- Home

- »

- Next Generation Technologies

- »

-

Desktop 3D Printing Market Size, Industry Report, 2030GVR Report cover

![Desktop 3D Printing Market Size, Share, & Trend Report]()

Desktop 3D Printing Market (2025 - 2030) Size, Share, & Trend Analysis Report By Component (Hardware, Software, Services), By Technology, By Software, By Application (Prototyping, Tooling, Functional Parts), By Vertical, By Material, By Region, Segment Forecasts

- Report ID: GVR-4-68039-949-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Desktop 3D Printing Market Summary

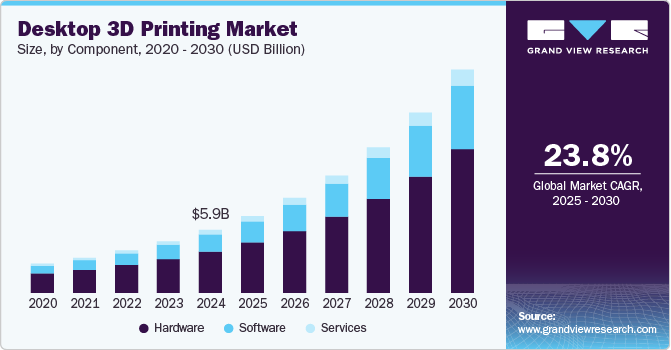

The global desktop 3D printing market was valued at USD 5.88 billion in 2024 and is projected to reach USD 20.93 billion by 2030, growing at a CAGR of 23.8% from 2025 to 2030. The emerging applications of additive manufacturing, as well as the increasing need for rapid prototyping and advanced manufacturing in several verticals, are driving the expansion of desktop 3D printers worldwide.

Key Market Trends & Insights

- The North America region held the largest market share, accounting for 38.5% of the global market revenue in 2024.

- By component, the hardware segment led the market with the largest revenue share of 65.43% in 2024.

- By technology, the digital light processing segment led the market with the largest revenue share of 21.73% in 2024, and is projected to grow at the fastest CAGR from 2025 to 2030.

- By application, the functional parts segment led the market with the largest revenue share of 48.38% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.88 Billion

- 2030 Projected Market Size: USD 20.93 Billion

- CAGR (2025-2030): 23.8%

- North America: Largest Market in 2024

Market expansion is anticipated to be hampered by limitations in raw materials & machinery and intellectual property concerns. Increased demand for rapid prototyping has allowed manufacturers to design and build efficient products and systems. These factors are expected to collectively drive the desktop 3D printing industry over the projected period.

The simplicity of production and additional benefits provided by 3D printing technology are vital drivers in the widespread acceptance of 3D printing technology across numerous verticals. Prototyping, structural design of structures and end products, modeling, and improved time to market are advantages of 3D printing for manufacturers. It has significantly reduced manufacturing costs, allowing manufacturers to provide superior products at affordable prices.

Mass customization in desktop 3D printing enables businesses to efficiently produce personalized products at scale, meeting growing consumer demand for unique and tailored items. This trend is driven by advancements in materials, affordable printers for SMEs and hobbyists, and integration with e-commerce platforms, reducing lead times and inventory costs. Applications span diverse sectors, including fashion, medical devices, and education, reflecting the technology's flexibility and value in niche markets.

Supportive ecosystem development is driving the global desktop 3D printing industry by enhancing user accessibility through advanced software, user-friendly interfaces, and online design repositories. These resources reduce technical barriers, enabling beginners and non-experts to efficiently create and print complex designs. In addition, educational tools and community support networks foster skill development, expanding the technology's adoption across hobbyists, small businesses, and educational institutions.

Component Insights

Based on component, the market is classified into hardware, software, and services. The hardware segment led the market with the largest revenue share of 65.43% in 2024. Rapid prototyping and advanced manufacturing practices have fueled the growth of the hardware segment. Factors including increasing penetration of consumer electronic products, rapid industrialization and urbanization, developing civil infrastructure, and optimized labor costs have propelled the hardware segment's growth over the forecast period. The hardware is responsible for producing end parts with similar parameters, including the orientation, position, and placement of components with respect to other elements in the print bed. However, the reliability and accuracy of desktop printers are a prime challenge for hardware manufacturers as the fabrication of metals remains crucial.

