- Home

- »

- Next Generation Technologies

- »

-

Crypto Wallet Market Size And Share, Industry Report, 2033GVR Report cover

![Crypto Wallet Market Size, Share & Trends Report]()

Crypto Wallet Market (2025 - 2033) Size, Share & Trends Analysis Report By Wallet Type (Hot Wallet, Cold Wallet), By Operating System (Android, iOS, Others), By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-986-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Crypto Wallet Market Summary

The global crypto wallet market size was estimated at USD 12.59 billion in 2024 and is expected to reach USD 100.77 billion by 2033, growing at a CAGR of 26.3% from 2025 to 2033. One of the fundamental growth drivers for the market is the widespread adoption of cryptocurrencies as a legitimate asset class.

Key Market Trends & Insights

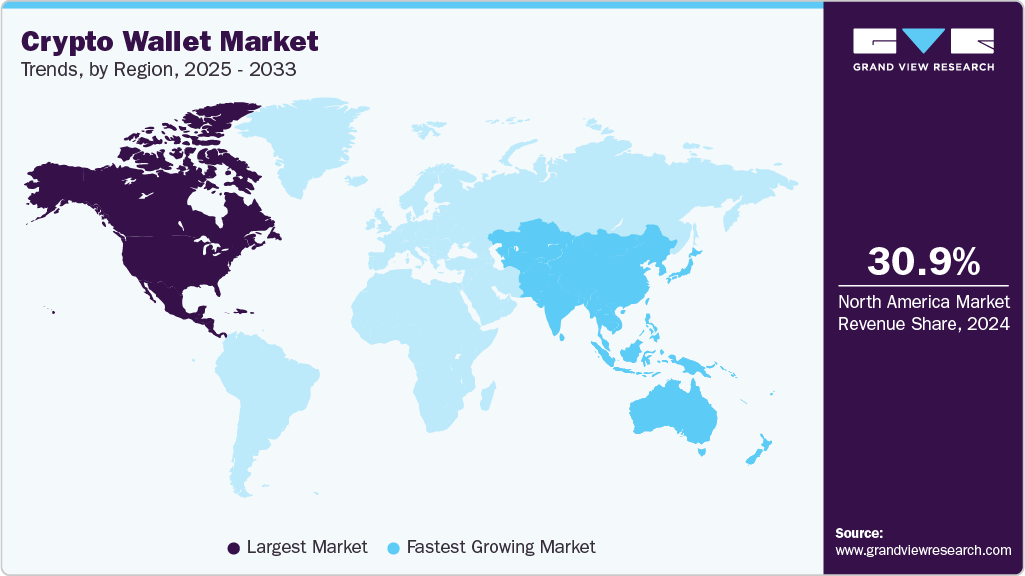

- North America dominated the crypto wallet market in 2024 and accounted for a revenue share of 30.9%.

- The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

- By wallet type, the hot wallets segment dominated the market in 2024 and had a revenue share of 56.0%.

- By operating system, the android segment dominated the market in 2024

- By application, the trading segment dominated the market in 2024

Market Size & Forecast

- 2024 Market Size: USD 12.59 Billion

- 2033 Projected Market Size: USD 100.77 Billion

- CAGR (2025-2033): 26.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As cryptocurrencies gain recognition from both individual investors and institutional players, the need for secure and user-friendly storage options has become increasingly evident. This recognition has spurred the development and utilization of crypto wallets worldwide. Another significant driver is the growing awareness of cybersecurity's critical role in the crypto space. With the rising value of digital assets, individuals are becoming more concerned about the safety of their investments.Crypto wallets provide a secure and private method for safeguarding cryptocurrencies, offering a compelling alternative to centralized exchanges that are vulnerable to hacking and cyberattacks. As cybersecurity threats evolve, the demand for robust crypto wallet solutions is expected to remain strong.

The rapid expansion of the Decentralized Finance (DeFi) ecosystem represents another driving force behind the crypto wallet market's growth. DeFi platforms rely on smart contracts, and users need crypto wallets to interact with these decentralized applications effectively. The popularity of DeFi for lending, borrowing, and trading has significantly boosted the demand for crypto wallets that seamlessly integrate with these platforms. Furthermore, the proliferation of Non-fungible Tokens (NFTs) has substantially impacted the market.

