- Home

- »

- Distribution & Utilities

- »

-

DC Distribution Network Market Size, Industry Report, 2033GVR Report cover

![DC Distribution Network Market Size, Share & Trends Report]()

DC Distribution Network Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (DC Switchgear & Protection, Power Conversion, Power Distribution & Busway), By Voltage Range, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-828-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DC Distribution Network Market Summary

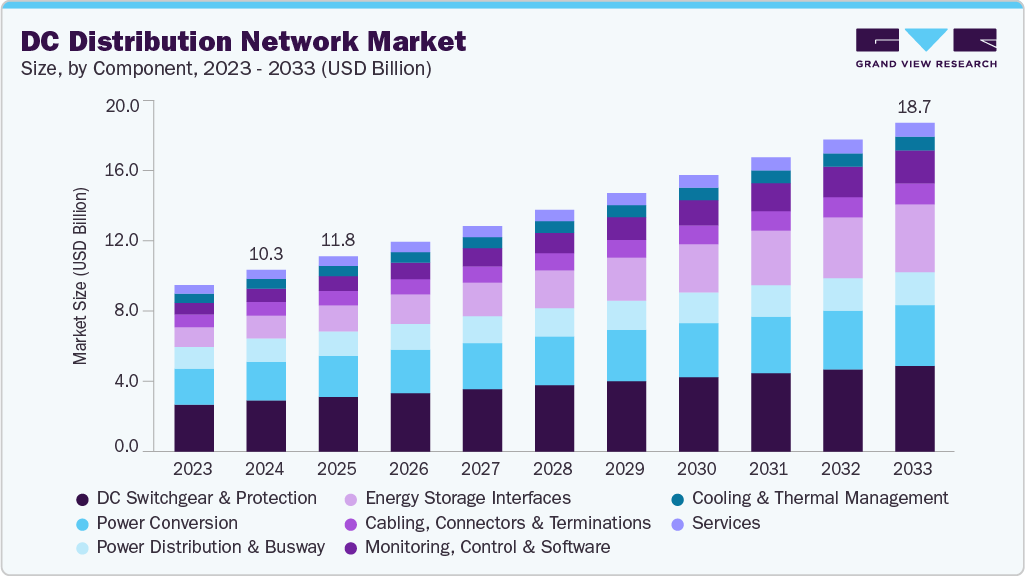

The global DC distribution network market size was estimated at USD 10.31 billion in 2024 and is projected to reach USD 18.67 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The market is expected to witness steady growth over the next several years due to the increasing integration of renewable energy systems, rising demand for high-efficiency power architectures, and the shift toward decentralized and digitalized power distribution.

Key Market Trends & Insights

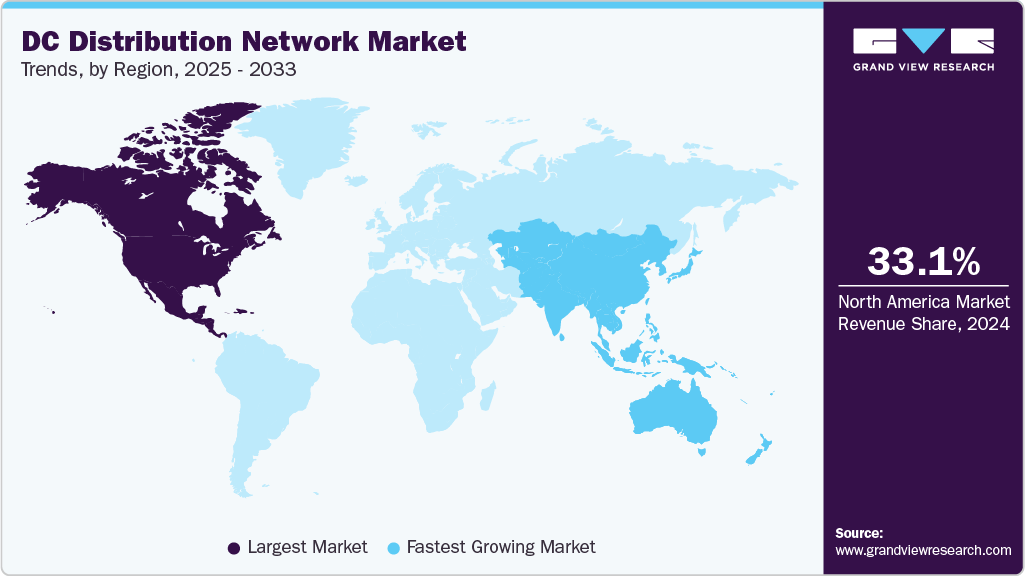

- North America DC distribution network market held the largest share of 33.06% of the global market in 2024.

