- Home

- »

- Organic Chemicals

- »

-

Decamethylcyclopentasiloxane Market, Industry Report, 2033GVR Report cover

![Decamethylcyclopentasiloxane Market Size, Share & Trends Report]()

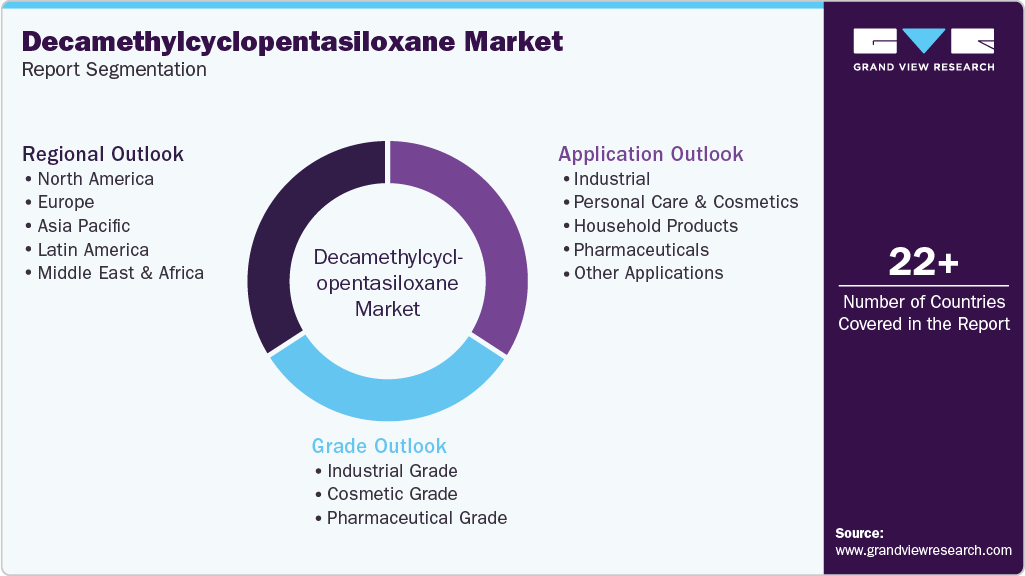

Decamethylcyclopentasiloxane Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (Industrial Grade, Cosmetic Grade), By Application (Industrial, Personal Care & Cosmetics, Household Products, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-800-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Decamethylcyclopentasiloxane Market Summary

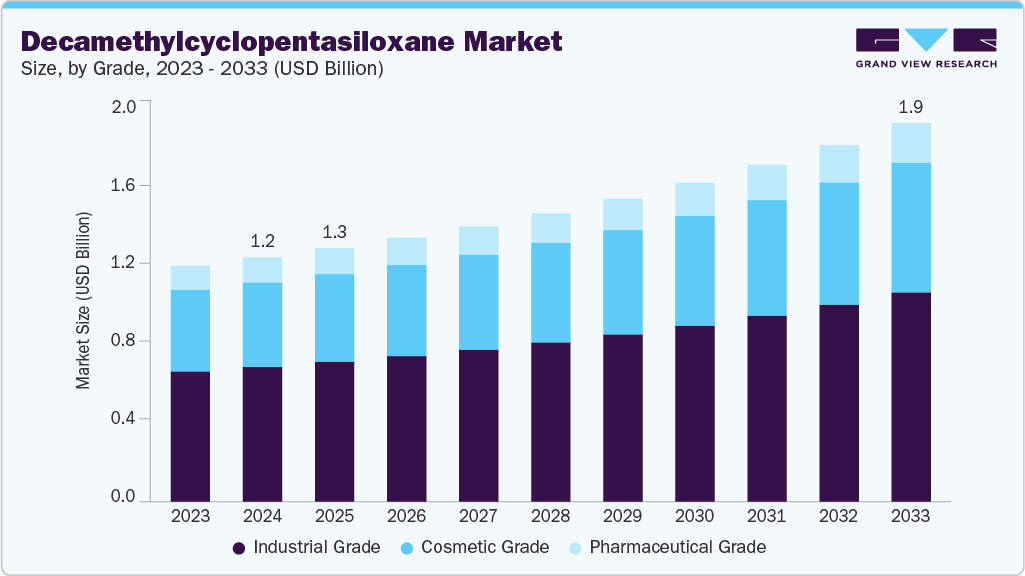

The global decamethylcyclopentasiloxane market size was estimated at USD 1,288.7 million in 2024 and is projected to reach USD 1,998.7 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The growth of the global Decamethylcyclopentasiloxane (D5) market is primarily driven by the expanding personal care and cosmetics industry, where D5 is widely utilized as a conditioning agent, emollient, and carrier fluid in skincare, haircare, and deodorant formulations.

