- Home

- »

- IT Services & Applications

- »

-

Data Center Transformation Market Size, Share Report, 2030GVR Report cover

![Data Center Transformation Market Size, Share & Trends Report]()

Data Center Transformation Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Consolidation, Optimization, Automation), By End-user, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-011-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Transformation Market Summary

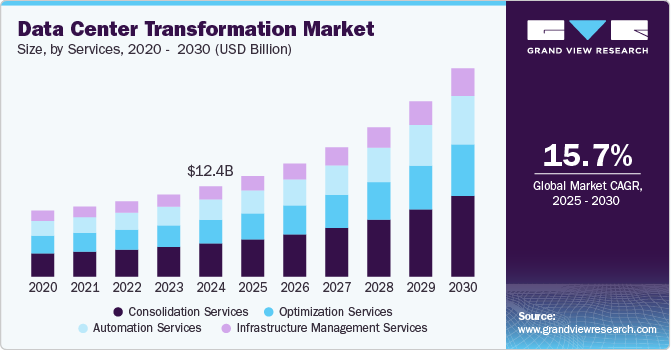

The global data center transformation market size was estimated at USD 12.40 billion in 2024 and is projected to reach USD 28.62 billion by 2030, growing at a CAGR of 15.7% from 2025 to 2030. As organizations shift towards hybrid cloud models to manage scalability, security, and agility, there’s an emphasis on transforming traditional data centers.

Key Market Trends & Insights

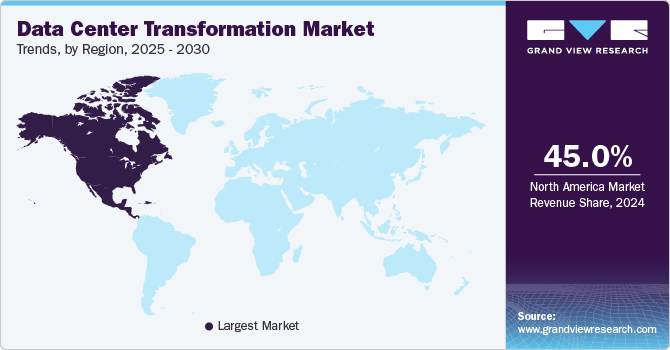

- The data center transformation market in North America held a share of over 45.0% in 2024.

- Asia Pacific is growing significantly at a CAGR of 16.5% from 2025 to 2030.

- Based on service, the consolidation services segment accounted for the largest revenue share of over 36.0% in 2024.

- Based on end-user, the cloud service providers segment accounted for the largest revenue share of over 45.0% in 2024.

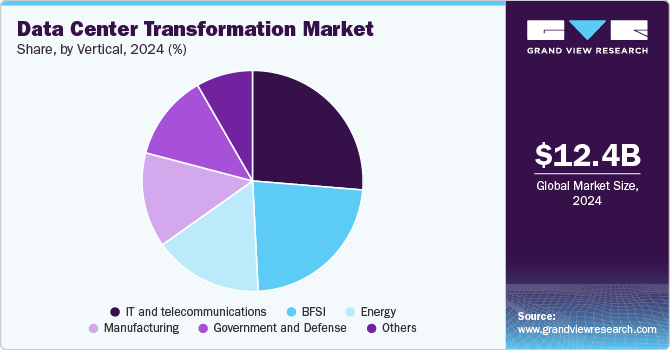

- Based on vertical, the IT and telecommunication segment accounted for the largest revenue share of over 36.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.40 Billion

- 2030 Projected Market Size: USD 28.62 Billion

- CAGR (2025-2030): 15.7%

- North America: Largest market in 2024

This transformation involves modernizing infrastructure through virtualization, automation, and the deployment of advanced networking solutions, which collectively enhance performance and reduce operational costs. The increased need for agility to support real-time data processing, a requirement that's heightened by trends such as edge computing and 5G, which rely on highly responsive, localized data centers.