- The DC distribution network market in the U.S. is expected to grow significantly over the forecast period.

- By component, DC switchgear & protection held the largest market share of 28.1% in 2024.

- Based on the application, the data centers segment held the largest market share in 2024.

- Based on the voltage range, the low-voltage DC (LVDC) (≤ 1.5 kV DC) segment held the largest market share in 2024.

- Based on the end use, the data center operators segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.31 Billion

- 2033 Projected Market Size: USD 18.67 Billion

- CAGR (2025-2033): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Deployment is being accelerated by the growing penetration of data centers, EV charging infrastructure, and industrial automation systems, along with advancements in power electronics, solid-state circuit breakers, and DC-optimized grid components. Direct Current (DC) distribution network solutions are becoming increasingly cost-effective due to reduced conversion losses, simplified system architectures, and favorable regulatory support for grid modernization. This positions DC distribution networks as a critical enabler of long-term energy efficiency, grid stability, and global electrification goals.

In North America, the DC distribution network industry leads globally, supported by strong federal and state-level initiatives for energy-efficient infrastructure, significant investments in hyperscale data centers, and the rapid expansion of electric mobility and fast-charging networks. The U.S. drives regional dominance through Department of Energy (DOE) programs, commercial microgrid deployments, and utility-backed pilots focused on medium-voltage DC (MVDC) distribution to enhance grid resilience and reduce conversion losses. Growing participation from commercial and industrial users, along with surging investments in battery energy storage systems (BESS), AI compute facilities, and advanced building electrification, is further accelerating the adoption of DC-based power distribution networks across the region.

The Asia Pacific region is emerging as one of the fastest-growing markets for DC distribution networks, fueled by rapid industrialization, smart city initiatives, large-scale renewable energy integration, and government-supported electrification programs. Countries such as China, India, Japan, and South Korea are expanding deployment through data center growth, EV charging infrastructure rollout, and policies promoting MVDC distribution across commercial, industrial, and utility applications. China continues to advance the market with industrial DC microgrid pilots and high-power charging networks, while India is scaling adoption through national EV infrastructure schemes, commercial microgrids, and incentives for efficient industrial power systems. Japan and South Korea are contributing to regional growth through stringent efficiency regulations, high electricity prices, and rising consumer demand for resilient, high-efficiency power distribution in buildings.

Drivers, Opportunities & Restraints

The global DC distribution network market is primarily driven by the growing need for high-efficiency power architectures, rapid expansion of data centers, and the accelerating shift toward electrification across industrial, commercial, and mobility sectors. Increasing penetration of renewable energy, particularly solar PV, and the rising adoption of battery energy storage systems (BESS) are reinforcing demand for DC-based power systems that minimize conversion losses and improve overall energy efficiency. Advancements in power electronics, including solid-state transformers, DC-DC converters, and smart protection devices, are further enabling safer and more scalable deployment of DC distribution networks. Additionally, the rising demand for reliable and resilient power infrastructure across critical facilities, such as hospitals, telecom towers, hyperscale data centers, and EV fast-charging stations, is significantly supporting market growth.

Opportunities are expanding rapidly as decentralized energy systems, electric mobility, and digital infrastructure continue to evolve. The increasing rollout of EV fast-charging corridors, fleet electrification hubs, and high-power charging plazas is accelerating the adoption of medium-voltage DC (MVDC) and low-voltage DC (LVDC) distribution systems. Microgrid development, particularly on campuses, in industrial clusters, in remote communities, and at military bases, is creating strong potential for DC-integrated architectures that offer higher efficiency and simplified energy management. The growing adoption of AI, cloud computing, and high-density compute workloads is driving demand for DC-optimized power systems in next-generation data centers. Moreover, opportunities are emerging through DC-ready smart buildings, DC lighting systems, and the integration of DC distribution with renewable energy, storage, and demand-response platforms.

