- Home

- »

- Power Generation & Storage

- »

-

Diesel Fuel Market Size And Share, Industry Report, 2033GVR Report cover

![Diesel Fuel Market Size, Share & Trends Report]()

Diesel Fuel Market (2026 - 2033) Size, Share & Trends Analysis Report By End-Use (Transportation Industry, Marine Industry), By Application (Commercial Vehicles, Passenger Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-137-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diesel Fuel Market Summary

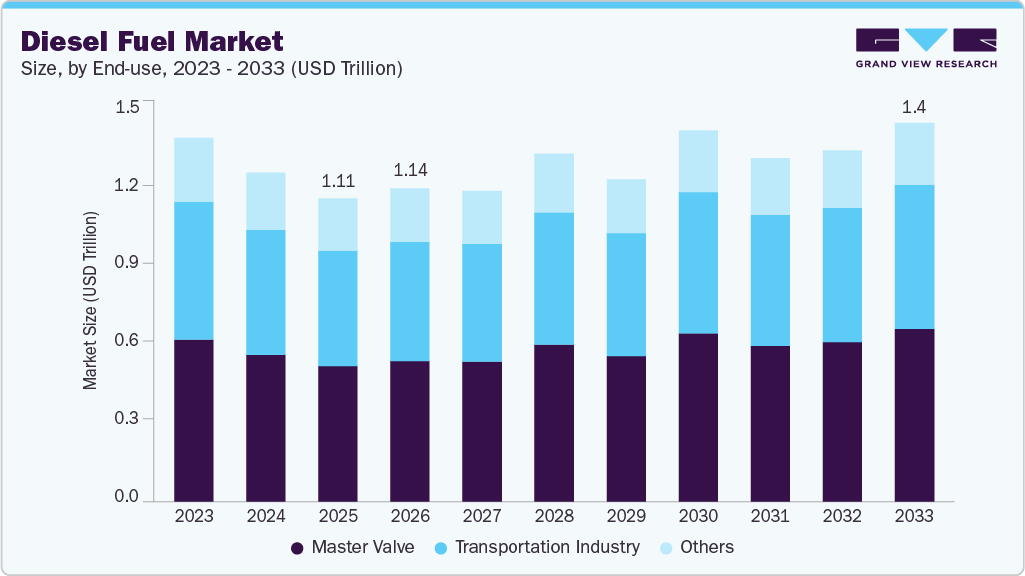

The global diesel fuel market size was estimated at USD 1,106.15 billion in 2025 and is projected to reach around USD 1,381.63 billion by 2033, growing at a CAGR of 2.7% from 2026 to 2033. Market growth is primarily driven by rising global energy demand, increasing consumption across transportation, industrial, agricultural, and power generation sectors, and continued reliance on diesel as a cost-effective and energy-dense fuel.

Key Market Trends & Insights

- Asia Pacific dominated the global diesel fuel market with the largest revenue share of 45.4% in 2025.

- The diesel fuel industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By end use, the transportation segment led the market with the largest revenue share of 44.7% in 2025.

