- Home

- »

- IT Services & Applications

- »

-

Custom Software Development Market, Industry Report 2030GVR Report cover

![Custom Software Development Market Size, Share & Trends Report]()

Custom Software Development Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Web-based Solutions, Mobile App, Enterprise Software), By Deployment Mode, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-001-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Custom Software Development Market Summary

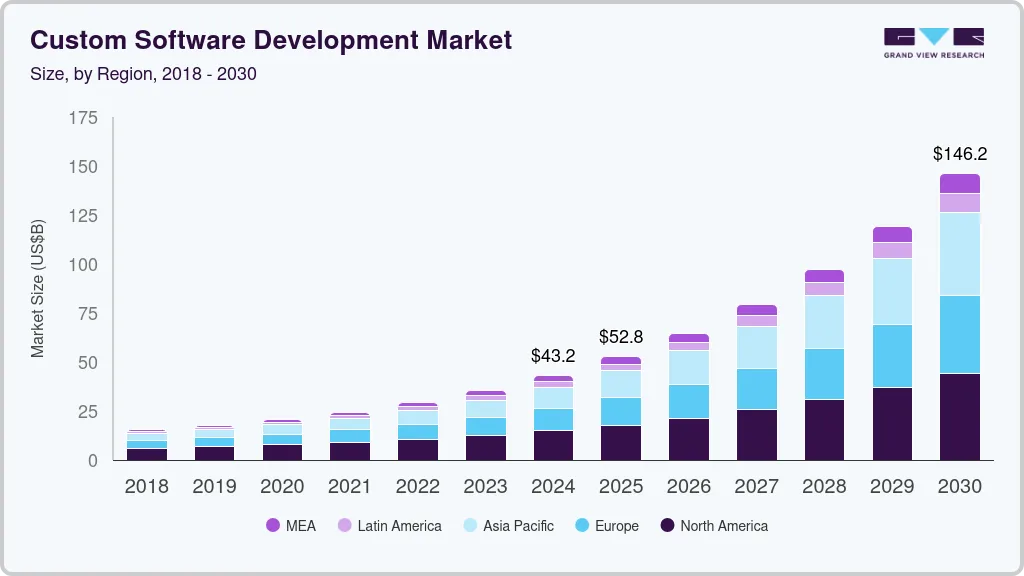

The global custom software development market size was estimated at USD 43.16 billion in 2024 and is projected to reach USD 146.18 billion by 2030, growing at a CAGR of 22.6% from 2025 to 2030. ustom software development is specially designed software or applications that meet the specific needs of an individual or a company.

Key Market Trends & Insights

- North America custom software development market held the major share of over 34.0% in 2024.

- The custom software development market in U.S. is growing significantly from 2025 to 2030.

- By type, the enterprise software segment accounted for the largest market share of over 60.0% in 2024.

- By deployment mode, the cloud segment accounted for the largest market share of 57.0% in 2024.

- By enterprise size, the large enterprises segment accounted for the largest market revenue share of over 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.16 Billion

- 2030 Projected Market Size: USD 146.18 Billion

- CAGR (2025-2030): 22.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

There are various factors that contribute to the growth of the custom software development market, such as the growing requirement for industry applications for real-time data analysis, the rising need for flexible workspace to enhance productivity, and the increasing adoption of the low code development platform (LCDP) for easier software development. Moreover, the adoption of analytics with the emergence of a variety of technologies, such as AI-driven Chatbots and robotics automation, is helping boost the growth of the custom software development market.

Analytical tools in custom software development, such as business intelligence (BI), machine learning, and artificial intelligence, allow for cross-departmental communication, market trend identification, and process automation. Furthermore, embedding analytics into a company's custom software allows it to understand its customers better and make strategic decisions based on the insight retrieved from the software. For instance, AEC Advisors, an investment banking and corporate finance advisory firm in New York, transformed its business by implementing Fingent Corporation's survey management system and analytics software.