Cost optimization and energy efficiency are also major growth drivers in data center transformation industry. Many organizations are shifting to energy-efficient models, integrating sustainable practices such as renewable energy sources, intelligent cooling systems, and smart power management. This trend is further amplified by regulatory pressures and corporate responsibility initiatives aimed at reducing carbon footprints. Data center transformation aligns with these goals by adopting energy-efficient hardware and software solutions that minimize power consumption while maintaining high-performance standards. According to the International Energy Agency (IEA), data centers consumed approximately 460 terawatt-hours (TWh) of electricity in 2022, with projections suggesting this could exceed 1,000 TWh by 2026 if current trends continue.

Security and compliance requirements also play a crucial role in driving data center transformation industry. As cyber threats become more complex and data protection regulations tighten, organizations are investing in robust, secure data infrastructures. This need is pushing businesses to transition from legacy systems, which are often vulnerable and non-compliant, to secure, modern environments that can better protect sensitive information and ensure regulatory adherence. Advanced encryption, multi-layered security frameworks, and integrated threat detection solutions are increasingly part of the data center transformation process, making security a primary concern for organizations across industries.

Digital transformation initiatives across industries also play a significant role. Sectors such as finance, healthcare, retail, and manufacturing are rapidly embracing digital tools to stay competitive, engaging in multi-cloud strategies, and migrating workloads to virtualized environments. As a result, organizations are overhauling their data centers to support agile IT environments and high-performance computing resources, aiming for improved operational efficiency and a better customer experience.

Data-driven business models are creating an ongoing demand for real-time data processing and analysis. Companies are leveraging big data and artificial intelligence (AI) for predictive analytics, machine learning, and improved decision-making, all of which require high-performance data centers. This shift towards data-centric business operations demands a transformation from traditional infrastructure to one that can handle vast data volumes and perform intensive computations, a necessity that legacy systems often cannot meet effectively.

Service Insights

The consolidation services segment accounted for the largest revenue share of over 36.0% in 2024 driven by the rising demand for optimized operational efficiency and cost reduction. Organizations aim to reduce their IT overhead while maximizing output, and consolidation services offer a streamlined way to achieve this by combining disparate data centers, reducing the number of physical servers, and integrating legacy systems into unified platforms. By consolidating data centers, businesses can lower their hardware and maintenance costs, conserve energy, and reduce their physical footprint, creating significant cost savings while maintaining, or even improving, performance.

The automation services segment is expected to grow at a CAGR of 16.2% over the forecast period. As companies work towards reducing their carbon footprint, automation plays a vital role in optimizing energy usage within data centers. Automated energy management systems, for instance, can monitor and adjust power usage, cooling systems, and workload distribution based on real-time demand, leading to significant reductions in energy consumption and operational costs. This focus on green IT initiatives aligns with corporate social responsibility goals and positions data centers as more environmentally sustainable infrastructure.

End-user Insights

The cloud service providers segment accounted for the largest revenue share of over 45.0% in 2024 owing to the increasing demand for hybrid and multi-cloud environments. As organizations seek to take advantage of both on-premises and cloud solutions, they are adopting hybrid cloud strategies to facilitate a smooth flow of data and applications between these environments. In addition, multi-cloud strategies are becoming more popular. These involve using multiple Cloud Service Providers (CSPs) to prevent vendor lock-in, improve flexibility, and optimize costs.

The colocation providers segment is expected to grow at a significant CAGR over the forecast period due to the improved connectivity and lower latency demands, fueled by advancements in 5G and edge computing. Colocation providers are increasingly establishing data centers in strategically located edge regions, closer toeEnd users, to reduce latency for real-time applications such as online gaming, video streaming, and autonomous systems. These facilities are optimized for low-latency requirements, making colocation an appealing option for businesses that need faster data processing speeds and closer proximity to customers.