The software segment is the second dominant segment in the market in 2024 and is expected to register at a notable CAGR from 2025 to 2030. Increasing demand for efficient automation of project and production management for 3D manufacturing has increased the market for the software segment. Each step of the production process in 3D printing primarily depends on software. In addition to automating production operations like build preparation and machine scheduling, the software can provide real-time production data and insights.

Technology Insights

Based on technology, the market is classified into stereolithography, fuse deposition modeling, selective laser sintering, digital light processing, laminated object manufacturing, and others. The digital light processing segment led the market with the largest revenue share of 21.73% in 2024, and is projected to grow at the fastest CAGR from 2025 to 2030. Increasing demand for jewelry production and manufacturing of parts with minute and fine details has increased the adoption of digital light processing across several industry verticals. The digital light processing is similar to that of stereolithography, where a safelight (light bulb) is used instead of UV laser to cure the photopolymer resin.

The stereolithography segment is expected to witness at a notable CAGR from 2025 to 2030. The stereolithography process enables users to create concept models, complex parts with intricate designs, and rapid prototypes for cosmetics. The process is one of the several methods used to build 3D-printed objects and is amongst the most traditional methods. The technique incorporates the stereolithography apparatus (SLA), which transforms liquid plastic into solid objects. The technology has gained momentum since it makes highly accurate parts using advanced materials and offers isotropic and watertight prototypes featuring a fine and smooth surface finish.

Application Insights

Based on application, the market is classified into prototyping, tooling, and functional parts. The functional parts segment led the market with the largest revenue share of 48.38% in 2024. The high market share can be attributed to the increasing demand for designing and building functional parts. 3D printing is a versatile process used to create anything from desk trinkets to ornaments and functioning parts. Smaller joints and other metallic hardware connecting components are examples of functional parts. When developing machinery and systems, these functioning pieces' accuracy and precise sizing are essential. 3D printing of functional parts allows users to easily fabricate the prototype without relying on machine shop resources, allowing iteration with shorter lead times leading to lessened fabrication costs and reduced time to market.

The prototyping segment is expected to grow at a significant CAGR from 2025 to 2030. The market for the prototyping segment has witnessed extensive adoption across several industry verticals. Automotive, aerospace, and defense verticals use prototyping to design and develop parts, components, and complex systems. Prototyping offers highly accurate results allowing manufacturers to build reliable end products. Hence, the segment is anticipated to continue dominating the market during the forecast period.

Material Insights

Based on material, the market is classified into plastic, metal, and ceramic segments. The metal segment is led the market with the largest revenue share of 46.21% in 2024. Metals for 3D printing are becoming more popular as the demand for direct fabrication of complicated end-use parts grows. Metals enable tooling for traditional manufacturing technologies easier, lowering costs and shortening lead times. Metal 3D printing blends 3D printing's design flexibility with metal's mechanical qualities.

The plastic segment is the second dominating segment in the market in 2024. The demand for plastic to create 3D-printed molds has increased due to its highly flexible manufacturing capabilities. Plastic is comparatively inexpensive, readily available, and suitable for several extrusion processes. Moreover, researchers are conducting extensive research and development to innovate new polymers by synthesizing several polymers and blending them with existing raw materials to ensure better performance in the final product.

Software Insights

Based on software, the market is classified into design software, inspection software, printer software, and scanning software. The design software segment led the market with the largest revenue share of 40.20% in 2024, and is expected to grow at the fastest CAGR over the forecast period. Design software allows users in the automotive, construction, aerospace and defense, and engineering verticals to create designs of the object to be printed. Design software acts as a bridge between the components to be printed and the printer’s hardware.

The scanning software is projected to witness at the fastest CAGR from 2025 to 2030. The growing popularity of scanning items and saving scanned papers is expected to increase the demand for scanning software. Scanning software maintains images of objects regardless of size or dimensions for 3-dimensional printing of these products as needed.

