- Home

- »

- Healthcare IT

- »

-

Digital Health Coaching Market Size, Industry Report, 2030GVR Report cover

![Digital Health Coaching Market Size, Share & Trends Report]()

Digital Health Coaching Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Nutrition & Diet Coaching, Fitness & Exercise Coaching), By Type (Holistic Health Coaching), By Payment Model (Per Session), By Duration, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-528-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Health Coaching Market Summary

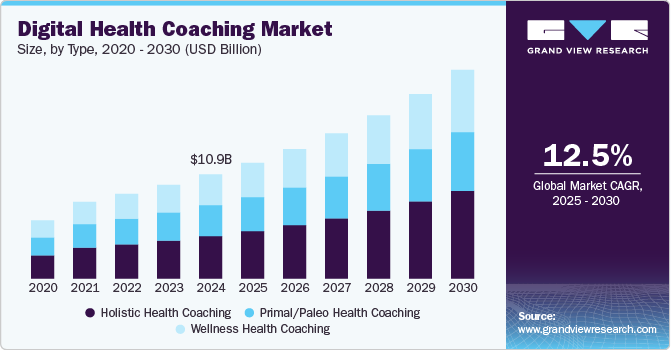

The global digital health coaching market size was estimated at USD 10,989.1 million in 2024 and is projected to reach USD 22,059.2 million by 2030, growing at a CAGR of 12.5% from 2025 to 2030. Favorable government initiatives, growing penetration of tablets, smartphones, and other mobile platforms, growing strategic alliances, rising prevalence of chronic diseases, and the growing focus on patient-centric healthcare solutions are key factors driving the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Canada is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, nutrition and diet coaching accounted for a revenue of USD 2,724.7 million in 2024.

- Mental Wellbeing Coaching is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 10,989.1 Million

- 2030 Projected Market Size: USD 22,059.2 Million

- CAGR (2025-2030): 12.5%

- North America: Largest market in 2024

For instance, according to the GSM Association (GSMA) report statistics published in the Mobile Economy 2023 report, around 5.4 billion people across the globe subscribed to mobile services in 2022, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030 (73% of the global population).

Digital health coaching leverages technology to provide personalized health guidance and support. It combines the expertise of health coaches with digital tools such as wearable devices, mobile apps, and telehealth platforms. For example, Liva Healthcare A/S, a UK-based digital health company, offers evidence-based digital health coaching to manage and prevent chronic conditions such as Obesity, Type 2 diabetes, Gestational diabetes, Prediabetes, Cardiovascular disease, and Hypertension.

The rise of wearable fitness trackers, smartphones, and health-related mobile apps, rapid advancements in digital technologies, and the growing interest in personalized health solutions fuel the market growth. Moreover, healthcare professionals began recognizing the potential of digital health coaching to reach a wider patient pool and adopting these tools due to their potential benefits. The following are some of the benefits offered by digital health coaching,

-

Accessibility: Digital Wellness Coaching provides easy access to professional guidance and resources, regardless of schedule or location.

-

Personalization: Digital tools allow coaches to customize their methods to suit each person's goals, needs, and preferences.

-

Cost-effectiveness: Digital Wellness Coaching is usually more affordable than conventional in-person coaching, making it available to a broader patient group.

-

Real-time Feedback: Wearable devices and mobile applications deliver immediate data and insights, facilitating timely adjustments and distinct support.

-

Data-Driven Insights: Digital tools collect and analyze data, offering valuable feedback on an individual's progress and identifying improvement areas.

-

Engaging and Interactive: Digital platforms provide interactive features, including gamification and social connections, to help keep individuals motivated and dedicated to their wellness journeys.

-

Flexibility: Digital Wellness Coaching enables individuals to connect with their coach and access resources conveniently, accommodating their busy lifestyles.

