- Home

- »

- Medical Devices

- »

-

Dental 3D Printing Market Size, Industry Report, 2030GVR Report cover

![Dental 3D Printing Market Size, Share & Trends Report]()

Dental 3D Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Orthodontics, Prosthodontics, Implantology), By Technology (Vat Photopolymerization, Polyjet Technology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-446-8

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental 3D Printing Market Summary

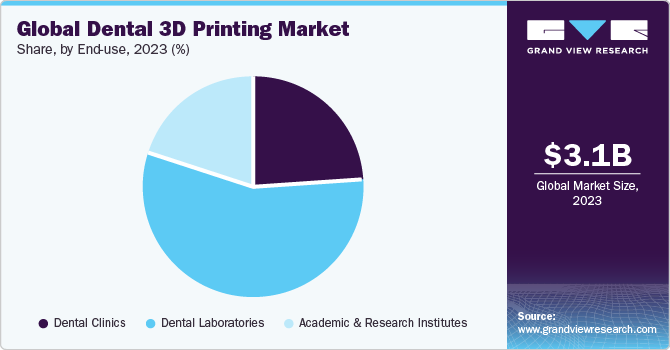

The global dental 3d printing market size was estimated at USD 3.1 billion in 2023 and is projected to reach USD 15.9 billion by 2030, growing at a CAGR of 26.4% from 2024 to 2030. 3D printing dentistry has established a strong position in today’s dental products due to the combination of state-of-art technology and a potential footprint.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 38.8% in 2023.

- Asia Pacific is anticipated to witness the most lucrative growth of 27.1% over the forecast period.

- Based on end-use, the dental laboratories segment dominated the market and accounted for the largest revenue share of 55.6% in 2023.

- Based on application, the orthodontics segment held the largest revenue share of 39.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.1 Billion

- 2030 Projected Market Size: USD 15.9 Billion

- CAGR (2024-2030): 26.4%

- North America: Largest market in 2023

The design and development of advanced products such as invisible aligners, advanced fabrication to provide an aesthetic look, and delivery positioning are some of the factors that are increasing the demand and adoption of dental 3D printers. The user-friendliness and ease of 3D printing procedures have promoted the dentistry industry to print products that can meet the dental requirements of different individuals. These printers will increase the output and also reduce fabrication time. Furthermore, the digitalized workflow will also overcome procedural discomfort and enhance customer satisfaction.

The market is growing at a significant rate and is expected to grow further in emerging economies. The American College of Prosthodontists stated that about 15% of the edentulous population makes dentures each year. Edentulism affects the most vulnerable populations – economically disadvantaged and aging populations. Around 120 million people in the U.S. are missing at least one tooth and more than 36 million Americans do not have any teeth. These numbers are expected to grow in the next two decades. The majority of aged population needs to go for replacements of the tooth. However, even partially toothless, aged or young people undergo dental procedures as they view dental implants as a viable option.

COVID-19 has caused a huge disruption in the supply chain of the overall medical device industry. The outbreak has resulted in a decrease in the number of procedures performed each year, resulting in an overall decline in the market. The demand and sale of dental equipment and procedures were negatively impacted due to the global restrictions and lockdowns in most countries. Furthermore, many device manufacturers shifted their focus to fight against coronavirus outbreaks. For instance, in March 2020, 3D printer company Formlabs reported that it was using more than 250 in-house 3D printers at its printing facility in Ohio to produce up to 150,000 COVID-19 test swabs per day. However, the medical device industry is trying to recover from the pandemic.

In recent years, the medical device industry has witnessed a significant number of consolidations in the market. Major manufacturers are using acquisition and collaboration strategies to expand their business operations by leveraging their product portfolio worldwide. The competitive nature of the market is likely to enhance further with a rise in product innovations, product/service extensions, and M&A. For instance, Stratasys Ltd. American-Israeli manufacturer, and a leading provider of polymer 3D printing solutions in December 2021, introduced the Stratasys Origin One Dental, the advanced printer in the growing portfolio of the company’s 3D printing solutions for the dental industry.

