- Home

- »

- Next Generation Technologies

- »

-

Customer Engagement Solutions Market Size Report, 2030GVR Report cover

![Customer Engagement Solutions Market Size, Share & Trends Report]()

Customer Engagement Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-249-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Engagement Solutions Market Summary

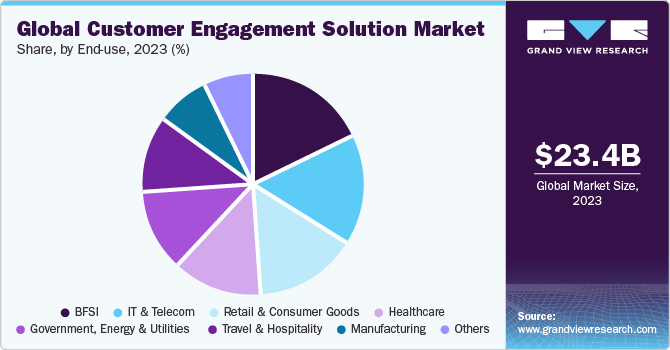

The global customer engagement solutions market size was estimated at USD 23.45 billion in 2023 and is projected to reach USD 50.03 billion by 2030, growing at a CAGR of 11.8% from 2024 to 2030. The increasing demand for customized and consistent customer experiences across various industries drives this growth.

Key Market Trends & Insights

- North America dominated the industry with a share of 38.2% in 2023.

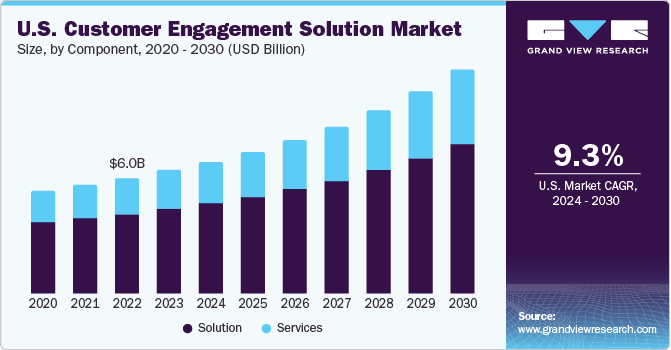

- The customer engagement solution market in the U.S. dominated the market in 2023 with a revenue share of 71.5%.

- Based on component, the solution segment accounted for the largest revenue share of 67.8% in 2023.

- Based on deployment, The hosted segment accounted for the largest revenue share in 2023.

- Based on enterprise size, the large enterprises segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.45 billion

- 2030 Projected Market Size: USD 50.03 billion

- CAGR (2024-2030): 11.8%

- North America: Largest market in 2023

Adopting customer engagement solutions to reduce customer churn rate, the rapid growth of e-commerce and m-commerce platforms, and the emphasis on delivering improved customer engagement through omnichannel are some of the other driving factors.The development of technology is one of the key factors driving the market growth. The introduction of advanced analytics, artificial intelligence (AI), and machine learning (ML) enables businesses to collect, analyze, and act upon customer data in real time. This has led to the development of advanced customer engagement tools that enable companies to deliver personalized experiences to their customers, thereby improving customer satisfaction and loyalty.

With customer data's increasing volume and complexity, businesses recognize the importance of data-driven decision-making. Customer engagement solutions offer advanced analytics capabilities that allow companies to gather, analyze, and interpret customer data to gain valuable insights. These insights can then be used to make informed decisions, optimize marketing strategies, and improve overall customer engagement, further fueling the growth of this market.

Businesses continue to recognize the significance of customer retention and maximizing lifetime value. Acquiring new customers can be costly, so retaining existing customers becomes essential for sustainable growth. Customer Engagement Solutions help maintain long-term relationships by enabling businesses to build customer loyalty through personalized communications, rewards programs, and proactive support.

Integration with Customer Relationship Management (CRM) and marketing automation platforms is used for smooth customer engagement. Businesses centralize customer data, streamline processes, and ensure consistent communication across the customer lifecycle by integrating customer engagement solutions with CRM systems and marketing automation platforms. This integration enables businesses to track customer interactions, automate personalized marketing campaigns, and provide a unified view of the customer across sales, marketing, and customer service teams. As businesses seek to break down data storage and improve collaboration between departments, the integration of customer engagement solutions with CRM and marketing automation platforms is driving market demand and adoption.

