- Home

- »

- IT Services & Applications

- »

-

Data Analytics Outsourcing Market Size & Share Report 2030GVR Report cover

![Data Analytics Outsourcing Market Size, Share & Trends Report]()

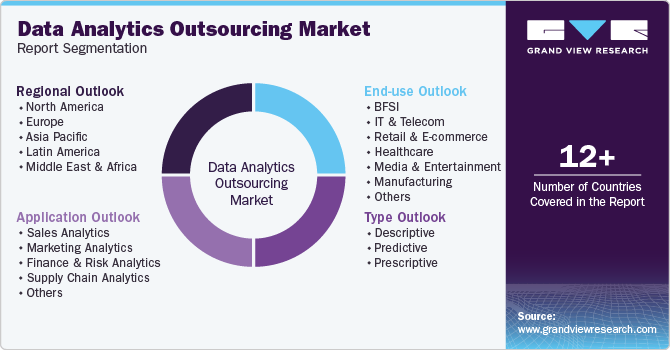

Data Analytics Outsourcing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Descriptive, Predictive, Prescriptive), By Application (Sales Analytics, Finance & Risk Analytics, Supply Chain Analytics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-561-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Analytics Outsourcing Market Summary

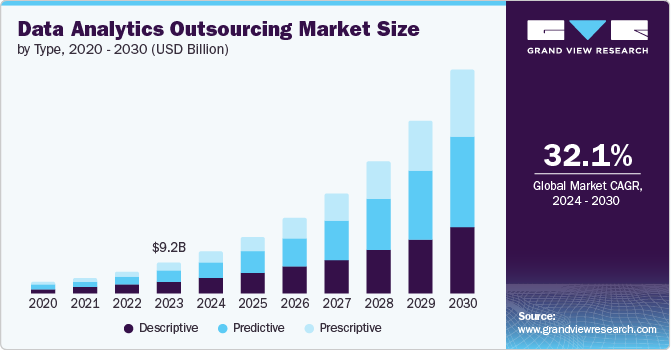

The global data analytics outsourcing market size was valued at USD 9.24 billion in 2023 and is projected to reach USD 66.68 billion by 2030, growing at a CAGR of 32.1% from 2024 to 2030. Establishing an in-house data analytics team requires substantial investment in technology, infrastructure, and skilled personnel.

Key Market Trends & Insights

- The North America region dominated the market with largest revenue share of 41.9% in 2023.

- Asia Pacific data analytics outsourcing market is expected to witness the fastest CAGR over the forecast period.

- Based on type, the descriptive type segment dominated the market and accounted for a market revenue share of 39.8% in 2023.

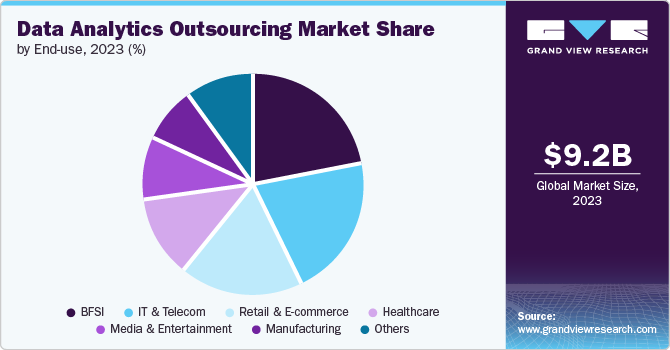

- Based on end use, the BFSI segment accounted for the largest market revenue share in 2023.

- Based on application, the sales analytics segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.24 Billion

- 2030 Projected Market Size: USD 66.68 Billion

- CAGR (2024-2030): 32.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Outsourcing to specialized analytics firms aids organizations in reducing these capital and operational expenses. Service providers offer scalable solutions, allowing businesses to pay only for their services. This flexibility in cost management drives the demand for the data analytics outsourcing market.

The exponential data growth of businesses and individuals has created a massive demand for data analytics. Organizations across various sectors are integrated with structured and unstructured data from diverse sources such as social media, IoT devices, transactions, and customer interactions. Managing and deriving actionable insights from this data internally is challenging due to infrastructure, expertise, and resource limitations. Outsourcing data analytics allows companies to handle large volumes of data efficiently, leveraging service provider's specialized skills and advanced tools.