Key Market Trends & Insights

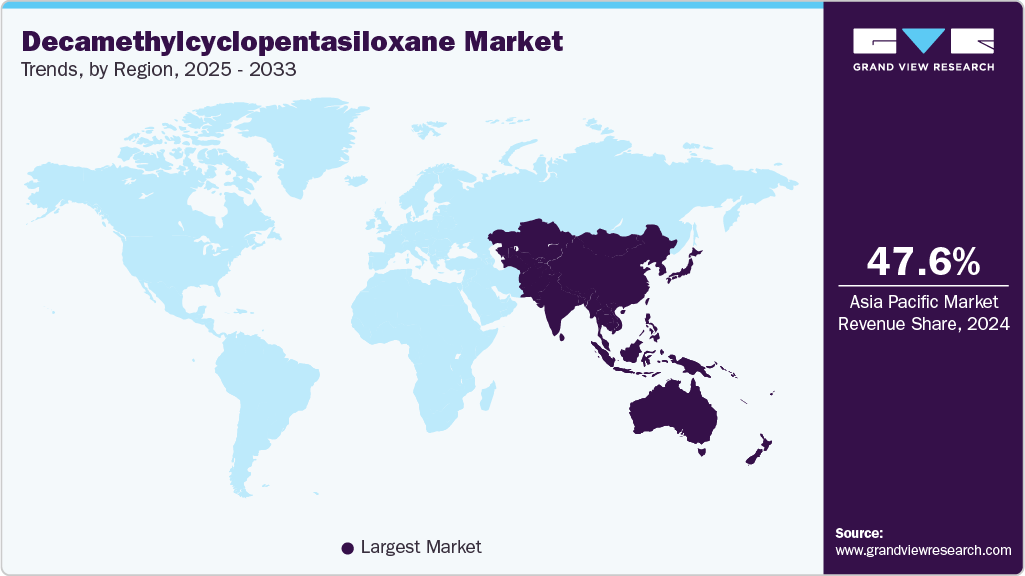

- Asia Pacific dominated the decamethylcyclopentasiloxane market with the largest revenue share of 47.6% in 2024.

- The China decamethylcyclopentasiloxane market accounted for 48.2% of the Asia Pacific D5 market in 2024.

- By grade, the industrial grade segment held the largest revenue share of 55.2% in 2024 in terms of value.

