- Home

- »

- Electronic Devices

- »

-

Power Electronics Market Size, Share & Growth Report, 2030GVR Report cover

![Power Electronics Market Size, Share & Trends Report]()

Power Electronics Market (2024 - 2030) Size, Share & Trends Analysis Report By Material, By Device, By Application (ICT, Consumer Electronics, Power, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-795-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Electronics Market Summary

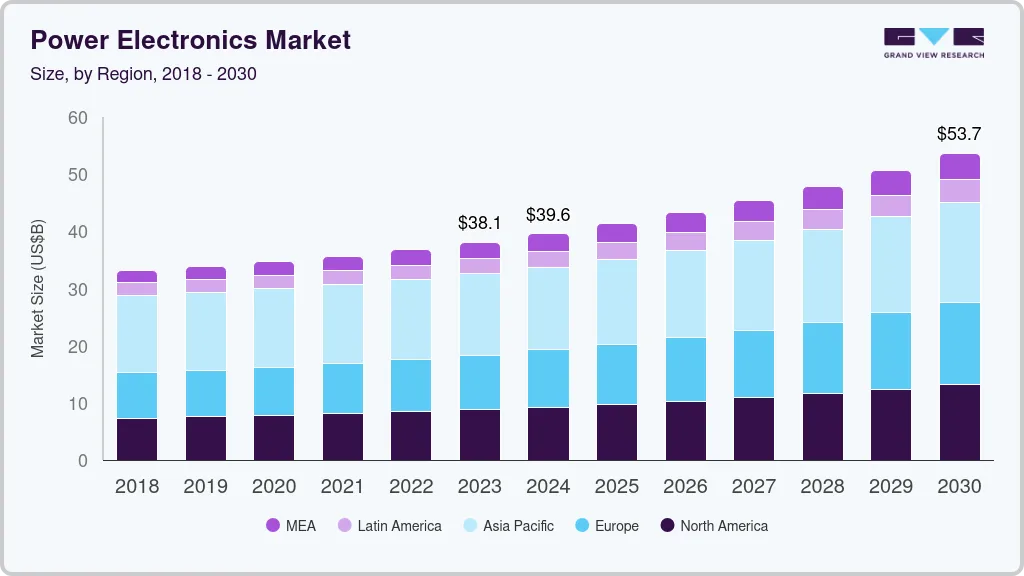

The global power electronics market size was valued at USD 38.12 billion in 2023 and is projected to reach USD 53.66 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030. The rising adoption of renewable energy sources, including solar and wind power, fuels the increased demand for power electronics systems.

Key Market Trends & Insights

- Asia Pacific power electronics market dominated the global market with a revenue share of 40.5% in 2023.

- U.S. dominated the regional market accounting for a market revenue share of 60.9% in 2023.

- Based on material, the silicon (Si) segment held the largest revenue share of 88.9% in 2023.

- Based on device, the IC segment dominated the market in 2023.

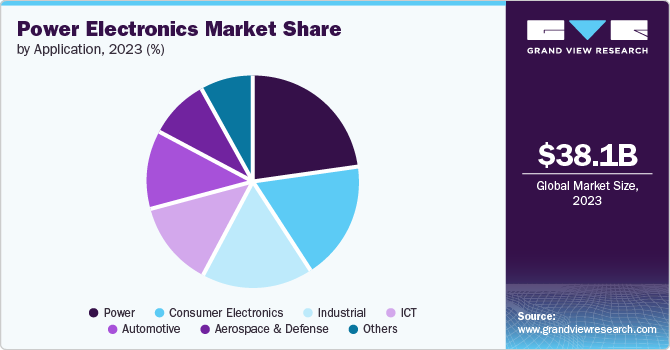

- Based on application, the power segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.12 Billion

- 2030 Projected Market Size: USD 53.66 Billion

- CAGR (2024-2030): 5.2%

- Asia Pacific: Largest market in 2023

Power electronics devices are utilized in the process of converting and controlling the electrical energy which is generated from renewable energy sources into functional forms for industrial, automotive, aerospace defense, and other applications. Electrification of transportation and industrial processes fuels the demand for power electronic devices. The increased demand for additional electricity sources, such as wind energy production and solar panel installations, is attributed to the rising consumption of electricity worldwide. Power electronic devices are essential in producing electrical energy from these sources. Furthermore, the extensive adoption of EVs, resulting in a significant decrease in CO2 emissions and eco-friendly mobility solutions, and the rising integration of renewable energy sources, including solar cells and wind energy, improve environmental sustainability.

Rising consumer awareness of energy consumption is driving the market growth for power electronic devices. There is a heavy demand for products with multitasking ability and low power consumption features. This leads to innovation in efficient power management circuits, which enhance the performing capabilities of devices without lower power consumption. For instance, in July 2023, Nordic Semiconductor introduced its power management integrated circuit nPM1300. This helps developers optimize power management solutions for low-power products.

