- Home

- »

- Next Generation Technologies

- »

-

Data Pipeline Tools Market Size, Share, Industry Report, 2030GVR Report cover

![Data Pipeline Tools Market Size, Share & Trends Report]()

Data Pipeline Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Tools, Services), By Type, By Deployment, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-026-0

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Pipeline Tools Market Summary

The global data pipeline tools market size was estimated at USD 12,086.6 million in 2024 and is projected to reach USD 48,331.7 million by 2030, growing at a CAGR of 26% from 2025 to 2030. Factors such as the increasing adoption of artificial intelligence & Internet of Things, rising investments in advanced technologies, and the need for reduced data latency are driving the demand for data pipeline tools.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, U.S. is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, tools accounted for a revenue of USD 6,557.6 million in 2022.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 12,086.6 Million

- 2030 Projected Market Size: USD 48,331.7 Million

- CAGR (2025-2030): 26%

- North America: Largest market in 2022

Published in September 2022, the State of IoT Spring 2022 report stated that, with over 12.2 billion active endpoints, the IoT connections have grown by 8% globally since last year.

The COVID-19 pandemic had a positive impact on the market growth. The majority of the people started to adopt work-from-home culture, which generated large volumes of structured, semi-structured, and unstructured data in the form of video, audio, emails, and several others on online platforms. Furthermore, various data pipeline providers such as Talend, Hevo Data Inc., and several others provided COVID-19 datasets to users. For instance, in collaboration with Bytecode, Talend developed an ETL COVID-19 datasets tool. The tool was specifically developed to help healthcare researchers.

Component Insights

Based on component, the tools segment led the market with the largest revenue share of 78.33% in 2024 and is expected to maintain its dominance over the forecast period. The growth in the use of data pipeline tools will be driven by the rise in big data, as it consists of large volumes of structured, unstructured, large, and complex data sources, which are required to be transferred to data repositories.

The services segment is projected to register at the fastest CAGR over the forecast period. The services segment is likely to witness the highest growth, as the software and applications provided by the companies require time-to-time updates and maintenance. Data pipeline tools are essential for organizations looking to streamline the flow of data from various sources to destinations such as data warehouses or lakes. These tools automate the processes of extraction, transformation, and loading (ETL), significantly reducing manual effort and minimizing errors that can disrupt data integrity.

Type Insights

Based on type, the ETL data pipeline segment led the market with the largest revenue share of 39.46% in 2024. In terms of type, the market is divided into ELT, ETL, real-time, and batch data pipelines. The growing volumes of unstructured streaming data is driving the growth of data pipeline tools; moreover, streaming data from sensors is likely to grow in the upcoming years owing to the growth in the adoption of the Internet of Things (IoT).

The real-time data pipeline segment registered at the fastest CAGR over the forecast period. This is owing to the initiatives taken by various firms and governments to promote Industry 4.0, which involves the integration and adoption of nanotechnology, the Internet of Things (IoT), machine learning, artificial intelligence, and other cutting-edge technologies.

Deployment Insights

Based on deployment, the cloud-based segment led the market with the largest revenue share of 71.18% in 2024. Cloud-based deployment in data pipeline tools has revolutionized how organizations manage and process data, offering scalability, flexibility, and cost-effectiveness. These tools enable seamless integration and orchestration of data workflows across various cloud environments, allowing businesses to harness vast amounts of data from diverse sources without the need for extensive on-premises infrastructure.

The on-premises segment is anticipated to grow at a significant CAGR from 2025 to 2030. On-premises deployment of data pipeline tools refers to the installation and operation of these tools on a company’s own hardware and network infrastructure. This approach offers distinct advantages and challenges compared to cloud-based solutions. As businesses evaluate their data strategy, understanding these factors is crucial for making informed decisions about their data pipeline architecture.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 72.18% in 2024. Large enterprises increasingly rely on sophisticated data pipeline tools to manage the complexities of their data ecosystems. These tools are essential for automating the extraction, transformation, and loading (ETL) of vast amounts of data from diverse sources, enabling organizations to derive actionable insights efficiently. Solutions like AWS Data Pipeline and Google Cloud Dataflow offer scalability and flexibility, allowing enterprises to handle both batch and real-time data processing seamlessly. Moreover, tools such as Fivetran, and Hevo Data provide advanced automation features that minimize manual intervention, ensuring high reliability and data integrity.