Moreover, integrating digital health coaching tools with artificial intelligence (AI) and virtual reality (VR) boosts market growth. AI analyzes vast data to provide more accurate and personalized health recommendations. Furthermore, it predicts potential health issues before they become serious, allowing for proactive intervention. Similarly, VR creates immersive experiences that make health coaching more engaging. In addition, integrating digital health coaching with EHR systems streamlines the care process. It allows for seamless information sharing between coaches and healthcare providers, ensuring a cohesive approach to patient care. Thus, such factors are expected to boost market growth over the forecast period.

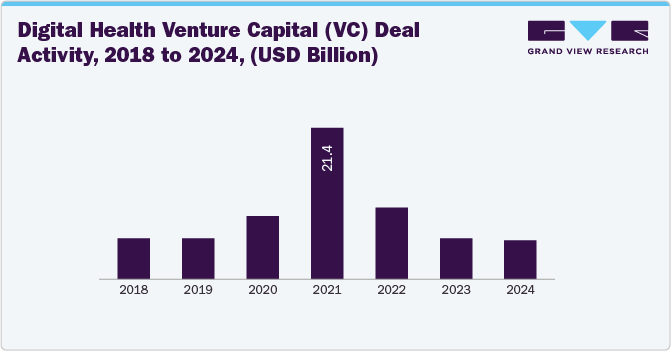

In recent years, there has been a significant surge in investments dedicated to supporting the digital health industry. This growing interest is fueled by technological advancements, increased smartphone adoption, and recognition of these innovations' transformative potential for healthcare. Governments, tech companies, and healthcare organizations are actively investing in digital health startups, creating a helpful regulatory environment and promoting the development of digital health coaching solutions.

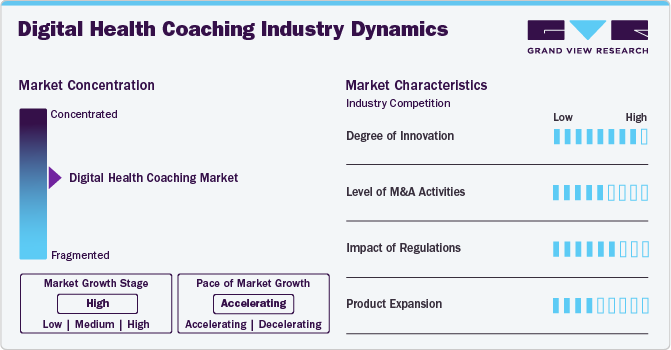

Market Concentration & Characteristics

The global digital health coaching industry is characterized by a high degree of innovation, owing to the development of technologically advanced tools driven by factors such as advancements in artificial intelligence (AI) functionalities, machine learning, and the availability of strong networks. For instance, In February 2025, Byram Healthcare, part of the Owens & Minor family, launched ByramConnect, a tailored digital health program designed for individuals with Type 1 and Type 2 diabetes utilizing the Welldoc app. This platform and app's benefits encompass digital coaching, support for GLP-1 medications, guidance on diet and nutrition, reporting insights, and assistance for mental well-being.

The digital health coaching industry is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for digital health coaching tools to maintain a competitive edge and the desire to gain access to new technologies and advancements and the need to consolidate in a rapidly growing market.

The eased regulations and formation of a robust framework for the digital health industry have positively impacted the market growth. The U.S. government took administrative and legislative action to reduce regulatory stringency and promote the development of digital health in the country. The digital health industry in the U.S. is regulated mainly by the FDA’s Center for Devices and Radiological Health (CDRH).

Market players are expanding their business by entering new geographical regions and launching new tools to strengthen their market position and expand their product portfolio. For instance, in July 2024, Sam Altman, CEO of OpenAI, and Arianna Huffington, founder of Thrive Global, a behavior tech company, introduced Thrive AI Health, a customized and hyper-personalized AI health coach, to improve chronic health issues and daily habits.

Service Insights

Based on service, the nutrition and diet coaching segment led the market with the largest revenue share of 22.2% in 2024.Increasing awareness and concern about obesity have led to the adoption of nutrition and diet coaching apps for individuals to track their health goals and reduce weight. For instance, according to SingleCare Administrators, about 40% of adults in the U.S. are obese, which is approximately 4 out of every 10 adults in 2024. Moreover, MyFitnessPal is health and nutrition apps with a macros counter, diet planner, fitness tracker, and nutrition coach features.

