- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone Elastomer Market Size, Share, Industry Report, 2033GVR Report cover

![Silicone Elastomer Market Size, Share & Trends Report]()

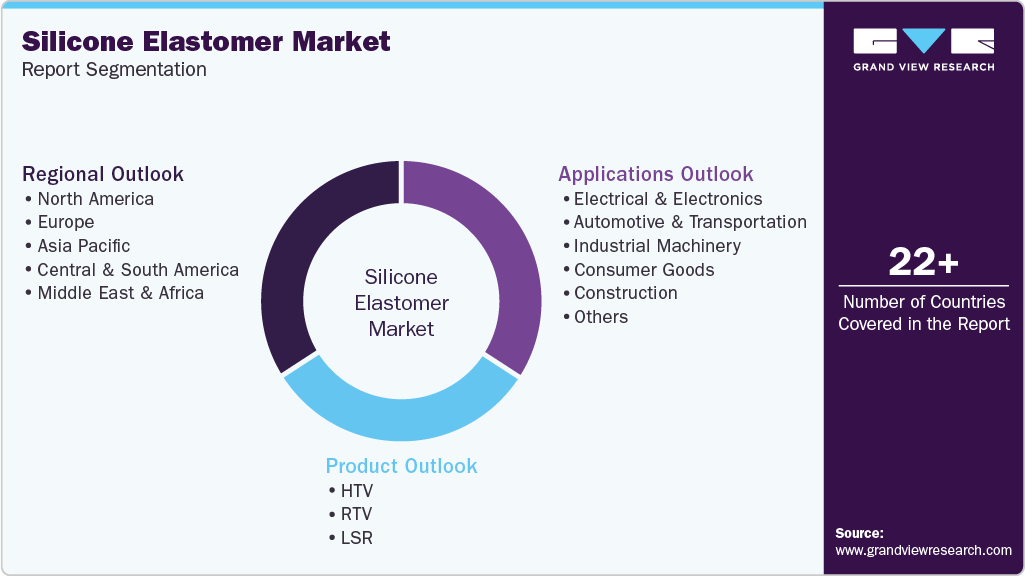

Silicone Elastomer Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (HTV, RTV, LSR), By Application (Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Consumer Goods, Construction, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-449-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Elastomer Market Summary

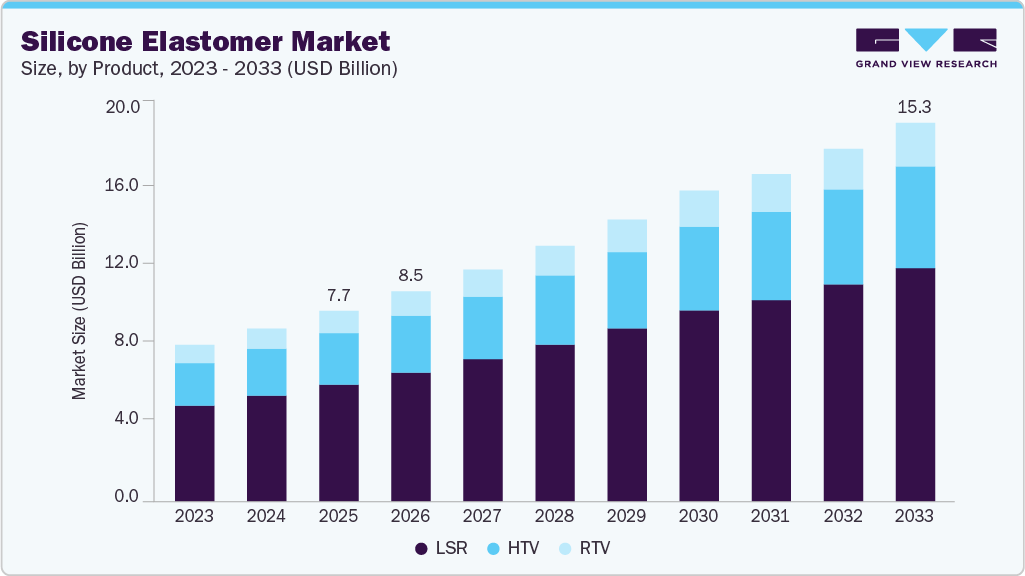

The global silicone elastomer market size was estimated at USD 7.71 billion in 2025 and is projected to reach USD 15.33 billion by 2033, growing at a CAGR of 8.8% from 2026 to 2033. The growing use of silicone elastomers in construction and infrastructure is driving the market.