However, the DC distribution network industry faces several restraints, including the lack of universal standards for DC infrastructure, compatibility issues with legacy AC systems, and limited awareness among end users. High initial deployment costs, particularly for MVDC architectures and advanced protection systems, can affect adoption in cost-sensitive regions. Regulatory uncertainties, fragmented codes, and the absence of well-defined interconnection guidelines may hinder large-scale implementation. Technical challenges related to arc flash management, protection coordination, and ensuring safe fault isolation in DC environments also pose significant barriers. Additionally, an insufficiently skilled workforce and traditional grid reliance on AC-based infrastructure may slow down the transition to widespread DC distribution networks.

Component Insights

The DC switchgear & protection segment held the largest revenue share in 2024, accounting for around 28.12% of the global market. Its dominance is supported by its essential role in ensuring safe fault isolation, arc-flash protection, and stable system operations across data centers, EV charging hubs, utilities, and industrial facilities. As grid operators and commercial users prioritize reliability and power quality, demand for advanced DC switchgear continues to rise, reinforced by the ongoing modernization of medium-voltage DC infrastructure.

The energy storage interfaces segment is expected to record the fastest growth, with a projected CAGR of 12.8% from 2025 to 2033. This rapid expansion is driven by the accelerating deployment of battery energy storage systems (BESS), DC-coupled renewable energy plants, and bidirectional EV charging networks. Growing adoption of hybrid microgrids, behind-the-meter storage, and high-capacity battery arrays strengthens the need for efficient DC interface technologies, positioning this segment as one of the most dynamic within the market.

Voltage Range Insights

The low-voltage DC (LVDC) (≤1.5 kV) segment represented the largest share in 2024, accounting for approximately 59.8% of global revenue. Its leadership is attributed to widespread use in data centers, telecom power systems, buildings, and residential electrification, where LVDC enables simplified wiring, safer distribution, and reduced conversion stages. LVDC continues to gain traction in commercial and small-scale industrial applications requiring compact, efficient, and electronics-compatible power networks.

The very high/distribution HVDC (> 320 kV DC (typically 500 - 1,100 kV DC) segment is projected to grow at the fastest CAGR of 13.1% between 2025 and 2033. Growth is being accelerated by rising demand for long-distance, high-capacity power transmission, integration of remote renewable plants, and development of large utility-scale HVDC corridors. As nations expand interconnection lines and grid-stability projects, VHVDC is expected to emerge as a crucial architecture supporting next-generation power infrastructure.

Application Insights

The data centers segment accounted for the largest share of the market in 2024, capturing around 24.5% of global revenue. Increasing computing intensity, AI workloads, and hyperscale facility expansion are driving preference for DC architectures that reduce conversion losses, enhance reliability, and support high-density power racks. Growing adoption of DC-based busways and rack-level distribution further reinforces the segment’s leading position.

The EV fast-charging hubs segment is expected to witness the fastest expansion, posting a CAGR of 13.5% from 2025 to 2033. The shift toward megawatt-class chargers, fleet electrification, and national charging-corridor rollouts is boosting demand for DC distribution systems capable of supporting high-power, low-loss charging operations. As governments strengthen EV mandates and charging infrastructure investments, this segment is set to accelerate sharply.

End Use Insights

Data center operators held the largest market share in 2024, representing approximately 23.85% of global revenue. The rapid scaling of AI data centers, cloud platforms, and edge facilities is driving migration toward DC distribution networks that enhance energy efficiency, improve uptime, and integrate seamlessly with battery storage systems. Operators continue adopting DC to meet sustainability targets and manage rising power densities.

The transport and logistics operators segment is projected to grow at the fastest CAGR of 13.4% over the forecast period. The electrification of freight terminals, automated warehouses, ports, and fleet charging depots is driving demand for robust DC distribution networks. The increasing reliance on electric mobility systems, autonomous equipment, and high-power vehicle charging is positioning this segment as one of the strongest contributors to growth in the forecast period.

