- Home

- »

- Medical Devices

- »

-

Dental Inlays & Onlays Market Size & Share Report, 2030GVR Report cover

![Dental Inlays & Onlays Market Size, Share & Trends Report]()

Dental Inlays & Onlays Market Size, Share & Trends Analysis Report By Material (Porcelain, Zirconia, Gold, Composite), By Type (Direct, Indirect), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-975-7

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global dental inlays and onlays market size was valued at USD 3.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.0% from 2022 to 2030. The market is majorly driven by the rise in advancements in the field of restorative dental care. Moreover, an increase in consumer awareness regarding dental inlays and onlays procedures is boosting the growth of the market.

The COVID-19 epidemic has negatively impacted the market growth owing to the strict restriction and lockdown imposed by the government in 2020. The epidemic has resulted in a fall in the number of patient visits to dental clinics and the enclosure of dental care facilities. Raw material procurement is unsuccessful; hence, materials of dental inlays and onlays are unavailable, which is negatively impacting the supply chain of these materials. However, with a fall in the number of COVID-19 patients, dental clinics are beginning to schedule dental procedures based on their capacity for dental clinic admission and patient comfort level.

Dental inlays and onlays are considered better substitutes for repairing and restoring damaged teeth. This procedure is aimed to blend with natural tooth color and more tooth is preserved during the procedure. The difference between dental inlays and onlays is that inlays are placed inside a cavity on a tooth whereas onlays replace the tips (cups) of the tooth. Dental inlays and onlays have enhanced physical properties to composite traditional fillings for posterior teeth, strong and durable nature, less microleakage, and minimal post-operative sensitivity than direct composite fillings.

The rise in public awareness regarding dental inlays and onlays procedures, the high adoption rate, increase in the prevalence of dental diseases, a surge in demand for cosmetic dentistry among the young population, and an increase in the number of dental practices worldwide are the major factors that drive the market. In addition, an increase in the public preference for porcelain-based dental inlays and onlays procedures, a rise in the adoption of CAD/CAM systems, and a rise in dental tourism in emerging countries are the other factors that boost the growth of the market. In addition, the rise in the adoption of dental inlays and onlays and the growing number of dental clinics across the globe fuel the growth of the market.

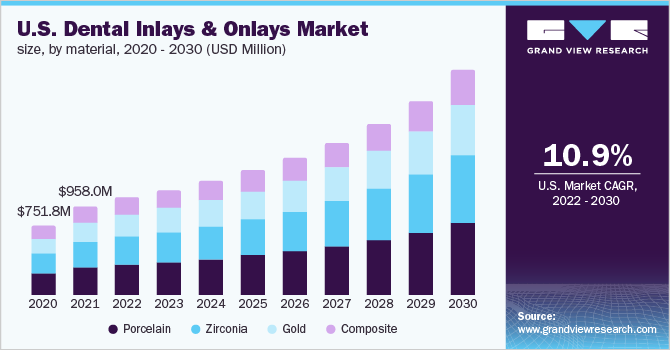

Material Insights

The porcelain segment accounted for the largest share of over 30.0% in 2021. This is attributed to the rapid surge in the demand for porcelain dental inlays and onlays in dental practices, extensive use of porcelain materials in dental restoration procedures, and rise in focus on dental aesthetics resulting in a large number of cosmetic dentistry treatments. In addition, porcelain dental inlays and onlays strengthen the tooth structure and are more conservative as compared to crowns. Based on material, the global market has been categorized into porcelain, zirconia, gold, and composite.

Porcelain materials do not provoke any reactions in the human body, are cost-effective, durable, and last much longer than conventional fillings. In addition, porcelain is a popular choice for dental inlays and onlays material as it is naturally translucent and it can match closely to the shades of teeth. Moreover, these materials are preferred when the decayed or broken part of the teeth is too large for conventional feeling.

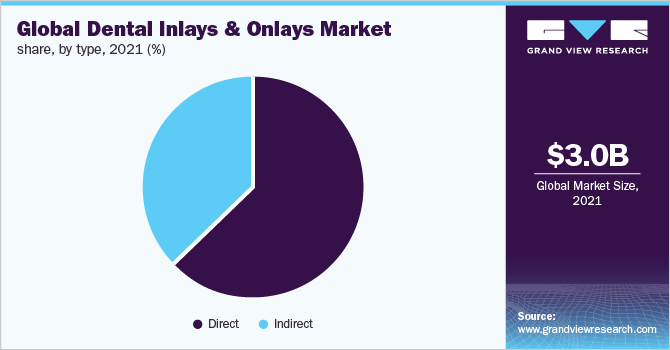

Type Insights

In 2021, the direct segment dominated the market and accounted for more than 60.0%. Direct inlays and onlays are made by dental professionals within a set of dental clinics. Direct inlays and onlays require only one dental visit as it is an easy process for the dental patient to partake. In addition, direct inlays and onlays need minimum time for preparation and these are the better option for natural teeth. Based on type, the global market has been divided into direct and indirect.

