- Home

- »

- Plastics, Polymers & Resins

- »

-

Diisononyl Phthalate Market Size, Share, Trends Report 2030GVR Report cover

![Diisononyl Phthalate Market Size, Share & Trends Report]()

Diisononyl Phthalate Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (PVC, Acrylics. Polyurethanes), By Application (Wires & Cables, Films & Sheets, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-343-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diisononyl Phthalate Market Size & Trends

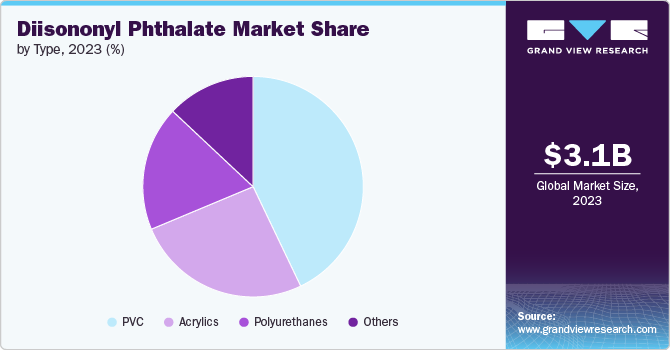

The global diisononyl phthalate market size was estimated at USD 3.13 billion in 2023 and is projected to grow at a CAGR of 3.8% in revenue from 2024 to 2030. The growing demand for coatings and adhesives drives the diisononyl phthalate (DINP) market. As the construction, automotive, and packaging industries continue expanding, a growing need for high-performance coatings and adhesives is needed.

DINP is a chemical used as a plasticizer to make plastics and rubber products more flexible. It is a mixture of phthalates with branched alkyl side chains of varying lengths, such as C10, C8, and C9. DINP is commonly used in various plastic items, including vinyl and PVC plastics, and in the adhesive, construction, and manufacturing industries. In addition, it is used in non-PVC products like pigments, inks, sealants, adhesives, lacquers, and paints. The market for DINP is expanding due to its wide use in key industries and the increased demand for flexible PVC.

Drivers, Opportunities & Restraints

The DNIP market is primarily driven by the growing demand for flexible PVC in various applications, including construction, automotive, and medical devices. DINP is often preferred for its ability to make PVC softer and more flexible, meeting the material requirements of these sectors.

Growing concerns about the environmental impact of strict regulations are hindering the DNIP market. The stringent regulatory environment governing the use of phthalates, such as REACH in Europe and similar standards in other regions, poses limitations on using DINP in consumer goods and other applications due to potential health and environmental risks. Increasing consumer awareness and demand for non-phthalate, safer, and more environmentally friendly alternatives are also challenging the DINP market.

The increasing advancements in bio-based plasticizers present an opportunity to reduce DINP's environmental impact. In addition, the expanding applications of DINP in emerging markets, such as new construction materials, healthcare products, and innovative consumer goods, offer significant growth prospects. Ongoing innovation in product formulations that can meet stricter regulatory standards while maintaining or improving performance characteristics also presents a substantial opportunity for the market.

Application Insights & Trends

Flooring & wall covering dominated the market with a market and accounted for a revenue share of 39.7% in 2023. The demand for durable and visually appealing interior solutions drives the use of DINP in various applications. DINP is a preferred plasticizer used to manufacture vinyl flooring, wallpapers, and synthetic leather materials and is widely used in residential, commercial, and industrial settings. Due to its properties, flooring and wall coverings are key application areas for DINP, which improve the flexibility, durability, and longevity of these products. By being used as a plasticizer in the production of vinyl flooring and wall coverings, DINP makes these materials easier to process, install, and maintain, providing consumers with more resilient and versatile interior design options. Furthermore, the use of DINP in this context supports the demand for more sustainable and low-maintenance living and working spaces, meeting the contemporary needs for functionality and aesthetic appeal.