The increasing influence of social media and online communities became a significant driver for customer engagement solutions. Businesses use social media platforms for marketing and advertising and as a channel for customer engagement and support. According to the Search Engine Journal, there were 4.8 billion social media users worldwide as of July 2023, representing over 60% of the global population and 92.7% of all internet users. Customers often turn to social media to share feedback, ask questions, and interact with brands. Customer engagement solutions that integrate with social media platforms enable businesses to monitor conversations, respond to inquiries promptly, and engage with customers in real time.

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. The customer engagement solutions market is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. The increasing adoption of customer engagement solutions across various industries, including healthcare, finance, and travel & hospitality, is driving the market growth.

The market is highly competitive, with numerous players offering innovative and exclusive solutions. This competition drives innovation and encourages companies to improve their offerings to stay ahead in the market continuously. A strong focus on data analytics and personalization also characterizes the market. As businesses collect vast amounts of customer data, they use it to create personalized experiences according to individual preferences and needs. For instance, in August 2023, GoDaddy launched a video-based digital marketing and social commerce solution called Instant Video. This solution is designed for small businesses to create videos for their social media, websites, marketing, and more without additional cost. It provides templates for creating professional videos to promote social media, tutorials, and product demos to drive customer engagement and sales.

Component Insights

The solution segment accounted for the largest revenue share of 67.8% in 2023. The growth can be attributed to the widespread adoption of smartphones and tablets, customers now expect businesses to provide seamless mobile experiences. It has led to an increased demand for customer engagement solutions that can cater to mobile users effectively. Mobile-optimized platforms, mobile applications, and responsive websites are becoming essential to businesses' customer engagement strategies, driving the market's growth.

The service segment is anticipated to grow the fastest from 2024 to 2030. Service providers in this market offer outcome-based pricing models, where they are compensated based on the results achieved for their clients. This approach supports the service providers' interests with those of their clients, incentivizing them to deliver measurable improvements in customer engagement. This focus on business outcomes drives the growth of the services segment as businesses seek to maximize the return on their investments in customer engagement solutions.

Deployment Insights

The hosted segment accounted for the largest revenue share in 2023. Customer engagement solutions provide support for various communication channels, such as email, social media, chat, and voice, which is expected to bode well for this segment. This multi-channel support enables businesses to engage with customers through their preferred communication methods, improving overall customer satisfaction and engagement.

For instance, in March 2023, Cognigy, a provider of Enterprise Conversational AI (CAI), announced a strategic partnership with Black Box, a Global Solutions Integrator (GSI). Cognigy's Conversational AI technology is set to be combined with Black Box's comprehensive CX solution practice through this partnership. The collaboration is expected to deliver AI-based solutions that enhance customer experiences. Businesses can free up contact centers and customer service agents to focus on more complex issues by automating routine customer interactions through AI-based virtual assistants.

The on-premise segment is anticipated to witness significant growth during the forecast period. Some companies from industries such ashealthcare, banking, and government agencies that are in high regulations, prefer on-premise deployment to maintain complete control over their data and ensure compliance with industry-specific requirements. On-premise deployment enables companies to keep their customer data within their own infrastructure, addressing data sovereignty and security concerns.

Enterprise Size Insights

The large enterprises segment held the largest revenue share in 2023. Large enterprises handle significant amounts of customer data, so security requirements and compliance become essential. This is anticipated to contribute to the segment share. Customer engagement solutions prioritizing data privacy, security, and adherence to industry-specific compliance requirements are necessary for large enterprises to maintain customer trust and avoid potential legal risks.

The SME segment is anticipated to witness the fastest CAGR from 2024 to 2030, due to the rising adoption of digital technologies among SMEs. With the proliferation of smartphones, social media platforms, and other digital channels, SMEs use these tools to connect with their customers more efficiently. Customer engagement solutions offer features such as omnichannel communication, allowing SMEs to reach customers across various channels easily. For instance, in June 2023, Dstny, a provider of cloud-based business communications, launched Dstny Engage. This solution is designed to help small and medium-sized businesses (SMEs). Dstny Engage is the latest addition to Dstny's customer engagement portfolio, and it complements their existing ConnectMe Omnichannel product.