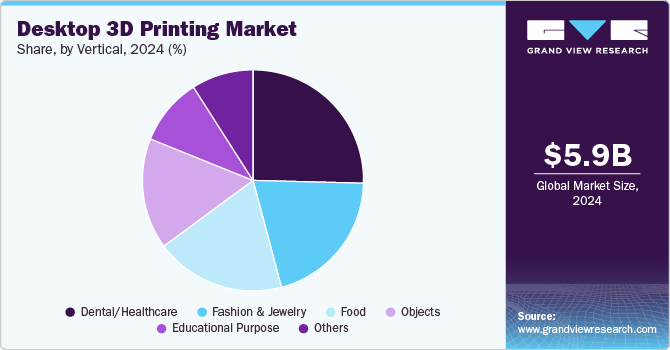

Vertical Insights

Based on vertical, the market is classified into education, fashion & jewelry, objects, dental/healthcare, food, and other segments in terms of vertical. The dental/healthcare segment led the market with the largest revenue share of 23.47% in 2024. Due to the active implementation of technology in many production processes related to this vertical, the healthcare vertical is expected to contribute considerably to the expansion of desktop additive manufacturing during the projection period. AM contributes to developing artificial tissues and muscles that mimic actual human tissues and can be utilized in replacement surgeries in the healthcare sector. These features are likely to aid in adopting desktop 3D printers in the healthcare sector and contribute considerably to the vertical's growth.

The fashion & jewelry segment is anticipated to witness at a significant CAGR from 2025 to 2030. The increasing adoption of 3D printing in manufacturing miniatures, imitation jewelry, clothing, apparel, and arts and crafts has propelled the market growth. The concepts of investment casting and lost wax casting are integrated with the capabilities of a digital design and manufacturing process for manufacturing 3D-printed jewelry. Jewelers utilize CAD software tools to create digital designs, and these designs are then fed into a high-resolution 3D printer to print the 3D printed patterns, which are cast into the mold. 3D printing minimizes time-intensive manual labor and allows users to efficiently preserve the design and modify and recreate it when required.

Regional Insights

North America dominated the desktop 3D printing market with the largest revenue share of 38.5% in 2024. Factors such as the presence of significant players in the region and the ability of consumers to spend more when compared to other regions are further expected to drive the market across the region. Further, using 3D-printed metal components in private aerospace companies and the government sector, coupled with high defense expenditure in the U.S., is expected to propel market growth over the forecast period. The U.S. and Canada have primarily adopted 3D printing technology across several manufacturing processes, which has largely contributed to the development of the 3D printing market over the forecast years. The regional market offers lucrative opportunities for additive manufacturing in different applications.

U.S. Desktop 3D Printing Market Trends

The desktop 3D printing market in the U.S. is growing due to increased adoption across industries like healthcare, education, and fashion, where it supports applications such as prosthetics, dental solutions, and design innovations. Technological advancements, including improved materials and printer capabilities, enhance accessibility and precision, attracting a diverse user base. In addition, government support and integration into educational programs foster skill development and broader market adoption, positioning the technology as a critical tool for prototyping and small-scale manufacturing.

Europe Desktop 3D Printing Market Trends

The desktop 3D printing market in Europe is likely to emerge as the second most promising region during the same period. Rising technological advancements and large-scale adoption of additive manufacturing technology are the factors propelling growth in this region. Favorable government policies, increased funding for R&D, and technology standardization across Europe are expected to boost market growth over the forecast period. According to AMFG, a leading European player engaged in providing automation software for additive manufacturing, Europe is the region with the highest number of additive manufacturing firms.

Asia Pacific Desktop 3D Printing Market Trends

The desktop 3D printing market in Asia Pacific is growing due to advancements in additive manufacturing technologies, enabling precise, cost-effective, and customizable production for industries like healthcare, automotive, and consumer goods. Increasing demand for rapid prototyping and personalized products, alongside expanded applications in healthcare, such as custom implants and surgical models, is further driving adoption. R&D investments and the rise of small and medium-sized enterprises leveraging 3D printing for innovative solutions also contribute to the market's robust expansion.

Key Desktop 3D Printing Company Insights

Some of the key players operating in the market include 3D Systems, Inc., Stratasys, and Materialise, among others.

- 3D Systems, Inc. is a leading global provider of 3D printing solutions known for its pioneering role in the additive manufacturing industry. Founded in 1986, the company has played a crucial part in the development of 3D printing technologies, offering a wide range of products and services, including 3D printers, software, and materials. 3D Systems, Inc. serves various industries, such as aerospace, automotive, healthcare, and consumer products, delivering solutions for prototyping, production, and tooling.