One of the most important aspects of custom software development is cloud technology, as it improves the agility and performance of custom software. In addition, cloud-based software development releases new, high-quality software more quickly and efficiently. Custom software developers collaborate with cloud infrastructure providers to enable companies to accelerate their development process using artificial intelligence. For instance, In March 2023, Replit, Inc., a cloud-based software developer, partnered with Google LLC, a cloud infrastructure provider, to create a generative AI application. The partnership allows Replit developers to access Google Cloud infrastructures, services, and foundation models through Replit, Inc.’s AI software development platform, Ghostwriter. Traditional development of software, such as manual coding, can be challenging. Enterprises need a dedicated team to update the code each time, which usually takes 2 to 8 months.

However, low-code application development enables custom software development teams to develop more applications in less time than traditional coding. The visual development environment makes it easy to design and develop low-code applications. These features allow developers to build customizable sites for multiple devices on a single platform. For instance, in October 2023, The ESDS Software Solution launched a low-code platform called "Low Code Magic." The platform redefines the application development landscape, making it faster, easier, and more efficient for businesses to create custom applications tailored to their needs. Low Code Magic allows organizations to minimize development costs, reduce their time to market, and maximize productivity with minimal coding effort.

Open-source programs are becoming more popular among custom software developers to optimize application development and reduce custom software development expenses. However, it introduces significant risks, including a risk to intellectual property (IP) from restrictive and reciprocal licenses and a security risk from components with vulnerabilities. Open-source development is more problematic for smaller companies that prefer to use it to save time and resources but lack the appropriate security measures to ensure the components they implement are safe. Thus, companies should never open source anything that is core to their business.

Type Insights

The enterprise software segment accounted for the largest market share of over 60.0% in 2024 in the custom software development market. Factors such as a centralized system for multiple departments, improved scalability and integration, and higher security across many different software platforms are contributing to the segment's growth. Moreover, enterprise software automates the business workflow, enhances the efficiency of the daily business process, controls data entry errors, minimizes costs, ensures growth, and integrates the strategies of all business areas for large organizations. Enterprise software comprises plenty of features, and organizations customize it according to their requirement. This software allows tracking and improving supply chains, managing resources, and communicating with customers.

The web-based solutions segment is anticipated to grow at a CAGR of 21.1% during the forecast period due to the ease of remote access, availability of real-time information, and elimination of hardware costs. Moreover, easy data sharing and collaboration due to a centralized software server and adding a new user simply by setting up an access control system are also driving market growth. Additionally, web-based software can help enterprises facilitate more simultaneous processes.

Deployment Mode Insights

The cloud segment accounted for the largest market share of 57.0% in 2024 in the custom software development market. This segment is primarily driven by factors such as ease of access, flexibility, and cost-effectiveness for small and medium-sized businesses. A cloud custom software service has no upfront cost to enterprises and provides a highly flexible environment for managing their business applications. Additionally, cloud computing enables smartphones and other devices to access data from anywhere. The rising number of smartphone users and Bring Your Own Device (BYOD) usage also drives the demand for cloud software development market.

The on-premise segment is expected to expand at a CAGR of 21.0% during the forecast period. On-premise software offers total ownership and control and is considered more reliable in companies; on-premise application development services are preferred as they provide a high level of data security through physical security controls and security protocols. Employees can access the data with on-premise solutions without an internet connection. Moreover, annual maintenance and one-time license fees are lower than recurring expenses associated with cloud software. The system can also be accessed by multiple users simultaneously without affecting performance.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share of over 60.0% in 2024 in the custom software development industry. Many large corporations rely on custom software for competitive advantage. Custom software development ensures the creation of solutions tailored to meet the specific requirements of enterprises. There is a growing need for custom software in various large enterprises as it allows particular criteria to be fulfilled at a lower cost than purchasing. Additionally, custom solutions can easily be integrated with existing systems and can even be used to extend the functionalities of existing tools. Furthermore, custom software solutions developed from scratch are hard to infiltrate, and the software adds an extra layer of security by encrypting the data.

The SMEs segment is anticipated to grow at the fastest CAGR during the forecast period. Several factors correlate with the growth prospects of this segment, including the growth of small and medium businesses, cost-effectiveness, and scalability. Extra features can be added to the existing system when the business grows. It offers integration of the latest technologies and enhances business operations for SMEs. Custom software solutions are an easy way for businesses to implement business workflow. Businesses don't need to adapt to the software; apparently, it is developed based on what they do. These solutions can streamline repetitive tasks and help boost collaboration within companies.