The global remittance market is also contributing to the growth of crypto wallets. Cryptocurrencies are increasingly being used for cross-border money transfers due to their cost-effectiveness and efficiency compared to traditional financial institutions. Crypto wallets are pivotal in facilitating these transactions, enabling users to send and receive digital currencies across borders with reduced fees and faster processing times.

In addition, regulatory developments are shaping the market for crypto wallets. Governments and regulatory bodies are beginning to establish guidelines and requirements for crypto wallet providers to enhance security measures and mitigate risks related to illicit activities like money laundering and fraud. Compliance with these regulations has become crucial for wallet providers to gain trust and attract users.

One notable restraint facing the market is the complex and technical nature of cryptocurrencies and blockchain technology. Understanding the intricacies of managing private keys, public addresses, and wallet security can intimidate many potential users. This complexity can discourage newcomers from entering the cryptocurrency space and using crypto wallets. To overcome this restraint, wallet providers and the industry as a whole must prioritize user education and user-friendly design. Wallets should be designed with intuitive interfaces, clear instructions, and robust customer support to guide users through the process of setting up and using their wallets securely.

Wallet Type Insights

The hot wallets segment accounted for the largest share of 56.0% in 2024. The segment is expected to be the fastest-growing segment during the forecast period. Hot wallets are connected to the internet, and they are more user-friendly. Hot wallets consist of various crypto wallets, including web-based, mobile, and desktop wallets. These wallets are easily accessible and downloadable on smartphones, desktops, or other devices. They are used to send and receive cryptocurrency and enable the users to view how many tokens are available. The increasing smartphone and internet penetration, coupled with the rising awareness about cryptocurrency, is driving the adoption of hot wallets. The accessibility and efficiency offered by hot wallets are driving their adoption among cryptocurrency users.

The cold wallet segment is expected to register significant growth over the forecast period. This segment is emerging primarily due to its enhanced security features. Cold wallets, also known as hardware wallets or offline wallets, are not connected to the internet, making them immune to online hacking attempts. This heightened security is increasingly attractive to cryptocurrency investors, especially institutional and high-net-worth individuals who seek to safeguard large sums of digital assets.

Operating System Insights

The Android segment held the largest market share in 2024. It has emerged as a dominant force due to the widespread global adoption of Android smartphones, making it the most popular mobile operating system. With a vast user base, Android provides an expansive user pool for crypto wallet developers to target. In addition, Android's open-source nature has facilitated the creation and customization of crypto wallet applications, allowing for a wide variety of wallet options with different features and security levels.

The iOS segment is expected to register significant growth over the forecast period. iOS has been seen as a more secure option than Android systems. Data has become the most valuable commodity in recent times. Consequently, data privacy concerns have been raised over time. Data security concerns have fueled the adoption of solutions that will keep consumers’ data safe and limit the personal information transmitted to operating system owners. iOS provides better data security for the private keys stored on the crypto wallet. Moreover, iOS crypto wallets offer a robust and reliable way of storing cryptocurrencies. The security, accessibility, and ease of use provided by iOS operating systems are expected to drive the segment’s growth over the forecast period.

Application Insights

The trading segment dominated the market in 2024. Crypto wallets are primarily used for cryptocurrency trading. Cryptocurrencies can be bought and sold via crypto exchanges and stored in crypto wallets. The decentralized cryptocurrency is not backed by any central authority or government, making it more vulnerable to cyberattacks and data theft. Under this scenario, crypto wallets provide a secure method of storing personal cryptocurrency keys, which are essential in crypto trading. The significant increase in crypto trading drives the demand for crypto wallets, thereby propelling the segment's growth.

The remittance segment is expected to register the highest CAGR over the forecast period. Consumers worldwide are adopting cryptocurrency as a medium to send money overseas. Users prefer cryptocurrency for remittance as they may be able to avoid some of the high costs charged by traditional banks and money transfer services. Several blockchain startups offer services to facilitate cryptocurrency remittance without requiring users to understand blockchain or cryptocurrency technology. For instance, in September 2022, Felix Pago integrated Circle's payment technology to enable real-time remittances from the U.S. to Latin America. Such initiatives are expected to fuel the segment's growth over the forecast period.

