- Home

- »

- Next Generation Technologies

- »

-

Crypto ATM Market Size, Share And Growth Report, 2030GVR Report cover

![Crypto ATM Market Size, Share & Trends Report]()

Crypto ATM Market Size, Share & Trends Analysis Report By Type (One Way, Two Way), By Offering, By Coin Type (Bitcoin, Dogecoin, Ethereum, Litecoin), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-699-7

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global crypto ATM market size was estimated at USD 116.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 62.5% from 2023 to 2030. The market's growth can be attributed to the growing adoption of cryptocurrencies among people who do not have a bank account and prefer using cash. Emerging as an attractive alternative, customers can purchase cryptocurrencies using cash at crypto ATMs. Furthermore, crypto ATMs allow customers to remit money abroad without needing a bank account, convert cryptocurrency into fiat currency, and allow cash withdrawal through ATMs. Furthermore, the legalization of cryptocurrency across several countries is also one of the major factors that bode well for the growth of the market for crypto ATMs.

The resurgence of crypto ATMs across the globe is also one of the major factors anticipated to propel the growth of the crypto ATM market over the forecast period. For instance, as of July 2023, according to Coin ATM Radar, an online Bitcoin ATM map, the net change in the number of Crypto ATMs had been positive in the past three months. The crypto ATM net numbers reported were 1,694 in May 2023, 560 in June 2023, and 387 in July 2023. Moreover, installing crypto ATMs at public places such as airports is expected to drive growth. Crypto ATMs add to the flexibility of options available to customers.

Crypto ATM companies are witnessing rising investment interest and capital flows, enabling them to raise capital for overall expansion. For instance, in August 2022, a Crypto ATM firm, Bitcoin Depot, merged with GSR II Meteora Acquisition Corp. in a USD 885 million deal. The merger resulted in Bitcoin Depot being listed on the NASDAQ stock exchange on 3 July 2023 making it accessible to the general public for investments through the secondary market. The stock price of Bitcoin Depot surged 12% on debut and provides an attractive way to gain exposure to the market for crypto ATM.

The growing popularity of cryptocurrencies across the globe is also expected to drive market growth over the forecast period. U.S. is the leader in the number of crypto ATMs, with 30,714, according to Coin ATM Radar. According to Chainalysis 2022 Global Crypto Adoption Index, cryptocurrency adoption is also rising in emerging countries such as Vietnam, the Philippines, and Thailand, all of which feature in the top 10 countries for cryptocurrency adoption. The growing landscape for cryptocurrencies globally would allow individuals and businesses to participate in the global economy without the need for traditional financial intermediaries.

However, the lack of knowledge about blockchain technology and cryptocurrency in some parts of the globe is anticipated to restrain the market's growth. In addition, the higher transaction fees charged by the operators to the users are also expected to hinder the market's growth. For instance, according to Coinsource, the average online Bitcoin ATM fee ranges from 11% to 25% of the transaction. The challenges to the crypto ATM market growth were observed in the initial months of 2023 when the number of new crypto ATMs installed witnessed a decline due to a market downturn and geopolitical tensions around the world.

COVID-19 Impact Analysis

The COVID-19 pandemic has played a crucial role in driving market growth. The COVID-19 pandemic boosted investments in Bitcoin and other virtual currencies by people finding ways to stay afloat financially. According to a survey of U.S. adults conducted by the Pew Research Center in 2021, 16% of Americans say they have used, invested, or traded cryptocurrency. Moreover, 24% of respondents have heard a lot about cryptocurrency, which is expected to increase the adoption of cryptocurrency and propel the market’s growth.

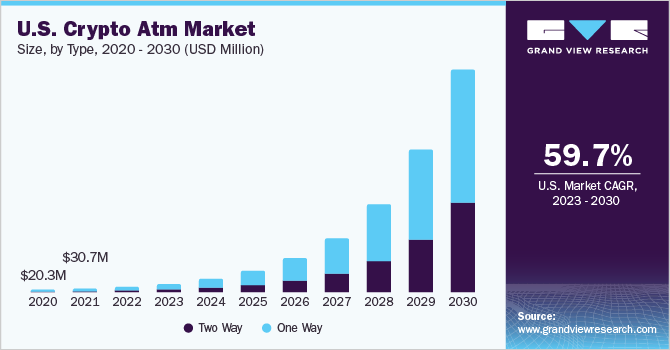

Type Insights

The one way segment dominated the market in 2022 and accounted for more than 67.0% of the global revenue share. Leading cryptocurrencies such as Bitcoin are gaining popularity as a hedge to traditional currency. Moreover, the ability to make profits through capital appreciation and staking is expected to drive cryptocurrency purchases. The increase in the purchase of cryptocurrency is expected to drive the segment's growth as one way ATMs allow users to purchase cryptocurrencies securely. Furthermore, according to the Coin ATM Finder, more than 66% of the crypto ATMs are one way ATMs which bodes well for the segment's growth.