End-use Insights

The BFSI segment held the largest revenue share in 2023, due to the increasing demand for personalized financial services such as personalized banking recommendations, targeted insurance offers, or proactive financial advice. For instance, in June 2023, India's B2B SaaS startup Nuclei partnered with Oracle to offer its merchant marketplace program and SaaS on Oracle's digital banking platform. The partnership aims to enhance the engagement and retention of a bank's customers through digital banking channels.

Regulatory compliance and risk management drive the adoption of customer engagement solutions in the BFSI sector. Compliance requirements such as General Data Protection Regulation (GDPR), Know Your Customer (KYC), and Anti-Money Laundering (AML) regulations impose stringent requirements on data handling, privacy protection, and fraud prevention. Customer engagement solutions equipped with strong security features and compliance capabilities help BFSI organizations adhere to regulatory requirements while safeguarding customer data and mitigating risks.

The retail & consumer goods segment is anticipated to witness the fastest CAGR during the forecast period. As competition increases and consumer preferences continue to evolve, retailers and consumer goods companies are turning to customer engagement solutions to set themselves apart, improve customer experiences, and boost business growth. The rise of digital channels and e-commerce platforms drives the need for omnichannel customer engagement solutions.

Regional Insights

North America dominated the industry with a share of 38.2% in 2023 and is projected to grow significantly over the forecast period, due to the increasing data-driven business environment that recognizes the importance of using customer insights and analytics to drive decision-making and strategy. Customer engagement solutions provide advanced analytics capabilities, allowing businesses to gain valuable insights into customer behaviors, preferences, and trends.

U.S. Customer Engagement Solution Market Trends

The customer engagement solution market in the U.S. dominated the market in 2023 with a revenue share of 71.5%. The increasing popularity of voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri has led to their integration into customer engagement solutions. These assistants help customers with queries, provide personalized recommendations, and streamline support interactions. The U.S. accounted for over 27% of the global queue management system market in 2023 and is expected to grow significantly over the forecast period.

Asia Pacific Customer Engagement Solution Market Trends

The customer engagement market in Asia Pacific is expected to witness significant growth during the forecast period due to the growing adoption of cloud computing. Small and medium-sized businesses in Australia, Malaysia, Japan, and Singapore are investing in information technology solutions to compete, secure their operations, and take advantage of digital opportunities in the market. According to Red Hat, Inc.'s report in 2023, 85% of business leaders in the Asia Pacific (APAC) region have adopted cloud technology, with Japan having the highest level of integration at 87%. Many executives cited its contribution to safeguarding jobs as the main rationale for adoption. In Singapore, 68% of respondents have reported complete adoption.

The China customer engagement solution market is expected to grow over the forecast period. With most internet users accessing the web via mobile devices, the growing use of customer engagement solutions is becoming significant. It ensures that customers have a seamless experience across all devices and platforms.

Europe Customer Engagement Solution Market Trends

The European customer engagement solution market is expected to grow over the forecast period. As European countries have a diverse population and various languages are spoken across the continent, companies are now prioritizing offering multilingual support to meet the needs of their customers. It involves providing customer support in different languages, creating localized content, and establishing personalized communication.

The customer engagement solution market in the UK is expected to grow over the forecast period. Companies in the country focus on providing personalized experiences to their customers, with the help of customer data, to understand their preferences and curate their interactions accordingly.

The Germany customer engagement solution market is expected to grow over the forecast period. German automotive companies emphasize after-sales service and customer support to build long-lasting customer relationships. It includes providing remote diagnostics, scheduling service appointments, and offering real-time updates on service status. Automotive companies in Germany are integrating chatbots and voice assistants into their customer engagement solutions to provide instant support, answer queries, and guide customers through the purchasing process.

Latin America Customer Engagement Solution Market Trends

The increasing focus on omnichannel customer engagement is driving the market growth in Latin America. The region's businesses recognize the importance of providing a seamless and consistent experience across multiple channels, including websites, mobile apps, social media, and physical stores. This omnichannel approach requires sophisticated customer engagement solutions integrating data and interactions from various touchpoints to deliver a cohesive experience, driving demand for comprehensive omnichannel platforms.

The customer engagement solution market in Brazil is expected to grow over the forecast period. Brazilian companies emphasize seamless interactions across various social media, email, chat, and phone channels to provide customers with a unified, consistent experience. With a high smartphone penetration in Brazil, businesses are optimizing their customer engagement solutions for mobile devices to ensure a seamless customer experience.

