- Home

- »

- Next Generation Technologies

- »

-

Data Monetization In Healthcare Market Size Report, 2033GVR Report cover

![Data Monetization In Healthcare Market Size, Share & Trends Report]()

Data Monetization In Healthcare Market (2025 - 2033) Size, Share & Trends Analysis Report By Method (Data As A Service, Insight As A Service), By Organization Size (Large Enterprises, SMEs), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-125-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Monetization In Healthcare Market Summary

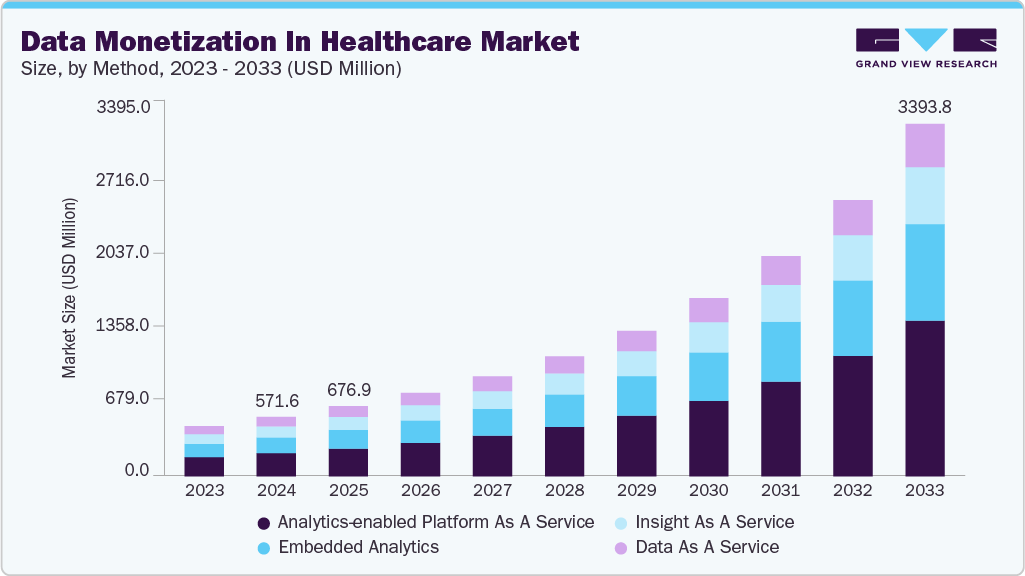

The global data monetization in healthcare market size was estimated at USD 571.6 million in 2024 and is projected to reach USD 3,393.8 million by 2033, growing at a CAGR of 22.3% from 2025 to 2033. The growth is attributed to the increasing adoption of electronic health records (EHRs) and rising public & private investments in advanced analytics solutions.

Key Market Trends & Insights

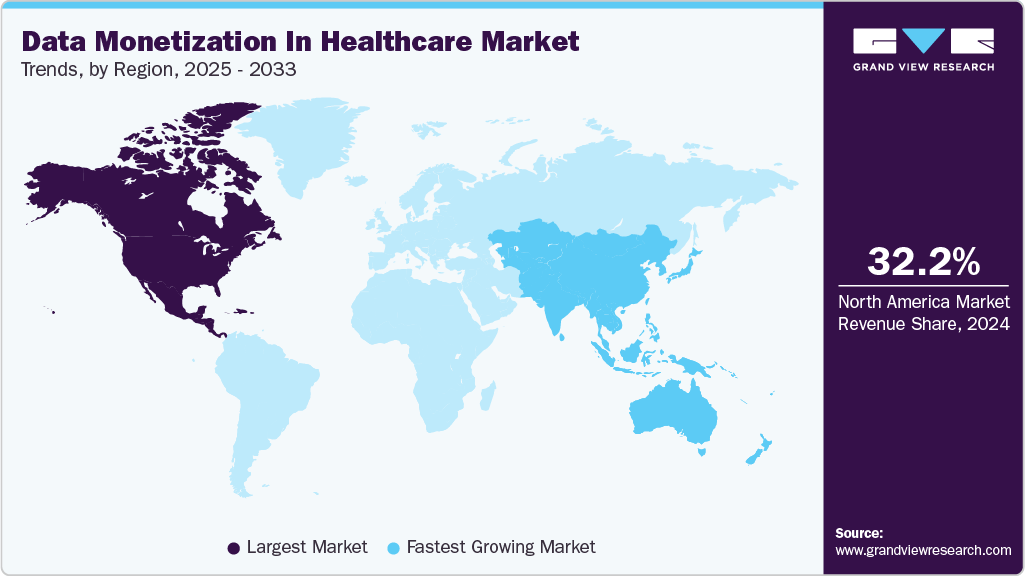

- North America held a 32.2% revenue share of the global data monetization in healthcare market in 2024.