Films and sheet materials are extensively used in various industries, including automotive, construction, and consumer goods, enabling the production of high-quality, resilient plastic products. The use of DINP in films and sheets enhances their performance, making them ideal for applications requiring extended durability and resistance to wear and tear. This adaptation ultimately contributes to the versatility and longevity of the finished products, affirming DINP's pivotal role in improving material properties and expanding application possibilities in the modern manufacturing landscape.

Type Insights

PVC type segment dominated the market and accounted for a revenue share of 42.9% in 2023. The PVC type segment represents a crucial part of the DINP market, serving a variety of applications where flexibility and durability are key. Diisononyl phthalate (DINP) is predominantly used as a plasticizer in manufacturing PVC products, enhancing their flexibility, workability, and overall performance. This includes applications in construction materials, automotive parts, consumer goods, and medical devices. The demand within this segment is driven by the widespread use of PVC in various industries, making it a vital component of the global DINP market.

Acrylics refer to a specific type of plasticizer used in various applications, ranging from flexible PVC to rubber products. These synthetic polymers are favored for their exceptional clarity, resistance to UV light, and versatility in enhancing the flexibility and durability of materials. Acrylics stand out in the DINP market due to their ability to balance performance and cost-effectiveness, making them highly sought after in industries such as automotive, construction, and consumer goods. Compared to traditional phthalates, their environmentally friendly profile further solidifies their position as a preferred choice for manufacturers aiming to comply with stringent regulations and sustainability standards.

Regional Insights & Trends

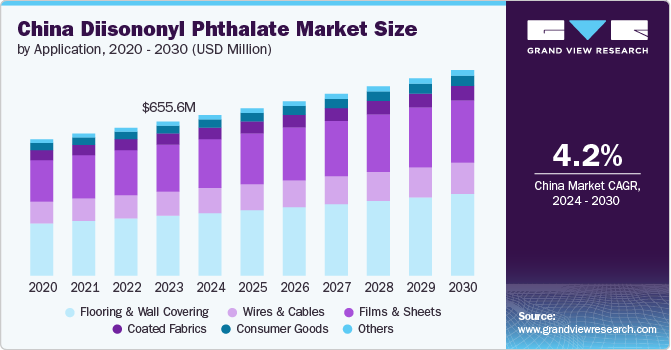

Asia Pacific dominated the market and accounted for a 35.8% share in 2023. The region's leading position is attributed to the rising construction and automotive sectors in Asia Pacific and the rising demand for flooring and wall-covering coated fabrics in the region, which are expected to drive the market. In addition, the availability of land, low raw materials, labor costs, and favorable government outlook are key factors associated with high production volumes of diisononyl phthalate in countries such as China and India.

China is a key player in the global diisononyl phthalate market, significantly influencing market dynamics. The country's dominance is attributed to its high production capacity, low labor costs, and availability of raw materials, driving the market's competitive pricing and high production volumes. Demand in China is mainly driven by rising construction projects and the automotive industry. Moreover, the low labor cost has also resulted in the rise of manufacturing plants in the country.

North America Diisononyl Phthalate Market Trends

The market in North America is expected to be driven by increasing manufacturing production in the region. Rising construction and automotive sectors fuel the market. The growth in the manufacturing industry has resulted in growing demand for the product market in the region.

Europe Diisononyl Phthalate Market Trends

Europe plays a significant role in the diisononyl phthalate market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the demand from construction projects, automotive industry, and consumer goods sector, leading to a rise in demand for diisononyl phthalate.

Key Diisononyl Phthalate Company Insights

Some of the key players operating in the global diisononyl phthalate market include

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments: Chemicals, Surface Technologies, Materials, Nutrition & care, Industrial Solutions, and Agricultural Solutions. Surface Technologies accounts for the highest contribution to the company’s consolidated revenue, followed by Materials and Chemicals. The company has 11 operating divisions, which are categorized under the company’s 6 business segments. These divisions are Petrochemicals, Intermediates, Performance Materials, Monomers, Dispersion & Resins, Performance Chemicals, Catalysts, Coatings, Care Chemicals, Nutrition & Health, and Agricultural Solutions. The divisions bear strategic and operational responsibility and are organized according to sectors or products. They manage the 52 global and regional business units and develop strategies for 72 strategic business units.

