company, announced its official launch in Australia. The company is committed to delivering customers a smooth, secure, and user-friendly experience as they explore the ever-evolving realms of cryptocurrencies and blockchain technologies

-

In January 2023, Genesis Coin Inc., a Bitcoin ATM operator, announced its acquisition by the founders of Bitstop, a crypto ATM technology provider. Established in 2013, Genesis Coin's software facilitates around 35% of global Bitcoin ATM transactions. With over 75 operators and 12,000 Bitcoin ATMs across the U.S. and international markets, the combined entities represent a substantial force, driving billions of dollars in annual sales volume

-

In May 2022, Coinsource, an ATM provider in the U.S., announced its partnership with the Kwik Trip, a gas station brand, and convenience stores to launch 800 Bitcoin ATMs across Minnesota, Wisconsin, Illinois, and Iowa. Coinsource implements an 11% fee nationwide, offering precise, up-to-date Bitcoin prices inclusive of any associated mining fees for transaction completion. In addition, Kwik Trip rewards members are eligible for extra discounts at select participating locations

Crypto ATM Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 286.7 million

Revenue forecast in 2030

USD 5.45 billion

Growth rate

CAGR of 63.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, offering, coin type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Australia; Thailand; South Korea; Singapore; Taiwan; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

GENERAL BYTES s.r.o.; Genesis Coin Inc.; Lamassu Industries AG; bitcovault.com; Bitaccess Inc.; Coinme; Coinsource; Bitstop; Byte Federal, Inc; Cryptomat

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crypto ATM Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global crypto ATM market report based on type, offering, coin type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

One Way

-

Two Way

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Coin Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bitcoin

-

Dogecoin

-

Ethereum

-

Litecoin

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Spaces

-

Restaurants & Other Hospitality Spaces

-

Transportation Hubs

-

Standalone Units

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crypto ATM market size was estimated at USD 182.1 million in 2023 and is expected to reach USD 286.7 million in 2024.

b. The global crypto ATM market is expected to grow at a compound annual growth rate of 63.4% from 2024 to 2030 to reach USD 5.45 billion by 2030.

b. North America dominated the crypto ATM market with a share of 45.77% in 2023. This is attributable to the presence of significant players in North America, such as Bitcoin Depot, Coin Cloud, and CoinFlip, among others.

b. Some key players operating in the crypto ATM market include GENERAL BYTES s.r.o.; Genesis Coin Inc.; Lamassu Industries AG; bitcovault.com; Bitaccess Inc.; Coinme; Coinsource; Bitstop; Byte Federal, Inc; and Cryptomat.

b. Key factors that are driving the crypto ATM market growth include rising fund transfers in developing countries and increasing installations of crypto ATMs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.