- The data monetization in healthcare industry in the U.S. is expected to grow significantly over the forecast period.

- By method, the analytics-enabled platform as a service segment held the largest revenue share of 38.9% in 2024.

- By organization size, large enterprises segment held the largest revenue share in 2024.

- By end use, the pharmaceutical and biotechnology companies segment captured the largest revenue share of 39.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 571.6 Million

- 2033 Projected Market Size: USD 3,393.8 Million

- CAGR (2025-2033): 22.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The data monetization in healthcare industry is experiencing significant growth, driven by increasing awareness of its benefits and a growing focus among healthcare enterprises on robust data management strategies. In addition, the adoption of emerging technologies such as Blockchain, Machine Learning (ML), Artificial Intelligence (AI), cloud computing, and big data analytics is further propelling this trend. Moreover, data monetization software and services enable pharmaceutical, healthcare, and medical technology companies to extract actionable insights, thereby accelerating business growth. Furthermore, these tools enhance operational efficiency by enabling risk prediction and anomaly detection, supporting the expansion of data monetization in healthcare landscape.The data monetization in healthcare industry is undergoing rapid transformation, fueled by the convergence of advanced analytics platforms and intelligent automation that enable organizations to extract, manage, and monetize data with greater precision and autonomy. A key trend shaping this evolution is the shift toward agentic AI and autonomous data ecosystems that empower healthcare providers, payers, and life sciences firms to unlock latent value from vast datasets, while ensuring compliance, security, and contextual intelligence. These platforms integrate seamlessly with existing data infrastructures, enabling real-time insights generation, anomaly detection, predictive modeling, and revenue optimization.

For instance, in May 2025, Brillio launched ADAM, a pioneering agentic AI platform designed to drive intelligent data autonomy across enterprises. This system facilitates advanced healthcare data monetization by empowering users to automate the end-to-end data lifecycle from acquisition and contextualization to insight extraction and monetization without constant human oversight. By harnessing generative AI, cognitive agents, and adaptive orchestration, ADAM enables healthcare stakeholders to turn fragmented data silos into actionable, revenue-generating assets. Consequently, this reflects a market shift where AI-powered data platforms are not just supporting healthcare analytics but transforming them into core engines of business growth, operational efficiency, and competitive differentiation.

Method Insights

The analytics-enabled platform-as-a-service segment held the largest revenue share of 38.9% in 2024, as healthcare enterprises are adopting cloud-based platforms that combine advanced analytics, real-time data processing, and AI-driven insights. These platforms allow providers to efficiently manage, analyze, and monetize vast datasets derived from EHRs, claims, clinical workflows, and patient experience tools, streamlining decision-making and driving revenue growth. Moreover, compared to legacy systems, analytics-enabled PaaS solutions offer improved scalability, faster deployment, and seamless integration with existing infrastructures. For instance, in June 2025, Quest Analytics partnered with Arcadia to embed Arcadia’s CareJourney Provider Performance Index into Quest’s QES platform, enabling health plans to access rich, episode-level provider performance and cost insights directly within their network design tools. This integration allows companies to monetize analytics more effectively through precision network optimization, thereby driving the growth of analytics-enabled PaaS in the global data monetization in healthcare industry.

The embedded analytics segment is expected to grow at the fastest CAGR during the forecast period due to the rising demand for real-time, in-context insights directly within operational healthcare applications such as EHR systems, patient portals, clinical decision support tools, and revenue cycle management platforms. Unlike traditional BI tools that require users to switch between systems, embedded analytics enables seamless access to actionable intelligence within existing workflows, enhancing clinical outcomes and improving operational efficiency. This demand is further fueled by healthcare providers’ emphasis on value-based care, where instant data visibility is critical for patient risk scoring, treatment optimization, and cost control. Therefore, the above-mentioned factors are contributing notably in spurring the growth of the embedded analytics segment in the market during the forecast period.

