- Home

- »

- Distribution & Utilities

- »

-

Digital Substation Market Size, Share, Industry Report, 2030GVR Report cover

![Digital Substation Market Size, Share & Trends Report]()

Digital Substation Market (2025 - 2030) Size, Share & Trends Analysis Report By Module (Hardware, Fiber-optic Communication Networks), By Insulation (Transmission, Distribution), By Voltage, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-411-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Substation Market Summary

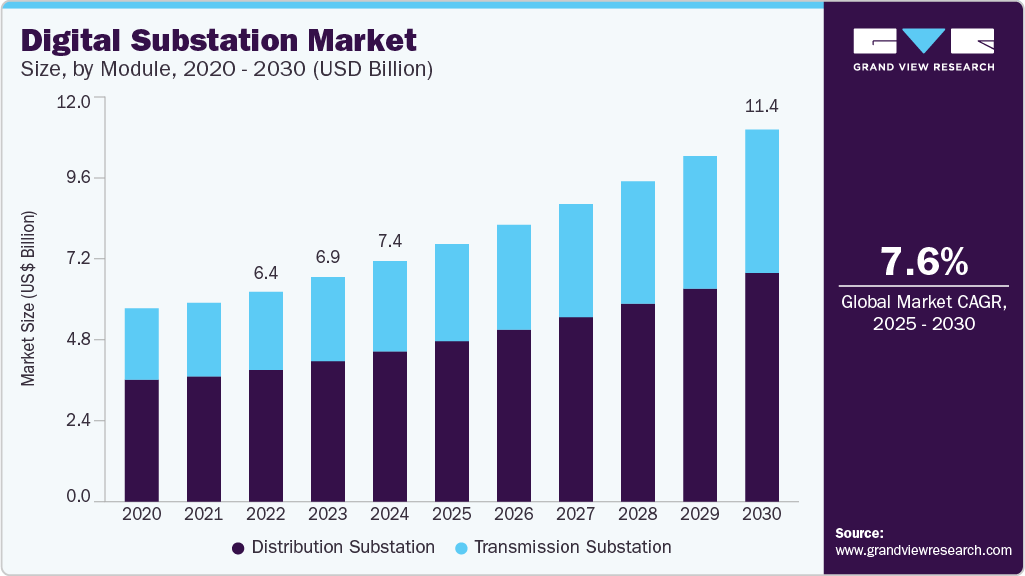

The global digital substation market size was valued at USD 7.39 billion in 2024 and is projected to reach USD 11.43 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The increasing digital transformation of various operations and processes with respect to electricity production and distribution to enhance their efficiency through data collection and analysis is fueling the digital substation market globally.

Key Market Trends & Insights

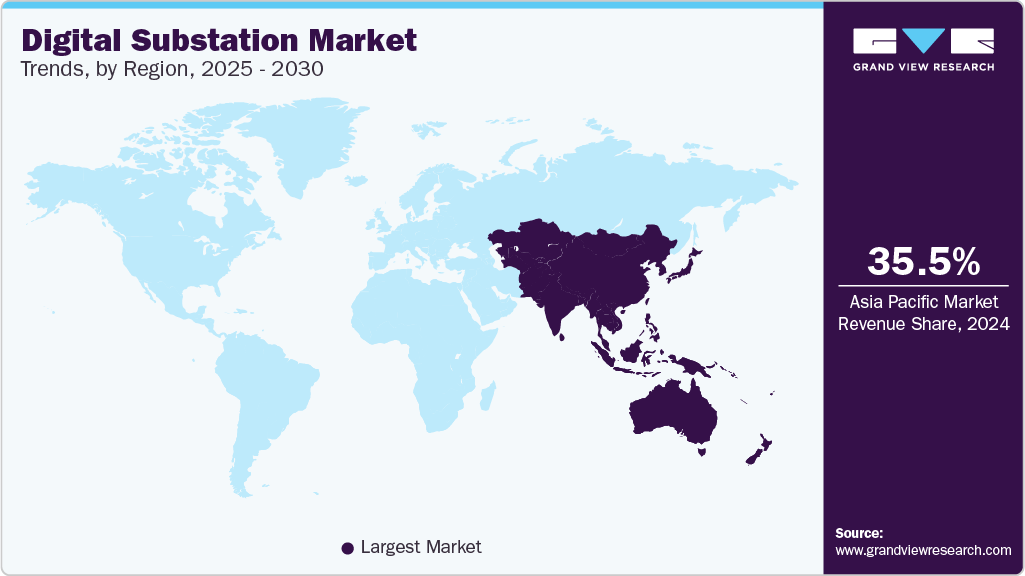

- Asia Pacific digital substation market dominated the global market and accounted for largest revenue share of 35.5% in 2024.