Key Market Trends & Insights

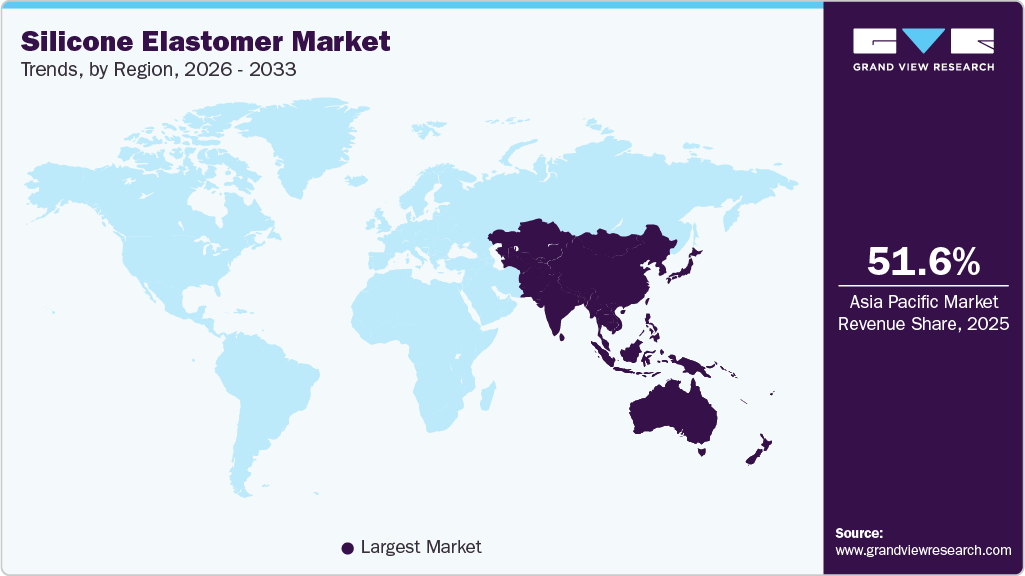

- Asia Pacific dominated the global silicone elastomer industry with the largest revenue share of 51.60% in 2025.

- The silicone elastomer industry in the U.S. is expected to grow at a substantial CAGR of 8.4% from 2026 to 2033.

- By product, the LSR segment is expected to grow at the fastest CAGR of 8.9% from 2026 to 2033 in terms of revenue.

- By application, the automotive & transportation segment is expected to grow at a considerable CAGR of 8.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 7.71 Billion

- 2033 Projected Market Size: USD 15.33 Billion

- CAGR (2026-2033): 8.8%

- Asia Pacific: Largest market in 2025

Their long service life, UV resistance, and flexibility make them ideal for use in sealants, gaskets, and expansion joints in commercial buildings and transportation infrastructure, thereby reducing maintenance costs and improving durability over time.

The silicone elastomer market is consolidating around high-value grades and processable formats, notably liquid silicone rubber. Demand is driven by miniaturization in electronics, higher thermal and chemical stability requirements in electric vehicles, and the expanding use of medical devices. Manufacturers are investing in automated LSR lines and formulation R&D to support precision moulding and faster cycle times. Production and consumption are concentrated in the Asia Pacific, which now leads global volume and capacity additions.

Drivers, Opportunities & Restraints

Performance-led substitution is the primary growth driver. Silicone elastomers offer a wide temperature range, electrical insulation, biocompatibility, and long-term weathering resistance that rigid polymers cannot match. These attributes are essential for EV powertrain components, medical tubing and implants, and sealing systems in renewable-energy equipment. Stricter safety and longevity standards in the automotive and healthcare industries force OEMs to prefer silicone, despite its higher unit cost, thereby sustaining demand across multiple high-growth end uses.

There is substantial upside in specialty and engineered silicones. Thermally conductive and electrically conductive grades address the thermal management and EMI needs in 5G infrastructure, power electronics, and wearable devices. Medical-grade, high-purity formulations create opportunities in minimally invasive devices and implantables. Automation-friendly LSR and advances in silicone additive manufacturing open high-mix, low-volume production for customized components. Licensing and co-development with OEMs for application-specific silicone compounds can capture margin and lock-in customers.

Cost and supply-side volatility are the main restraints. Feedstock prices for siloxane monomers fluctuate in tandem with energy and specialty chemical markets, thereby raising production costs and compressing margins. The capacity for high-purity monomers and medical-grade supply chains remains concentrated, thereby increasing geopolitical and logistical risk. Competition from lower-cost elastomers and engineered thermoplastics also constrains adoption in price-sensitive segments. Finally, stringent regulatory certification for medical and automotive applications increases time to market and development expense.

