- Home

- »

- Communications Infrastructure

- »

-

Data Center Blade Server Market Size, Industry Report 2030GVR Report cover

![Data Center Blade Server Market Size, Share & Trends Report]()

Data Center Blade Server Market (2025 - 2030) Size, Share & Trends Analysis Report By Form Factor (Half-height, Full-height, Quarter-height), By Channel, By Application (Virtualization & Cloud Computing, AI & ML), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-511-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Blade Server Market Summary

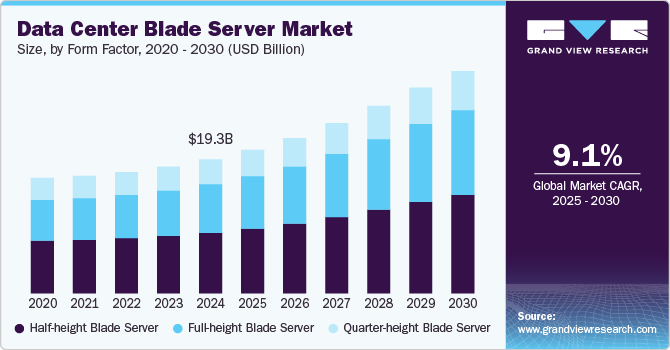

The global data center blade server market size was estimated at USD 19.26 billion in 2024 and is projected to reach USD 31.94 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The growth of the market is driven by increasing demand for high-density, energy-efficient computing solutions to support evolving enterprise IT and cloud infrastructure needs.

Key Market Trends & Insights

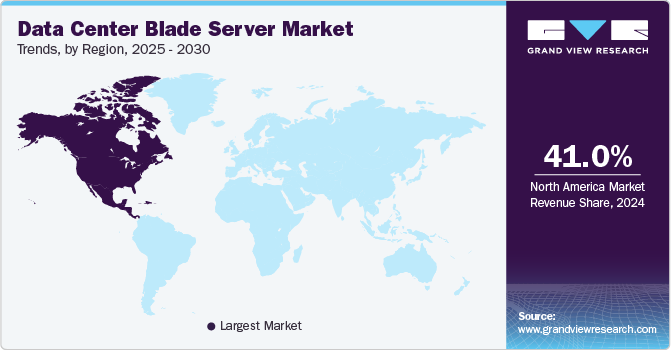

- North America held the major share of over 41% of the data center blade server industry in 2024.

- The data center blade server market in the U.S. is expected to grow significantly from 2025 to 2030.

- By form factor, the half-height blade server segment accounted for the largest market share of over 46% in 2024.

- By channel, the direct channel accounted for the largest market share of over 52% in 2024.

- By application, the virtualization and cloud computing segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.26 Billion

- 2030 Projected Market Size: USD 31.94 Billion

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

Organizations prioritize modular server architectures to enhance scalability, optimize space utilization, and reduce power consumption, making blade servers a preferred choice. In addition, the rising adoption of artificial intelligence (AI), big data analytics, and virtualization technologies is accelerating the deployment of high-performance computing environments, further fueling market expansion. The shift toward hybrid and multi-cloud strategies also increases the demand for blade servers as businesses seek flexible, cost-effective solutions to manage diverse workloads.

Furthermore, advancements in server management software and automation tools improve operational efficiency and minimize downtime, making blade server deployments more attractive. Regulatory requirements for data security and sustainability further influence investments in energy-efficient blade server solutions, reinforcing their role in modern data center infrastructures.

The increasing demand for high-density and energy-efficient computing solutions is a key driver of the data center blade server industry. As enterprises and cloud service providers seek to maximize computing power while minimizing physical space requirements, blade servers offer a compact, modular architecture that optimizes space utilization. Their shared power and cooling infrastructure significantly reduces energy consumption compared to traditional rack-mounted servers, aligning with sustainability goals and cost-saving initiatives.