Material Insights

The silicon (Si) segment held the largest market revenue share of 88.9% in 2023. The demand for silicon in the power electronics market is increasing due to its essential properties that meet the growing needs of high-efficiency and high-performance applications. Silicon's ability to withstand high temperatures and voltages and its superior electrical conductivity and thermal stability make it suitable for power devices like transistors, diodes, and integrated circuits. Additionally, the rising adoption of renewable energy systems, electric vehicles, and advanced consumer electronics requires power management solutions to handle large power loads and improve energy efficiency efficiently. As a result, silicon's proven reliability and cost-effectiveness continue to drive its demand in the power electronics sector.

The sapphire segment is projected to grow at the fastest CAGR of 6.7% over the forecast period. The demand for sapphire in the power electronics market is rising due to its superior material properties, which make it a suitable substrate for semiconductor devices. Sapphire's high thermal conductivity and electrical insulation properties enhance device performance and reliability, especially in high-temperature and high-voltage applications. Additionally, sapphire substrates provide superior optical clarity and chemical resistance, which is crucial for advanced electronic components.

Device Insights

IC segment dominated the market in 2023. The increasing utilization of smart systems and electric vehicles due to technological progress boosts the need for power electronics. These gadgets depend on effective power transformation and management systems supplied by ICs. Chips used in LED lighting, photovoltaic inverters, and digital signage in the industrial sector are driving the expansion of power ICs. Furthermore, industrial automation and control systems applications also have a crucial role. The SiC-based power electronics market is driven by the need for advanced ICs operating at elevated temperatures and voltage levels. SiC-based integrated circuits provide enhanced performance and efficiency.

The module segment is projected to grow at a significant CAGR over the forecast period. The rising need for battery-operated equipment, including inverters, converters, and LED systems, plays a substantial role in the growth of the module market. The need for power electronics modules is increased by applications in smart grids that depend on digital communication and control systems to monitor power quality. Moreover, the swift implementation of electric vehicles (EVs) requires dependable and high-quality power parts, fueling expansion in this sector. Consumers increasingly prioritize energy efficiency, seeking to minimize losses and maximize savings, driving growth in the module market.

Application Insights

The power segment held the largest market revenue share in 2023. Energy storage systems such as batteries and capacitors are on the rise to support and maintain grid stability, improve the incorporation of renewable energy, and offer backup power in case of outages. Power electronics are crucial for the functioning of energy storage systems because they facilitate efficient charging and discharging. Power electronics are used in industrial settings to regulate motors, drives, and other machinery efficiently. The use of automation technologies in sectors such as manufacturing, transportation, and healthcare is increasing the need for custom power electronics solutions.

Automotive segment is projected to grow at the fastest CAGR over the forecast period. The shift towards electric vehicles (EVs) and hybrid vehicles is a primary driver, as these vehicles rely heavily on power electronics for efficient energy management, battery charging, and motor control. Additionally, advancements in automotive technology, such as autonomous driving and advanced driver-assistance systems (ADAS), require sophisticated power electronics to manage the increased electrical loads and ensure reliable performance. Furthermore, stringent environmental regulations and the push for reduced emissions are prompting automakers to adopt power electronics to enhance vehicle efficiency and reduce carbon footprints.

Regional Insights

North America power electronics is projected to grow at a significant CAGR over the forecast period. The rapid expansion of renewable energy sources, such as wind and solar power, requires efficient power management systems, driving the need for advanced power electronic devices. Additionally, the growing adoption of electric vehicles (EVs) necessitates sophisticated power conversion and control systems to enhance performance and efficiency. The increasing investments in smart grid infrastructure and energy storage solutions further bolster the demand for power electronics, as these technologies rely heavily on efficient power conversion and management.

U.S. Power Electronics Market Trends

U.S. dominated the regional market accounting for a market revenue share of 60.9% in 2023. The rapid expansion of renewable energy sources, such as solar and wind power, requires efficient power conversion and management systems provided by power electronics. Additionally, the growing adoption of electric vehicles (EV's) drives demand for advanced power electronics to ensure efficient energy use and battery management. The increasing implementation of smart grid technologies to improve energy efficiency and reliability also boosts the need for sophisticated power electronics.

Europe Power Electronics Market Trends

Europe region is witnessed as lucrative in this industry. The region's strong commitment to sustainability and renewable energy sources has driven the need for efficient power conversion and management systems. Power electronics are critical in integrating renewable energy into the grid, managing energy storage systems, and enhancing the efficiency of electric vehicles, all of which are central to Europe's green energy initiatives. Additionally, the rise of smart grids and the increasing adoption of electric vehicles amplify the demand for advanced power electronics.

The UK power electronics market is projected to grow significantly in the coming years. The nation's significant investment in research and development fosters innovation and inventions in power electronics. Collaborations between universities, research institutes, and industry players drive technological advancements. The UK government provides subsidies, tax incentives, and funding for power electronics projects. These initiatives encourage companies to invest in research, development, and production. Engineering. Initiatives such as "Power Electronics UK" focus on creating a community within the sector, increasing collaboration and knowledge sharing among companies.