The U.S. dominates the market and is expected to continue during the forecast period. The surging demand for cosmetic dentistry, technological advancements, and the growing awareness among individuals regarding the maintenance of oral health are propelling the market growth. Other factors, including the rising geriatric population, increasing healthcare expenditure, favorable government policies, and improving healthcare infrastructure, are also expected to create a positive market outlook. Furthermore, the leading manufacturers are engaging in research and development (R&D) activities to launch innovative product variants.

End-use Insights

The dental laboratories segment dominated the market and accounted for the largest revenue share of 55.6% in 2023. The segment is likely to show the highest CAGR of 26.7% over the forecast period. The rising adoption of advanced technologies in laboratories is supplementing the growth of the segment. Moreover, the increasing number of dental laboratories, rising outsourcing of various manufacturing functions to dental laboratories, and increasing demand for fabricated/customized dental framing solutions required for several applications are fueling the demand for dental 3D printing technologies.

Academic and research institutes are undergoing collaboration with private and government-funded institutions and associations for the R&D process. For instance, in 2016, the Foundation for Fundamental Research on Matter and the University of Twente, Eindhoven University of Technology collaborated to form the Inkjet Printing program to support challenges in the 3D printing industry. Such supportive initiatives from the players in R&D are likely to lead to manifold growth of the segment over the forecast period.

Application Insights

The orthodontics segment held the largest revenue share of 39.0% in 2023 and is expected to grow at a significant rate of 26.5% during the forecast period. The growth can be attributed to the rising number of cases of misalignment and gaps in the teeth. Furthermore, it is observed that approximately 3 million Canadian and American teens have braces, with the number of adults beginning orthodontic treatment rising at a steady rate.

The American Association of Orthodontists (AAO) recommends that children should be seen for their first orthodontic constellation before the age of 8. The rising demand and need for orthodontics treatment are driving the overall growth of the dental 3D printing industry. However, the prosthodontics segment is projected to expand at a CAGR of 26.8%, slightly higher than that of orthodontics during the forecast period. This is due to the growing cases of edentulism and tooth decay that are contributing to the growth of the segment.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 38.8% in 2023. The region is expected to retain its position through 2030. Factors that are supporting the dominance are the high purchasing power of the populace, widening base of edentulous population, availability of suitable reimbursement policies, and strong government support for quality healthcare in the U.S. and Canada. For instance, in the U.S., the Patient Protection and Affordable Act (PPACA), also known as Obamacare, provides affordable and quality health insurance schemes to its citizens. Moreover, the rising favorable government initiatives to support R&D for healthcare are also augmenting the adoption of dental 3D printing technologies.

Asia Pacific is anticipated to witness the most lucrative growth of 27.1% over the forecast period. The growth of the market can be attributed to the rising commercial activities by major industry manufacturers, expanding the number of patients undergoing tooth replacement surgeries, and improving healthcare infrastructure in emerging economies. The rising geriatric population, flourishing dental tourism, growing per capita income, and favorable government policies are some of the factors that are driving the growth of the regional market. India and China are projected to spearhead the growth in the Asia Pacific and market players are looking forward to investing in these countries.

Market Dynamics Insights

The wide and universal prevalence of dental ailments and diseases poses a costly burden on healthcare services. These include defects in tooth enamel, periodontal disease, dental caries, and dental erosion. Nutrition and eating habits affect oral health in many ways. For instance, prolonged consumption of tobacco can lead to dental caries, dental erosion, enamel defects, and periodontal disease among adults.

Dental caries are cavities in the teeth. They are a result of decay caused by bacterial infections. A certain type of bacteria produces acids that erode tooth enamel and dentin. Dental erosion is a progressive loss of dental hard tissues from the surface due to attrition and abrasion of teeth over a period of time. Periodontal disease occurs mostly in adults due to deficiency of vitamin C in the body and/or excessive consumption of tobacco.

The most common chronic disease among children aged 5 to 17 is tooth decay. According to the Canada Dental Association (CDA), it is estimated that approximately 2.5 school days are missed each year due to dental problems, accounting for one-third of surgeries performed on children between the age group of 1 and 5. Canadians spend around 13 billion dollars a year on oral health treatment, diseases, and injuries that are almost all preventable.