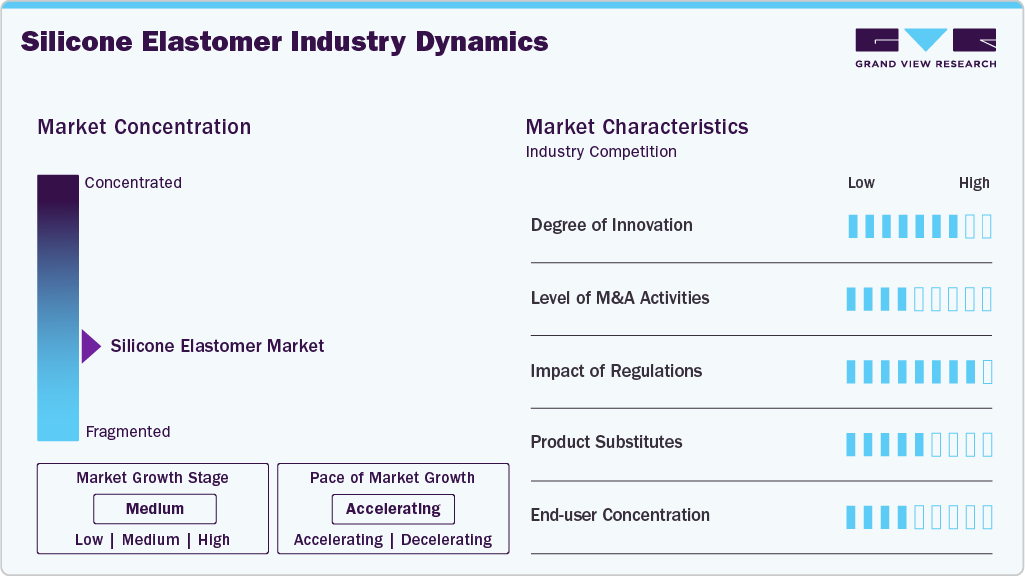

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as China National BlueStar (Group) Co., Ltd., Dow Corning Corporation, KCC Corporation, Mesgo S.P.A., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Reiss Manufacturing Inc., Wacker Chemie AG, Zhejiang Xinan Chemical Industrial Group Co., Ltd., Stockwell Elastomerics, Specialty Silicone Products, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in the silicone elastomer market is increasingly driven by advanced material science and digital manufacturing technologies. Developments such as self-healing formulations, antimicrobial and electrically conductive silicones enhance functional performance for emerging sectors such as wearable tech and soft robotics. Digital manufacturing, including 3D printing and smart process automation, improves design flexibility, reduces cycle time, and enables customization at scale. These technology advances expand end-use applicability and support premium pricing strategies for differentiated silicone elastomer products.

Silicone elastomers face substitution pressure from engineered thermoplastics, fluoropolymers, and advanced synthetic rubbers in cost-sensitive segments. Thermoplastic elastomers offer lower material and processing costs in non-critical sealing and consumer goods applications. Fluoropolymers provide superior chemical resistance that can replace silicones in aggressive environments. Natural and synthetic rubbers continue to compete where extreme temperature or biocompatibility requirements are less stringent. Substitution risk intensifies when cost dynamics outweigh silicone performance advantages.

Product Insights

Liquid silicone rubber (LSR) segment dominated the market across all product segments in terms of revenue, accounting for a 61.25% market share in 2025, and is forecasted to grow at an 8.9% CAGR from 2026 to 2033. LSR continues to gain market traction as it enables high-precision, automated manufacturing at scale. Its low viscosity and fast cure cycles reduce cycle times and scrap, lowering production costs for complex components. Medical device OEMs and automotive Tier-1 suppliers are increasingly specifying LSR for critical seals, sensors, and EV battery pack components due to its consistent dimensional control and biocompatibility. Investment in multi-shot molding and robotic handling further strengthens LSR’s competitive position.

High-temperature vulcanized (HTV) segment is anticipated to grow at a substantial CAGR of 8.7% over the forecast period. HTV silicone elastomers are driven by demand for rugged materials that sustain performance under extreme conditions. HTV compounds offer superior heat stability, mechanical strength, and long service life, which are essential for gaskets, insulation, and heavy-duty seals in industrial and energy infrastructures. Regulatory requirements for safety and durability in aerospace, power generation, and automotive under-hood applications reinforce HTV adoption. Continuous formulation improvements enhance chemical and weather resistance, broadening HTV use cases.