Direct inlays and onlays have a fixed surface that matches the shape of the present enamel to aid it to stay in place when bonded with dental cement or dental adhesive. Factors such as a rise in the patient preference for direct type dental inlays and onlays and a surge in the adoption of minimum time-consuming dental procedures are the major factors that boost the growth of the market.

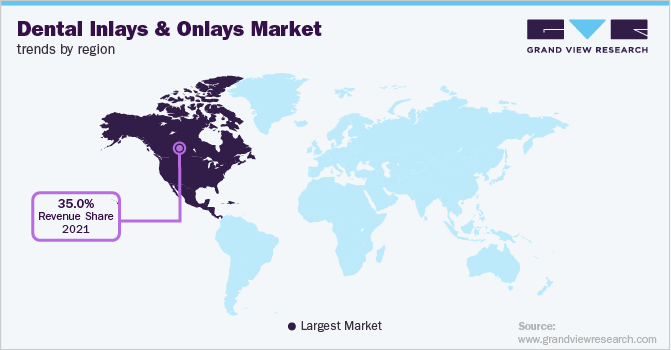

Regional Insights

North America accounted for the largest revenue share of more than 35.0% in 2021. This is attributed to the increase in the prevalence of dental diseases, surge in the number of dental procedures in the region, and increase in public awareness regarding oral health are the key factors boosting the market growth. In addition, the availability of skilled dental professionals, an increase in expenditure on dental care, the presence of well-built healthcare infrastructure, an increase in demand for technologically advanced cosmetic dentistry procedures, and high personal disposable income are the other factors that fuel the growth of the market in North America.

Moreover, advancements in the techniques used in dental practices and improvements in dental inlays & onlays materials are likely to increase the number of dental visits by patients in this region. An increase in the number of dental practices such as corporate dental practices and group dental practices and a rise in the number of dental practitioners also fuels the growth of the market. For instance, according to the American Dental Association, nearly 201,927 registered dentists were practicing in the U.S. in 2021.

Key Companies & Market Share Insights

Key market players are increasingly opting for strategic collaborations, product launches, geographical expansion, and partnerships through mergers & acquisitions in economically favorable and emerging regions. In April 2021, Glidewell and the Misch Institute have entered into a strategic collaboration to make dental education more accessible to dentists. Some prominent players in the global dental inlays and onlays market include:

-

3M Company

-

Glidewell Laboratories

-

Smile Brands

-

Institut Straumann AG

-

Ivoclar Vivadent AG

-

COLTENE Holding AG

-

Dentsply Sirona

-

Aspen Dental

-

National Dentex Corporation

-

DenMat

Recent Development

- In April 2021, National Dentex Labs, announced the acquisition of Dental Services Group, a growing dental laboratories network in North America. The combined company was developed to provide best of the services to the customers including a variety of options in fixed, implant, and orthodontics dentistry products & services.

Dental Inlays & Onlays Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.3 billion

Revenue forecast in 2030

USD 7.6 billion

Growth rate

CAGR of 11.0% from 2022 to 2030

Base year for estimation

2021

Historic data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

3M Company; Glidewell Laboratories; Smile Brands; Institut Straumann AG; Ivoclar Vivadent AG; COLTENE Holding AG; Dentsply Sirona; Aspen Dental; National Dentex Corporation; DenMat

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Inlays & Onlays Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental inlays and onlays market report based on material, type, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Porcelain

-

Zirconia

-

Gold

-

Composite

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct

-

Indirect

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dental inlays & onlays market size was estimated at USD 3.0 billion in 2021 and is expected to reach USD 3.3 billion in 2022.

b. The global dental inlays & onlays market is expected to grow at a compound annual growth rate of 11.0% from 2022 to 2030 to reach USD 7.6 billion by 2030.

b. North America dominated the dental inlays & onlays market with a share of 38.2% in 2021. This is attributable to the rise in preventive approaches towards oral care & hygiene, the presence of private dental clinics, and rising R&D activities in dentistry.

b. Some key players operating in the dental inlays & onlays market include 3M Company, Glidewell Laboratories, Smile Brands, Institut Straumann AG, Ivoclar Vivadent AG, COLTENE Holding AG, Dentsply Sirona, Aspen Dental, National Dentex Corporation, and DenMat

b. Key factors that are driving the dental inlays & onlays market growth include increase in public preference for minimally invasive dental restoration treatments, a rise in number of dental practitioners, surge in R & D activities along with new dental inlays & onlays material launches, and a rise in healthcare expenditure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."