The mental wellbeing coaching segment is anticipated to grow at the fastest CAGR over the forecast period. The rising prevalence of depression and anxiety and growing awareness regarding mental health for the treatment of these conditions are factors that fuel the segment's growth. For instance, according to an article published by the World Health Organization in March 2023, depression was one of the most common mental health disorders, with around 280 million people suffering from it across the globe.

Headspace Inc. offers a mental health coach app with the following features,

-

A personalized plan from the coach

-

Three 30-minute text-based sessions per month

-

Schedule sessions after work hours and on weekends

-

Includes the full Headspace sleep library and meditation

Type Insights

Based on type, the holistic health coaching segment led the market with the largest revenue share of 40.8% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Increasing collaborations among public and private players to raise patient awareness and launch new apps drive segment growth. For instance, in August 2023, Abbott, a healthcare company, introduced the Vertigo Coach app, a digital health solution to provide comprehensive aid to people with vertigo in India. This app offers users a range of information and tools to manage their vertigo condition holistically throughout the day. It is an essential guide for vertigo sufferers, providing advice on exercises and lifestyle for effective condition management.

The wellness health coaching segment is anticipated to grow at a significant CAGR over the forecast period. The growing awareness of health and wellness globally, driven by concerns regarding obesity rates, sedentary lifestyles, and the role of physical activity in maintaining overall well-being, is fueling the demand for wellness health coaching apps. For example, a Wellness Coach app provides customized advice based on users' well-being goals, progress, and preferences.

Payment Model Insights

Based on payment model, the freemium model with the paid upgrades segment led the market with the largest revenue share of 24.6% in 2024 and is expected to grow at the fastest CAGR during the forecast period. Increasing smartphone and wearable adoption has expanded access to digital health coaching apps. Moreover, the rise in chronic conditions such as diabetes and obesity led to the growing adoption of digital coaching for lifestyle management, with users willing to invest in premium guidance. The rise of subscription fatigue in paid-only models has increased the appeal of freemium apps, as users prefer testing features before committing to a purchase. For example, CoachAccountable, Calm, and Headspace are free digital health coaching apps available in the market.

The monthly subscription segment is expected to grow at a significant CAGR during the forecast period. The growing adoption of digital health coaching apps due to their benefits and cost-effectiveness fuels the segment's growth. However, digital wellness coaching costs depend on several factors, including the coach's experience, area of expertise, and program length. Generally, group coaching or short-term programs cost approximately USD 50 to USD 150 per month. For individual coaching packages, prices range from USD 200 to USD 1,000 per month, with some premium coaches charging as much as USD 2,000 or more for extensive programs. Many coaches provide various service tiers, enabling clients to select a plan that aligns with their budget and requirements.

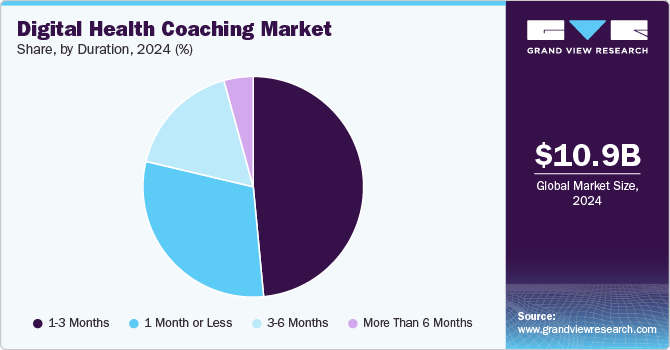

Duration Insights

Based on duration, the 1-3 months segment led the market with the largest revenue share of 48.5% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This segment is driven by individuals seeking short-term health improvements, such as weight loss, habit formation, or post-recovery rehabilitation. Seasonal demand surges, especially around New Year resolutions and summer fitness goals, boost engagement in this duration. Employers and insurers increasingly offer short-term wellness programs to improve workforce health and reduce healthcare costs.