Another major factor is the growing adoption of artificial intelligence (AI), big data analytics, and virtualization technologies. Organizations increasingly deploy AI-driven applications and large-scale data processing workloads that require high-performance computing infrastructure. Blade servers, with their ability to support powerful processors, large memory capacities, and high-speed interconnects, are well-suited for these demanding applications. In addition, the widespread use of virtualization in enterprise IT environments enhances the efficiency of blade servers by enabling resource consolidation and workload optimization.

The shift toward hybrid and multi-cloud strategies is also accelerating market growth. Businesses are moving towards flexible IT architectures integrating on-premise infrastructure with public and private cloud environments. Blade servers offer seamless integration capabilities, making them an ideal choice for companies implementing hybrid cloud solutions. Their ability to support software-defined networking (SDN) and hyper-converged infrastructure (HCI) further enhances their appeal in modern cloud-centric environments.

Advancements in server management software and automation tools improve operational efficiency and reduce downtime, further driving adoption. Blade servers come equipped with integrated management solutions that allow IT teams to monitor, configure, and maintain hardware remotely. Automated provisioning, predictive analytics, and AI-driven system optimization reduce manual intervention, ensuring seamless operation while lowering maintenance costs. These features make blade servers an attractive option for enterprises aiming to enhance IT agility and reliability.

Form Factor Insights

The half-height blade server segment accounted for the largest market share of over 46% in 2024. Half-height blade servers dominate the data center blade server market primarily due to their optimal balance of performance, space efficiency, and energy consumption. Their compact design allows for higher server density within a chassis, enabling organizations to maximize computing power while minimizing physical footprint. This particularly benefits enterprises and cloud service providers that require scalable solutions without significantly increasing power and cooling costs. In addition, half-height blade servers are widely adopted due to their versatility in supporting a broad range of workloads, including virtualization, web hosting, and enterprise applications, making them the preferred choice for diverse IT environments.

The full-height blade server segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for high-performance computing (HPC), AI, and data-intensive applications. These servers offer greater processing power, higher memory capacity, and expanded storage options, making them ideal for complex workloads such as AI training models, big data analytics, and enterprise resource planning (ERP) systems. Organizations requiring advanced computing capabilities are investing in full-height blade servers to meet rising performance demands while benefiting from the modular efficiency of blade architectures. The growth is further driven by industries such as finance, healthcare, and scientific research, where high computing power is crucial for mission-critical applications.

Channel Insights

The direct channel accounted for the largest market share of over 52% in 2024. The direct sales channel dominates the data center blade server market due to its ability to offer customized solutions, dedicated technical support, and cost advantages to enterprises. Large organizations, hyperscale data centers, and cloud service providers prefer procuring blade servers directly from manufacturers to ensure seamless integration with their existing IT infrastructure. Direct sales also provide benefits such as better pricing, tailored configurations, and comprehensive service-level agreements (SLAs), making it the preferred channel for enterprises with specific performance and scalability requirements. In addition, direct engagement with vendors enables organizations to access the latest technological advancements and receive priority support, further strengthening the dominance of this channel.

The reseller segment is expected to grow at a significant rate during the forecast period due to the increasing demand from small and medium-sized enterprises (SMEs) and regional data centers. Resellers are crucial in providing localized support, cost-effective solutions, and value-added services such as installation, maintenance, and financing options. As businesses seek flexible procurement models and managed service offerings, resellers are becoming an essential bridge between manufacturers and end-users. The rise of cloud computing, edge data centers, and hybrid IT environments is further driving the growth of this channel, as resellers cater to organizations looking for scalable, pre-configured, and budget-friendly blade server solutions.

Application Insights

The virtualization and cloud computing segment accounted for the largest market share in 2024. Virtualization and cloud computing workloads dominate the data center blade server market due to their widespread adoption across enterprises, hyperscale data centers, and cloud service providers. Blade servers are highly optimized for virtualization, allowing organizations to consolidate workloads, improve resource utilization, and reduce operational costs. Their modular architecture supports software-defined data centers (SDDCs) and hyper-converged infrastructure (HCI), making them ideal for cloud-based deployments.