- North America digital substation market is expected to grow at a CAGR 7.8% of over the forecast period.

- Based on module, the hardware segment led the market with the largest revenue share of 55.7% in 2024.

- Based on insulation, the distribution substation segment led the market with the largest revenue share of 62.5% in 2024.

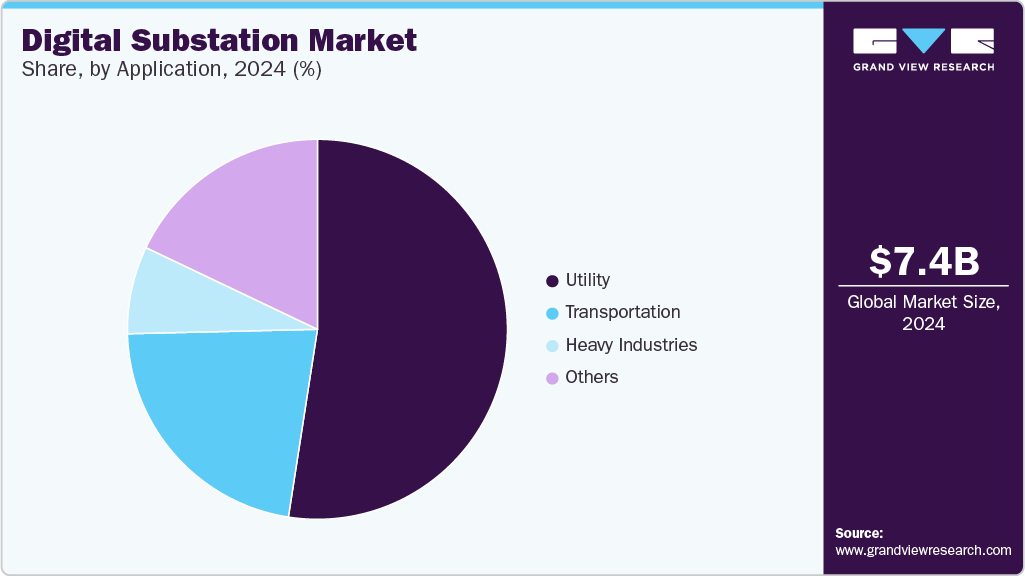

- Based on application, the utility segment led the market with the largest revenue share of 52.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.39 Billion

- 2030 Projected Market Size: USD 11.43 Billion

- CAGR (2025-2030): 7.6%

- Asia Pacific: Largest market in 2024

The digital substation market is significantly influenced by the ongoing trend of grid modernization and the integration of renewable energy sources. As renewable energy generation becomes more prevalent, the complexity of managing grid operations increases due to the intermittent nature of solar and wind power. Digital substations offer the flexibility and adaptability needed to handle these fluctuations, enhancing grid reliability and efficiency. They enable real-time monitoring, dynamic power flow adjustments, and seamless integration of distributed energy resources (DERs), making them crucial for modernizing electrical grids to support renewable energy adoption.

The digital substation market is significantly influenced by the ongoing trend of grid modernization and the integration of renewable energy sources. As renewable energy generation becomes more prevalent, the complexity of managing grid operations increases due to the intermittent nature of solar and wind power. Digital substations offer the flexibility and adaptability needed to handle these fluctuations, enhancing grid reliability and efficiency. They enable real-time monitoring, dynamic power flow adjustments, and seamless integration of distributed energy resources (DERs), making them crucial for modernizing electrical grids to support renewable energy adoption.

A major driver in the digital substation market is the escalating demand for efficient automation solutions. The adoption of digital technologies like SCADA systems and fiber-optic communication networks is transforming how electrical utilities manage and control their operations. These technologies improve grid reliability, reduce operational costs, and enhance safety by enabling advanced monitoring and predictive maintenance. The push towards more efficient, automated solutions is further driven by the need to upgrade aging infrastructure and incorporate advanced functionalities such as real-time data analytics and enhanced cybersecurity measures.