The 1 month or less segment is expected to grow at a significant CAGR during the forecast period. Consumers seeking temporary health interventions, such as fitness challenges, detox programs, or stress management, are boosting this segment's growth. The growing popularity of trial-based coaching services and freemium models attracts users looking for a short-term commitment before investing in long-term plans. Corporate wellness initiatives often include one-month coaching programs to boost employee engagement and productivity.

Regional Insights

North America digital health coaching market dominated with largest revenue share of 37.7% in 2024. Increasing awareness regarding fitness & daily health monitoring has led to a rise in the adoption of digital health coaching apps and a significant increase in the number of new players in the region. For instance, in April 2023, Conifer Health Solutions, a provider of Value-Based Care, collaborated with Welldoc Inc., a digital health company, and introduced Conifer Connect, a personalized digital health app developed to provide Data-driven Digital Coaching and Feedback to Assist users in managing their daily health.

U.S. Digital Health Coaching Market Trends

The digital health coaching market in the U.S. accounted for the largest market revenue share in North America in 2024, due to innovative software development, advanced healthcare management, and numerous key players operating across segments, such as mobile & network operations. According to a survey conducted in mhealth intelligence in December 2022, around 40% and 35% of adults use health apps & wearables. Furthermore, as per ZIPPA estimates, as of 2022, there were 307 million smartphone users in the U.S., with 86% of adults using smartphones. In addition, health-related mobile apps are extremely popular across the U.S. due to rising health consciousness.

Europe Digital Health Coaching Market Trends

The digital health coaching market in Europe is expected to grow at a significant CAGR over the forecast period. Favorable government initiatives and growing awareness among people regarding nutritious diets fuel market growth. Moreover, the market is witnessing many mergers & acquisitions, and partnerships between key players to introduce fitness apps. For instance, in November 2024, Liva Healthcare A/S partnered with Boots Online Doctor to offer coaching or advice to assist patients in making long-term healthy habits for sustainable weight loss.

The Germany digital health coaching market is expected to grow at a significant CAGR during the forecast period, as there is a significant expenditure on health. Furthermore, startups with innovative business models are being established, boosting the market. For instance, in April 2022, ONVY HealthTech Group GmbH introduced AI Health Coach, an AI-powered app embedded in preventative healthcare to keep customers physically and mentally balanced.

Asia Pacific Digital Health Coaching Market Trends

The digital health coaching market in the Asia Pacific is expected to register at the fastest CAGR over the forecast period. The increasing awareness of health and wellness among the region’s population has driven the demand for digital health solutions, with apps providing a convenient and accessible coaching means to maintain fitness routines. In addition, the widespread adoption of smartphones and improved Internet connectivity have made fitness apps more accessible to a broader audience. According to The Mobile Economy 2023 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2023.

The digital health coaching market in Japan is anticipated to register at a considerable CAGR during the forecast period. Rising health consciousness among individuals drives market growth. The growing prevalence of chronic diseases such as diabetes, cardiovascular disease (CVD), and other lifestyle disorders has compelled people to opt for digital health coaching apps for healthy dietary habits and fitness. For instance, according to the International Diabetes Federation, 11,004,999 adults in Japan had diabetes in 2021.

Latin America Digital Health Coaching Market Trends

The digital health coaching industry in Latin America is anticipated to witness at a considerable CAGR over the forecast period. Latin America is considered to have a large pool of healthcare human resources and tech entrepreneurs. This is one of the key factors driving the digital health coaching industry in Latin America. In addition, increasing expenditure on electronic & mobile devices by buyers is contributing to market growth.

The Argentina digital health coaching market is anticipated to register at a considerable CAGR during the forecast period. Increasing smartphone penetration and internet connectivity have made digital health apps, including various coaching apps, more accessible to a broader population. For instance, GSMA Intelligence’s data published in January 2023 revealed that the number of mobile connections in Argentina reached the equivalent of 133.7% of the total population.