Companies increasingly collaborate with specialized data analytics firms to leverage their expertise, advanced technologies, and innovative methodologies. These collaborations allow businesses to enhance their data-driven decision-making processes without requiring substantial in-house investments. By partnering with analytics service providers, companies access advanced tools such as machine learning and AI, gain insights from vast amounts of data more efficiently, and ensure compliance with data security standards. For instance, in June 2023, Moody’s Corporation and Microsoft announced a strategic partnership to deliver next-generation data, analytics, collaboration, research, and risk solutions for financial services and worldwide users. The solutions developed through this partnership are built on Microsoft Azure AI Service, Microsoft Teams, and Microsoft Fabric, leveraging Moody’s proprietary data, analytics, and research.

Type Insights

The descriptive type segment dominated the market and accounted for a market revenue share of 39.8% in 2023. Descriptive analytics involves summarizing and interpreting historical data to identify trends and patterns through data visualization techniques. Companies outsource descriptive analytics to leverage advanced visualization tools that transform complex data sets into understandable, interactive visual formats. This aids businesses in learning key insights and making informed decisions quickly. Service providers specialize in creating dashboards and visual reports that highlight essential metrics, making it easier for decision-makers to track performance, identify issues, and capitalize on opportunities.

The prescriptive type segment is expected to witness the fastest CAGR over the forecast period. Prescriptive analytics provides recommendations based on the analysis of historical data and predictive models, aiding businesses in optimizing their processes. Companies outsource prescriptive analytics to leverage advanced algorithms and optimization techniques offered by specialized service providers. These providers allow organizations to identify the most efficient ways to allocate resources, simplify operations, and enhance productivity, leading to operational efficiency and cost savings.

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2023. Outsourcing data analytics for fraud detection enables institutions to leverage advanced techniques such as machine learning and artificial intelligence to monitor real-time transactions and detect suspicious activities. Specialized analytics providers employ algorithms to identify patterns indicative of fraud and recommend preventive measures. Enhanced fraud detection and prevention capabilities help institutions safeguard their assets and maintain customer trust, driving demand.

The healthcare segment is anticipated to register the fastest CAGR over the forecast period. Data analytics plays an essential role in enhancing patient care and outcomes by providing insights into patient data, treatment effectiveness, and disease patterns. Healthcare providers outsource data analytics to specialized firms to leverage advanced analytical tools and techniques to process vast medical data. These insights aid in developing personalized treatment plans, predicting disease outbreaks, and improving overall patient care. By utilizing the expertise of analytics providers, healthcare organizations deliver more accurate diagnoses, effective treatments, and better patient outcomes.

Application Insights

The sales analytics segment accounted for the largest market revenue share in 2023. Sales analytics provides businesses with the tools to predict future sales trends accurately. Companies outsource sales analytics to leverage advanced predictive models and machine learning algorithms that analyze historical sales data, market conditions, and customer behavior. These insights enable businesses to forecast demand more accurately, plan inventory, and set sales targets. Improved forecasting reduces the risk of stock outs or overstock situations, optimizing inventory management and enhancing profitability.

The finance & risk analytics segment is expected to witness the fastest CAGR over the forecast period. Finance and risk analytics enable organizations to identify, assess, and mitigate various types of risks, including credit, market, operational, and liquidity risks. By outsourcing this function, companies benefit from advanced risk modeling techniques and tools used by analytics providers. These providers use historical data and predictive analytics to detect potential risks and recommend strategies to minimize their impact. This approach to risk management aids businesses in protecting their assets.

Regional Insights

North America region accounted for the largest revenue share in 2023. The region has numerous tech giants and startups, such as IBM, Fractal Analytics, and others specializing in advanced analytics, machine learning, and artificial intelligence. Companies in North America leverage these advanced technologies to gain a competitive edge, improve operational efficiencies, and enhance decision-making processes. Outsourcing data analytics allows businesses to access these advanced technologies without substantial in-house investment and drive their demand in the North American market.

U.S. Data Analytics Outsourcing Market Trends

The U.S. data analytics outsourcing market accounted for the largest market revenue share of 76.6% in 2023. The country generates a huge volume of data daily from diverse sources such as social media, e-commerce platforms, IoT devices, financial transactions, and healthcare records. Managing and analyzing this massive data requires significant resources and expertise. Outsourcing data analytics enables U.S. companies to process and interpret large datasets efficiently, transforming raw data into actionable insights that drive business strategies and operational improvements.