Vertical Insights

The IT and telecommunication segment accounted for the largest revenue share of over 36.0% in 2024. Growing data traffic is a critical factor driving the transformation of data centers in the IT and telecommunications sectors. The explosive rise in data generated by mobile devices, video streaming, and IoT sensors is pushing telecom companies to modernize their data infrastructure to accommodate increased volumes and more complex data types. This modernization includes upgrades to storage and networking capabilities and integration with cloud environments to ensure seamless data flow and access. Telecom companies are adopting scalable, cloud-based solutions to handle these surges in data, allowing for faster processing and improved data management across networks.

The BFSI segment is expected to grow at a significant CAGR over the forecast period. Data security and regulatory compliance are essential in the BFSI sector, driving significant investment in secure, modern data centers. With stringent regulations such as GDPR, PCI-DSS, and CCPA governing data protection, financial institutions are modernizing their data centers to ensure compliance and prevent costly data breaches. Advanced data centers provide enhanced security frameworks, including multi-factor authentication, encryption, and AI-powered threat detection, which help institutions manage compliance risks and protect sensitive customer information.

Regional Insights

The data center transformation market in North America held a share of over 45.0% in 2024. Software-defined networking (SDN), software-defined storage (SDS), and other SDI solutions are enabling more efficient resource management within data centers. In North America, SDI adoption is rising, as it allows organizations to virtualize and dynamically manage infrastructure, boosting agility and scalability.

The data center transformation market in the U.S. is expected to grow significantly at a CAGR of 14.7% from 2025 to 2030. U.S. organizations are adopting hybrid and multi-cloud infrastructures at a rapidly, allowing them to blend on-premises data centers with public and private cloud resources. This model offers flexibility and scalability, helping businesses manage diverse workloads across different cloud environments while maintaining control over sensitive data.

Europe Data Center Transformation Industry Trends

The data center transformation market in Europe is growing with a significant CAGR from 2025 to 2030. Sustainability and Green Data Centers are a primary trend, as European companies and governments prioritize reducing carbon footprints. Many organizations are investing in energy-efficient data center solutions, such as renewable energy sources (wind, solar, hydro), advanced cooling technologies, and power usage effectiveness (PUE) optimizations. Initiatives such as the EU's Green Deal and the Climate Neutral Data Centre Pact push data centers toward net-zero emissions targets, promoting energy-efficient equipment, intelligent cooling systems, and renewable power integration.

The UK data center transformation market is expected to grow rapidly in the coming years. Many UK businesses are turning to colocation services as part of their data center transformation strategy. By partnering with colocation providers, organizations benefit from shared infrastructure, enhanced security, and access to advanced technologies without the high capital expenditures associated with building and maintaining their own data centers.

The Germany data center transformation market held a substantial market share in 2024. Artificial intelligence (AI) and automation are becoming integral to data center operations in Germany. Organizations are utilizing AI-driven tools for predictive maintenance, workload optimization, and security threat detection. Automation technologies are streamlining operations and reducing the need for manual intervention, leading to improved efficiency and reduced operational costs.

Asia Pacific Data Center Transformation Industry Trends

Asia Pacific is growing significantly at a CAGR of 16.5% from 2025 to 2030. The rollout of 5G networks is significantly impacting data center transformation in the region. As telecommunications companies invest in 5G infrastructure, the need for robust and flexible data centers to support increased bandwidth and low-latency applications is growing. This trend is leading to the establishment of new data center facilities that are optimized for 5G use cases, such as smart cities, autonomous vehicles, and augmented reality.

The Japan data center transformation market is expected to grow rapidly in the coming years. The demand for colocation services is rising as companies seek to reduce capital expenditures while gaining access to advanced data center facilities. Colocation providers offer scalable solutions, enabling businesses to expand their IT infrastructure without the need for significant upfront investment.

The China data center transformation market held a substantial market share in 2024 as China is witnessing a surge in cloud computing adoption across various sectors, including finance, healthcare, and e-commerce. Major cloud service providers, such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud, are investing heavily in expanding their data center footprints to meet the growing demand for cloud services.