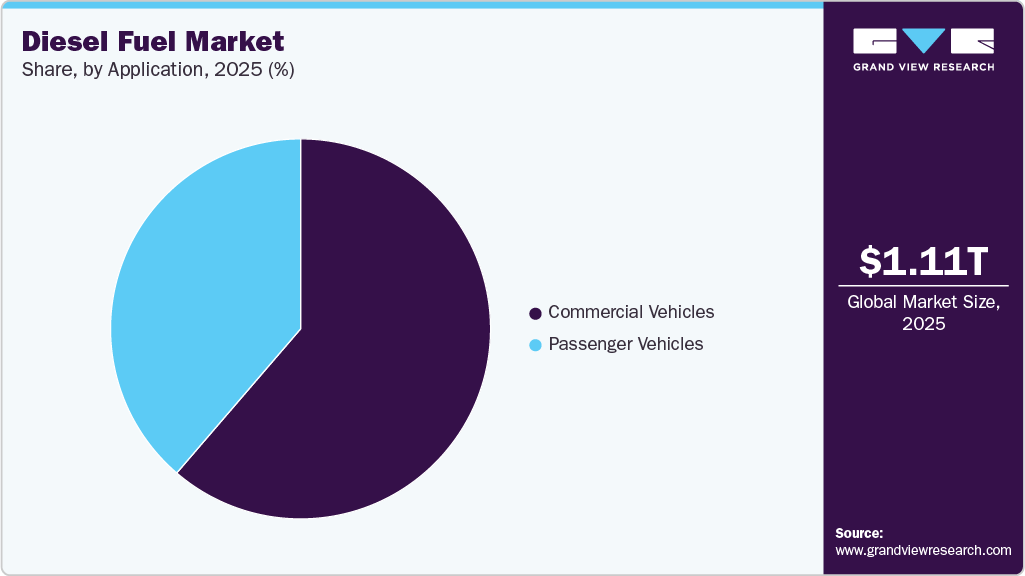

- By application, the commercial vehicles segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,106.15 Billion

- 2033 Projected Market Size: USD 1,381.63 Billion

- CAGR (2026-2033): 2.7%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

The expansion of infrastructure development, logistics activities, and mining operations, particularly in emerging economies, is further supporting diesel fuel demand. Moreover, the growing focus on energy security and the steady expansion of offshore and onshore oil and gas exploration activities, especially in regions such as the Middle East, Africa, and the Asia Pacific, are strengthening diesel consumption for drilling, production, and auxiliary power applications. Ongoing advancements in refining technologies, fuel quality standards, and low-sulfur diesel formulations are enhancing efficiency, reducing emissions, and fostering the long-term growth of the global diesel fuel industry.

Drivers, Opportunities & Restraints

The global diesel fuel industry is primarily driven by rising demand across transportation, construction, mining, agriculture, and industrial sectors, where diesel remains a preferred fuel due to its high energy density, fuel efficiency, and reliability. Growing freight movement, infrastructure development, and urbanization, particularly in emerging economies, are significantly increasing diesel consumption. In addition, sustained activity in upstream oil and gas exploration and production continues to support diesel demand for drilling rigs, generators, and auxiliary power systems. Government investments in road development, logistics networks, and industrial expansion across North America, the Middle East, and the Asia Pacific are further strengthening market growth.

Opportunities in the diesel fuel industry are expanding with increasing demand from off-grid and backup power generation, especially in remote locations, industrial facilities, and developing regions with limited grid reliability. The growing adoption of ultra-low sulfur diesel (ULSD) and cleaner fuel formulations presents opportunities to meet stricter emission standards while sustaining demand. Advancements in fuel refining technologies, the use of diesel in hybrid power systems, and rising marine and rail transportation activity also create new growth avenues. Furthermore, expanding industrialization and agricultural mechanization in emerging markets continue to open long-term opportunities for diesel fuel suppliers.

However, the diesel fuel industry faces several restraints, including volatile crude oil prices, which directly impact diesel pricing and consumption patterns. Stringent environmental regulations aimed at reducing greenhouse gas emissions, along with the increasing penetration of alternative fuels such as electric mobility, natural gas, and biofuels, may limit long-term diesel demand growth. In addition, fuel taxation policies, supply chain disruptions, and geopolitical uncertainties can affect diesel availability and pricing. Rising public and private investments in renewable energy and decarbonization initiatives further pose challenges to sustained growth in the global diesel fuel industry.

End-User Insights

The transportation segment led the market with the largest revenue share of 44.75% in 2025 and is expected to grow at the fastest CAGR during the forecast period, driven by extensive diesel consumption across road freight, commercial vehicles, public transportation, railways, and marine transport. Diesel fuel remains the primary energy source for heavy-duty and long-haul transit due to its high energy density, superior fuel efficiency, and reliability under continuous operating conditions. Rising freight movement, expanding logistics and warehousing activities, and increasing infrastructure development across emerging and developed economies are reinforcing strong demand from the transportation sector.

The increasing size of vehicle fleets, rapid growth in e-commerce-driven logistics, and sustained reliance on diesel-powered transportation in regions with limited electric vehicle infrastructure all support this growth. In addition, continued demand from marine and rail transport, along with improvements in diesel engine efficiency and fuel quality standards such as ultra-low sulfur diesel, are contributing to the segment’s steady growth outlook within the global diesel fuel industry.