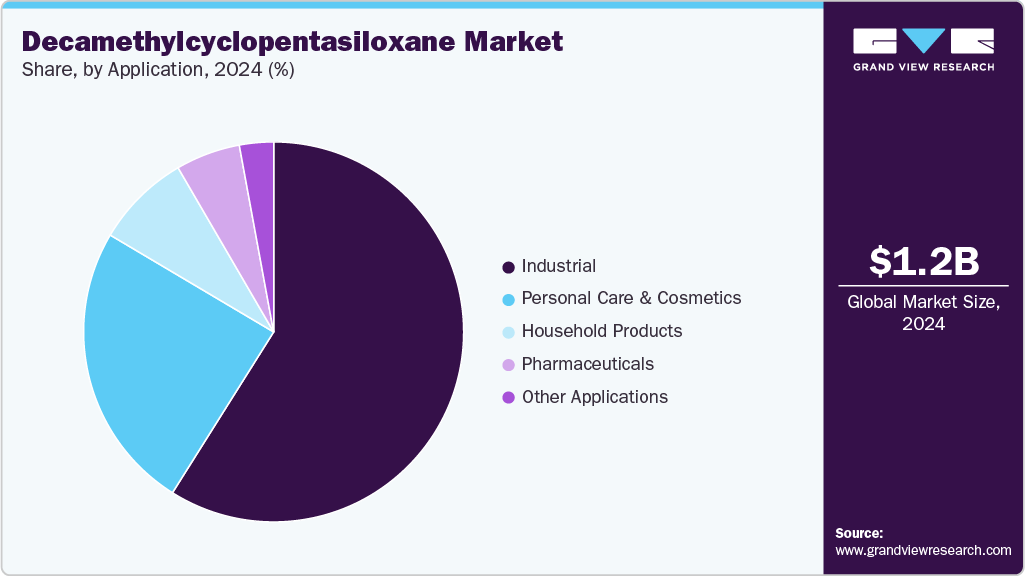

- By application, the industrial segment held the largest revenue share of 59.0% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 1,288.7 Million

- 2033 Projected Market Size: USD 1,998.7 Million

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

Its excellent volatility, spread ability, and compatibility with a wide range of ingredients make it indispensable for premium product formulations. The rising demand for silicone-based lubricants and cleaning agents in industrial and household applications is further supporting market expansion. The increasing adoption of D5 in pharmaceutical formulations, coupled with advancements in high-purity silicone synthesis and growing industrial output in Asia Pacific, is also fueling market growth.Significant opportunities exist in the development of biocompatible and low-residue grades of D5, catering to pharmaceutical and biomedical applications such as topical drug delivery and medical device coatings. The growing trend toward eco-friendly and sustainable silicones presents potential for innovation through recycling and closed-loop silicone recovery systems, enabling producers to align with regulatory and environmental standards. Moreover, emerging economies in Asia, Latin America, and the Middle East offer untapped potential due to rising consumer spending on personal care and industrial modernization. Partnerships between silicone producers and cosmetic brands for advanced formulation technologies could further expand the market’s value proposition across high-growth verticals.

The D5 market faces challenges primarily from stringent environmental and regulatory scrutiny, especially in Europe and North America, where D5 has been under evaluation for potential bioaccumulation and persistence in aquatic environments. Such assessments have led to formulation restrictions in rinse-off products and increased pressure on manufacturers to validate product safety and environmental performance. Volatility in raw material prices, particularly siloxane precursors, and dependence on energy-intensive manufacturing processes further constrain profitability. The emergence of alternative silicone fluids and bio-based emollients could limit market expansion if D5 producers fail to adapt through technological innovation and sustainability integration.