-

Exxon Mobil Corporation is a U.S.-based company involved in the exploration and production of crude oil and natural gas along with the manufacturing, trading, transporting, and selling petroleum products, petrochemicals, and a wide variety of specialty products. The company mainly deals in three business segments: upstream (oil & gas, E&P, shipping, and wholesale operations), downstream (refining, marketing, and retail operations), and chemicals. It owns 37 oil refineries in 21 countries with a refining capacity of 6.3 million barrels per day. The company operates in more than 60 countries and has a global team of 62,000 engineers, scientists, technicians, researchers, professionals, and employees of more than 160 nationalities.

Evonik Industries and LG Chem are some of the emerging market participants in the global diisononyl phthalate market.

-

Evonik Industries AG is one of the leading chemicals manufacturing company operational globally. The company operates through its 5 business segments: Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, and Technology & Infrastructure. The company offers its crosslinking agents to various end use industries like automotive, aerospace, construction, and electronics among others. The company has around 104 production facilities in over 27 countries globally. The largest production facilities are in Germany, Belgium, Singapore, China, and in the U.S.

-

LG Chem is a petrochemical company offering its product portfolio through three business segments, namely petrochemicals, advanced materials, and life sciences. The company manufactures a wide range of products including petrochemicals, renewable plastics, electronic and battery materials, drugs, and vaccines. It is working toward achieving carbon neutrality by 2030 and net-zero emissions by 2050. The company invests heavily in R&D activities and has registered a total of 31,828 patents as of 2023.

Key Diisononyl Phthalate Companies:

The following are the leading companies in the diisononyl phthalate market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- ExxonMobil

- Evonik Industries

- LG Chem

- Mitsubishi Chemical Holdings Corporation

- KLJ Group

- Azelis Group

- AEKYUNG

- Nan Ya Plastics

- UPC Technology Corporation

Recent Developments

-

In October 2023, BASF SE agreed to provide technology for producing isononyl alcohol (INA) in China. The license agreement allows NZRCC to construct a large-scale INA production facility in China at integrated refinery ZRCC’s and petrochemical complex. The plant is expected to have a capacity of 200,000 tons annually and is scheduled to begin operations in 2026. INA is a plasticizer alcohol used to produce PVC plasticizers with better toxicological profiles than other alternatives.

-

In November 2021, Evonik announced the plan to launch new plasticizer products based on the raw material INA, strengthening its global business in plasticizers used for flexible PVC products. This expansion aligns with the strategy of offering innovative next-generation plasticizers.

Diisononyl Phthalate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.24 billion

Revenue forecast in 2030

USD 4.06 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; ExxonMobil; Evonik Industries; LG Chem; Mitsubishi Chemical Holdings Corporation; KLJ Group; Azelis Group; AEKYUNG; Nan Ya Plastics; UPC Technology Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diisononyl Phthalate Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diisononyl phthalate market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PVC

-

Acrylics

-

Polyurethanes

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flooring & Wall Covering

-

Wires & Cables

-

Films & Sheets

-

Coated Fabrics

-

Consumer Goods

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global diisononyl phthalate market size was estimated at USD 3,124.9 million in 2023 and is expected to reach USD 3,243.6 million in 2024.

b. The global diisononyl phthalate market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 4,057.1 million by 2030.

b. Asia Pacific dominated the diisononyl phthalate market with a share of 35.8% in 2023. The region's leading position is attributed to the rising construction sector, and automotive sector in Asia-pacific and due to the rising demand for flooring and wall covering, coated fabrics in the region which are expected to drive the market.

b. Some key players operating in diisononyl phthalate market include BASF SE; ExxonMobil; Evonik Industries; LG Chem; Mitsubishi Chemical Holdings Corporation; KLJ Corporation; Azelis Group; AEKYUNG; Nan Ya Plastics; and UPC Technology Corporation

b. Key factors that are driving the market growth include growing demand for coatings and adhesives drives the diisononyl phthalate (DINP) market. As the construction, automotive, and packaging industries continue expanding, a growing need for high-performance coatings and adhesives is needed

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.