Application Insights

The commercial vehicles segment led the market with the largest revenue share of 61.3% in 2025, driven by extensive diesel consumption across heavy-duty trucks, buses, construction vehicles, and fleet-operated logistics transport. Diesel remains the preferred fuel for commercial vehicles due to its high torque output, superior fuel efficiency, and durability under continuous and heavy-load operating conditions. Rapid growth in freight transportation, expanding construction and infrastructure projects, and increasing cross-border trade are sustaining strong diesel demand from commercial vehicle applications. In addition, rising urbanization, large-scale public transport systems, and ongoing investments in logistics and supply chain infrastructure further reinforce the segment’s dominance in the diesel fuel industry.

The passenger vehicles segment is expected to register at the fastest CAGR of 3.5% during the forecast period. This growth is supported by continued demand for diesel-powered passenger cars in regions where fuel efficiency, longer driving range, and lower operating costs remain key purchase considerations. Emerging economies in the Asia Pacific, Latin America, and parts of Europe continue to witness the adoption of diesel passenger vehicles, particularly for long-distance travel. Advancements in engine technology, improved emission control systems, and the adoption of ultra-low sulfur diesel are enhancing performance and compliance with regulatory standards, supporting the strong growth outlook for the passenger vehicles segment within the global market.

Regional Insights

The diesel fuel market in North America remains a key regional market, driven by strong demand from transportation, construction, agriculture, and industrial applications. The region’s extensive highway and rail networks, along with a large fleet of heavy-duty commercial vehicles, sustain high diesel consumption for freight movement and logistics operations. Diesel is also widely used in construction machinery, mining equipment, and agricultural operations, where fuel efficiency and high torque output are critical. Ongoing investments in infrastructure development and maintenance continue to support steady demand across the region.

U.S. Diesel Fuel Market Trends

The diesel fuel market in the U.S. represents a key market within North America, supported by extensive use of diesel across road freight, rail transport, agriculture, and industrial operations. A large base of heavy-duty trucks, long-haul logistics networks, and high agricultural mechanization sustains consistent diesel demand. Diesel is also widely used in construction equipment and backup power systems across commercial and industrial facilities. While the adoption of alternative fuels and electric vehicles is gradually increasing, diesel continues to play a crucial role in freight transportation due to its fuel efficiency, range, and established fueling infrastructure, which supports steady market performance in the U.S.

Asia Pacific Diesel Fuel Market Trends

Asia Pacific dominated the global diesel fuel market with the largest revenue share of 45.4% in 2025, driven by rapid industrialization, expanding transportation and logistics networks, and strong growth in construction, mining, and agricultural activities. Major economies such as China, India, Indonesia, and Japan represent significant diesel consumers due to high freight movement, large commercial vehicle fleets, and ongoing infrastructure development. Rising urbanization, increasing power demand in off-grid and rural areas, and sustained reliance on diesel for backup power generation further support market dominance. In addition, government investments in highways, ports, railways, and industrial corridors continue to reinforce diesel fuel consumption across the Asia Pacific region.

Europe Diesel Fuel Market Trends

The diesel fuel market in Europe held a substantial share in 2025, supported by steady demand from commercial transportation, railways, construction, and industrial operations. Countries such as Germany, France, the UK, and Italy continue to rely on diesel for freight movement and public transportation systems. While passenger diesel vehicle adoption has slowed due to stricter emission norms and electrification policies, diesel remains critical for heavy-duty trucks, buses, and off-road machinery. The widespread adoption of ultra-low sulfur diesel and continued investments in fuel efficiency improvements are helping sustain diesel demand across the region.

Latin America Diesel Fuel Market Trends

The diesel fuel market in Latin America is expected to register at the fastest CAGR of 4.1% over the forecast period, driven by rising infrastructure development, growing commercial transportation activity, and increasing industrialization across countries such as Brazil, Mexico, Argentina, and Chile. The expansion of the mining, agriculture, and construction sectors is boosting demand for diesel-powered machinery and vehicles. In addition, improvements in logistics networks, growth in cross-border trade, and rising investments in road and port infrastructure are strengthening diesel consumption. Government initiatives to modernize transportation systems and expand industrial capacity further support strong growth prospects for the diesel fuel industry in Latin America.

