- Home

- »

- Consumer F&B

- »

-

Cultured Food Market Size, Share & Growth Report, 2030GVR Report cover

![Cultured Food Market Size, Share & Trends Report]()

Cultured Food Market Size, Share & Trends Analysis Report By Product (Dairy-based, Plant-based), By Distribution Channel (Convenience Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-251-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cultured Food Market Size & Trends

The global cultured food market size was estimated at USD 31.77 billion in 2023 and is expected to grow at a CAGR of 8.5% from 2024 to 2030. Cultured foods, which include lab-grown or cell-cultured products, are becoming increasingly prominent as a solution to address the challenges of feeding a growing population and mitigating environmental impacts. The drive towards environmental sustainability, coupled with the imperative to ensure a stable food supply, is fueling the industry growth. The expansion of this industry is further driven by an increasing recognition of the necessity to seek alternatives to conventional agriculture and animal farming practices. A confluence of consumer trends, environmental considerations, and advancements in biotechnology is propelling the interest in cultured foods produced in labs using fermentation processes.

Consumers are increasingly drawn to these innovative food solutions due to their minimal environmental footprint, offering a sustainable alternative to resource-intensive traditional agriculture and livestock farming. This shift is also motivated by the pressing need for food security in light of a rapidly growing global population, where cultured foods efficiently produce protein without extensive land, water, and energy requirements. Technological breakthroughs have enabled these lab-grown foods to closely mimic the taste and texture of their conventional counterparts, enhancing consumer acceptance. In January 2022, a joint venture between Pluristem and Tnuva Group developed, manufactured, and commercialized cell-cultivated products for the food industry.

Pluristem provided its proprietary technology and expertise in cell production, while Tnuva Group invested in the business and provided the R&D platform. The first product in the pipeline was a raw meat product that was kosher-certified. The collaboration plans to expand to milk and seafood products in the future. From a health and safety perspective, cultured foods are designed to meet, if not exceed, the nutritional benefits of traditional foods, offering a richer profile of proteins, vitamins, and minerals. They are subject to strict safety standards and regulatory oversight, ensuring that they are safe and healthy for consumption. The controlled lab environments significantly reduce the risk of contamination from common pathogens, further bolstering their safety profile.

This combination of factors is driving the demand for cultured foods as a viable, and in many ways preferable, alternative to traditional farming products. Furthermore, ethical concerns surrounding animal welfare in traditional farming practices are compelling some consumers to explore cultured foods as a more humane option. The health and wellness movement, emphasizing clean labels and transparency in food sourcing, aligns well with the controlled, additive-reduced production of cultured foods, making them attractive to health-conscious individuals. In addition, the potential to engineer these foods to be free from allergens, GMOs, and antibiotics caters to those with specific dietary restrictions and allergies.

Market Concentration & Characteristics

The market is experiencing a remarkable degree of innovation, characterized by groundbreaking advancements in food technology and production methods. From lab-grown meat to fermentation-based dairy alternatives, companies are pioneering novel approaches to creating sustainable and environmentally friendly food products. This wave of innovation is reshaping the food industry, offering consumers exciting alternatives to traditional animal-derived products while addressing key challenges, such as resource scarcity and climate change.

Regulation plays a crucial role in shaping the market, influencing everything from R&D to production and marketing. As governments worldwide struggle with novel food technologies, regulatory frameworks are being established to ensure safety, transparency, and consumer confidence. While regulations can pose challenges for market entry and product development, they also provide a necessary framework for industry growth and consumer protection. Striking a balance between fostering innovation and safeguarding public health is key to unlocking the market’s full potential.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the industry. Over the next few years, internationally reputed companies are likely to acquire small- and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Product Insights

The dairy-based product segment accounted for a share of over 62.03% of the global revenue in 2023. Increasing awareness of the health benefits associated with dairy-based cultured foods, such as probiotic yogurts and kefir, is driving demand. These products are known to promote gut health, boost immunity, and provide essential nutrients, appealing to health-conscious consumers seeking functional foods. Manufacturers are continuously innovating in the dairy-based cultured food sector, introducing new flavors, formats, and formulations to cater to diverse consumer preferences. In November 2022, Unilever, a major food company known for its brands, utilized precision fermentation to develop animal-free dairy ice cream as part of its environmental strategy to reduce greenhouse gas (GHG) emissions.