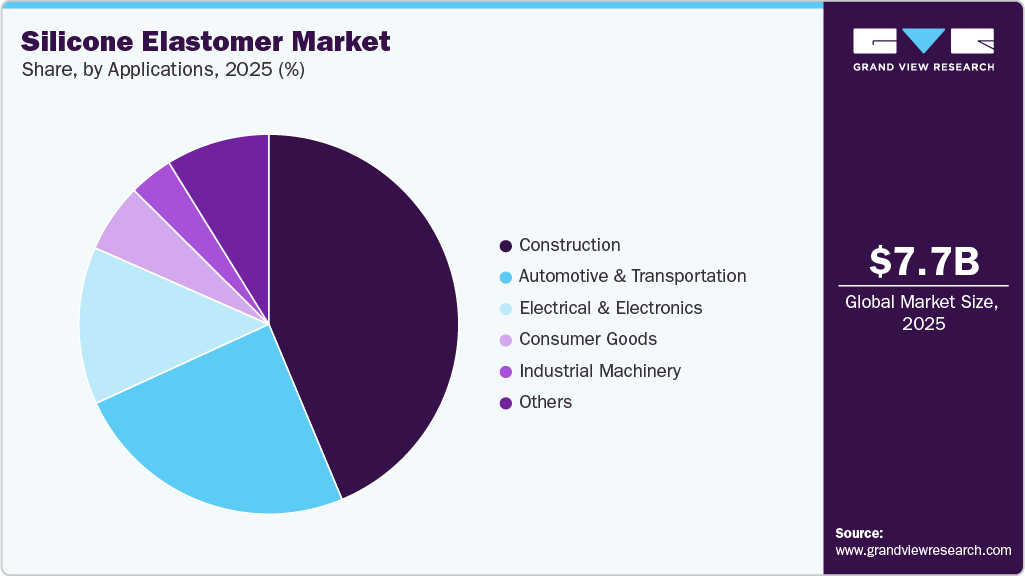

Applications Insights

Construction dominated the market across the applications segmentation in terms of revenue, accounting for a market share of 43.70% in 2025, and is forecasted to grow at a significant CAGR of 8.8% from 2026 to 2033. Growth in the construction segment is driven by the increased deployment of silicone elastomer sealants and coatings to meet higher building performance standards. Silicone materials offer exceptional resistance to UV, moisture, and temperature fluctuations, thereby enhancing building envelope longevity and reducing maintenance costs. Urbanization and enforcement of energy-efficient building codes support uptake in curtain walls, structural glazing, and expansion joints. Demand for low-VOC, weatherable silicones aligns with sustainability goals and green construction mandates globally.

The automotive & transportation segment is expected to expand at a substantial CAGR of 8.9% over the forecast period. In the automotive and transportation industries, silicone elastomers play a crucial role in electrification, lightweighting, and safety strategies. Electrified powertrains require materials with excellent thermal management, electrical insulation, and durability, roles where silicones outperform conventional polymers. Battery pack seals, high-voltage cable jackets, and thermal gap fillers are key growth applications. OEMs focus on emissions reduction and reliability, putting a premium on silicone’s extended temperature tolerance and mechanical resilience in both EV and internal combustion platforms.

Regional Insights

The Asia Pacific silicone elastomer industry held the largest share, accounting for 51.60% of the revenue in 2025, and is expected to grow at the fastest CAGR of 9.1% over the forecast period. Asia Pacific’s silicone elastomer market expansion is anchored in its robust manufacturing base and rapid industrialization. Large-scale automotive and electronics production hubs in China, Japan, South Korea, and India drive significant demand for elastomers in EV components, 5G infrastructure, and semiconductor packaging. Urbanization and government infrastructure investment further propel the use of silicone in the construction and healthcare sectors. Competitive local raw material availability and cost advantages enhance regional supplier positioning and support export growth.

Silicone elastomer market in China stands out as the dominant regional driver due to its vast manufacturing ecosystem and infrastructure buildup. Strong growth in automotive electrification, consumer electronics, and renewable energy equipment fuels silicone elastomer consumption, especially in LSR and HTV grades. Urbanization initiatives and government support for advanced materials strengthen domestic production capacity and attract foreign investment. The export orientation of China’s manufacturing sector further amplifies elastomer demand across global supply chains.

North America Silicone Elastomer Market Trends

The North American silicone elastomer market is experiencing growth driven by advanced automotive electrification, a robust healthcare sector, and innovations in high-performance materials. The U.S. leads regional demand for EV battery components, medical devices that require biocompatible elastomers, and resilient construction materials. Regulatory emphasis on sustainability and product safety encourages the use of premium, environmentally friendly silicone formulations. Established supply chains and significant R&D investments by leading chemical firms strengthen technological leadership.