Technology Insights

The selective laser sintering segment dominated the market with the largest share of 37.8% in 2023 and is likely to maintain its position throughout the forecast period, owing to its advantages over other technologies such as good chemical resistance, biocompatibility, and excellent surface finishing. The other technological segment is expected to show the highest CAGR of 27.5% during the forecast period, due to the rising investments in R&D related to material jetting, electron beam melting, and binder jetting techniques. The popularity of fused deposition modeling is rising due to the availability of a wide range of strong, biocompatible, and sterilizable thermoplastics. FDM is very cost-effective and is the most widely used technique to produce complicated shapes and designs. This is due to the growing cases of edentulism and tooth decay that are contributing to the growth of the segment.

Key Companies & Market Share Insights

Players in the market could face two restrains- a lack of skilled dental professionals and the high cost of dental 3D printers which can hamper their growth pace. The dental 3D printing sector is a highly competitive market with the presence of large and medium-sized organizations. The growing demand for advanced technologies in the field of dentistry is encouraging the manufacturers in the dental 3D printing industry to enhance their existing scope of R&D activities by allocating high funds to incorporate advanced technologies.

These manufacturers also focus on various growth strategies such as mergers & acquisitions and launch of the new products. For instance, In February 2022, 3D Systems and Saremco Dental AG entered into partnership to advance the digital dentistry innovation. Combining 3D Systems' NextDent with Saremco's materials science expertise, the collaboration aims to empower dental laboratories and clinics with enhanced accuracy, repeatability, productivity, and cost-effectiveness across various indications. In February 2023, Stratasys Ltd. has unveiled TrueDent, a groundbreaking full-color 3D printed permanent dentures solution. TrueDent resin allows dental labs to produce natural-looking gums and accurate tooth structure with the desired shade and translucency, all in a single continuous print.

Key Dental 3D Printing Companies:

- 3D Systems

- Stratasys Ltd.

- Renishaw

- Roland DG

- SLM Solutions

- EnvisionTec

- DentsPly Sirona

- Straumann

- Form Labs

- Prodways

- Planmeca

Dental 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.9 billion

Revenue forecast in 2030

USD 15.9 billion

Growth rate

CAGR of 26.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative Units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Application, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3D Systems; Stratasys Ltd; Renishaw; Roland DG; SLM Solutions; EnvisionTec; DentsPly Sirona; Straumann; Form Labs; Prodways; Planmeca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental 3D printing market report based on application, technology, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthodontics

-

Prosthodontics

-

Dentures

-

Temporary Tooth

-

Permanent Tooth

-

-

-

Implantology

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Vat Photopolymerization

-

Stereolithography

-

Digital Light Processing

-

-

Polyjet Technology

-

Fused Deposition Modelling

-

Selective Laser Sintering

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Dental Laboratories

-

Academic And Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental 3D printing market size was estimated at USD 3.1 billion in 2023 and is expected to reach USD 3.9 billion in 2024.

b. The global dental 3D printing market is expected to grow at a compound annual growth rate of 26.4% from 2024 to 2030 to reach USD 15.9 billion by 2030.

b. North America dominated the dental 3D printing market with a share of 38.8% in 2023. This is attributable to the widening base of the edentulous population, the high purchasing power of the populace, strong government support for quality healthcare, and the availability of suitable reimbursement policies in the U.S and Canada.

b. Some key players operating in the dental 3D printing market include 3D Systems; Stratasys; SLM Solutions; EnvisionTEC; Straumann AG Group; Roland DG Corporation; Prodways Group; Renishaw Inc.; FormLabs Inc.; EOS Germany; Dental Wings; Planmeca; Rapid Shape; DWS Italy; Ultimaker; Carbon; and Asiga Inc.

b. Key factors that are driving the market growth include demand for customized dental 3D printing, Growing geriatric population with rising, and technological advancements and rise in R&D expenses prevalence of teeth problems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.