- Home

- »

- Smart Textiles

- »

-

Disposable Medical Gloves Market Size & Share Report, 2030GVR Report cover

![Disposable Medical Gloves Market Size, Share & Trends Report]()

Disposable Medical Gloves Market Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Neoprene, Vinyl, Polyethylene), By Product, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-633-2

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Advanced Materials

Disposable Medical Gloves Market Trends

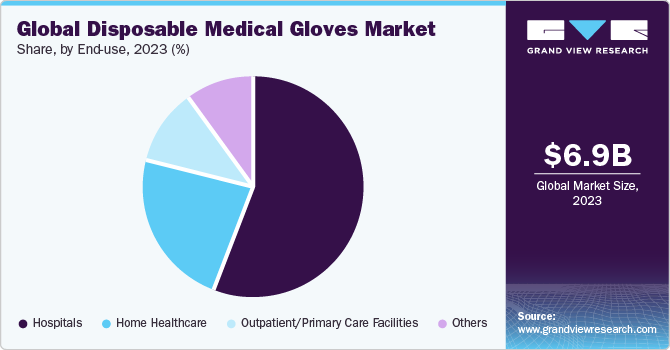

The global disposable medical gloves market size was estimated at USD 6.93 billion in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. The growing demand for safety and security at healthcare workplaces and rising healthcare expenditure are expected to have a positive impact on industry growth. Growing awareness of safety and health measures associated with the treatment of patients and emergency response incidents is further anticipated to augment the demand for disposable medical gloves in the healthcare sector. Furthermore, the risks related to on-the-job transmission of bloodborne pathogens and germs have led to an increased adoption of gloves in medical & healthcare facilities.

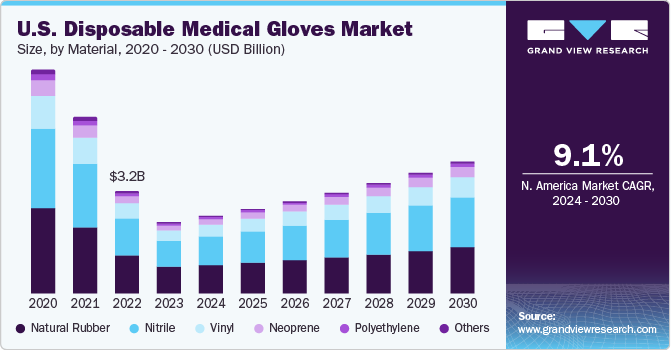

The market in the U.S. is undergoing a transition owing to the rising prevalence of chronic diseases, which has increased the number of hospital visits and re-admissions. This, in turn, is positively impacting the product demand in hospitals. The growing number of surgical procedures performed in the U.S. including cesarean section, appendectomy, coronary artery bypass graft (CABG), carotid endarterectomy, and circumcision, is expected to boost product demand.

Factors, such as the expansion of public healthcare systems, increased economic power, and population growth are anticipated to increase healthcare spending globally. Furthermore, the aging population, rising number of people with chronic & long-term conditions, increased investments in MedTech & expensive infrastructure, increasing labor costs & staff shortages, and the growing demand for broader ecosystem services are expected to boost the healthcare expenditure across the globe.

Disposable medical gloves are distributed through direct and indirect channels, such as distributors and retailers, along with e-commerce and social media advertising. The manufacturers of these products distribute products through independent distributors, exclusive distributors, and multi-brand retailers. However, a few companies distribute the product directly to companies, hospitals, commercial institutions, and consumers to avoid additional costs.

The growing need for healthcare services and products has driven a surge in the utilization of personal protective equipment (PPE) within the healthcare sector. This includes coveralls, gowns, lab coats, aprons, respirators, bouffant caps, shoe covers, masks, and gloves. Furthermore, the growing geriatric population in the region is expected to contribute to an increase in healthcare expenditure.

Market Concentration & Characteristics

The market growth stage is medium and the pace of its growth is accelerating. The market is characterized by a high degree of innovation, which is attributable to rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The market has witnessed a notable degree of innovation in recent years, driven by advancements in material science and manufacturing technologies. Traditional latex gloves have given way to synthetic alternatives, such as nitrile and vinyl, addressing concerns related to latex allergies while offering enhanced durability and tactile sensitivity. Moreover, manufacturers have increasingly focused on developing gloves with specialized features like antimicrobial coatings, textured surfaces for improved grip, and ergonomic designs for better comfort during prolonged use.

The market has experienced a notable level of mergers and acquisitions, driven by several factors including the consolidation of key players, expansion into new geographic regions, and diversification of product portfolios. Large multinational corporations have actively pursued strategic acquisitions to strengthen their market presence and gain access to new technologies and distribution channels. In addition, smaller manufacturers have been targets for acquisition as larger companies seek to capitalize on niche markets or specialized expertise. These M&A activities have reshaped the competitive landscape of the industry, with implications for pricing dynamics, product innovation, and overall market competitiveness.

Regulations play a pivotal role in shaping the dynamics of the market, influencing aspects, such as product quality standards, manufacturing practices, and distribution protocols. Stringent regulatory frameworks, particularly in regions like North America and Europe, mandate compliance with specific safety and performance requirements, driving manufacturers to invest in R&D to meet these standards. In addition, evolving regulations related to healthcare-associated infections (HAIs) and worker safety have spurred innovation in glove design and materials, leading to the development of products with enhanced barrier properties and antimicrobial features.