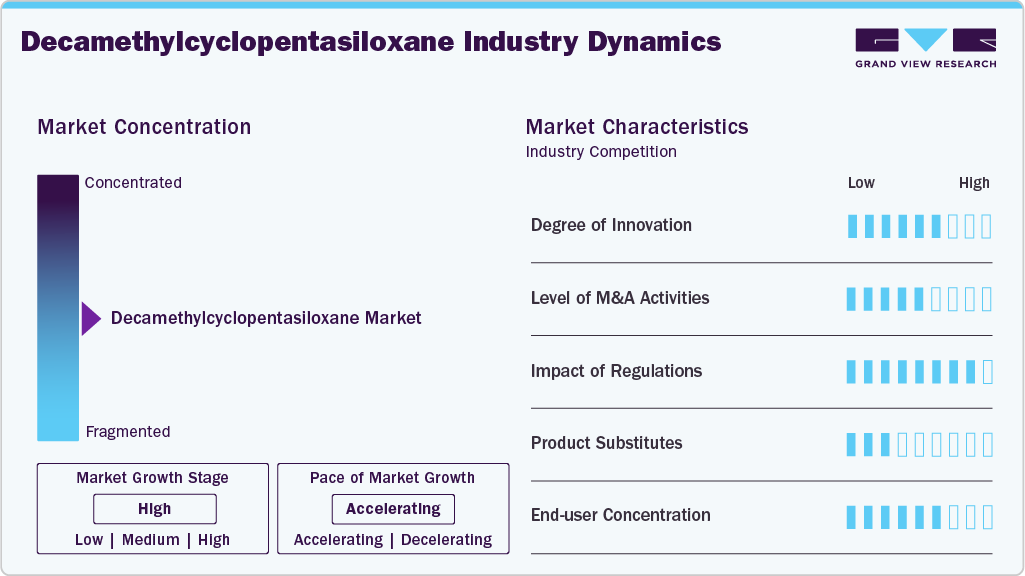

Market Concentration & Characteristics

The market is moderately consolidated, dominated by vertically integrated players such as Dow, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Momentive Performance Materials Inc., and Elkem ASA. These companies control extensive upstream siloxane production and downstream formulation capabilities, ensuring strong cost efficiency and supply reliability. Their strategic focus lies in product stewardship, regulatory compliance, and sustainability initiatives to maintain market access in regions with stringent environmental standards. Through diversified product portfolios and global distribution networks, these leaders effectively serve key end-use industries such as personal care, industrial manufacturing, and pharmaceuticals.

In contrast, niche players including Evonik Industries AG, KCC Silicone Corporation, Gelest Inc., Siltech Corporation, and Clearco Products Co., Inc. strengthen the market’s competitive dynamics through specialization in high-purity, cosmetic, and pharmaceutical-grade D5. They emphasize formulation flexibility, rapid customization, and technical support for small- and mid-scale customers seeking performance differentiation or regulatory-compliant alternatives. The competition is increasingly shaped by sustainability credentials, innovation in low-residue and recyclable silicones, and regional rebalancing of production in response to environmental regulations across Europe and North America.

Grade Insights

In 2024, the industrial grade segment dominated the global Decamethylcyclopentasiloxane (D5) market, accounting for the largest revenue share of 55.2%. This dominance is attributed to the extensive use of industrial-grade D5 as a key intermediate in the production of silicone polymers, lubricants, and surface treatment agents across automotive, electronics, and chemical processing industries. Its favorable thermal stability, dielectric properties, and low surface tension make it indispensable in formulating release agents, cleaning fluids, and coatings. The expanding demand for high-performance silicones in manufacturing and the continued industrialization in emerging economies, particularly in Asia Pacific, have reinforced the dominance of this segment. The ability of major producers such as Dow, Wacker, and Elkem to offer large-volume supply with consistent quality has further consolidated the segment’s market position.

The cosmetic and pharmaceutical grade segments collectively represent the high-value portion of the market, driven by rising demand for premium-quality silicones with stringent purity specifications. Cosmetic-grade D5 is widely used in skin and hair care formulations due to its excellent volatility, spreadability, and sensory performance, making it a preferred ingredient in antiperspirants, lotions, and conditioners. Meanwhile, pharmaceutical-grade D5 is gaining traction for its use in topical drug formulations, medical coatings, and controlled-release applications. Although these segments command smaller market shares, they are expected to record faster growth rates over the forecast period (2025-2033), supported by increasing regulatory acceptance, innovation in biocompatible silicones, and growing investment in high-purity production technologies by leading manufacturers.

Application Insights

In 2024, the industrial segment accounted for the largest revenue share of 59.0% in the global Decamethylcyclopentasiloxane (D5) market, primarily driven by its extensive use as a processing aid, lubricant, and intermediate in silicone polymer manufacturing. Industrial-grade D5 serves as a key feedstock in the production of silicone elastomers, sealants, and coatings used across automotive, electronics, and construction industries. Its excellent thermal stability, low surface tension, and dielectric properties make it ideal for applications such as mold release agents, heat-transfer fluids, and cleaning formulations. The segment’s dominance is further supported by the rapid industrial expansion in Asia Pacific, coupled with increasing adoption of silicone-based solutions for performance enhancement and process efficiency in advanced manufacturing environments.

The personal care and cosmetics segment represents the second-largest application category and is projected to record robust growth through 2033, driven by the widespread use of D5 in skincare, haircare, and deodorant formulations due to its smooth sensory profile and fast-evaporating characteristics. The household products segment also contributes steadily, supported using D5 in polishes, cleaning agents, and fabric care products. Meanwhile, pharmaceutical and other specialized applications, including medical device coatings and laboratory reagents, are emerging as high-potential niches, benefiting from growing R&D investments in biocompatible silicone formulations. Overall, while industrial applications underpin the market’s volume strength, the increasing shift toward high-purity and sustainable formulations in consumer and healthcare sectors is expected to drive value growth across other segments in the long term.