Asia Pacific Power Electronics Market Trends

Asia Pacific held the largest market revenue share in 2023. The rapid industrialization and urbanization in countries like China, India, and South Korea have significantly increased the need for efficient energy management systems. Power electronics are essential in improving energy efficiency and reducing power losses in industrial applications. Additionally, the growing adoption of electric vehicles (EVs) in these countries is driving the demand for advanced power electronic components, which are essential for the efficient functioning of EVs. The region's focus on renewable energy sources, such as solar and wind power, further contributes to this trend, as power electronics are vital for converting and controlling the energy generated from these sources.

India market is projected to grow significantly over the forecast period. The expansion of the industrial sector, coupled with the modernization of infrastructure, also contributes to this demand, as industries require advanced power electronics for automation and energy efficiency. Furthermore, India's growing consumer electronics market, with the rising adoption of smartphones, laptops, and other digital devices, adds to the need for robust power management systems.

Middle East and Africa Power Electronics Market Trends

The Middle East and Africa is expected to grow with the fastest CAGR over the forecast period. The region is witnessing significant investments in renewable energy projects, such as solar and wind power, driven by the need to diversify energy sources and reduce dependence on oil. Additionally, the rapid urbanization and industrialization in many countries within the region are boosting the need for efficient power management solutions. Governments and private sectors are increasingly focusing on enhancing energy infrastructure to meet the growing electricity demand, which further propels the adoption of advanced power electronics. Furthermore, initiatives aimed at improving energy efficiency and reducing carbon emissions encourage the integration of power electronics in various applications, from grid systems to consumer electronics, thereby driving market growth in the Middle East and Africa.

Key Power Electronics Company Insights

Some of the key companies in the power electronics market include Vishay Intertechnologies, Inc.; Renesas Electronics Corporation; Semiconductor Components Industries, LLC; Texas Instruments Incorporated, and others.

-

Vishay Intertechnologies, Inc. provides a range of affordable power capacitors for managing harmonics, filtering, and stabilizing voltage. The gadgets deliver dependable functionality in harsh environmental conditions like wind turbines, solar power plants, traction and industrial drives, and others.

-

Renesas Electronics Corporation provides a wide range of power electronics solutions to speed up transition towards a cleaner, more sustainable future, including renewables, smart grids, EVs, and automation in industries and buildings, fostering innovation throughout the energy transition.

Key Power Electronics Companies:

The following are the leading companies in the power electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Semiconductor Components Industries, LLC

- ABB

- Infineon Technologies AG

- Texas Instruments Incorporated.

- ROHM Co. Ltd

- STMicroelectronics NV

- Renesas Electronics Corporation.

- Vishay Intertechnologies, Inc.

- Toshiba Corporation

- Mitsubishi Electric Corporation

Recent Developments

-

In May 2024, Mitsubishi Electric Corporation announced a partnership with Musashi Energy Solutions to develop innovative energy storage devices for the railway industry. This collaboration aims to enhance carbon neutrality by integrating advanced energy storage modules and battery management systems into railcars and other vehicles.

-

In December 2023, ROHM announced a partnership with Toshiba Electronic Devices & Storage to enhance their power device manufacturing capabilities. This partnership will see significant investment in silicon carbide (SiC) and silicon (Si) power devices to boost production capacity and ensure a stable semiconductor supply in Japan.

Power Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.61 billion

Revenue forecast in 2030

USD 53.66 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, device, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Semiconductor Components Industries, LLC; ABB; Infineon Technologies AG; Texas instruments Inc.; ROHM Co. Ltd; STMicroelectronics NV; Renesas electronic corporation; Vishay Intertechnologies Inc.; Toshiba Corporation; Mitsubishi Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Electronics Market Report Segmentation

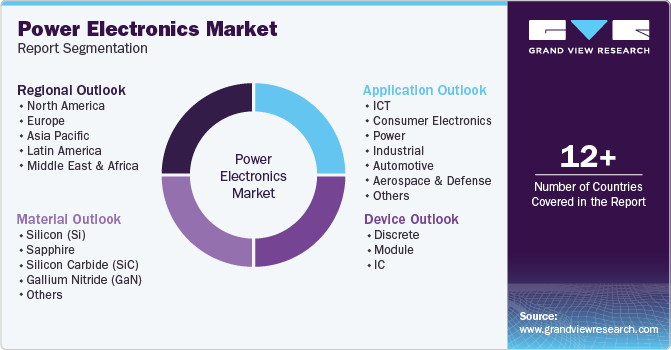

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power electronics market report based on material, device, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon (Si)

-

Sapphire

-

Silicon Carbide (SiC)

-

Gallium Nitride (GaN)

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Discrete

-

Module

-

IC

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ICT

-

Consumer Electronics

-

Power

-

Industrial

-

Automotive

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

- South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.