- Home

- »

- IT Services & Applications

- »

-

Data Center GPU Market Size & Share, Industry Report 2033GVR Report cover

![Data Center GPU Market Size, Share & Trends Report]()

Data Center GPU Market (2025 - 2033) Size, Share & Trends Analysis By Deployment (On-premises, Cloud), By Function (Training, Inference), By End Use (Cloud Service Providers, Enterprises, Government), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-450-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center GPU Market Summary

The global data center GPU market size was estimated at USD 14.48 billion in 2024 and is projected to reach USD 190.10 billion by 2033, growing at a CAGR of 35.8% from 2025 to 2033 due to the rapid adoption of artificial intelligence (AI), machine learning (ML), and deep learning applications across industries.

Key Market Trends & Insights

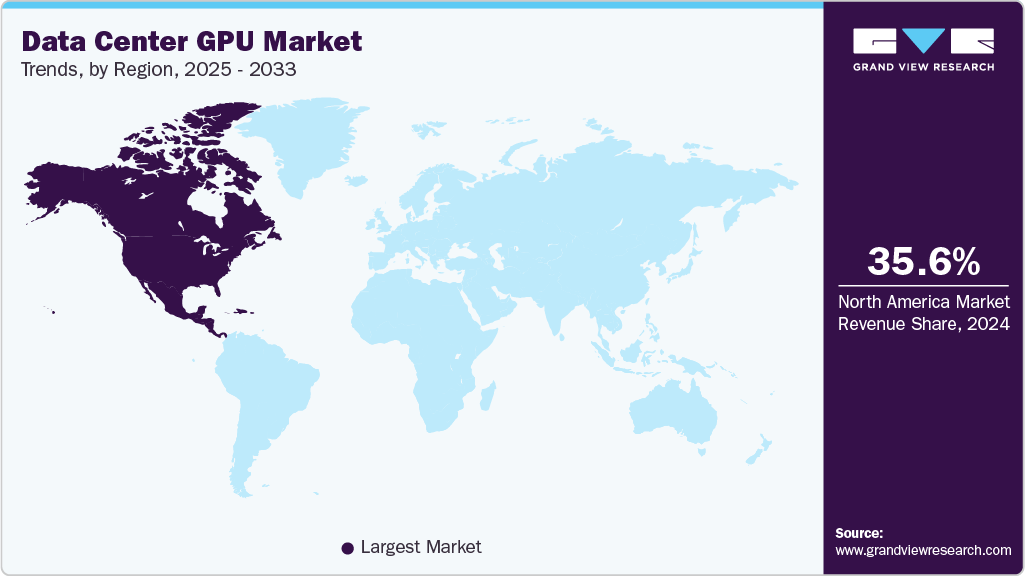

- North America data center GPU dominated the global market with the largest revenue share of 35.6% in 2024.

- The data center GPU industry in U.S. is expected to grow significantly over the forecast period.

- By deployment, on-premises led the market and held the largest revenue share of 50.1% in 2024.

- By function, the inference segment held the dominant position in the market and accounted for the largest revenue share in 2024.