The small and medium enterprise segment is projected to grow at the fastest CAGR over the forecast period. Small and medium enterprises (SMEs) are increasingly adopting data pipeline tools to streamline their data management processes and enhance decision-making capabilities. These tools, such as Hevo Data, and Fivetran, provide user-friendly, no-code solutions that allow SMEs to integrate data from various sources-like CRM systems and marketing platforms-into a centralized data warehouse without requiring extensive technical expertise. This ease of use is particularly beneficial for smaller teams that may lack dedicated data engineering resources.

Application Insights

Based on application, the real-time analytics segment led the market with the largest revenue share of 22.92% in 2024. The market is segmented into real-time analytics, predictive maintenance, sales and marketing data, customer relationship management, data traffic management, data migration, and others. The increasing need for real-time data streamlining and management tools, especially in weather forecasts, share markets, energy & utilities, logistics & transportation industries, is fueling the demand for data pipeline tools.

The data migration segment is projected to register at the fastest CAGR over the forecast period. The emergence of 5G connectivity, the rise in the number of IoT-connected devices, and Industry 4.0 are anticipated to boost market growth in the near future. Data migration is a critical component of data pipeline tools, enabling organizations to transfer data efficiently between systems while minimizing downtime and ensuring data integrity. These tools streamline the migration process through features such as automated data mapping, transformation, and validation, which are essential for maintaining data quality during transfers.

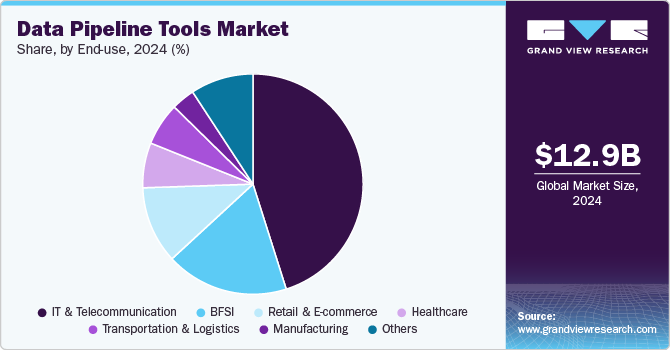

End-use Insights

Based on end use, the IT & telecommunication segment led the market with the largest revenue share of 45.10% in 2024. Increased deployment of the 5G network is driving the demand for data pipeline systems in the industry as the 5G network constantly requires performance monitoring of the network. The IT and telecommunications sectors are increasingly leveraging data pipeline tools to enhance operational efficiency and data management capabilities. These tools facilitate seamless integration, transformation, and analysis of vast amounts of data generated from various sources, such as network devices, customer interactions, and service usage metrics. Solutions like Fivetran and Hevo Data provide robust automation features that enable real-time data processing, allowing organizations to respond swiftly to changing market conditions and customer needs.

The healthcare segment is projected to register at the fastest CAGR over the forecast period. The healthcare industry is increasingly utilizing data pipeline tools to enhance data management and improve patient outcomes. These tools automate the extraction, transformation, and loading (ETL) of complex healthcare data from various sources, such as electronic health records (EHRs), insurance claims, and patient management systems. For example, platforms like CloverDX facilitate the integration of diverse data formats, including HL7 and FHIR, streamlining workflows and reducing manual errors. By automating data ingestion and processing, healthcare organizations can ensure timely access to accurate information, which is crucial for making informed clinical decisions.

Regional Insights

The North America data pipeline tools market led the global market with the largest revenue share of 34.8% in 2024. One of the reasons North America is a leading market is its large investments in AI and other advanced technologies. Moreover, this would increase the usage of data pipeline tools as the transformed data from pipelines are used for performing AI algorithms. For instance, according to the Artificial Intelligence Index Report published in 2022, the amount of newly funded AI companies in the U.S. is two times higher than in China.

U.S. Data Pipeline Tools Market Trends

The data pipeline tools market in U.S. held a dominant position in 2024. U.S.-based data pipeline tools play a pivotal role in facilitating the efficient transfer and transformation of data from various sources to destinations like data warehouses or data lakes. These tools, such as Fivetran, Hevo Data, and Stitch Data, automate tasks like data extraction, transformation, and loading (ETL), thereby minimizing manual effort and ensuring data integrity. Platforms like Fivetran stand out with their fully managed ETL pipelines that require minimal maintenance, supporting over 150 data sources and incorporating features like data mapping and schema updates.

Europe Data Pipeline Tools Market Trends

The data pipeline tools market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The landscape of data pipeline tools in Europe is rapidly evolving, driven by the increasing demand for efficient data management solutions across various industries. The European market for data pipeline tools is marked by a strong focus on real-time analytics, cloud adoption, AI integration, and regulatory compliance, positioning it for continued growth and innovation in the forecast year.