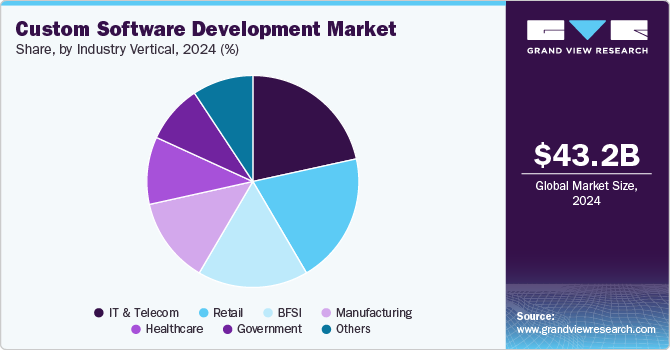

Industry Vertical Insights

The IT & telecom segment accounted for the largest market share of over 21.0% in 2024 in the custom software development market. Custom software can incorporate all essential security apps and programs that comply with current trends and industry standards. IT solutions tailored to customer needs often provide more flexibility than traditional software. Custom software enables more efficient operations along with low maintenance and licensing costs. By using custom software, businesses can create clear and accessible reports. As a result, they can save time and concentrate on core tasks.

The government segment is anticipated to grow at a CAGR of 25.9% during the forecast period. Governments worldwide know the potential transformation technology can effectuate, translating into improved citizen services, operational efficiencies, and thriving economies. Custom software solutions tailored to the unique needs of government agencies are becoming indispensable tools for modernizing legacy systems, automating processes, and fostering transparency and accountability.

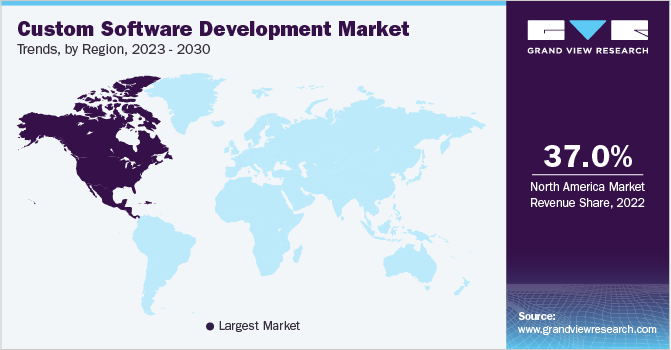

Regional Insights

North America custom software development market held the major share of over 34.0% in 2024. Various factors contribute to the region's growth, including the widespread use of advanced expertise, the surge in IT services, and the rise of SMEs. Moreover, with growing automation and digital transformation in the region, North America is becoming the preferred destination for custom software development services.

U.S. Custom Software Development Market Trends

The custom software development market in U.S. is growing significantly from 2025 to 2030. The growth of edge computing and IoT (Internet of Things) adoption is fueling custom software demand. The U.S. is experiencing a surge in smart devices, industrial IoT (IIoT) applications, and real-time edge computing solutions that require custom-built software to process, analyze, and secure data at the network edge. Industries such as manufacturing, energy, and transportation rely on custom IoT software to monitor operations, predict maintenance needs, and optimize supply chains. As the adoption of connected devices continues to expand, the demand for custom-built IoT and edge computing solutions will keep increasing.

Europe Custom Software Development Market Trends

The custom software development market in Europe is growing at a CAGR of 26.2% from 2025 to 2030. The promising growth prospects of the European market can be attributed to the presence of various companies in the region that introduce advanced solutions to better serve specific industries. In December 2023, Nokia Corporation announced that its 5G Standalone Core SaaS software was chosen by Telia Company (Finland) as part of an innovation program funded by the European Union (EU).

The custom software development market in UK is growing significantly at a CAGR of 20.2% from 2025 to 2030. The rising complexity of multi-cloud and hybrid cloud environments is driving market growth. Many enterprises operate across multiple cloud providers, such as AWS, Microsoft Azure, and Google Cloud, while also maintaining some on-premises infrastructure. Managing such diverse environments can be challenging without proper visibility and control. Custom software development solutions provide unified dashboards, automated alerts, and analytics-driven insights that enable IT teams to oversee performance across different cloud platforms. This demand for cross-platform monitoring is driving innovation and investment in advanced cloud monitoring technologies.