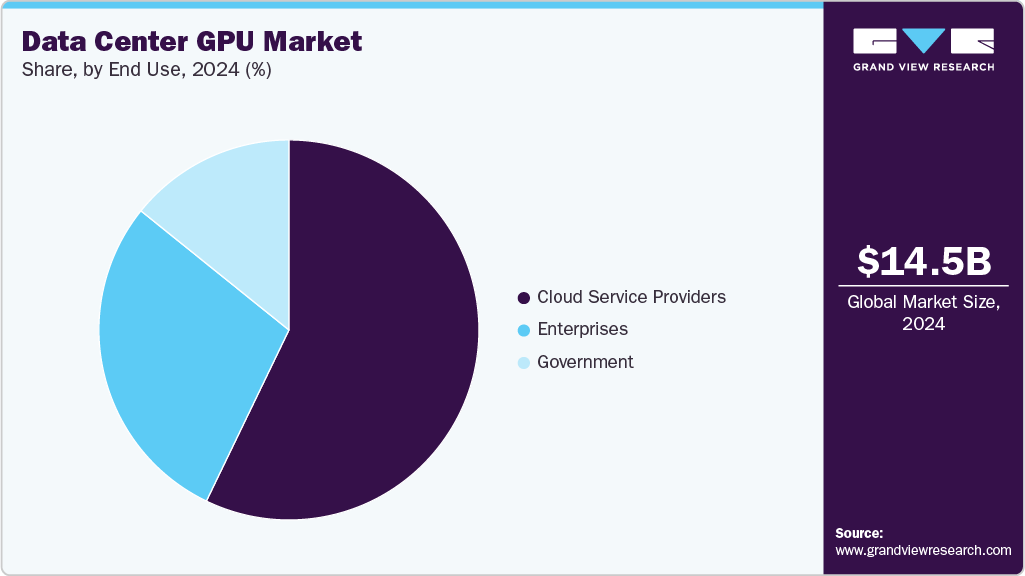

- By end use, the cloud service providers segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 14.48 Billion

- 2033 Projected Market Size: USD 190.10 Billion

- CAGR (2025-2033): 35.8%

- North America: Largest market in 2024

GPUs are highly efficient in handling parallel processing tasks, making them essential for training and inference workloads in AI models. Organizations are increasingly deploying GPU-accelerated computing infrastructure to support applications such as computer vision, natural language processing, and recommendation engines, fueling the demand for powerful, scalable GPU solutions in data centers.The global growth of hyperscale data centers operated by tech giants such as Amazon Web Services (AWS), Google Cloud, Microsoft Azure, and Alibaba Cloud is significantly boosting data center GPU industry. These providers are investing in high-performance computing (HPC) infrastructure to meet increasing customer demand for cloud-based AI and data analytics services. The scalability, cost-efficiency, and flexibility of GPU-accelerated cloud instances are further propelling demand across both public and private cloud environments.

Data-driven industries, such as finance, healthcare, e-commerce, and telecom, are increasingly leveraging big data analytics and real-time data processing. GPUs offer enhanced speed and parallel processing capabilities to handle massive datasets, providing a performance edge over traditional CPUs. This need for faster, more efficient computing is accelerating the integration of GPUs into data center architectures, especially in sectors requiring advanced simulations, predictive analytics, and business intelligence.

Deployment Insights

The on-premises segment dominated the market and accounted for the revenue share of 50.1% in 2024, driven bythe increasing concerns over data security, compliance, and latency-sensitive workloads that require localized processing. Organizations in highly regulated industries such as finance, healthcare, and government prefer on-premises GPU infrastructure to maintain full control over their data and computing environments. Moreover, enterprises with customized AI models or proprietary datasets often opt for on-premise deployments to optimize performance, reduce data transfer costs, and ensure privacy. The rising need for deterministic performance in AI workloads, combined with advancements in modular, high-density GPU server solutions, is further encouraging businesses to invest in on-premises GPU infrastructure.

The cloud segment is anticipated to grow at the highest CAGR during the forecast period due to the growing demand for scalable, on-demand GPU resources to support fluctuating AI, machine learning, and data analytics workloads without the need for heavy capital investment. Enterprises and startups are leveraging cloud-based GPU services to accelerate time-to-market for AI innovations, benefiting from flexible pricing models and global infrastructure availability.

Function Insights

Theinference segment dominated the market and accounted for the largest revenue share in 2024,driven by therising deployment of AI-powered applications across industries such as healthcare, finance, retail, and autonomous vehicles, which require real-time decision-making capabilities. The increasing volume of unstructured data and demand for low-latency processing are accelerating the adoption of GPUs for AI inference tasks. Additionally, the proliferation of edge computing and IoT devices necessitates rapid, efficient inference at the data center level.