Organization Size Insights

The large enterprises held the largest revenue share in 2024, largely because these entities have the infrastructure, resources, and data maturity required to implement enterprise-scale analytics and monetization solutions. In addition, these organizations are leveraging unified data platforms that support real-time analytics, multi-source data integration, and embedded AI to enhance clinical decision-making, optimize cost structures, and commercialize insights across diverse operational units. For instance, in July 2025, Nordic Capital acquired Arcadia Solutions, a major healthcare analytics provider used by large clients such as Aetna and Johns Hopkins Medicine, with the goal of expanding its AI-driven analytics capabilities. This emphasizes large enterprises' strategic focus on consolidating advanced analytics technologies to accelerate data-driven decision-making, generate new revenue opportunities, and solidify their dominant position in the rapidly evolving healthcare data monetization landscape.

SMEs are expected to grow at the fastest CAGR during the forecast period, driven by increasing access to affordable cloud-based analytics platforms, growing awareness of data as a strategic asset, and the rising adoption of digital health tools among smaller providers, clinics, and health-tech startups. As low-code platforms, AI-enabled tools, and embedded analytics become more accessible, SMEs are leveraging these solutions to monetize patient insights, operational data, and clinical outcomes without the need for large IT infrastructure. In addition, regulatory support for health data interoperability and the emergence of healthcare data marketplaces have lowered entry barriers for SMEs to participate in data-driven ecosystems. The ability to unlock new revenue streams, enhance care delivery, and compete in value-based models is accelerating adoption, positioning SMEs as key players in the market during the upcoming years.

End Use Insights

The pharmaceutical and biotechnology companies segment captured the largest revenue share of 39.6% in 2024 as these organizations harness extensive clinical, genomic, and patient-derived datasets to fuel drug discovery, optimize clinical trials, advance real-world evidence generation, and support personalized medicine initiatives. Their deep involvement in R&D pipelines, combined with significant investments in AI-driven analytics platforms and predictive modeling tools, enables them to transform raw data into actionable, monetizable insights that reduce time to market and enhance regulatory strategies. Moreover, pharma and biotech firms are at the forefront of forming data-commercialization partnerships with healthcare providers and research organizations to monetize anonymized health data. For instance, in May 2025, REGENXBIO entered a strategic royalty monetization agreement with Healthcare Royalty (HCRx), securing USD 150 million upfront (with potential funding up to USD 250 million) in exchange for future royalty streams from approved gene therapies like ZOLGENSMA and others in its pipeline including RGX‑121, RGX‑111, and NAVplatform. This move underscores that biotech companies are leveraging non‑dilutive data monetization instruments to accelerate commercial execution, fund late-stage development, and reinforce their leadership in data-rich therapeutic innovation.

The medical technology companies segment is expected to grow at the fastest CAGR during the forecast period, driven by the rapid proliferation of connected medical devices, diagnostic platforms, and remote monitoring solutions that generate vast volumes of real-time patient data. As medtech firms integrate IoT, AI, and cloud-based analytics into their products, they are expected to create opportunities to monetize device-generated health data through predictive insights, clinical decision support, and partnerships with payers, providers, and research institutions. In addition, the rising adoption of software-as-a-medical-device (SaMD) models and the shift toward outcome-based healthcare are further incentivizing medtech players to transform raw data into revenue-generating assets. Moreover, regulatory advancements supporting interoperability and real-world evidence are enabling these companies to play a pivotal role in data-driven care delivery and commercialization, thus contributing significantly in bolstering the market share.

Regional Insights

North America data monetization in healthcare industry accounted for the largest market share of 32.2% in 2024, driven by the widespread adoption of advanced healthcare IT infrastructure, robust regulatory frameworks supporting health data exchange, and the presence of major pharmaceutical, biotech, and medtech companies actively investing in data commercialization strategies. The region’s accelerating shift toward value-based care, coupled with strong federal incentives like the 21st Century Cures Act and widespread adoption of EHR interoperability under TEFCA, has enabled providers and payers to unlock revenue from patient-level data. Furthermore, venture capital investment in health data analytics startups remains strong in the U.S. and Canada, with a surge in strategic acquisitions by large enterprises to consolidate analytics capabilities and scale data monetization initiatives across population health, payer networks, and life sciences research.

U.S. Data Monetization In Healthcare Market Trends

The U.S. data monetization in healthcare industry is witnessing strong momentum, fueled by specific national developments such as the implementation of TEFCA to standardize health data exchange across states, and the widespread commercialization of real-world evidence (RWE) by providers and life sciences companies. Major health systems in the U.S. are increasingly partnering with tech firms to monetize de-identified EHR and claims data, supporting drug discovery, payer-provider alignment, and clinical trial recruitment. The growing use of cloud-native platforms such as Microsoft Azure for Health, Amazon HealthLake, and Oracle’s AI-enhanced Cerner ecosystem has enabled scalable, HIPAA-compliant monetization of structured and unstructured data assets. Furthermore, the emergence of value-based reimbursement models has prompted payers and ACOs to invest in analytics-as-a-service platforms to derive financial value from population health insights.

