Digital Dentistry Market Size & Trends

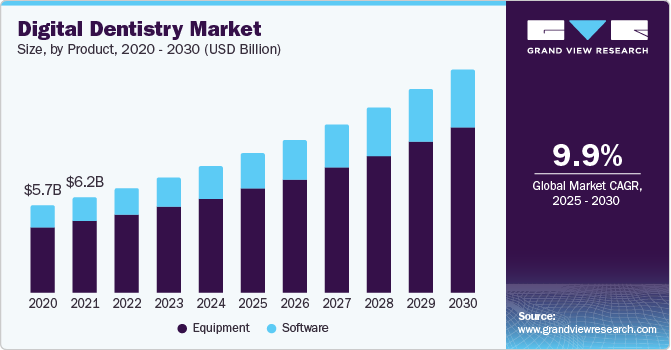

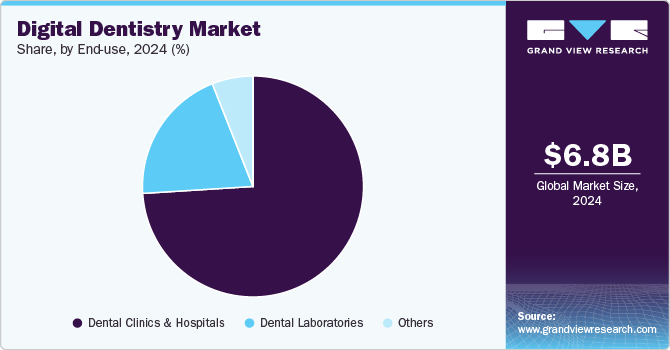

The global digital dentistry market size was valued at USD 6.8 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2025 to 2030. The global digital dentistry market size was valued at USD 6.8 billion in 2023 and is expected to grow at a CAGR of 9.9% over the forecast period. Digital dentistry involves computer-aided design & production, decision-making, diagnosis, long-term oral health care of the patients, and treatment delivery & re-evaluation. The use of Internet & Communication Technologies (ICT) and Big Data in dental care is growing.

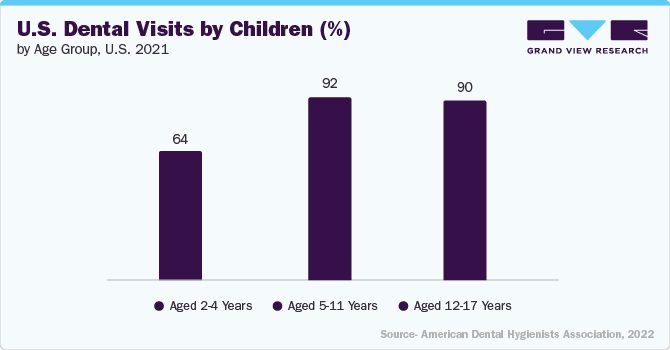

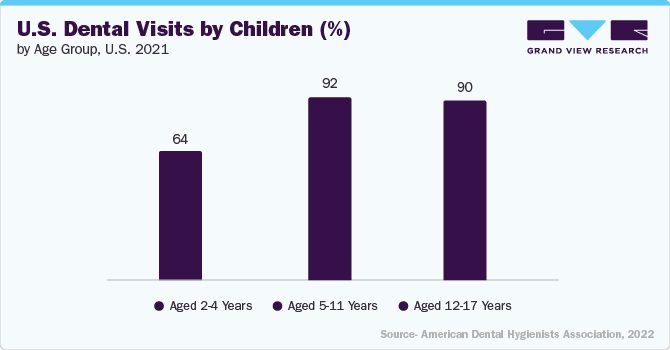

The rise in awareness of dentistry among people, technological developments in dentistry, the surge in the prevalence of dental caries and other periodontal diseases, and the high demand for digital dentistry are the major factors that drive the growth of the market. In addition, the adoption of outsourcing activities by large dental players, the rise in cost-effective treatments, the surge in the number of dental aesthetic treatment procedures, the surge in demand for dental 3D printing technologies, and the rise in the number of dental visits worldwide further boosts the growth of the market. For instance, Dental 3D printing dentistry has established a strong position in today’s dental products due to the combination of state-of-the-art 3D printing technology with a potential footprint.

COVID-19 caused a massive disruption in the supply chain of the overall medical device industry. The pandemic reduced the number of dental procedures performed, resulting in an overall decline in the market in 2020. The demand & sale of dental equipment & procedures were adversely impacted owing to the global restrictions & lockdown in most of the countries. Moreover, many device providers shifted their attention to the fight against COVID-19 outbreaks. However, after the second quarter of 2020, dental procedures resumed, leading to a total market recovery by 2021.