Middle East & Africa Diesel Fuel Market Trends

The diesel fuel market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. Large-scale infrastructure development, oil and gas operations, and growing transportation activity drive the Middle East & Africa. Diesel is extensively used for power generation, construction equipment, mining operations, and commercial transport, particularly in regions with limited grid reliability. Oil-rich countries such as Saudi Arabia, the UAE, and Nigeria maintain strong diesel demand across industrial and logistics applications. In Africa, expanding urbanization, improving road networks, and increasing agricultural mechanization are supporting market growth. Continued investments in energy infrastructure and economic diversification initiatives are expected to sustain diesel fuel consumption across the region.

Key Diesel Fuel Company Insights

Some of the key players operating in the global diesel fuel industry include Shell plc and Exxon Mobil Corporation, among others.

-

Shell plc is one of the world’s largest integrated energy companies and a leading producer, refiner, and distributor of diesel fuel across global markets. Through its extensive downstream operations, Shell supplies diesel to transportation, industrial, marine, and power generation sectors. The company operates a large network of refineries, fuel terminals, and retail fuel stations, enabling reliable supply across North America, Europe, Asia Pacific, and emerging markets.

-

Exxon Mobil Corporation is a major global supplier of diesel fuel, supported by its vast refining capacity, integrated supply chain, and extensive distribution network. The company produces and markets diesel fuel for road transportation, rail, marine, construction, agriculture, and industrial uses. ExxonMobil focuses on high-quality fuel standards, advanced refining technologies, and operational efficiency to ensure consistent supply and performance. Ongoing investments in refinery optimization, logistics infrastructure, and fuel quality enhancements position the company as a key contributor to global diesel fuel availability, particularly in regions with high freight and industrial activity.

Key Diesel Fuel Companies:

The following are the leading companies in the diesel fuel market. These companies collectively hold the largest market share and dictate industry trends.

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- PetroChina Company Limited

- Reliance Industries Limited

- Saudi Aramco

- Shell plc

- TotalEnergies SE

Recent Developments

-

In March 2025, Reliance Industries Limited announced the completion of major upgrades at its Jamnagar refining complex to enhance diesel fuel output and quality further, aligning production with stricter global emission and fuel efficiency standards. The upgrades focused on enhancing the performance of hydrocracking and desulfurization units to increase the share of ultra-low sulfur diesel (ULSD) used in transportation, industrial, and export markets.

Diesel Fuel Market Report Scope

Report Attribute

Details

Market Definition

The diesel fuel market encompasses the total revenue generated from the production, refining, distribution, and sale of diesel fuel used in various applications, including transportation, industrial, agricultural, construction, mining, marine, rail, and power generation.

Market size value in 2026

USD 1,142.56 billion

Revenue forecast in 2033

USD 1,381.63 billion

Growth rate

CAGR of 2.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in Million Liters, Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End Use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

BP p.l.c; Chevron Corporation; China Petroleum & Chemical Corporation (Sinopec); Exxon Mobil Corporation; Indian Oil Corporation Limited.; PetroChina Company Limited; Reliance Industries Limited; Saudi Aramco; Shell plc; TotalEnergies SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diesel Fuel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global diesel fuel market report on the basis of end use, application and region.

-

End Use Outlook (Volume, Million Liters; Revenue, USD Billion, 2021 - 2033)

-

Transportation Industry

-

Marine Industry

-

Others

-

-

Application Outlook (Volume, Million Liters; Revenue, USD Billion, 2021 - 2033)

-

Commercial Vehicles

-

Passenger Vehicles

-

-

Regional Outlook (Volume, Million Liters; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global diesel fuel market size was estimated at USD 1,106.15 billion in 2025 and is expected to reach USD 1,142.56 billion in 2026.

b. The global diesel fuel market is expected to grow at a compound annual growth rate of 2.7% from 2026 to 2033 to reach USD 1,381.63 billion by 2033.

b. Based on the end-user segment, transportation industry held the largest revenue share of more than 44.7% in 2025.

b. Some of the key players operating in the global diesel fuel market include Saudi Aramco, Exxon Mobil Corporation, Shell plc, Chevron Corporation, BP p.l.c., PetroChina Company Limited, China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited, TotalEnergies SE, and Indian Oil Corporation Limited, among others.

b. The diesel fuel market is primarily driven by rising demand from the transportation, construction, agriculture, and industrial sectors, along with growing freight movement and infrastructure development worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.