Regional Insights

Asia Pacific held the dominant 47.6% share of the global Decamethylcyclopentasiloxane (D5) market in 2024, driven by strong industrial activity and robust demand from the personal care and cosmetics industries. The region benefits from a well-established silicone manufacturing base, particularly in China, Japan, and South Korea, supported by cost-efficient raw material access and expanding export capabilities. Growing consumer expenditure on premium personal care products, coupled with rising industrial applications across automotive, electronics, and construction sectors, has further strengthened market growth. In addition, the increasing investments in high-purity silicone production facilities and localized R&D initiatives have positioned Asia Pacific as the global hub for D5 production and consumption.

China Decamethylcyclopentasiloxane Market Trends

The China decamethylcyclopentasiloxane market accounted for 48.2% of the Asia Pacific D5 market in 2024, reflecting its role as the regional and global production center for siloxane intermediates. The country’s dominance is underpinned by its vertically integrated silicone value chain, encompassing upstream raw material supply and downstream formulation capabilities for personal care and industrial applications. Rising domestic consumption of silicone-based cosmetics, coupled with rapid industrialization and export-oriented manufacturing, continues to drive market expansion. Moreover, favorable government policies promoting chemical manufacturing modernization and green chemistry adoption are encouraging capacity upgrades, further reinforcing China’s leadership in the D5 market.

North America Decamethylcyclopentasiloxane Market Trends

North America captured 24.0% of the global D5 market in 2024, supported by mature industrial infrastructure, technological innovation, and strong demand from personal care, healthcare, and specialty chemical sectors. The region’s market is primarily driven by the United States, where advanced formulation technologies and high regulatory compliance standards promote consistent demand for both industrial- and cosmetic-grade D5. Additionally, major manufacturers such as Dow and Momentive maintain large-scale production facilities and invest in sustainability-driven silicone product lines. The region’s market growth is expected to remain stable, supported by product diversification and rising demand for high-purity silicones in medical and industrial applications.

The U.S. decamethylcyclopentasiloxane market accounted for 72.2% of the North American D5 market in 2024, reflecting its leadership in silicone innovation and high-end application development. The U.S. market is characterized by advanced R&D capabilities, stringent quality standards, and diversified end-use sectors, including cosmetics, automotive, pharmaceuticals, and electronics. High domestic consumption of personal care products and the presence of leading chemical companies such as Dow and Momentive strengthen the nation’s position. Additionally, ongoing efforts to develop environmentally responsible silicone formulations and circular economy models are fostering product innovation and ensuring sustained market relevance amid evolving regulatory frameworks.

Europe Decamethylcyclopentasiloxane Market Trends

Europe accounted for 17.0% of the global D5 market in 2024, driven by well-established cosmetic and pharmaceutical industries, along with a strong presence of specialty silicone producers such as Wacker Chemie AG and Evonik Industries. Demand is particularly concentrated in Western Europe, where high-quality cosmetic formulations and industrial applications sustain steady consumption. However, the region’s growth is tempered by stringent environmental regulations and restrictions on D5 use in rinse-off personal care products under REACH legislation. Nevertheless, ongoing innovation in low-residue and recyclable silicone chemistries, along with rising demand for sustainable industrial formulations, continues to create niche growth opportunities.

The Germany decamethylcyclopentasiloxane market remains the key market for D5 within Europe, supported by its advanced chemical manufacturing ecosystem and significant demand from the automotive, personal care, and electronics industries. The presence of major producers such as Wacker Chemie AG and Evonik Industries enhances the country’s technical expertise and export capacity for silicone intermediates and high-purity formulations. Although regulatory limitations on certain cosmetic applications present challenges, German manufacturers are investing in environmentally compliant production methods and alternative silicone chemistries to retain competitiveness. The market continues to benefit from robust R&D infrastructure and high-value industrial demand across multiple downstream sectors.

Middle East & Africa Decamethylcyclopentasiloxane Market Trends

The Middle East & Africa (MEA) region represents a smaller but steadily expanding market for D5, driven by industrial diversification efforts and growing demand for silicone-based materials in construction, automotive, and personal care sectors. The Gulf countries, particularly Saudi Arabia and the UAE, are increasing their chemical production capabilities, offering potential for local silicone manufacturing in the long term. Meanwhile, rising consumer awareness and increasing imports of personal care products across Africa are contributing to gradual market expansion. Although the region currently relies heavily on imports from Asia and Europe, its growing industrial base and favorable economic reforms are expected to support moderate yet sustained demand growth through 2033.