The training segment is expected to grow at a significant CAGR during the forecast period due tothe growing complexity and scale of deep learning models, which require immense parallel processing power and high memory bandwidth, capabilities by GPUs. The surge in generative AI, natural language processing (NLP), and computer vision applications is fueling demand for GPU-accelerated training environments. In addition, hyperscale cloud providers and AI research institutions are heavily investing in high-performance computing infrastructure to support continuous model development and experimentation.

End Use Insights

The cloud service providers segment dominated the market and accounted for the largest revenue share in 2024, driven by therising demand for scalable, on-demand AI and machine learning capabilities across various industries. Enterprises are increasingly turning to cloud platforms to avoid the high capital and operational costs of maintaining GPU infrastructure, thereby boosting demand for GPU-accelerated instances. The rapid expansion of AI workloads, including model training, inference, and data analytics, is compelling cloud providers to invest in advanced GPU clusters.

The enterprises segment is expected to grow at a significant CAGR over the forecast period.Enterprises across sectors such as manufacturing, healthcare, and finance are leveraging GPU-accelerated computing for simulation, predictive analytics, and digital twins. Moreover, the integration of GPUs into hybrid cloud architectures enables enterprises to maintain performance while balancing flexibility and control, further fueling market growth in this segment.

Regional Insights

North America data center GPU held a significant share in the global market in 2024 due to the early adoption of AI technologies, the presence of major cloud and hyperscale data center operators, and a robust startup ecosystem focused on AI and high-performance computing. Significant investments in AI infrastructure by both private and public sectors, along with favorable regulatory frameworks supporting digital transformation, are accelerating GPU deployment. In addition, the region's strong semiconductor R&D capabilities and partnerships between tech companies and academic institutions are driving innovation and adoption of advanced GPU solutions.

U.S. Data Center GPU Market Trends

The data center GPU market in the U.S. is expected to grow significantly at a CAGR of 33.9% from 2025 to 2033, due togovernment initiatives to strengthen national AI capabilities, large-scale digital transformation projects various companies, and surging demand from industries such as defense, automotive, and healthcare. The country’s strong venture capital landscape fuels AI startups, while a mature cloud ecosystem fosters widespread use of GPU-powered services. Moreover, growing concerns around data sovereignty and cybersecurity are prompting enterprises to build GPU-powered private and hybrid data centers.

Europe Data Center GPU Market Trends

The data center GPU market in Europe is anticipated to register considerable growth from 2025 to 2033 due to increasing adoption of AI and analytics in industrial automation, smart manufacturing, and energy optimization initiatives. The region’s commitment to sustainability and energy-efficient data center operations is encouraging the deployment of modern, GPU-accelerated infrastructure. EU-backed digital and AI funding programs, combined with a growing focus on building sovereign AI infrastructure and local data processing capabilities, are further supporting market growth across the continent.

The UK data center GPU market is expected to grow rapidly in the coming years as enterprises and research institutions increasingly adopt AI for applications in financial services, pharmaceuticals, and climate modeling. The government’s National AI Strategy and funding for AI research hubs are promoting GPU adoption in both public and private sectors. In addition, post-Brexit efforts to strengthen domestic digital infrastructure and attract international tech investment are further accelerating demand for high-performance GPU-driven data centers.

The Germany data center GPU market held a substantial market share in 2024 due tothe country’s strong industrial base, which is integrating AI and machine learning into manufacturing (Industry 4.0), automotive R&D, and logistics optimization. Public-private initiatives focused on digital transformation, data center modernization, and smart city infrastructure are encouraging GPU investment.

Asia Pacific Data Center GPU Market Trends

Asia Pacific data center GPU market is expected to grow at the highest CAGR of 37.6% from 2025 to 2030, due to rising digitalization, smart city development, and rapid AI adoption across sectors such as fintech, healthcare, and e-commerce. Government-led digital infrastructure projects, along with the expansion of local and international hyperscale data centers, are fueling GPU demand. The region's growing tech talent pool, startup ecosystem, and favorable regulatory support for emerging technologies are also contributing to sustained market expansion.