In addition, the increasing shift toward hybrid and multi-cloud environments further reinforces the demand for blade servers in managing scalable, agile, and cost-efficient computing infrastructures. As enterprises continue migrating workloads to cloud platforms, blade servers remain crucial in supporting virtualized applications and cloud-native services.

The AI and machine learning (ML) workloads segment is expected to grow at the fastest rate during the forecast period due to the rising demand for HPC capabilities. Organizations across various industries, including healthcare, finance, and autonomous systems, increasingly deploy AI-driven applications that require powerful processing, high memory bandwidth, and accelerated computing. Full-height blade servers, equipped with GPUs, FPGAs, and specialized AI accelerators, are gaining traction to support deep learning models, predictive analytics, and real-time data processing. As AI adoption expands across sectors and enterprises invest in AI-driven decision-making and automation, the demand for blade servers optimized for AI/ML workloads is expected to surge rapidly.

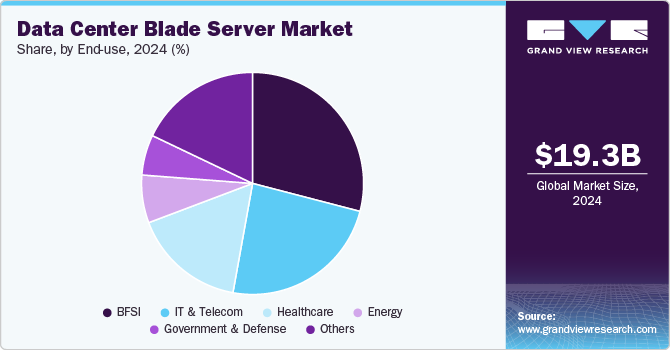

End-use Insights

The BFSI end use segment accounted for the largest market share in 2024. The BFSI sector dominates the data center blade server market due to its critical need for high-performance computing, data security, and real-time transaction processing. Financial institutions handle vast amounts of sensitive data, requiring robust and scalable IT infrastructure to ensure secure and efficient operations. Blade servers enable BFSI organizations to consolidate workloads, optimize data center space, and enhance operational efficiency while complying with stringent regulatory requirements. In addition, the growing adoption of digital banking, fintech applications, and AI-driven financial analytics further drives the demand for blade servers in this sector. The BFSI industry's reliance on low-latency computing and uninterrupted service delivery reinforces its leading position in the market.

The IT & telecom segment is expected to grow at a significant rate during the forecast period due to the rapid expansion of cloud computing, 5G infrastructure, and edge data centers. Telecom providers are increasingly deploying blade servers to support network virtualization, software-defined networking (SDN), and high-speed data processing required for next-generation connectivity solutions. In addition, the rising demand for hyperscale and colocation data centers, driven by increased internet usage, IoT proliferation, and digital transformation initiatives, is fueling market growth. As IT and telecom companies scale their infrastructure to meet the growing demand for cloud services, streaming, and mobile applications, the adoption of blade servers is expected to surge, making this segment the fastest-growing end-use industry.

Regional Insights

North America held the major share of over 41% of the data center blade server industry in 2024. The North America data center blade server industry is driven by the rapid expansion of hyperscale data centers, increasing adoption of cloud computing, and strong demand for AI and machine learning workloads. The region's advanced IT infrastructure and investments from major cloud service providers and enterprises support the growing deployment of blade servers. In addition, sustainability initiatives and the push for energy-efficient data centers are leading to the adoption of blade servers with enhanced power management and cooling technologies.