Latin America Decamethylcyclopentasiloxane Market Trends

The Latin American D5 market is in a growth phase, supported by expanding industrialization and increasing adoption of silicone-based personal care products. Rising disposable income and the growing popularity of premium cosmetic formulations in countries such as Brazil and Mexico are key demand drivers. Although the region’s silicone manufacturing capacity remains limited, imports from North America and Asia Pacific meet the growing consumption needs. The gradual modernization of chemical industries and investments in regional distribution networks are expected to enhance accessibility and competitiveness, positioning Latin America as an emerging opportunity within the global D5 value chain.

Key Decamethylcyclopentasiloxane Company Insights

Key players, such as Dow, Wacker Chemie AG , Shin-Etsu Chemical Co., Ltd., Momentive Performance Materials Inc. , Elkem ASA , and Evonik Industries AG are dominating the market.

-

Wacker Chemie AG is a leading global manufacturer of silicones and specialty chemicals, playing a pivotal role in the Decamethylcyclopentasiloxane (D5) market through its comprehensive siloxane value chain and advanced production technologies. The company leverages its extensive expertise in silicone chemistry to supply high-quality D5 for diverse applications, including personal care, pharmaceuticals, and industrial manufacturing. Wacker’s strong R&D capabilities enable continuous innovation in environmentally compliant and high-purity silicone formulations, aligning with evolving regulatory standards in Europe and other key markets. Its integrated operations, global manufacturing footprint, and commitment to sustainability, evident through initiatives aimed at energy-efficient production and circular silicone recycling, strengthening its competitive positioning. By combining technical excellence with a broad customer network, Wacker Chemie AG remains one of the most influential players shaping the global D5 and broader silicone markets.

Key Decamethylcyclopentasiloxane Companies:

The following are the leading companies in the decamethylcyclopentasiloxane market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- Elkem ASA

- Evonik Industries AG

- KCC Silicone Corporation

- Gelest Inc.

- Siltech Corporation

- Clearco Products Co, Inc.

Decamethylcyclopentasiloxane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,337.7 million

Revenue forecast in 2033

USD 1,998.7 million

Growth Rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Dow; Wacker Chemie AG; Shin-Etsu Chemical Co., Ltd.; Momentive Performance Materials Inc.; Elkem ASA; Evonik Industries AG; KCC Silicone Corporation; Gelest Inc.; Siltech Corporation; Clearco Products Co, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decamethylcyclopentasiloxane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global decamethylcyclopentasiloxane market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Industrial Grade

-

Cosmetic Grade

-

Pharmaceutical Grade

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Personal Care & Cosmetics

-

Household Products

-

Pharmaceuticals

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global decamethylcyclopentasiloxane market size was estimated at USD 1,288.7 million in 2024 and is expected to reach USD 1,337.7 million in 2025.

b. The global decamethylcyclopentasiloxane market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 1,998.7 million by 2033.

b. The industrial grade segment held the largest revenue share of 55.2% in 2024 due to its extensive use as a key intermediate in silicone polymer, lubricant, and coating manufacturing across automotive, electronics, and construction industries. Its superior thermal stability, dielectric strength, and low surface tension make it indispensable in high-performance industrial formulations. The rapid industrialization in Asia Pacific and large-scale production capabilities of major manufacturers such as Dow and Wacker reinforced the segment’s dominance.

b. Some of the key players operating in the decamethylcyclopentasiloxane market include Dow, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Momentive Performance Materials Inc., Elkem ASA, Evonik Industries AG, KCC Silicone Corporation, Gelest Inc., Siltech Corporation, and Clearco Products Co, Inc.

b. The growth of the Decamethylcyclopentasiloxane (D5) market is driven by increasing demand from the personal care and cosmetics industry, where D5 is widely used for its excellent volatility and smooth sensory profile. Rising industrial applications in lubricants, coatings, and silicone polymer production further support market expansion. The advancements in high-purity silicone synthesis and growing industrialization in emerging economies are strengthening global demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.