Asia Pacific Data Analytics Outsourcing Market Trends

Asia Pacific data analytics outsourcing market is expected to witness the fastest CAGR over the forecast period. Data analytics is essential for understanding international markets, consumer behavior, and competitive landscapes. Outsourcing data analytics allows companies to access global market insights provided by specialized providers. These providers offer analytics services that aid businesses in identifying growth opportunities, developing market entry strategies, and customizing their offerings to meet the needs of diverse markets. Additionally, outsourcing data analytics aids companies in enhancing their cybersecurity by leveraging the provider's expertise in data security. These providers implement advanced security protocols, encryption techniques, and compliance measures to protect sensitive data, driving its demand in the market.

The China data analytics outsourcing market is expected to witness significant growth over the forecast period. Outsourcing data analytics allows companies to work with providers specializing in their industry requirements. These providers offer customized solutions that address industry-specific challenges, such as regulatory compliance in healthcare, fraud detection in finance, retail inventory management, and manufacturing process optimization. This specialization ensures that businesses receive analytics services that are highly relevant and effective for their specific contexts. This customized solution drives the demand for data analytics outsourcing market in China.

Europe Data Analytics Outsourcing Market Trends

The Europe data analytics outsourcing market is expected to grow significantly over the forecast period. Outsourcing data analytics facilitates this collaboration by providing centralized analytics platforms and services integrating data from various sources. Service providers offer tools and methodologies that enable seamless data sharing and collaboration, ensuring that all stakeholders have access to accurate and up-to-date information. This collaborative approach enhances decision-making and drives organizational collaboration. Moreover, outsourcing data analytics aids companies by getting access to the latest analytics tools and methodologies without the need for significant internal investment. Analytics providers continuously update their technologies and techniques, allowing businesses to adopt innovations and respond to market changes. These factors combine to drive the demand for the European data analytics outsourcing market.

The UK data analytics outsourcing market is expected to grow significantly over the forecast period. Building and maintaining an in-house data analytics infrastructure is costly due to high labor costs, technology investments, and ongoing maintenance. Outsourcing data analytics offers a cost-effective solution, allowing businesses to access specialized skills and advanced tools without significant upfront expenditure. Additionally, outsourcing provides scalability, enabling companies to adjust their analytics capabilities according to business needs and market conditions.

Key Data Analytics Outsourcing Company Insights

Key industry players operating in the data analytics outsourcing market include Infosys Limited, IBM Corporation, Capgemini Accenture, TATA Consultancy Services Limited and others.

-

International Business Machines Corporation is a global technology and consulting company that provides IT solutions and services. The company offers a wide range of products and services, including cloud computing, artificial intelligence, data analytics, cybersecurity, and quantum computing.

-

Accenture is a leading company that provides a wide range of services and solutions in strategy, consulting, digital technology, and operations. Its product offerings include Accenture Cloud Platform, Accenture Applied Intelligence, and Accenture Cybersecurity Consulting Services & Strategies.

Key Data Analytics Outsourcing Companies:

The following are the leading companies in the data analytics outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Capgemini

- Fractal Analytics Inc.

- Genpact

- Infosys Limited

- IBM Corporation

- Mu Sigma

- TATA Consultancy Services Limited

- Trianz

- ZS Associates

Recent Developments

-

In February 2024, IBM and Wipro expanded their partnership to offer new AI services and client support. This collaboration aims to provide clients an Enterprise AI-ready platform to integrate and standardize numerous data sources, augmenting AI-enabled transformation across business functions by leveraging IBM's Watson AI and data platform.

-

In May 2023, Capgemini and Google Cloud announced the expansion of their strategic partnership in artificial intelligence (AI) and data analytics. The partnership aims to create a global Generative AI Google Cloud Center of Excellence (CoE). CoE aims to assist clients in advancing their business transformation goals, enhancing customer engagement, and achieving their AI-related objectives.

Data Analytics Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.57 billion

Revenue forecast in 2030

USD 66.68 billion

Growth rate

CAGR of 32.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; South Africa; South Arabia; UAE

Key companies profiled

Accenture; Capgemini; Fractal Analytics Inc.; Genpact; Infosys Limited; IBM Corporation; Mu Sigma; TATA Consultancy Services Limited; Trianz; ZS Associates

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Analytics Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the data analytics outsourcing market report based on, type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Descriptive

-

Predictive

-

Prescriptive

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Sales Analytics

-

Marketing Analytics

-

Finance & Risk Analytics

-

Supply Chain Analytics

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & E-commerce

-

Healthcare

-

Media & Entertainment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

South Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.