U.S. Data Center Blade Server Market Trends

The data center blade server market in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. remains the largest market for data center blade servers due to the presence of leading cloud providers, technology firms, and hyperscale data centers. The growing need for HPC in AI, big data analytics, and cybersecurity further accelerates market growth. The increasing shift toward hybrid and multi-cloud environments and regulatory compliance requirements is also driving demand for blade servers with advanced security and virtualization capabilities.

Europe Data Center Blade Server Industry Trends

Europe's data center blade server industry is growing significantly at a CAGR of over 7% from 2025 to 2030. The European data center blade server industry is witnessing steady growth, primarily driven by the digital transformation of enterprises, increasing cloud adoption, and the expansion of colocation data centers. The European Union's data protection regulations, such as GDPR, encourage secure and efficient server infrastructure investments. Additionally, sustainability initiatives to reduce data center carbon footprints influence the adoption of energy-efficient blade servers.

The UK data center blade server industry is expected to grow rapidly in the coming years. In the UK, the data center blade server industry is expanding due to increasing cloud service deployments, rising demand for edge computing, and growth in fintech and AI-driven applications. London remains a key data center hub, attracting investments from hyperscale cloud providers and colocation service providers. The shift towards hybrid IT infrastructure and government initiatives supporting digital transformation further fuel market expansion.

The Germany data center blade server industry held a substantial market share in 2024. Germany is one of Europe's leading markets for data center blade servers, driven by its strong industrial base, increasing adoption of Industry 4.0 technologies, and growing demand for AI and HPC applications. Enterprises in Germany are investing in modernized IT infrastructure to support cloud-based operations and IoT-driven smart manufacturing. Stringent data security regulations and sustainability mandates also push companies to adopt energy-efficient and compliant server solutions.

Asia Pacific Data Center Blade Server Industry Trends

The Asia Pacific's data center blade server industry is growing significantly at a CAGR of over 10% from 2025 to 2030. The Asia Pacific region is experiencing significant growth in the data center blade server industry due to rapid digitalization, increasing internet penetration, and rising demand for cloud services. Countries in this region are witnessing a surge in hyperscale and colocation data centers to support expanding IT and telecom networks. The deployment of 5G, edge computing, and AI-driven applications further drives demand for high-performance blade servers across various industries.

The China data center blade server industry held a substantial share in 2024. China is a dominant player in the Asia Pacific data center blade server industry, fueled by the rapid expansion of cloud computing, government-led digital initiatives, and strong investments from tech giants such as Alibaba, Tencent, and Huawei. The increasing deployment of AI, big data, and IoT applications drives demand for high-density, scalable server solutions. Additionally, China's push for self-reliance in semiconductor and IT hardware development is leading to innovation in domestic server manufacturing.

The Japan data center blade server industry held a substantial share in 2024. Japan's data center blade server industry is growing steadily, supported by advancements in AI, fintech, and 5G infrastructure. The country's emphasis on data security, regulatory compliance, and sustainable IT solutions shapes investment trends in energy-efficient blade server technologies. Additionally, Japan's robust IT and telecom sector, coupled with increasing demand for edge computing, is accelerating the adoption of modular and high-performance server architectures.

India's data center blade server industry is expanding rapidly. India is emerging as a high-growth market for data center blade servers, driven by rapid cloud adoption, increasing investments in hyperscale data centers, and expanding digital services. Government initiatives such as Digital India and data localization policies encourage enterprises to invest in domestic IT infrastructure. Additionally, the rise of AI-driven applications, e-commerce, and fintech services fuel demand for scalable and cost-efficient server solutions. The growing presence of global cloud providers and data center operators further supports market expansion.

Key Data Centre Blade Server Company Insights

Key players operating in the data center blade server market include Cisco Systems, Inc., Dell Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Huawei, IBM, INSPUR Co., Ltd., Lenovo, Oracle, and Super Micro Computer, Inc. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Super Micro Computer, Inc. unveiled its latest X14 AI, multi-node, rackmount, and edge server families. It is powered by Intel Xeon 6 processors with E-cores, with P-core systems to follow soon, incorporating advanced liquid cooling technology. The new X14 portfolio is designed for optimal performance and energy efficiency while enhancing manageability, security, and compliance with open industry standards. Additionally, the systems are rack-scale optimized, ensuring seamless integration into modern data centers.