Middle East & Africa Customer Engagement Solution Market Trends

Increasing mobile technology and connectivity adoption across the region is driving the market growth. With a significant portion of the population accessing the internet through smartphones, businesses are leveraging mobile channels to engage with customers effectively. Mobile apps, SMS marketing, and mobile-responsive websites are becoming essential to customer engagement strategies, driving the demand for solutions that enable seamless mobile interactions and experiences.

The customer engagement solution market in the UAE is expected to grow over the forecast period. Social media platforms are essential channels for customer engagement in the UAE. Businesses integrate social media into customer engagement solutions to monitor customer feedback, address concerns, and promote brand loyalty.

The South Africa customer engagement solution market is expected to grow over the forecast period. By leveraging data from various sources, such as social media, browsing history, and purchase behavior, businesses deliver highly contextual and personalized marketing messages to customers in South Africa, improving the relevance and effectiveness of their engagement efforts.

Key Customer Engagement Solution Company Insights

Some of the key market players include Oracle Corporation and Salesforce.com Inc.

-

Oracle Corporation offers Oracle Retail Customer Engagement Cloud Services, which includes components like Customer Management and Segmentation, Loyalty and Awards Management Cloud Service, and Data Integration with Interactive Marketing Tools. These features consolidate customer data, create targeted segments, and facilitate personalized engagements.

-

Salesforce.com Inc. provides customer engagement solutions through its digital experience platform, Experience Cloud. Salesforce's digital experience platform helps businesses deliver connected digital experiences and improve the customer experience.

Key Customer Engagement Solution Companies:

The following are the leading companies in the customer engagement solution market. These companies collectively hold the largest market share and dictate industry trends.

- Alvaria, Inc.

- Avaya Inc.

- Calabrio Inc.

- Genesys

- IBM Corporation

- NICE

- Nuance Communications Inc.

- OpenText Corporation

- Oracle Corporation

- Pegasystems Inc.

- Salesforce.com Inc.

- SAP SE

- Verint Systems Inc.

Recent Developments

-

In August 2023, Salesforce and IBM announced a collaboration to assist businesses in adopting AI for CRM. The two companies aim to work together to help clients transform customer, partner, and employee experiences while ensuring the security of their data.

-

In September 2023, Oracle introduced Generative AI features to improve customer service for organizations. Generative AI powers the new capabilities and has been added to the Oracle Fusion Cloud Customer Experience (CX) platform. This update aims to streamline customer service delivery, boost productivity, and enhance customer experience.

-

In June 2023, Avaya and Alvaria announced a partnership to improve their customer experience solutions. The partnership focuses on incorporating outreach capabilities into Avaya's cloud portfolio. This collaboration aims to deliver proactive customer outreach experiences while ensuring compliance with regulatory requirements. The partnership also aims to facilitate coordination of engagement activity across the enterprise, providing innovation without disruption.

Customer Engagement Solution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.64 billion

Revenue forecast in 2030

USD 50.03 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico;; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Alvaria, Inc.; Avaya Inc.; Calabrio Inc.; Genesys; IBM Corporation; NICE; Nuance Communications Inc.; OpenText Corporation; Oracle Corporation; Pegasystems Inc.; Salesforce.com Inc.; SAP SE; Verint Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Engagement Solutions Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the customer engagement solutionmarketreport based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Analytics & Reporting

-

Omnichannel

-

Robotic Process Optimization

-

Self-service

-

Workforce optimization

-

-

Services

-

Integration & deployment

-

Support & maintenance

-

Training & consulting

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & consumer goods

-

Healthcare

-

IT & telecom

-

Government, energy & utilities

-

Manufacturing

-

Travel & hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer engagement solutions market size was estimated at USD 23.45 billion in 2023 and is expected to reach USD 25.64 billion by 2024

b. The global customer engagement solutions market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 50.03 billion by 2030

b. North America dominated the industry with a share of 38.2% in 2023 and is projected to grow significantly over the forecast period due to the increasing data-driven business environment that recognizes the importance of using customer insights and analytics to drive decision-making and strategy.

b. Some key players operating in the customer engagement solutions market include Alvaria, Inc., Avaya Inc., Calabrio Inc., Genesys, IBM Corporation, NICE, Nuance Communications Inc., OpenText Corporation, Oracle Corporation, Pegasystems Inc., Salesforce.com Inc., SAP SE, Verint Systems Inc.

b. The increasing demand for customized and consistent customer experiences across various industries is the key factor driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.