Europe Data Monetization In Healthcare Market Trends

The data monetization in healthcare industry in Europe is anticipated to register considerable growth from 2025 to 2033, driven by regulatory advancements and innovative data-sharing initiatives. The implementation of the European Health Data Space (EHDS) mandates the creation of national Health Data Access Bodies and cross-border interoperability standards, significantly boosting the potential for secondary use of electronic health data across research, policy, and commercial domains. Moreover, the EMA’s DARWIN EU network has scaled its real-world evidence capabilities, expanding to over 140 studies annually by 2025, enabling pan-European aggregation and federated analytics of EHR, registry, and biobank data for regulatory and commercialization purposes.

The UK data monetization in healthcare industry is gaining traction, owing to the UK government's push to centralize and streamline NHS data access, aiming to simplify and standardize patient records. In addition, the launch of a £600 million Health Data Research Service by the end of 2026 will provide a cost-recovery-based centralized repository at the Wellcome Genome Campus, bolstering research and commercialization efforts in life sciences. Moreover, NHS England is deploying AI systems for real-time patient safety monitoring, becoming the first global health system to do so, to detect anomalies early and ensure high-quality, data-driven care.

Germany data monetization in healthcare industry is gaining traction, driven by national digital health reforms, increased private investment in health data platforms, and a growing emphasis on interoperable infrastructure. Under the Digital Act (Digitale-Gesetz) and Health Data Utilization Act (GDNG) introduced in 2023-2024, Germany is accelerating the rollout of electronic patient records (ePA) and enabling broader secondary use of de-identified health data for research and commercial purposes. These laws mandate insurers to offer ePA to all citizens by 2025, creating one of the largest structured health data pools in Europe.

Asia Pacific Data Monetization In Healthcare Market Trends

The Asia Pacific data monetization in healthcare industry is poised for a remarkable growth, with a projected CAGR of 24.2% from 2025 to 2033, fueled by several region-specific trends. The growth is attributed to the rapid investment in cloud-based analytics and AI infrastructure due to increasing partnerships like Singtel and Hitachi building GPU-powered health data centers across Japan and Southeast Asia is laying the technological foundation for scalable data solutions.

Japan’s data monetization in the healthcare industry is gaining momentum, propelled by legal frameworks, high-value data platforms, and strong public-private collaboration. The government is actively reforming regulations to balance patient privacy with secondary use of partially anonymized clinical and genomic datasets, paving the way for secure, AI-driven analytics in diagnostics and treatment planning. In addition, strategic investments by leading tech and healthcare firms such as SoftBank’s ¥30 billion joint venture with U.S.-based Tempusare accelerating the deployment of genomic and treatment-recommendation services based on patient-level data.

China data monetization in healthcare industry held a substantial market share in 2024, driven by a maturing regulatory framework, massive enterprise infrastructure deployment, and strategic innovation in AI-enabled platforms. The 2021 Personal Information Protection Law (PIPL), along with complementary Cybersecurity and Data Security laws, now mandate strict data classification, encryption, local storage, and individual consent, especially for sensitive information like health data enabling compliant secondary use.

Key Data Monetization In Healthcare Company Insights

Key players operating in data monetization in healthcare industry are Optum, Inc., Oracle Corporation, SAS Institute Inc. and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In March 2025, Microsoft and Kyndryl collaborated to bring Dragon Copilot, a generative AI-powered healthcare assistant, to market-using voice dictation and ambient listening to automatically generate clinical notes, summarize evidence, prep orders, and more, all while integrating seamlessly into existing workflows to free clinicians from administrative burdens and enhance patient care.

-

In January 2025, Nvidia unveiled partnerships with Mayo Clinic, IQVIA, Illumina, and Arc Institute to deploy its DGX Blackwell systems, AI Foundry, and BioNeMo platforms-enabling scalable AI applications in digital pathology, genomics, clinical trials, and biology foundation models.

-

In July 2024, Humana signed a new multi-year agreement with Google Cloud to modernize its cloud infrastructure and harness generative AI capabilities aimed at reducing care costs, improving member experiences, and delivering more personalized, efficient healthcare services, while ensuring HIPAA-compliant data security.