U.S. Silicone Elastomer Market Trends

In the U.S., silicone elastomer demand is driven by electric vehicle adoption and the modernization of healthcare technologies. Federal and state incentives for clean energy adoption and EV production support expanding use of silicone in battery seals, thermal interfaces, and high-voltage insulation. The mature medical device industry’s stringent quality standards increase uptake of medical-grade silicones for implants and diagnostic equipment. Strong ties between OEMs and silicone material developers expedite the deployment of specialized compounds.

Europe Silicone Elastomer Market Trends

Europe’s silicone elastomer market is shaped by stringent sustainability and regulatory frameworks. The European Union’s environmental policies influence the adoption of low-emission, eco-compliant silicone formulations in automotive, construction, and renewable energy applications. Germany, France, and the UK lead regional demand through investments in advanced manufacturing, smart infrastructure, and lifecycle-oriented material solutions. Regulatory emphasis on circular economy and energy efficiency drives technological upgrades and premium product specification.

Key Silicone Elastomer Company Insights

The silicone elastomer industry is highly competitive, with several key players dominating the landscape. Major companies include China National BlueStar (Group) Co., Ltd., Dow Corning Corporation, KCC Corporation, Mesgo S.P.A., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Reiss Manufacturing Inc., Wacker Chemie AG, Zhejiang Xinan Chemical Industrial Group Co., Ltd., Stockwell Elastomerics, and Specialty Silicone Products, Inc. The silicone elastomer industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Silicone Elastomer Companies:

The following are the leading companies in the silicone elastomer market. These companies collectively hold the largest market share and dictate industry trends.

- China National BlueStar (Group) Co., Ltd.

- Dow Corning Corporation

- KCC Corporation

- Mesgo S.P.A.

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Reiss Manufacturing Inc.

- Wacker Chemie AG

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Stockwell Elastomerics

- Specialty Silicone Products, Inc.

Recent Developments

-

In June 2024, Shin-Etsu announced construction of a new silicone products plant in Pinghu, Zhejiang Province, China. The facility likely to produce functional and environmentally sustainable silicone emulsions and high-performance silicone products to meet the growing demand for local electronics and coatings.

-

In January 2024, Elkem brought its Phoenix (Xinghuo) project into operation in China. The completion substantially increased silicone monomer capacity to support an overall output of 700,000 t/yr and expanded downstream specialty product capacity to approximately 300,000 t/yr, thereby strengthening the Asia supply.

Silicone Elastomer Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.51 billion

Revenue forecast in 2033

USD 15.33 billion

Growth rate

CAGR of 8.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Product, applications, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Germany; UK; Italy; France; China; Japan; South Korea; India; Brazil

Key companies profiled

China National BlueStar (Group) Co., Ltd.; Dow Corning Corporation; KCC Corporation; Mesgo S.P.A.; Momentive Performance Materials Inc.; Shin-Etsu Chemical Co., Ltd.; Reiss Manufacturing Inc.; Wacker Chemie AG; Zhejiang Xinan Chemical Industrial Group Co., Ltd.; Stockwell Elastomerics; Specialty Silicone Products, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Elastomer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the silicone elastomer market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

HTV

-

RTV

-

LSR

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrical & Electronics

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Goods

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global silicone elastomer market size was estimated at USD 7.71 billion in 2025 and is expected to reach USD 15.33 billion in 2026.

b. The global silicone elastomer market is expected to grow at a compound annual growth rate of 8.8% from 2026 to 2033 to reach USD 15.33 billion by 2033.

b. LSR dominated the market across all product segments in terms of revenue, accounting for a 61.25% market share in 2025, and is forecasted to grow at an 8.9% CAGR from 2026 to 2033.

b. Some key players operating in the silicone elastomer market include China National BlueStar (Group) Co., Ltd., Dow Corning Corporation, KCC Corporation, Mesgo S.P.A., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Reiss Manufacturing Inc., Wacker Chemie AG, Zhejiang Xinan Chemical Industrial Group Co., Ltd., Stockwell Elastomerics, and Specialty Silicone Products, Inc.

b. The growing use of silicone elastomers in construction and infrastructure is driving the market. Their long service life, UV resistance, and flexibility make them ideal for use in sealants, gaskets, and expansion joints in commercial buildings and transportation infrastructure, thereby reducing maintenance costs and improving durability over time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.