End User Insights

The individual segment dominated the market in 2024. End-users are increasingly using cryptocurrencies for individual use as a robust store of value in the long term. Cryptocurrencies are speculative, which makes them highly volatile. However, more significant risks lead to greater returns in the long term, which is why cryptocurrency is so popular among technologically inclined consumers. The blockchain landscape is expanding into new horizons and has now expanded to decentralized finance and non-fungible tokens. Individuals' increasing use of cryptocurrencies for trading, investing, peer-to-peer payments, and remittance is driving the demand for crypto wallets, thereby contributing to the segment's growth.

The commercial segment is projected to grow at the fastest CAGR over the forecast period. Various businesses are using cryptocurrency as a store of value to gain a competitive edge in the market by leveraging advanced technologies. Businesses are leveraging cryptocurrency technology to offer their customers contactless and advanced payment options. By doing so, companies cater to a varied customer base that is more technologically inclined and values transparency in their payment transactions. Moreover, businesses also recognize that crypto can be an effective alternative for balancing assets with cash. A crypto wallet is an essential component of implementing all these changes. The increasing use of crypto wallets in end-use industries, such as BFSI, gaming, government, retail & e-commerce, media & entertainment, and others, is expected to drive the segment's growth.

Regional Insights

The North America crypto wallet market held a largest share of 30.9% in 2024. The North American crypto wallet market is primarily driven by widespread digital asset adoption, innovative wallet infrastructure, and regulatory developments. In the U.S., institutional interest and consumer demand for decentralized applications (dApps) and NFTs are fueling the growth of wallets like MetaMask and Coinbase Wallet.

U.S. Crypto Wallet Market Trends

The U.S. crypto wallet market is experiencing strong growth, driven by institutional adoption and consumer interest in decentralized finance (DeFi). Companies like Coinbase, Robinhood, and MetaMask are continually innovating with non-custodial wallets and Web3 integrations. For instance, Coinbase’s Wallet-as-a-Service API allows businesses to create secure crypto wallets for their users, while MetaMask has added staking and NFT support.

Europe Crypto Wallet Market Trends

Europe's crypto wallet market is shaped by proactive regulation, a strong fintech base, and increasing demand for decentralized finance (DeFi) and NFT integration. Countries such as the UK and Germany are front-runners, supported by the Financial Conduct Authority (FCA) and BaFin regulations that promote secure wallet offerings.

The UK crypto wallet market is driven by a well-developed fintech sector and increased adoption of blockchain in finance. The Financial Conduct Authority (FCA) has been actively registering and regulating crypto asset businesses, which is promoting secure wallet options in the market. Startups like Zumo and Argent have gained traction for offering user-friendly wallets with features such as gasless transactions and fiat-crypto onramps.

Asia Pacific Crypto Wallet Market Trends

Asia Pacific showcases a diverse crypto wallet environment, ranging from state-led digital currency initiatives to grassroots Web3 adoption. In China, although private crypto is restricted, state-sponsored projects like the Digital Yuan (e-CNY) have driven adoption of CBDC-compatible wallets developed by leading banks and tech firms. Despite ongoing regulatory ambiguity, India is seeing strong uptake of mobile wallets through exchanges like CoinDCX, supported by a young, digital-first population.

The India crypto wallet market thrives due to growing retail investor participation, a large developer base, and widespread smartphone adoption. As centralized exchanges like CoinDCX and ZebPay introduce wallet features within their platforms, many users are also turning to non-custodial wallets such as Trust Wallet and MetaMask for greater control. The regulatory landscape remains uncertain, but has not deterred a young, urban population from experimenting with DeFi, NFTs, and crypto-based savings tools.

The China crypto wallet market, despite strict regulations on cryptocurrency trading and exchanges, continues to see demand for crypto wallets, particularly for self-custody and hardware-based solutions. While centralized exchanges are banned, individuals are still permitted to hold digital assets, leading to a quiet but steady uptake of wallets like Ledger, Trezor, and decentralized browser-based options such as MetaMask (accessed via VPNs).