Key Data Monetization In Healthcare Companies:

The following are the leading companies in the data monetization in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Arcadia Solutions LLC

- Cerner Corporation

- Clarify Health Solutions, Inc.

- Flatiron Health, Inc.

- Google LLC

- Health Catalyst, Inc.

- IBM Corporation

- IQVIA Inc.

- Microsoft Corporation

- Optum, Inc.

- Oracle Corporation

- Palantir Technologies Inc.

- SAS Institute Inc.

- Snowflake Inc.

- Truveta, Inc.

Data Monetization In Healthcare Market Report Scope

Report Attribute

Details

Market size in 2025

USD 676.9 million

Revenue forecast in 2033

USD 3,393.8 million

Growth Rate

CAGR of 22.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

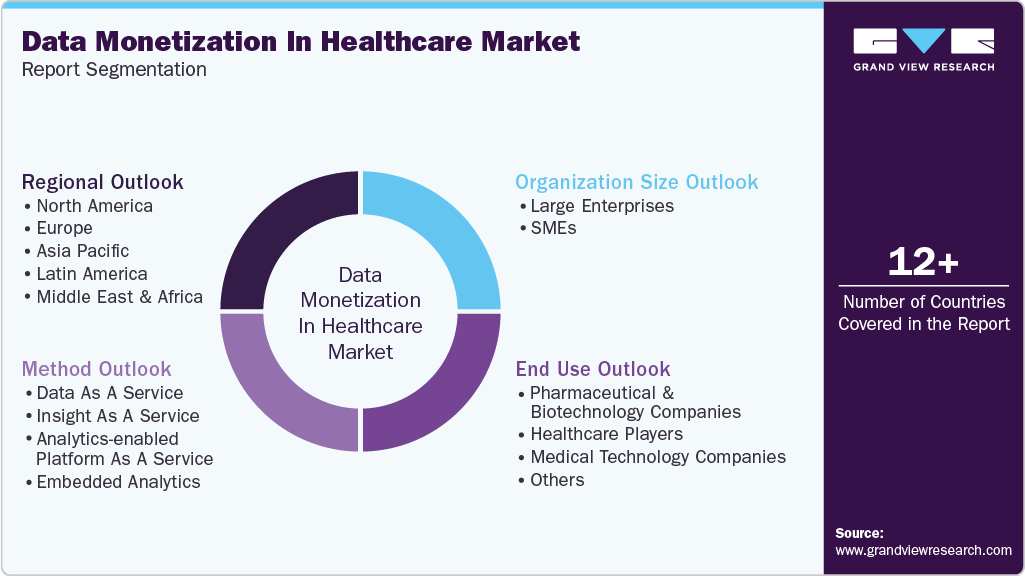

Segments covered

Method, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Optum, Inc.; Oracle Corporation; SAS Institute Inc.; IBM Corporation; Microsoft Corporation; Google LLC; Snowflake Inc.; IQVIA Inc.; Flatiron Health, Inc.; Palantir Technologies Inc.; Truveta, Inc.; Arcadia Solutions LLC; Clarify Health Solutions, Inc.; Cerner Corporation; Health Catalyst, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Monetization In Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data monetization in healthcare market report based on method, organization size, end use, and region:

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Data As A Service

-

Insight As A Service

-

Analytics-enabled Platform As A Service

-

Embedded Analytics

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Healthcare Players

-

Medical Technology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data monetization in healthcare market size was estimated at USD 571.6 million in 2024 and is expected to reach USD 3,393.8 million in 2033.

b. The global data monetization in healthcare market is expected to grow at a compound annual growth rate of 22.3% from 2025 to 2033 to reach USD 3,393.8 million in 2033.

b. The Analytics-enabled platform as a service segment accounted for the largest market share of 38.89% in 2024. The growth of the segment can be attributed to the growing demand among several healthcare enterprises to measure consistency in the patterns among data, which has resulted in a growing focus on improving their computational and statistical abilities.

b. Some key players operating in the data monetization in healthcare market include Optum, Inc, Oracle Corporation, SAS Institute Inc., IBM Corporation, Microsoft Corporation, Google LLC, Snowflake Inc., IQVIA Inc., Flatiron Health, Inc., Palantir Technologies Inc., Truveta, Inc., Arcadia Solutions LLC, Clarify Health Solutions, Inc., Cerner Corporation, Health Catalyst, Inc. and Others

b. The considerable growth of data monetization in healthcare market can be attributed to the growing adoption of Electronic Health Records (EHRs) and rising public & private investments in advanced analytics solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.