Asia Pacific Data Pipeline Tools Market Trends

The data pipeline tools market in Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2030. The Asia Pacific region is witnessing rapid growth in data pipeline tools, driven by increasing digital transformation across industries. Companies are increasingly adopting tools like Apache Kafka, Apache Airflow, and cloud-based solutions such as Google Cloud Dataflow and AWS Glue to manage and streamline data flows. These tools facilitate real-time data processing and integration, enabling businesses to harness large volumes of data efficiently.

Key Data Pipeline Tools Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

Google LLC, a subsidiary of Alphabet Inc., is a leading provider of internet-based services, primarily focused on search and advertising. Its extensive product portfolio encompasses well-known services such as Google Search, YouTube, Google Drive, and Google Cloud. Within the realm of data management, Google has developed robust data pipeline tools that facilitate the extraction, transformation, and loading (ETL) of data. These tools are essential for businesses looking to harness the power of big data and machine learning. For instance, Google Cloud's Dataflow allows users to create and manage data pipelines that efficiently process both batch and streaming data, enhancing operational efficiency and decision-making capabilities.

IBM, a global provider of technology and consulting, has a rich history of innovation in computing and data management. Headquarters in Armonk, New York, IBM offers a wide array of products and services, including cloud computing, artificial intelligence, and data analytics. Central to its offerings are advanced data pipeline tools that facilitate the efficient movement and transformation of data. IBM DataStage, for instance, is a powerful data integration tool that supports both ETL (Extract, Transform, Load) and ELT (Extract, Load, Transform) processes, enabling organizations to design and deploy complex data workflows seamlessly.

Key Data Pipeline Companies:

The following are the leading companies in the data pipeline tools market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- IBM

- Microsoft Corporation

- Software AG

- Actian Corporation

- Oracle

- Amazon Web Services, Inc.

- Hevo Data Inc.

- K2VIEW

- SnapLogic Inc.

Recent Developments

-

InDecember 2023, IBM announced a definitive agreement to acquire StreamSets and webMethods, Software AG's Super iPaaS (integration platform-as-a-service) enterprise technology platforms, for €2.13 billion in cash. The acquisition of StreamSets and webMethods underscores IBM's strong commitment to AI and hybrid cloud technologies. StreamSets will enhance data ingestion capabilities within watsonx, IBM's AI and data platform, while webMethods will provide clients and partners with additional integration and API management tools for their hybrid multi-cloud environments.

-

In May 2023, Informatica, a provider in enterprise cloud data management, strengthened its long-standing partnership with Amazon Web Services (AWS) through a new announcement aimed at enhancing product integrations across data, analytics, and artificial intelligence (AI). This initiative will support go-to-market strategies, foster innovative vertical solutions, and expedite cloud transformation for customers. These developments were presented at Informatica World 2023, the company’s annual customer conference taking place in Las Vegas.

Data Pipeline Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14,758.9 million

Revenue forecast in 2030

USD 48,331.7 million

Growth rate

CAGR of 26.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Chile; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

Google; IBM; Microsoft; Software AG; Actian Corporation; Oracle; Amazon Web Services, Inc.; Hevo Data Inc.; K2VIEW; SnapLogic Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Data Pipeline Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data pipeline tools market report based on component, type, deployment, enterprise size, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Tools

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ETL Data Pipeline

-

ELT Data Pipeline

-

Real-time Data Pipeline

-

Batch Data Pipeline

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud Based

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Real Time Analytics

-

Predictive Maintenance

-

Sales and Marketing Data

-

Customer Relationship Management

-

Data Traffic Management

-

Data Migration

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Healthcare

-

Transportation and Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data pipeline tools market size was valued at USD 12,086.5 million in 2023 and witnessed a value of USD 14,758.9 million in 2024.

b. The data pipelines tools market is estimated to grow at a CAGR of 26.8% from 2025 to 2030 and reach USD 48,331.7 million by 2030

b. North America dominated the data pipeline tools with a share of 33.8% in 2024. This is attributable to the presence of prominent players in the market such as Google LLC, Amazon Web Services, Inc., Microsoft Corporation, Oracle, Integra SnapLogic Inc., Talend, and several others.

b. Some key players operating in the data pipeline tools market are Google LLC, IBM, Microsoft Corporation, Software AG, Actian Corporation, Oracle, Amazon Web Services, Inc. Hevo Data Inc., K2VIEW, and SnapLogic Inc.

b. Key factors driving the market growth include the growth in the adoption of AI and IoT, investment in IT, and increasing investment in 5G for reducing latency

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.