The two way segment is anticipated to witness the fastest growth over the forecast period. The segment is expected to be driven by the growing demand from customers for two way crypto ATMs. According to GENERAL BYTES s.r.o., a manufacturer of crypto ATMs, two way machines dominate the crypto ATMs outside of the U.S. and Canada. For instance, Europe has around 70% of all ATMs installed as two-way ATMs. Furthermore, the increasing launches of two way ATMs worldwide are also anticipated to drive the segment's growth.

Offering Insights

The hardware segment dominated the market in 2022 and accounted for more than 77.0% of the global revenue share. Crypto ATM providers sell hardware that can be integrated with existing traditional ATMs. This integration allows financial institutions and businesses to expand their services by offering cryptocurrency buying and selling capabilities alongside traditional banking services. Moreover, the rising demand for hardware components from cryptographic ATM manufacturers to build ATMs is further expected to contribute to the segment’s growth.

The software segment is expected to grow fastest over the forecast period. The growing concern about reducing the risks of fraudulent activities is a significant factor driving the segment's growth. Crypto ATM manufacturers are partnering with the compliance solution offering companies to improve the KYC process. Moreover, crypto ATM providers are leveraging partnerships with software companies to improve accessibility. For instance, in June 2023, crypto ATM company Bitcoinmat partnered with smart contract platform provider Callisto Network to improve accessibility to cryptocurrency assets.

Coin Type Insights

The Bitcoin segment accounted for the highest revenue share of more than 31.0% in 2022. The growing popularity of Bitcoin, owing to its rising acceptance as a payment method, is anticipated to drive the segment's growth. For instance, in September 2022, a software-as-a-service e-commerce platform BigCommerce announced its partnership with CoinPayments and Bitpay, enabling merchants to accept Bitcoin and other cryptocurrency payments. Furthermore, in May 2022, fashion giant Gucci started accepting cryptocurrency payments, including Bitcoin, in some of its stores, which grew to over 70% of stores accepting crypto payments.

The Litecoin segment is anticipated to register significant growth over the forecast period. Litecoin can be mined using personal computers, and the Litecoin blockchain can handle higher transaction volume than Bitcoin, which is anticipated to propel the demand for Litecoin cryptocurrency. The ability to handle high transaction volume results in merchants getting faster confirmation times, influencing several merchants to accept Litecoin in payment. For instance, in February 2022, Sling TV partnered with Bitpay to accept cryptocurrencies such as Bitcoin, Ethereum, and Litecoin as payment from customers for monthly subscriptions. As of September 2022, more than 30,000 crypto ATMs in the U.S. support Litecoin, which bodes well for the segment's growth.

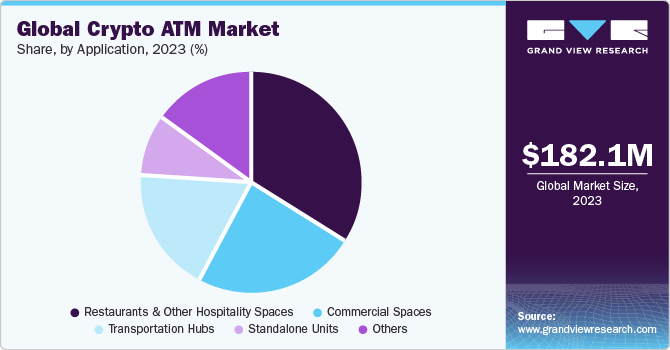

Application Insights

The restaurants & other hospitality spaces segment accounted for the highest revenue share of over 33.0% in 2022. Restaurants and bars increasingly invest in crypto ATMs to generate extra income by hosting crypto ATMs. The crypto ATM allows users to buy and sell cryptocurrencies like fiat currency ATMs, increasing footfall at public places, including restaurants, bars, and cafes. For instance, in August 2022, Canadian online Bitcoin ATM provider HoneyBadger Enterprises installed a crypto ATM at Pangea Pod Hotel in Sunrise Alley in Whistler. The increasing installation of crypto ATMs at restaurants and hotels propels the segment's growth.