Middle East & Africa Digital Health Coaching Market Trends

The digital health coaching market in the Middle East and Africa is anticipated to witness at a considerable CAGR over the forecast period. With the increasing penetration of smartphones and government initiatives, entrepreneurs and healthcare professionals are inclined toward smartphones for better and healthier lifestyles. In addition, the rising awareness regarding digital health among people has increased the potential for digital health coaching.

The digital health coaching market in UAE is anticipated to register at a significant CAGR during the forecast period. The UAE is one of the most favorable markets for healthcare and digital platforms. Factors such as government aid to innovative startups and high government funding to promote digital health are propelling market growth in the country. Key players focus on developing newer solutions to meet the growing demand for better care.

Key Digital Health Coaching Company Insights

Key participants in the digital health coaching industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Digital Health Coaching Companies:

The following are the leading companies in the digital health coaching market. These companies collectively hold the largest market share and dictate industry trends.

- Atlantis Health.

- Naluri Therapeutics Ltd.

- Noom, Inc.

- Lark Technologies, Inc.

- Omada Health Inc.

- Advanced Wellness Systems

- Choose Health Services LLC.

- Avidon Health LLC.

- Wellness Coaches USA

- Quartet Health

- Lyra Health, Inc.

Recent Developments

-

In January 2025, Numan, a digital healthcare provider, launched an AI Health Assistant designed to enhance the company's comprehensive strategy for weight management by offering health coaching.

-

In January 2025, Elyria, a UK-based health tech startup, introduced a digital health coaching platform developed especially for people with fibromyalgia. The app aims to offer personalized support through human coaching and digital tools.

Digital Health Coaching Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.24 billion

Revenue forecast in 2030

USD 22.06 billion

Growth rate

CAGR of 12.51% from 2025 to 2030

Historical data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, type, payment model, duration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Atlantis Health; Naluri Therapeutics Ltd.; Noom, Inc.; Lark Technologies, Inc.; Omada Health Inc.; Advanced Wellness Systems; Choose Health Services LLC.; Avidon Health LLC.; Wellness Coaches USA; Quartet Health; Lyra Health, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Health Coaching Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global digital health coaching market report based on service, type, payment model, duration, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Nutrition and Diet Coaching

-

Fitness and Exercise Coaching

-

Women's Health Coaching

-

Chronic Condition Coaching

-

Mental Wellbeing Coaching

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Holistic Health Coaching

-

Wellness Health Coaching

-

Primal/Paleo Health Coaching

-

-

Payment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Monthly Subscription

-

Annual Subscription

-

Per Session

-

Freemium Model with Paid Upgrades

-

Others

-

-

Duration Outlook (Revenue, USD Million, 2018 - 2030)

-

1 Month or Less

-

1-3 Months

-

3-6 Months

-

More than 6 Months

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital health coaching market size was estimated at USD 10.99 billion in 2024 and is expected to reach USD 12.24 billion in 2025.

b. The global digital health coaching market is expected to grow at a compound annual growth rate of 12.51% from 2025 to 2030 to reach USD 22.06 billion by 2030.

b. Nutrition and diet coaching segment dominated the digital health coaching market with a revenue share of 22.2% in 2024. Increasing awareness and concern about obesity have led to the adoption of nutrition and diet coaching apps for individuals to track their health goals and reduce weight

b. Some key players operating in the digital health coaching market include Atlantis Health., Naluri Therapeutics Ltd., Noom, Inc., Lark Technologies, Inc., Omada Health Inc., Advanced Wellness Systems, Choose Health Services LLC., Avidon Health LLC., and Wellness Coaches USA.

b. Favorable government initiatives, growing penetration of tablets, smartphones, and other mobile platforms, growing strategic alliances, rising prevalence of chronic diseases, and the growing focus on patient-centric healthcare solutions are key factors driving the growth of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.