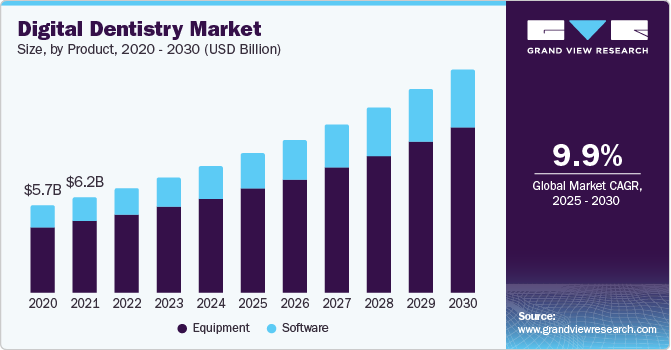

Product Insights

Based on the product, the digital dentistry market is segmented into equipment and software. The software segment is anticipated to grow fastest during the forecast period. The advantages of cloud-based dental software include increased flexibility, scalability, and reduced upfront cost, which are expected to boost the market. Moreover, the increase in the focus of dental clinics and hospitals on adopting digital dentistry software further fuels the market growth.

Application Insights

On the basis of application, the market is segmented into restorative dentistry, orthodontics , implantology and others. Restorative dentistry held the largest share in 2024. Restorative dentistry focuses on diagnosing and treating oral health issues related to damaged, decayed, or missing teeth. It encompasses a range of procedures, including dental fillings, crowns, bridges, dentures, and implants, aimed at restoring both function and aesthetics. Advancements in digital dentistry have enhanced restorative treatments, enabling precise planning, customized restorations, and improved patient outcomes. Technologies such as CAD/CAM systems, 3D printing, and intraoral scanning streamline workflows, reducing chair time and improving accuracy in restorations.

The orthodontics segment is growing at the fastest CAGR over the forecast period. Orthodontics focuses on diagnosing, preventing, and treating dental and jaw misalignments to improve oral function and aesthetics. Traditional orthodontic treatments, such as metal braces, remain widely used, but advancements in clear aligners and digital treatment planning have transformed the field. Technologies like intraoral scanners, 3D imaging, and AI-driven treatment simulations enhance accuracy and efficiency, allowing for customized treatment plans tailored to individual patient needs.

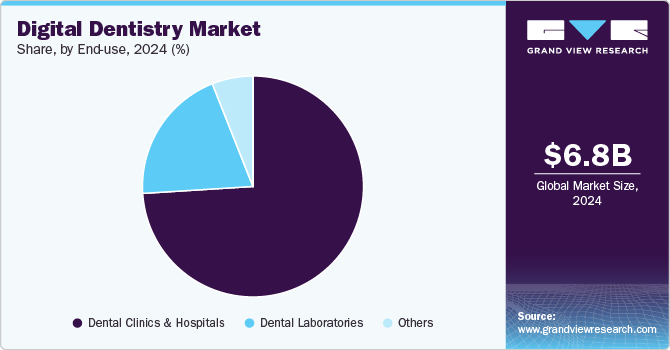

End-use Insights

On the basis of end use, the market is segmented into hospitals, dental clinics, and others. Dental clinics held the largest share in 2024. Most dental patients visit private practice due to the presence of specialists. Over 80% of dental practices are run by the owners. The number of independent practices is rising across the globe. This trend will likely continue in the coming years owing to the cost efficiency, the availability of specialists, and technologically advanced equipment.

During the early stage of the COVID-19 pandemic, the dental market faced many problems as the dentists’ offices were at high risk of spreading the infection. The dental clinics were not operating during the initial phase. However, the practices are getting back to their normal operations. In these unprecedented times, dental professionals should be well-informed about the recent guidelines to follow by the regulatory protocols to avoid the spread of the virus.

Regional Insights

North America dominated the market in 2024 owing to factors including a preventive approach towards oral care and hygiene, the growing R&D activities in dentistry, the presence of independent clinics, and rising disposable income. Increasing government funding for dental programs is likely to contribute to market growth. The U.S. federal funding for Medicare and Medicaid is expected to increase the demand for dental care services as most patients are likely to pay less out-of-pocket expenses.

Asia Pacific is expected to witness the fastest growth from 2025 to 2030 due to the rise in number of clinics, increase in dental tourism, rise in R&D in manufacturing, and growing awareness about dental care. Most dental practices in this region are private. The healthcare infrastructure in the Asia Pacific is expanding with advanced technology and equipment. Various companies and governments in countries such as India and China are announcing initiatives to spread awareness regarding dental care services. For instance, in June 2021, My Dental Plan announced that it would add 4,000 more clinics, expanding its reach to 250 cities by the end of 2021.

Key Digital Dentistry Company Insights

Key players operating in the market are Align Technology Inc., Apteryx Imaging Inc., Carestream Dental LLC, Dentsply Sirona, GC Corporation, Ivoclar Vivadent, J. MORITA CORP., Kulzer GmbH, Midmark Corporation, PLANMECA OY, Shofu Dental, and Zimmer Biomet. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In November 2022, Imagoworks Inc. introduced an AI-based web CAD 3Dme Crown product, which is a crown design module of 3Dme solutions that aid in producing the crown prosthesis design as per the person’s oral environment.

-

In October 2022, the DEXIS introduced the DEXIS IS portfolio, a full suite of intraoral solutions that provide a wide range of digital diagnostic dental systems, including each scanning stage.