The Japan data center GPU market is expected to grow rapidly in the coming yearsas the country leverages GPUs for robotics, autonomous systems, and AI-enhanced manufacturing in line with Society 5.0 goals. The aging population is also driving healthcare innovation powered by AI, increasing the need for GPU-based processing. Strategic partnerships between tech companies, research institutes, and the government are fostering AI and HPC development, while ongoing efforts to reduce dependency on foreign cloud services are promoting domestic GPU data center investment.

The China data center GPU market held a substantial market share in 2024, due to thegovernment support for AI development under initiatives such as the New Infrastructure policy. The rapid deployment of AI in surveillance, fintech, and smart city applications is driving demand for GPU-accelerated data centers. Domestic tech giants are investing heavily in AI cloud services, and geopolitical factors are pushing the development of homegrown GPU technologies and self-reliant computing infrastructure, further boosting market momentum.

Key Data Center GPU Company Insights

Key players operating in the data center GPU industry are NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Micron Technology, Inc., IBM Corporation, Samsung SDS, Qualcomm Technologies, Inc., Google Cloud. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Intel Corporationintroduced a new range of GPUs and AI accelerators aimed at professionals and developers, with a focus on enhancing scalable AI performance across diverse workloads. Among the highlights is the Intel Gaudi 3 PCIe card, engineered to enable efficient AI inferencing within existing data center infrastructure. Supporting advanced AI models like Llama, the solution offers flexibility for organizations of all sizes, allowing them to run models from Llama 3.1 8B up to full-scale versions such as Llama 4 Scout and Maverick.

-

In March 2025, NVIDIA Corporation unveiled its latest RTX PRO Blackwell series, in GPU technology for professionals across AI, design, engineering, and creative industries. This new generation delivers cutting-edge capabilities in accelerated computing, AI inference, ray tracing, and neural rendering. The lineup features the NVIDIA RTX PRO 6000 Blackwell Server Edition for data centers, alongside several desktop GPUs including the RTX PRO 6000, 6000 Max-Q, 5000, 4500, and 4000 Blackwell Workstation Editions.

Key Data Center GPU Companies:

The following are the leading companies in the data center GPU market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Google Cloud

- Huawei Cloud Computing Technologies Co., Ltd.

- IBMCorporation

- Imagination Technologies

- Intel Corporation

- Micron Technology, Inc.

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Samsung SDS

Data Center GPU Market Report Scope

Report Attribute

Details

Market size in 2025

USD 16.40 billion

Revenue forecast in 2033

USD 190.10 billion

Growth rate

CAGR of 35.8% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, function, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

NVIDIA Corporation; Intel Corporation; Advanced Micro Devices, Inc.; Micron Technology, Inc.; IBM Corporation; Samsung SDS; Qualcomm Technologies, Inc.; Google Cloud; Imagination Technologies; Huawei Cloud Computing Technologies Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center GPU Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the data center GPU market report based on deployment, function, end use, and region.

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Training

-

Inference

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud Service Providers

-

Enterprises

-

Government

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center GPU market was valued at USD 14.48 billion in 2024 and is expected to reach USD 16.40 billion in 2025.

b. The global data center GPU market is expected to grow at a compound annual growth rate of 35.8% from 2025 to 2033 to reach USD 190.10 billion by 2033.

b. The on-premises segment dominated the market and accounted for the revenue share of 50.1% in 2024, driven by the increasing concerns over data security, compliance, and latency-sensitive workloads that require localized processing.

b. Key players in the cloud workflow market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Micron Technology, Inc., IBM Corporation, Samsung SDS, Qualcomm Technologies, Inc., Google Cloud, Imagination Technologies, Huawei Cloud Computing Technologies Co., Ltd.

b. The data center GPU market has been experiencing significant growth, driven by the rapid adoption of artificial intelligence (AI), machine learning (ML), and deep learning applications across industries. GPUs are highly efficient in handling parallel processing tasks, making them essential for training and inference workloads in AI models.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.