The commercial spaces segment is anticipated to grow at the fastest CAGR over the forecast period. Using crypto ATMs at commercial places is expected to increase customer convenience and payment options. For instance, in April 2023, Jacksons Food Stores, a prominent convenience store chain, announced installing online Bitcoin ATMs in 80 of its outlets in the U.S. The crypto ATMs would enable customers to use cash to purchase Bitcoin and would be installed in every state where Jacksons Food Stores operates.

Regional Insights

North America dominated the crypto ATM market in 2022, accounting for over 44.0% of global revenue. The presence of the players such as Covault and Coinme across the region is anticipated to drive the regional growth. Crypto ATMs in North America offer support for multiple cryptocurrencies beyond Bitcoin. Users can access digital assets like Ethereum, Litecoin, and Bitcoin Cash. Furthermore, the U.S. has many cryptocurrency owners, which bodes well for the regional market's growth. For instance, according to Coinbase, 20% of Americans own cryptocurrency.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The regional growth can be attributed to the growing expansion of the market players into the Asia Pacific region. For instance, in March 2022, Intellogate, a Ukraine-based crypto ATM manufacturer, announced the expansion of its services across Asia in association with Publish, a South Korean blockchain service provider, and Lincrux, a kiosk producer. Furthermore, the growing awareness of cryptocurrency among consumers in the Asia Pacific is also expected to propel the regional growth over the forecast period.

Key Companies & Market Share Insights

The market is competitive due to the presence of various prominent players. The key players are seeking to expand operations through mergers and acquisitions. Moreover, players are driving innovation using technology to gain market share. For instance, in March 2023, Bullet Blockchain Inc., a SaaS company, illustrated the same by announcing the use of its Bitcoin ATM technology by TekX Mining and Gaming PC Solutions LLC. This was a result of a licensing agreement between the two, and TekX Mining and Gaming PC Solutions LLC would pay a royalty for the technology. The partnership seeks to expand the number of online Bitcoin ATM kiosks across the U.S.

Furthermore, the players are constantly aiming to develop and launch new capabilities and functionalities. For instance, in April 2023, a Bitcoin ATM company, CoinFlip, launched Olliv, a self-custody platform. The self-custodial platform provides a seamless way for customers to buy, sell, and swap cryptocurrency assets. Some prominent players in the global crypto ATM market include:

-

GENERAL BYTES s.r.o.

-

Genesis Coin Inc.

-

Lamassu Industries AG

-

Covault

-

Bitaccess Inc.

-

Coinme

-

Coinsource

-

Bitstop

-

Orderbob

-

Cryptomat

Crypto ATM Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 182.1 million

Revenue forecast in 2030

USD 5,451.0 million

Growth rate

CAGR of 62.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, offering, coin type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Australia; Thailand; South Korea; Singapore; Taiwan; Brazil; Mexico; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

GENERAL BYTES s.r.o.; Genesis Coin Inc.; Lamassu Industries AG; Covault; Bitaccess Inc.; Coinme; Coinsource; Bitstop; Orderbob; Cryptomat

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crypto ATM Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global crypto ATM market report based on type, offering, coin type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

One Way

-

Two Way

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Coin Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bitcoin

-

Dogecoin

-

Ethereum

-

Litecoin

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Spaces

-

Restaurants & Other Hospitality Spaces

-

Transportation Hubs

-

Standalone Units

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crypto ATM market size was estimated at USD 116.7 million in 2022 and is expected to reach USD 182.1 million in 2023.

b. The global crypto ATM market is expected to grow at a compound annual growth rate of 62.5% from 2023 to 2030 to reach USD 5,451.0 million by 2030.

b. North America dominated the crypto ATM market with a share of 44.81% in 2022. This is attributable to presence of significant players in North America such as Bitcoin Depot, Coin Cloud, and CoinFlip, among others.

b. Some key players operating in the crypto ATM market include GENERAL BYTES s.r.o.; Genesis Coin Inc.; Lamassu Industries AG; Covault; Bitaccess Inc.; Coinme; Coinsource; Coin ATM Radar; Orderbob; Cryptomat.

b. Key factors that are driving the crypto ATM market growth include rising fund transfers in developing countries and increasing installations of crypto ATMs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."