-

The launch includes the Intel Xeon 6700-series processors with E-cores, featuring SuperBlade—Supermicro’s high-performance, density-optimized, and energy-efficient multi-node platform. Engineered for AI, data analytics, cloud, HPC, and enterprise workloads, these new blade systems enable a single rack to support up to 34,560 Xeon compute cores, delivering exceptional processing power and efficiency.

-

In October 2024, Hewlett Packard Enterprise Development LP introduced the industry's first 100% fanless direct liquid cooling system architecture, designed to enhance energy and cost efficiency for large-scale AI deployments. This innovative architecture is built on four key pillars: Comprehensive 8-Element Cooling Design - The system features liquid cooling for the CPU, GPU, full server blade, local storage, network fabric, pod/cluster, and coolant distribution unit (CDU), ensuring efficient thermal management across all critical components. High-Density, High-Performance System Design - Engineered for maximum performance, the system undergoes rigorous testing and includes advanced monitoring software and on-site services to facilitate the seamless deployment of sophisticated compute and cooling solutions. Integrated Network Fabric for Massive Scalability - The architecture incorporates an optimized network fabric, utilizing lower-cost and lower-power connections to support large-scale AI workloads efficiently. Open System Design for Accelerator Flexibility - Designed for adaptability, the system allows enterprises to choose from a variety of accelerators, ensuring flexibility in AI and HPC applications. By eliminating fans and leveraging advanced liquid cooling, HPE’s new architecture sets a benchmark for energy-efficient, high-performance AI infrastructure at scale.

Key Data Centre Blade Server Companies:

The following are the leading companies in the data centre blade server market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Dell Inc.

- FUJITSU

- Hewlett Packard Enterprise Development LP

- Huawei

- IBM

- INSPUR Co., Ltd.

- Lenovo

- Oracle

- Super Micro Computer, Inc.

Data Center Blade Server Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.63 billion

Revenue forecast in 2030

USD 31.94 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Form factor, channel, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Cisco Systems, Inc.; Dell Inc.; FUJITSU; Hewlett Packard Enterprise Development LP; Huawei; IBM; INSPUR Co., Ltd.; Lenovo; Oracle; Super Micro Computer, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Blade Server Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center blade server market report based on form factor, channel, application, end-use, and region.

-

Form Factor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Half-height Blade Server

-

Full-height Blade Server

-

Quarter-height Blade Server

-

-

Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Reseller

-

Systems Integrator

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Virtualization and Cloud Computing

-

High-performance Computing (HPC)

-

Storage and Backup

-

Web Hosting

-

Database Management

-

AI and Machine Learning Workloads

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Energy

-

IT & Telecom

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center blade server market size was estimated at USD 19.26 billion in 2024 and is expected to reach USD 20.63 billion in 2025

b. The global data center blade server market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 31.94 billion by 2030

b. The North America dominated the data center blade server market with a share of over 41% in 2024. The North America data center blade server industry is driven by the rapid expansion of hyperscale data centers, increasing adoption of cloud computing, and strong demand for AI and machine learning workloads. The region's advanced IT infrastructure and investments from major cloud service providers and enterprises support the growing deployment of blade servers.

b. Some key players operating in the data center blade server market include Cisco Systems, Inc., Dell Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Huawei, IBM, INSPUR Co., Ltd., Lenovo, Oracle, and Super Micro Computer, Inc.

b. The growth of the data center blade server market is driven by increasing demand for high-density, energy-efficient computing solutions to support evolving enterprise IT and cloud infrastructure needs. Organizations prioritize modular server architectures to enhance scalability, optimize space utilization, and reduce power consumption, making blade servers a preferred choice.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.