The digital substation market presents significant growth opportunities, particularly in emerging markets that are rapidly industrializing and urbanizing. These regions have the chance to circumnavigate traditional infrastructure challenges by adopting cutting-edge digital substation technologies from the outset. This approach can prevent costly future retrofits and lay the groundwork for sustainable economic growth. Investments in smart grid projects and the increasing deployment of automation and control devices offer additional opportunities for market expansion as these technologies become integral to managing the complexities of modern power distribution networks.

Module Insights

The hardware segment led the market with the largest revenue share of 55.7% in 2024. The hardware segment in digital substations is being driven by the growing need for efficient and reliable power management solutions. As traditional power grids become increasingly inadequate to handle modern energy demands, digital substations provide a more robust infrastructure. These substations offer enhanced control and monitoring capabilities, which are critical for maintaining grid stability and efficiency. The integration of advanced hardware components such as intelligent electronic devices (IEDs), digital transformers, and circuit breakers significantly improves the reliability and safety of power distribution networks. In addition, the push towards renewable energy sources necessitates sophisticated hardware to manage the intermittent nature of these resources, further propelling the demand for advanced digital substation hardware.

Fiber-optic communication networks are expected to grow at a CAGR of 7.7% over the forecast period, as these are a cornerstone in the evolution of digital substations, driven by the need for high-speed, reliable data transmission. These networks facilitate real-time monitoring and control of power systems, ensuring efficient operation and quick response to faults. The transition from copper to fiber-optic cables reduces electromagnetic interference and enhances the accuracy of data transfer, which is crucial for the sophisticated protection and automation functions of digital substations.

Insulation Insights

The distribution substation segment led the market with the largest revenue share of 62.5% in 2024. With the growing urbanization and expansion of electricity access in developing regions, there is a heightened demand for substations that can reliably distribute power to end consumers. Digital distribution substations offer advanced features such as real-time monitoring, automated fault detection, and remote control, improving power distribution networks' overall reliability and efficiency.

Transmission substations is expected to grow at a significant CAGR of 8.1% over the forecast period, owing to the rising adoption of renewable energy in power grids. As global energy consumption rises and renewable energy sources like wind and solar become more integrated into the grid, the need for advanced transmission systems that can handle variable loads and ensure stability has become critical, thus promoting the segment.

Voltage Insights

The 220-500kV segment dominated the digital substation market with the largest revenue share of 45.2% in 2024, driven by the need for robust transmission infrastructure to support large-scale industrial operations and inter-regional power transfer. In addition, rapid industrialization in emerging economies is driving the demand for digital substation in this segment. Furthermore, digital substations in this voltage range are essential for minimizing transmission losses and ensuring the stable delivery of electricity over long distances.

The Up to 220kV segment is expected to grow at a CAGR of 8.1% over the forecast period. This segment caters to the growing electricity needs of residential and commercial consumers. With the growing population globally, the need for electricity in the residential sectors is expected to rise. Furthermore, the proliferation of smart devices such as smartphones, tablets, smart TVs and others is expected to promote the digital substation market.

Application Insights

The utility segment held the dominant position in the market. It accounted for the largestrevenue share of 52.4% in 2024, attributed to the integration of renewable energy sources, such as solar and wind power, which require advanced grid management capabilities. Digital substations provide real-time data analytics, enabling utilities to monitor equipment health and predict failures before they occur, thus minimizing downtime and maintenance costs.

The transportation segment is expected to grow at a significant CAGR of 7.5% from 2025 to 2030, owing to the growing railway and electric vehicles (EVs) industries. The growing demand for sustainable transportation to reduce carbon emissions is shifting the consumer preference towards EVs, propelling the demand for digital substations in the market.

Regional Insights

Asia Pacific digital substation market dominated the global market and accounted for largest revenue share of 35.5% in 2024. The Asia-Pacific region, characterized by rapid industrialization and urbanization, is emerging as a major market for digital substations. Furthermore, the region invests heavily in renewable energy projects to meet growing energy needs and environmental commitments. Solar & wind energy projects are increasingly being constructed in countries such as India, Japan, Indonesia, China, and Thailand, driving the demand for digital substations in the region.