Unilever is working with startups on creating dairy proteins using fermentation techniques and aims to launch the product in one of its major brands in 2023. This move follows in the footsteps of other food conglomerates like Nestle, which is also exploring animal-free dairy options. The meat & seafood segment is projected to grow at a CAGR of 31.2% from 2024 to 2030. Ethical considerations surrounding animal welfare have led to an increasing number of consumers seeking alternatives to conventionally produced meat and seafood. Cultured meat and seafood offer a cruelty-free option by eliminating the need for animal slaughter. This appeals to individuals who are concerned about the treatment of animals in the food industry and prefer more humane alternatives.

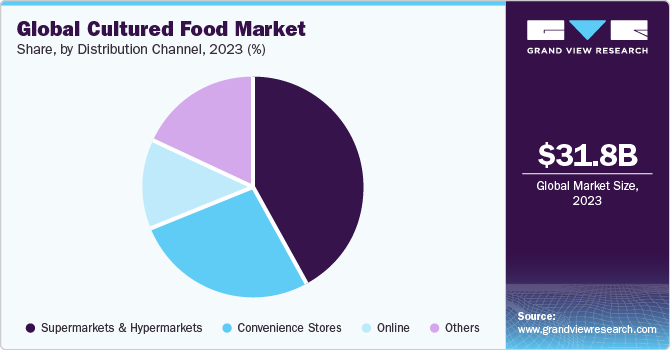

Distribution Channel Insights

The supermarkets and hypermarkets segment accounted for a share of around 42% in 2023. There is a growing demand for cultured food products among consumers seeking healthier and more sustainable dietary options. Supermarkets and hypermarkets are expanding their offerings in response to this demand, providing a wider selection of cultured foods, such as yogurt, kefir, kombucha, and fermented vegetables, to cater to diverse consumer preferences. In January 2023, Daily Harvest, a company dedicated to simplifying the consumption of sustainably grown fruits and vegetables, partnered with Kroger to introduce Daily Harvest favorites to customers nationwide. Beginning in July, select Kroger Family of Companies stores, including Kroger, Dillons, Fry's, Fred Meyer, QFC, Ralphs, Smith's, and Harris Teeter, will feature Daily Harvest products in the freezer aisle.

For Daily Harvest, partnering with Kroger was a natural fit to extend the reach and availability of its beloved Flatbreads, Smoothies, and Harvest Bowls beyond its online platform. The online distribution channel segment is projected to grow at a CAGR of 9.8% from 2024 to 2030. The rise of direct-to-consumer brands in the market has contributed to the expansion of online sales. These brands often sell their products exclusively online, leveraging digital marketing and e-commerce platforms to reach a wider audience and bypass traditional distribution channels. This direct-to-consumer model allows for greater control over branding, pricing, and customer engagement, driving growth in the online channel for cultured foods.

Regional Insights

The North America cultured food market accounted for a share of around 39% in 2023. The region boasts a vibrant food innovation ecosystem, with numerous startups and established companies continually introducing new and innovative cultured food products to the market. From plant-based alternatives to artisanal fermented foods, there's a constant stream of new offerings driving growth in the segment. In addition, several U.S.-based companies, such as Fork & Goode and BlueNalu, are gradually investing in cell-agriculture technologies to produce cultivated meats in the region.

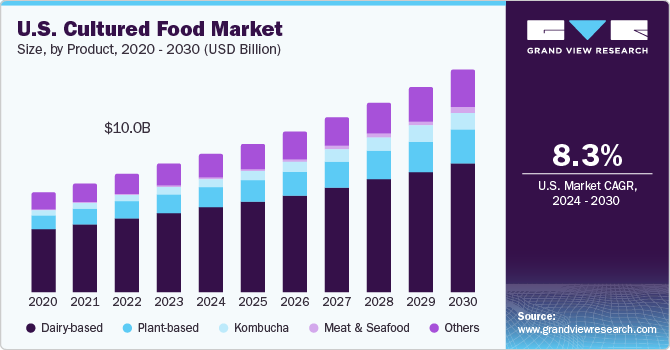

U.S. Cultured Food Market Trends

The cultured food market in the U.S. is projected to grow at a CAGR of 8.3% from 2024 to 2030. Consumer demand for nutritious and probiotic-rich food options has been a major driver, leading to increased interest in cultured dairy products, fermented foods, and plant-based alternatives. In addition, rising preference for sustainable and environmentally friendly food choices has propelled the market for cultured meats and plant-based protein sources.