Regional Insights

The North America DC distribution network industry held the largest share in 2024, accounting for 33.06% of total revenue. The region’s leadership is driven by major investments in hyperscale data centers, rapid electrification of transportation, and strong government support for modernizing power infrastructure. The U.S. continues to dominate regional demand through the extensive deployment of medium-voltage DC (MVDC) pilot projects, the expansion of EV fast-charging corridors, and the increasing adoption of DC-based microgrids across commercial, industrial, and utility environments. Federal modernization funds, coupled with rising load from AI compute facilities and battery energy storage systems (BESS), further reinforce North America’s position as the core hub for DC distribution innovation and deployment.

U.S. DC Distribution Network Market Trends

The U.S. DC distribution network industry is expanding rapidly due to strong federal support for grid modernization, rising deployment of hyperscale and AI-driven data centers, and accelerating electrification across transportation and industrial sectors. Increasing investment in national EV fast-charging corridors, advanced battery energy storage systems, and DC-based microgrids is strengthening demand for efficient, high-capacity DC architectures. Utilities are adopting MVDC pilots and DC-coupled renewable-storage configurations to improve system resilience and reduce conversion losses, while commercial and industrial facilities continue upgrading to DC power systems to support automation, digitalization, and higher load densities. With robust private-sector R&D, widespread modernization initiatives, and growing emphasis on energy efficiency, the U.S. remains the most dynamic and influential market for DC distribution networks in North America.

Asia Pacific DC Distribution Network Market Trends

The DC distribution network industry in the Asia Pacific is projected to grow at the fastest CAGR of 9.55% from 2025 to 2033, expanding its market presence as electrification and digital infrastructure investments accelerate across China, India, Japan, and South Korea. Rising deployment of DC microgrids, large renewable-plus-storage plants, and high-power EV charging networks is driving strong regional demand. China leads growth through industrial DC electrification, data center expansion, and aggressive adoption of high-capacity DC fast-charging systems. India is rapidly scaling DC infrastructure through national EV programs, industrial modernization, and utility-backed microgrid installations. Advancements in semiconductor manufacturing, increasing automation, and smart-city development are expected to further propel the Asia Pacific’s expansion through the forecast period.

Europe DC Distribution Network Market Trends

The DC distribution network industry in Europe continues to progress steadily, supported by strong decarbonization mandates, rising electricity costs, and accelerated investment in energy-efficient power architectures. Countries such as Germany, the Netherlands, and the Nordics are advancing DC deployment through smart building electrification, digital substations, and data center expansion. The region’s push toward power-dense industrial clusters, marine electrification, and grid-interactive buildings is prompting increased adoption of DC systems across both LVDC and MVDC applications.

Latin America DC Distribution Network Market Trends

The DC distribution network industry in Latin America is experiencing healthy growth as regional demand for efficient, reliable, and cost-optimized power systems strengthens. Brazil leads the adoption of modernization in industrial facilities, expansion of EV charging networks, and increased integration of storage-coupled renewable energy systems. Mexico and Chile are enhancing DC readiness through utility microgrid pilots, port electrification projects, and upgrades to C&I energy systems. As digital infrastructure and transportation electrification accelerate, the region’s reliance on DC networks is expected to rise.

Middle East & Africa DC Distribution Network Market Trends

The DC distribution network industry in the Middle East & Africa region is expanding steadily, driven by high-capacity infrastructure projects, industrial electrification, and growing interest in grid-independent DC microgrids. The UAE and Saudi Arabia are leading deployments, with significant investments in data centers, smart-city initiatives, and DC-enabled commercial developments. In Africa, the adoption of DC mini-grids, rural electrification systems, and telecom power networks is increasing as governments strive to enhance reliability and reduce reliance on diesel generation. Continued growth in utilities, transportation, and off-grid systems supports the region’s advancement in DC distribution technologies.

Key DC Distribution Network Company Insights

Some of the key players operating in the global market for DC distribution network include ABB Ltd and Siemens Energy, among others.

-

ABB is one of the most influential global players in the market, recognized for its broad portfolio of power electronics, MVDC and HVDC technologies, and advanced grid automation solutions. The company offers a comprehensive suite of DC switchgear, solid-state protection devices, DC-DC converters, busway systems, and microgrid controllers designed to enhance power quality, system resilience, and operational efficiency.