Key Data Center Transformation Company Insights

Key players operating in the data center transformation market IBM, Microsoft, Cisco Systems, Inc., Dell Inc., and Schneider Electric SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2024, Dell Inc. launched new rack-scalable systems, servers, and storage innovations within its Dell AI Factory, tailored for high-density computing and scalable AI workloads. The 21-inch Dell IR7000 rack, designed for high CPU and GPU density, includes native liquid cooling capable of managing up to 480KW and capturing nearly 100% of heat. Dell's Integrated Rack Scalable Systems (IRSS) simplifies AI infrastructure setup with a plug-and-play approach, while new PowerEdge models like the XE9712 (NVIDIA-based) and M7725 (AMD-based) support large AI clusters and dense compute. PowerScale advancements boost capacity, AI performance, and data discoverability, with Dell’s Generative AI Solutions delivering optimized, scalable systems.

-

In June 2024, Cisco Systems, Inc. introduced its Nexus HyperFabric AI Clusters, a streamlined data center solution developed in partnership with NVIDIA to support generative AI workloads. This solution combines Cisco and NVIDIA technologies to simplify the deployment of generative AI applications, providing extensive visibility and analytics across the entire AI infrastructure stack. The Nexus HyperFabric AI Clusters enable enterprises to build AI models and inference application infrastructure without needing advanced IT expertise. In addition, the exclusive cloud management capabilities make it easier for customers to deploy, handle, and monitor their data centers, colocation facilities, and edge sites efficiently.

Key Data Center Transformation Companies:

The following are the leading companies in the data center transformation market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Atos

- Cisco Systems, Inc.

- Cognizant

- Dell Inc.

- HCL Technologies

- IBM

- Schneider Electric SE

- Wipro

Data Center Transformation Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.82 billion

Revenue forecast in 2030

USD 28.62 billion

Growth rate

CAGR of 15.7% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

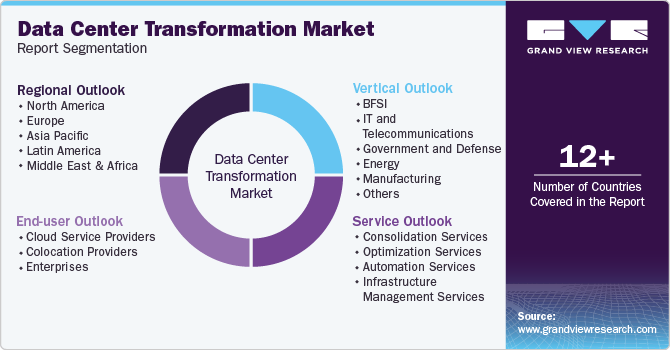

Service, end-user, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Atos; Cisco Systems, Inc.; Cognizant; Dell Inc.; HCL Technologies; IBM; Microsoft; Schneider Electric SE; Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Transformation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center transformation market report based on services, end-user, vertical, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consolidation Services

-

Optimization Services

-

Automation Services

-

Infrastructure Management Services

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud Service Providers

-

Colocation Providers

-

Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and telecommunications

-

Government and defense

-

Energy

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center transformation size was estimated at USD 12.40 billion in 2024 and is expected to reach USD 13.82 billion in 2025.

b. The global data center transformation is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2030 to reach USD 28.62 billion by 2030

b. The data center transformation market in North America held a share of over 45.0% in 2024. Software-defined networking (SDN), software-defined storage (SDS), and other SDI solutions are enabling more efficient resource management within data centers. In North America, SDI adoption is rising, as it allows organizations to virtualize and dynamically manage infrastructure, boosting agility and scalability.

b. Some key players operating in the data center transformation include Accenture, Atos, Cisco Systems, Inc., Cognizant, Dell Inc., HCL Technologies, IBM, Microsoft, Schneider Electric SE, and Wipro

b. The growth of the market is driven by rapid digitalization, growing data volumes, and increasing cloud adoption. As organizations shift towards hybrid cloud models to manage scalability, security, and agility, there’s an emphasis on transforming traditional data centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.