3DCeram and ExOne are some of the emerging market participants in the global market.

- 3DCeram is a French company specializing in 3D printing solutions for ceramics, focusing on industrial and medical applications. Founded in 2001, it has become one of the leaders in ceramic additive manufacturing, offering specialized 3D printing services and equipment for the production of highly detailed ceramic parts. 3DCeram’s technology is used across various industries, including aerospace, automotive, and healthcare.

Key Desktop 3D Printing Companies:

The following are the leading companies in the desktop 3D printing market. These companies collectively hold the largest market share and dictate industry trends

- 3DCeram

- Autodesk Inc.

- Dassault Systèmes

- Canon Inc.

- 3D Systems, Inc.

- EOS GmbH

- ExOne

- voxeljet AG

- General Electric Company

- Materialise

- ENVISIONTEC US LLC

- Proto Labs

- Shapeways

- Stratasys

Recent Development

-

In July 2024, 3D Systems, Inc. and Precision Resource, a U.S.-based company, announced a strategic partnership to accelerate additive manufacturing in high-criticality industries by integrating 3D Systems, Inc.'s Direct Metal Printing (DMP) platform into Precision Resource's advanced production processes. This collaboration, leveraging 3D Systems, Inc.'s cutting-edge technology and Precision Resource's secondary finishing expertise, aims to deliver superior manufacturing solutions, reduce time-to-market, and address supply chain challenges with vertically integrated workflows and innovative additive manufacturing capabilities.

-

In June 2024, 3DCeram introduced CERIA Set, an advanced AI-powered software tailored for its CERAMAKER 3D printers to optimize technical ceramics production. This innovative tool enhances efficiency by streamlining workflows, reducing costs, and improving industrial reliability for sectors like aerospace and biomedical. By leveraging AI and ceramic materials, CERIA Set offers expert guidance throughout the 3D printing process, enabling manufacturers to achieve precision and accelerate time-to-market, setting new standards in additive manufacturing.

-

In May 2022, HP Inc. partnered with Oechsler, a plastics technology firm, and Additive Manufacturing Technologies (AMT), an automated post-processing systems manufacturer, to commence series production of powder-based additive manufacturing processes in Oechsler’s Ansbach-Brodswinden site in Germany. Oechsler is expected to expand its additive manufacturing service portfolio using the HP Multi Jet Fusion (MJF) 3D printers through this partnership.

Desktop 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.21 billion

Revenue forecast in 2030

USD 20.93 billion

Growth rate

CAGR of 23.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, software, application, vertical, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Singapore; Australia; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

3D Systems, Inc.; 3DCeram; Autodesk Inc.; Canon Inc.; Dassault Systèmes; ENVISIONTEC US LLC; EOS GmbH; ExOne; General Electric Company; Materialise; Proto Labs; Shapeways; Stratasys; voxeljet AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Desktop 3D Printing Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global desktop 3D printing market report based on component, technology, software, application, vertical, material, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Stereolithography

-

Fuse Deposition Modeling

-

Selective Laser Sintering

-

Digital Light Processing

-

Laminated Object Manufacturing

-

Others

-

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Educational Purpose

-

Fashion & Jewelry

-

Objects

-

Dental/Healthcare

-

Food

-

Others

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Plastic

-

Metal

-

Ceramic

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

-

The Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global desktop 3D printing market size was estimated at USD 5.88 billion in 2024 and is expected to reach USD 7.21 billion in 2025.

b. The global desktop 3D printing market is expected to grow at a compound annual growth rate of 23.8% from 2025 to 2030 to reach USD 20.93 billion by 2030.

b. The hardware component has dominated the global market, gaining a share of 65.4% in 2024. Rapid prototyping and advanced manufacturing practices have fueled the growth of the hardware segment.

b. Some key players operating in the desktop 3D printing market include Stratasys, Ltd.; Materialise NV; 3D Systems, Inc.; Protolabs Inc.; Dassault Systemes; Autodesk Inc.; and Canon Inc.

b. Key factors that are driving the global desktop 3D printing market growth include the increasig necessity of prototyping and designing across several verticals such as denatl/healthcare, fashion, and jewelery among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.