The digital substation market in China led the Asia Pacific market with the largest revenue share in 2024, driven by substantial government investments in grid modernization and the integration of renewable energy sources.As per an article published in April 2022, China Southern Power Grid plans to invest over USD 4.1 billion in digital power grid construction during the 14th Five-Year Plan period (2021-2025), focusing on five southern provinces.

North America Digital Substation Market Trends

North America digital substation market is expected to grow at a CAGR 7.8% of over the forecast period, owing to the expanding smart grid network in semi-urban and rural regions. In addition, the region is at the forefront of implementing various technologies further fueling the growth of digital substation in the region.

The digital substation market in the U.S. dominated the North American market and held the largest revenue share in 2024, driven by technological advancements and innovation across various sectors. The country is one of the largest EV adopters in the world, leading to an increased demand for well-established EV charging infrastructure. As of 2023, the U.S. set a goal for 50% of all new vehicles sold by 2030 to be zero-emission vehicles, with a plan to build 500,000 EV chargers nationwide under the Bipartisan Infrastructure Law.

Europe Digital Substation Market Trends

The European digital substation market is expected to grow significantly over the forecast period, driven by the emphasis on sustainability and energy transition. European countries are leading the way in adopting stringent environmental regulations and ambitious renewable energy targets. The European Union's Green Deal and various national energy policies aim to significantly reduce carbon emissions and increase the share of renewable energy in the energy mix.

Key Digital Substation Company Insights

The digital substation market is highly competitive, with several key players dominating the landscape. Major companies include ABB Ltd., Siemens AG, General Electric Company; Schneider Electric, Honeywell International Inc., Cisco Systems Inc., Eaton Corporation plc, Emerson Electric Co., NR Electric Co. Ltd., and Hitachi Energy Ltd. The digital substation market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

-

Siemens AG manufactures a comprehensive range of products, including high- and medium-voltage switchgear, transformers, protection relays, control systems, and digital automation equipment.

-

General Electric Company (GE) manufactures digital protection relays, substation automation systems, communication networks, and advanced monitoring devices tailored for digital substations. The company specializes in hardware and software solutions enabling real-time data acquisition, asset management, and grid optimization.

Key Digital Substation Companies:

The following are the leading companies in the digital substation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric

- Honeywell International Inc.

- Cisco Systems Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- NR Electric Co. Ltd.

- Hitachi Energy Ltd.

Recent Developments

-

In March 2025, Siemens announced that it would unveil its grid modernization advancements at DISTRIBUTECH 2025. Siemens Xcelerator simplifies energy systems transformations, allowing utilities to manage growing complexity with interoperable, scalable and AI-powered solutions.

-

In March 2025, Schneider Electric announced the launch of the One Digital Grid Platform. The platform provides a technical foundation for independent software solutions, which enables utilities to accelerate grid modernization and deliver more affordable and cleaner energy.

-

In January 2024, Hitachi Energy Ltd. introduced new digital substation technology aimed at enhancing efficiency and reliability in power distribution. This technology leverages advanced digital tools to improve the management and monitoring of electrical networks.

-

In July 2023, U.S. announced the start of operations of its first fully digital located in California. This innovative facility utilizes advanced digital technology to enhance the efficiency and reliability of electricity distribution. The digital substation is designed to improve monitoring and control systems, ultimately leading to better service for customers and reduced operational costs for utility companies. This development marks a significant step forward in modernizing the electrical grid in the U.S. and could pave the way for more digital substations in the future

Digital Substation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.91 billion

Revenue forecast in 2030

USD 11.43 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Module, insulation, voltage, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia.

Key companies profiled

ABB Ltd.; Siemens AG; General Electric Company; Schneider Electric; Honeywell International Inc.; Cisco Systems Inc.; Eaton Corporation plc; Emerson Electric Co.; NR Electric Co. Ltd.; Hitachi Energy Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Substation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global digital substation market report based on, module, insulation, voltage, application, and region.

-

Module Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Fiber-optic Communication Networks

-

SCADA

-

-

Insulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission Substation

-

Distribution Substation

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 220kV

-

220-500kV

-

Above 500kV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Heavy Industries

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.