ABB’s pioneering HVDC Light and MVDC platforms are widely deployed in utility networks, industrial facilities, offshore installations, and large-scale renewable energy systems, enabling long-distance, low-loss power transmission and efficient integration of distributed energy resources (DERs). With strong R&D capabilities, digital monitoring systems, and global project experience, ABB plays a central role in modernizing DC infrastructure across data centers, electrified transportation, and smart grid environments. Its continued investments in power electronics and grid digitalization solidify ABB’s position as a leading player shaping the next generation of DC distribution networks.

- Siemens Energy is a major contributor to the global industry, offering end-to-end solutions spanning MVDC systems, HVDC transmission technology, advanced converter stations, and digital grid automation tools. The company is recognized for its robust HVDC PLUS platform, which provides superior efficiency, a reduced footprint, and enhanced stability for long-distance power transmission and renewable energy integration. Siemens Energy also provides innovative DC switchgear, semiconductor-based protection systems, and energy management platforms that support the growing demand for high-efficiency power distribution in data centers, industrial clusters, ports, and electrified transportation networks.

Key DC Distribution Network Companies:

The following are the leading companies in the DC distribution network market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Cummins Inc.

- Delta Electronics, Inc.

- Eaton Corporation

- Huawei Digital Power Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric

- Siemens Energy

- SMA Solar Technology AG

- Vertiv Group Corp.

Recent Developments

- In July 2024, ABB was selected by Washington State Ferries to supply its Onboard DC Grid system, including DC power distribution, hybrid propulsion, and energy-storage integration for five new hybrid vessels. This development expands ABB’s deployment of DC-based marine power systems in the U.S. and increases the adoption of DC distribution technologies in large-scale transportation electrification projects.

DC Distribution Network Market Report Scope

Report Attribute

Details

Market Definition

The power distribution network market refers to the industry that supplies equipment, technologies, and services used to deliver electricity from transmission systems to end uses across residential, commercial, and industrial sectors. It includes distribution infrastructure such as substations, switchgear, transformers, distribution automation, monitoring systems, and related services.

Market size value in 2025

USD 11.08 billion

Revenue forecast in 2033

USD 18.67 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025-2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, voltage range, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Netherlands; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB Ltd.; Siemens Energy; Schneider Electric; Eaton Corporation; Mitsubishi Electric Corporation; Delta Electronics, Inc.; Vertiv Group Corp.; Cummins Inc.; Huawei Digital Power Technologies Co. Ltd.; SMA Solar Technology AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DC Distribution Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global DC distribution network market report on the basis of component, voltage range, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

DC Switchgear & Protection

-

Power Conversion

-

Power Distribution & Busway

-

Energy Storage Interfaces

-

Cabling, Connectors & Terminations

-

Monitoring, Control & Software

-

Cooling & Thermal Management

-

Services

-

-

Voltage Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Low-Voltage DC (LVDC) (≤ 1.5 kV DC)

-

Medium-Voltage DC (MVDC) (1.5 kV - 35 kV DC)

-

High-Voltage DC (HVDC distribution) (35 kV - 320 kV DC)

-

Very High/Distribution HVDC (> 320 kV DC (typically 500 - 1,100 kV DC)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Data centers

-

EV Fast-Charging Hubs

-

Commercial & Industrial Buildings

-

Telecom

-

Utility & Microgrid

-

Renewable + Storage Plants

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Utilities & Grid Operators

-

Data Center Operators

-

Telecom Operators

-

Commercial Real Estate & Facility Owners

-

Transport & Logistics Operators

-

Industrial & Manufacturing

-

Residential

-

Defense & Government

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global DC distribution network market size was estimated at USD 10.31 billion in 2024 and is expected to reach USD 11.08 billion in 2025.

b. The global DC distribution network market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 18.67 billion by 2033.

b. Based on the component type segment, DC switchgear & protection held the largest revenue share of more than 28% in 2024.

b. Some of the key players operating in the global DC distribution network market include ABB Ltd., Siemens Energy, Schneider Electric, Eaton Corporation, Mitsubishi Electric Corporation, Delta Electronics, Inc., Vertiv Group Corp., Cummins Inc., Huawei Digital Power Technologies Co., Ltd., and SMA Solar Technology AG.

b. The DC distribution network market is primarily driven by the rapid electrification of transportation, increasing deployment of data centers and AI compute facilities, growing integration of battery energy storage systems, and the need to reduce conversion losses in modern power infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.