Germany custom software development market is growing significantly at a CAGR of 22.5% from 2025 to 2030. The rapid adoption of AI, big data, and cloud computing is driving demand for custom software development in Germany. Businesses are increasingly leveraging AI-powered analytics, machine learning models, and cloud-based platforms to improve decision-making and enhance operational efficiency. Custom software development firms are catering to this demand by providing AI-driven applications, data analytics platforms, and cloud-native solutions that are tailored to the specific needs of German enterprises.

Asia Pacific Custom Software Development Market Trends

The custom software development market in Asia Pacific is anticipated to register the highest CAGR from 2025 to 2030 due to the advancement of technological implementation in enterprises. The emergence of SMEs, the growing market for custom software, and the need to modernize legacy software development systems are also driving the market growth. Large tech firms and an increasing number of custom software suppliers in advanced Asian economies such as Japan and South Korea contribute to market growth.

China custom software development market is growing significantly at a CAGR from 2025 to 2030. The expansion of e-commerce and digital payments in China is significantly boosting demand for custom software development. With China being the world’s largest e-commerce market, businesses need specialized digital platforms, payment gateways, and customer engagement tools to stay competitive. Companies are investing in tailored e-commerce platforms that offer seamless user experiences, integrate advanced payment solutions such as WeChat Pay and Alipay, and leverage AI-driven recommendation engines. Moreover, businesses operating in cross-border e-commerce require custom solutions that comply with international trade regulations, handle multi-currency transactions, and optimize logistics.

The custom software development market in India is growing significantly at a CAGR from 2025 to 2030. India’s IT outsourcing and software services industry is a major driver of custom software development. India has some of the largest IT service providers, such as TCS, Infosys, Wipro, and HCL, which serve global clients by providing customized software solutions. Many international companies outsource their custom software development projects to Indian firms due to the availability of highly skilled software engineers, cost-effective solutions, and a strong technical talent pool. With a growing number of enterprises worldwide looking for tailored software solutions, India’s position as an outsourcing hub continues to fuel the expansion of its custom software development market.

Middle East & Africa Custom Software Development Market Trends

The custom software development industry in Middle East & Africa is growing significantly at a CAGR from 2025 to 2030. The increasing demand for fintech and digital banking solutions is fueling the growth of custom software development in MEA. The financial sector is undergoing a massive digital transformation, with banks and fintech startups investing in blockchain, AI-powered risk management, and mobile banking applications. Custom software is crucial for financial institutions looking to develop secure, scalable, and regulation-compliant financial technology solutions. Countries such as the UAE and Saudi Arabia with startups and enterprises seeking tailored financial applications to enhance customer engagement and streamline operations.

Key Custom Software Development Company Insights

Some of the key companies operating in the market Tata Consultancy Services Limited, Capgemini, Tietoevry, and among others are some of the leading participants in the custom software development market.

-

Tata Consultancy Services Limited is an IT services, consulting, and business solutions provider. The company has categorized its services under Cognitive Business Operations, Cloud, Consulting, Data and Analytics, Cybersecurity, Enterprise Solutions, Network Solutions and Services, IoT and Digital Engineering, TCS Interactive, and Sustainability Services. The company also specializes in custom software development services, including complete product and platform development, next-generation product engineering, product integration, and flexible engagement models for products and product lines.

-

Capgemini is a consulting, technology services, and digital transformation company that helps businesses transform their business operations by leveraging cutting-edge technology. The company has been a trusted strategic partner to businesses worldwide for more than 50 years. With deep industry expertise and technology expertise across cloud, data, Artificial Intelligence (AI), software, and digital engineering, the company offers a wide range of services, including strategy formulation, custom software development, and application designing to help businesses address their diverse needs.

Magora, Iflexion, and TRooTech Business Solutions are some of the emerging market participants in the custom software development market.