Key Crypto Wallet Company Insights

Some of the key companies in the crypto wallet market include Binance, Coinbase, Ledger SAS, and others. The market for crypto wallets can be described as highly fragmented. Key players are implementing various strategic initiatives, such as product launches, mergers & acquisitions, partnerships, collaborations, and geographical expansions, to secure their strong position in the market and gain a competitive edge. Key players are leveraging advances in blockchain technology and are expanding their offerings to crypto assets such as Non-Fungible Tokens (NFTs). The technological innovations driven by prominent market players are expected to fuel the industry’s growth.

-

Binance offers a comprehensive blockchain ecosystem that includes spot and derivatives trading, crypto-to-fiat and crypto-to-crypto transactions, staking, savings, an NFT marketplace, and a range of financial products. Binance supports over 675 cryptocurrencies and provides advanced trading features such as futures with up to 125x leverage, leveraged tokens, and an OTC trading portal for institutional clients.

-

Coinbase offers a broad range of products for retail investors, institutional clients, businesses, and software developers. Its offerings include the Coinbase app for buying and trading cryptocurrencies, Coinbase Pro (now Coinbase Advanced) for professional trading, Coinbase Wallet for decentralized app access, and Coinbase Commerce for merchant payment solutions.

Key Crypto Wallet Companies:

The following are the leading companies in the crypto wallet market. These companies collectively hold the largest market share and dictate industry trends.

- Coinbase

- BitGo Holdings, Inc.

- Binance

- BitPay

- Trezor

- Ledger SAS

- Exodus Movement, Inc.

- Zengo Ltd.

- Crypto.com

- Blockchain.com

Recent Developments

-

In April 2025, Binance partnered with global payments technology provider Worldpay to integrate two of the world’s most widely used digital wallets, Google Pay and Apple Pay, into its fiat onramp ecosystem. This integration allows Binance users to purchase cryptocurrencies seamlessly using debit or credit cards already linked to these digital wallets, either through the Binance website or mobile app. By incorporating these familiar and trusted payment methods, Binance aims to simplify and accelerate the process of converting fiat currency into crypto assets, making the entry into the Web3 ecosystem more accessible and convenient for millions of users worldwide.

-

In January 2025, Trezor launched the Safe 5 Freedom Edition, a limited-edition hardware wallet with only 2,100 individually numbered units available worldwide, designed to emphasize the ideals of personal independence and financial sovereignty.

Crypto Wallet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.54 billion

Revenue forecast in 2033

USD 100.77 billion

Growth rate

CAGR of 26.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Wallet type, operating system, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Italy; Spain; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Coinbase; BitGo Holdings, Inc.; Binance; BitPay; Trezor; Ledger SAS; Exodus Movement, Inc.; Zengo Ltd.; Crypto.com; Blockchain.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crypto Wallet Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global crypto wallet market report based on wallet type, operating system, application, end user, and region.

-

Wallet Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hot Wallet

-

Web-Based Wallets

-

Mobile Wallets

-

Desktop Wallets

-

-

Cold Wallet

-

Paper Wallets

-

Hardware Wallets

-

-

-

Operating System Outlook (Revenue, USD Million, 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Peer-to-Peer Payments

-

Trading

-

Remittance

-

Others

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Individual

-

Commercial

-

BFSI

-

Gaming

-

Government

-

Retail & E-Commerce

-

Media & Entertainment

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crypto wallet market size was estimated at USD 12.59 billion in 2024 and is expected to reach USD 15.54 billion in 2025.

b. The global crypto wallet market is expected to grow at a compound annual growth rate of 26.3% from 2025 to 2033 to reach USD 100.77 billion by 2033

b. North America dominated the crypto wallet market with a share of 30.9% in 2024. The region's growth can be attributed to the presence of key market players in the region, such as Coinbase Global, Inc., BitGo, and BitPay, among others

b. Some key players operating in the crypto wallet market include Coinbase Global, Inc.; BitGo; Binance; BitPay; SatoshiLabs s.r.o.(Trezor); Ledger SAS; BlockFi Inc.; Exodus Movement, Inc.; ZenGo Ltd; Crypto.com; Blockchain.com, Inc.

b. Key factors that are driving the crypto wallet market growth include increasing financial awareness and use of cryptocurrency and acceptance of cryptocurrencies by businesses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.