Asia Pacific Cultured Food Market Trends

The Asia Pacific cultured food market is projected to grow at a CAGR of 9.1% from 2024 to 2030. Asia Pacific is home to a culturally diverse population with varied culinary preferences, creating a strong demand for a wide range of cultured foods. From traditional favorites to innovative fusion cuisines, the market can cater to a broad spectrum of tastes and preferences. Key factors driving the regional market include rising consumer awareness of the health benefits of probiotic-rich foods, increasing focus on digestive wellness, and growing preference for natural & organic products. In addition, technological advancements in the food industry have enabled the development of a diverse range of cultured food products, catering to varied consumer preferences.

Key Cultured Food Company Insights

The market for cultured food is highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key Cultured Food Companies:

The following are the leading companies in the cultured food market. These companies collectively hold the largest market share and dictate industry trends.

- UPSIDE Foods

- Mosa Meat

- Finless Foods, Inc.

- BlueNalu

- Aleph Farms

- Wildtype

- Mission Barns

- Perfect Day, Inc.

- SuperMeat

- Shiok Meats Pte Ltd.

- Fonterra Co-operative Group Limited.

- Danone SA

- Nestlé SA

- Lactalis American Group, Inc.

- Chobani, LLC

Recent Developments

-

In November 2022, Mosa Meat, a prominent Dutch food-tech firm specializing in cultivated meat, collaborated with Esco Aster, a contract manufacturer based in Singapore, to introduce cultivated beef to the market. Singapore stands out as a frontrunner in the sector, being the first and sole country, thus far to authorize regulatory approval for cultivated meat. Esco Aster, as the premier and sole facility to obtain regulatory clearance for cultivated product production in Singapore, is instrumental in this partnership

-

In June 2022, Strive Nutrition Corp. entered into a partnership with Perfect Day, Inc. to introduce a fresh range of milk alternatives fortified with Perfect Day's animal-free whey protein. The lineup comprises Strive Free Milk in Whole and Chocolate variants, alongside Strive Oat and Strive Almond. These products deliver both the flavor and nutritional benefits of traditional cow's milk while sidestepping the health and environmental drawbacks associated with conventional dairy. In addition, the milk alternatives are devoid of lactose, hormones, antibiotics, and cholesterol, promoting kindness towards animals and the planet

-

In July 2022, SuperMeat, a food-tech enterprise dedicated to providing top-tier cultivated meat globally, revealed the signing of a Memorandum of Understanding (MOU) with Migros, Switzerland's premier retail supermarket chain and prominent meat producer. This collaboration aims to accelerate the production and distribution of cultivated meat on a commercial level

Cultured Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.33 billion

Revenue forecast in 2030

USD 55.88 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa; South Africa

Key companies profiled

UPSIDE Foods; Mosa Meat; Finless Foods, Inc.; BlueNalu; Aleph Farms; Wildtype; Mission Barns; Perfect Day, Inc.; SuperMeat; Shiok Meats Pte. Ltd.; Fonterra Co-operative Group Ltd.; Danone SA; Nestlé SA; Lactalis American Group, Inc.; Chobani, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cultured Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cultured food market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy-based

-

Yogurt

-

Kefir

-

Others

-

-

Plant-based

-

Sauerkraut

-

Kimchi

-

Pickles

-

Miso

-

Tempeh

-

-

Meat and Seafood

-

Kombucha

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cultured food market size was estimated at USD 31.77 billion in 2023 and is expected to reach USD 34.33 billion in 2024.

b. The global cultured food market is expected to grow at a compounded growth rate of 8.5% from 2024 to 2030 to reach USD 55.88 billion by 2030.

b. Dairy based cultured food market accounted for a share of over 57% of the global revenues in 2023. Increasing awareness of the health benefits associated with dairy-based cultured foods, such as probiotic yogurts and kefir, is driving demand.

b. Some key players operating in cultured food market include UPSIDE Foods, Mosa Meat, Finless Foods, Inc., BlueNalu, Aleph Farms, Wildtype, Mission Barns., Perfect Day, Inc., SuperMeat, Shiok Meats Pte Ltd., Fonterra Co-operative Group Limited., Danone SA, Nestlé SA, Lactalis American Group, Inc., Chobani, LLC

b. Key factors that are driving the market growth include consumer demand for nutritious and probiotic-rich food options. Additionally, the rising preference for sustainable and environmentally friendly food choices has propelled the market for cultured meats and plant-based protein sources.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."