-

Magora specializes in developing custom applications and software and providing seamless integration services. The company’s collaborative approach prioritizes maximizing value and the return on investment for clients by providing comprehensive technology tools to enhance customer engagement and drive commerce. The company employs a team of specialists to develop mobile applications for Android and iOS and offer software and web development services. The company offers a wide range of services, including web development, mobile app development, custom software development, bespoke software development, outsourcing software development, startup MVP development, AI & Machine Learning (ML) integration, enterprise app development, product discovery, and IoT app development, among others.

-

TRooTech Business Solutions is a custom software development company. The company specializes in developing performance-boosting and purpose-driven tools that can be seamlessly integrated into any business application. The company’s team of experienced custom software developers and consultants offers comprehensive guidance from strategic planning and software optimization to deployment. The company’s software development services include custom software development, custom mobile app development, custom web app development, cloud app development, customized SaaS development, and remaking legacy software. The company also offers other professional services, including technology portfolio consulting, enterprise architecture consulting, software modernization, and application consulting.

Key Custom Software Development Companies:

The following are the leading companies in the custom software development market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Brainvire Infotech Inc.

- Capgemini

- Cognizant

- HCL Technologies Limited

- Iflexion

- Infopulse

- Infosys Ltd.

- Magora

- Microsoft

- Tata Consultancy Services Limited

- Thoughtworks, Inc.

- Tietoevry

- Trigent Software, Inc.

- TRooTech Business Solutions

Recent Developments

-

In May 2024, Proxet Group Inc. partnered with Palantir Technologies Inc., a leading provider of AI-powered enterprise solutions. Palantir offers a comprehensive suite of tools for data analysis, collaboration, and operational efficiency. Businesses leverage Palantir's software to enhance vehicle safety, strengthen global supply chains, and advance cancer research. Through this partnership, Proxet expands the development of service options for Palantir customers while maintaining high standards.

-

In January 2024, Brainvire Infotech Inc. announced a collaboration with Sing In Chinese to develop an interactive app for children, with advanced features and modules, such as lessons, games, quizzes, karaoke, pet management, and subscription options. The app offers a user-friendly educational platform for children, thereby revolutionizing the learning landscape.

-

In November 2023, Infopulse announced the release of PACE Suite 6.1, a user-friendly solution that streamlines the complete workflow of application packaging management. The new updates help reduce complex scripting challenges, enhance installation success, and provide consistent deployment experience.

-

In July 2023, Tietoevry announced the acquisition of MentorMate, a provider of digital engineering, consulting, and design services. The acquisition was aimed at accelerating Tietoevry’s software and digital engineering capabilities, along with increasing its customer base and digital talent in the market.

Custom Software Development Market Report Scope

Report Attribute

Details

Market size in 2025

USD 52.84 billion

Revenue forecast in 2030

USD 146.18 billion

Growth rate

CAGR of 22.6% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment mode, enterprise size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Brainvire; Infotech Inc.; Capgemini; Cognizant; HCL Technologies Limited; Iflexion; Infopulse; Infosys Ltd.; Magora; Microsoft; Tata Consultancy Services Limited; Thoughtworks, Inc.; Tietoevry; Trigent Software, Inc.; TRooTech Business Solutions

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Custom Software Development Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global custom software development market report based on type, deployment mode, enterprise size, industry vertical, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web-based Solutions

-

Mobile App

-

Enterprise Software

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global custom software development market size was estimated at USD 43.16 billion in 2024 and is expected to reach USD 52.84 billion in 2025.

b. The global custom software development market is expected to witness a compound annual growth rate of 22.6% from 2025 to 2030 to reach USD 146.18 billion by 2030.

b. North America held the largest share of over 34% in 2024. There are a variety of factors that contribute to the region's growth including the widespread use of advanced expertise, the surge in IT services, and the rise of SMEs.

b. Key industry players operating in the custom software development market include Accenture, Brainvire Infotech Inc., Capgemini, Cognizant, HCL Technologies Limited, Iflexion, Infopulse, Infosys Ltd., Magora, Microsoft, Tata Consultancy Services Limited, Thoughtworks, Inc., Tietoevry, Trigent Software, Inc., TRooTech Business Solutions

b. Various factors contribute to the custom software development market growth, such as the growing requirement for industry applications for real-time data analysis, rising need for flexible workspace to enhance productivity, and the increasing adoption of the low code development platform (LCDP) for easier software development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.