In this market, there exists a range of product substitutes that healthcare facilities may consider, depending on specific application requirements and cost considerations. While disposable gloves are widely used for barrier protection in healthcare settings, alternatives, such as reusable gloves made from materials like rubber or silicone, offer a more sustainable option for facilities aiming to reduce waste.

In this market, end-user concentration refers to the distribution of demand among various sectors that utilize these products for protection against contaminants. Healthcare facilities, including hospitals, clinics, and laboratories, represent the largest segment of end-users, accounting for a significant portion of glove consumption globally. This concentration is driven by the high demand for barrier protection in healthcare settings to prevent cross-contamination and transmission of infectious diseases.

Material Insights

The natural rubber material segment dominated the market in 2023 with a share of 37.2% of the overall revenue. Disposable medical gloves made of natural rubber or latex are tactile and are used in applications, such as medical procedures and surgery. Furthermore, they are flexible and easy to use, making them excellent for working with water-based or biological materials. All these factors are expected to boost industry demand over the forecast period.

The demand for nitrile disposable gloves is expected to witness significant growth from 2024 to 2030. Nitrile gloves are favored in an application where exposure to blood-borne diseases and other contaminants is a key concern because of their strong puncture resistance, superior barrier protection, and durability. Furthermore, because of their high elasticity and memory, they provide excellent comfort and fit.

Application Insights

The examination disposable medical gloves application segment led the market in 2023. Growing demand for these products in the medical sector, on account of higher demand in hospitals, dental applications for regular checkups, and patient visits, is expected to drive industry growth. The surgical segment is expected to witness significant growth over the forecast period. Rising incidences of chronic diseases, such as heart disease and cancer, which frequently necessitate medical procedures and operations for treatment, are predicted to drive product demand in surgical applications.

Product Insights

The powdered disposable medical gloves product segment led the market in 2023. The powder, typically cornstarch or calcium carbonate, serves as a lubricant, making it easier for users to slide the gloves onto their hands. This feature is particularly beneficial in fast-paced environments, such as healthcare settings, where healthcare professionals need to quickly put on gloves for patient care tasks.

The powder-free product segment is expected is expected to witness significant growth from 2024 to 2030. Powder-free gloves eliminate the risk of powder-related adverse reactions, such as allergies or respiratory issues, making them a preferred choice for individuals with sensitivities or allergies. In addition, powder-free gloves reduce the potential for contamination in sensitive environments, such as surgical procedures or laboratory work, where even trace amounts of powder could compromise test results or patient outcomes.

End-use Insights

The hospital end-use segment led the market in 2023 on account of the rapidly growing geriatric population, especially in developed countries, coupled with the rising prevalence of hospital-acquired and other infections, such as hepatitis and AIDS. Primary care physicians provide primary care services to a specific patient population.

These doctors are the first point-of-contact (PoC) for patients who have unidentified symptoms, signs, or health concerns. Thus, medical gloves are essential while working with individuals who have undiscovered disorders to avoid cross-transmission and contamination. The growing number of patients seeking consultation at primary care facilities is likely to boost industry demand.

Regional Insights

North America led the market and accounted for the largest share of 36.9% in 2023. Rising instances of chronic illnesses, including obesity, are likely to further increase healthcare expenditure, thereby benefiting the market growth. The region is characterized by the presence of several major disposable gloves manufacturers, including 3M, Kimberly-Clark Corporation, Cardinal Health, and Medicom, among others, which is likely to benefit market growth over the forecast period.

Canada Disposable Medical Gloves Market

The disposable medical gloves market in Canada is expected to be driven by several factors including the rising geriatric population coupled with substantial investments in both public and private sectors are expected to drive the healthcare industry in the country, which, in turn, is anticipated to have a positive impact on the demand for disposable medical gloves over the forecast period.

Germany Disposable Medical Gloves Market

The expansion of publicly funded long-term care benefits has increased the demand for nurses, which has stimulated the disposable medical gloves market growth in recent years. Also, the increasing requirement for clean room technology in the biotechnology and pharmaceutical industries is expected to enhance the disposable medical gloves demand in the Germany over the forecast period.

China Disposable Medical Gloves Market

Medical & healthcare industry in China is expected to grow at a rapid pace owing to several factors including aging population, urbanization, improving standard of living, and expanding healthcare infrastructure. Rising healthcare expenditure is expected to contribute to the growth of healthcare sector in the country. These factors are expected to have a positive impact on the growth of the disposable medical gloves market in China over the forecast period.

Brazil Disposable Medical Gloves Market

Despite the recent economic downturn, healthcare industry is anticipated to grow on account of the continued expansion of the country’s private healthcare sector coupled with adequate purchasing power with the public and private hospitals. In addition, the growing elderly population coupled with the increasing burden of non-communicable chronic diseases is expected to drive the demand for healthcare services. Moreover, the aging population is one of the major drivers for home healthcare services. Thus, the factors mentioned above are expected to positively impact the disposable medical gloves market in Brazil over the forecast period.

South Africa Disposable Medical Gloves Market

The market in South Africa is anticipated to expand with a growing awareness of the importance of hand hygiene in reducing the spread of infectious diseases, There has been a heightened demand for disposable gloves among healthcare professionals, and this demand is further fueled by factors, such as rising healthcare expenditure, expanding healthcare infrastructure, and a growing patient population.

Key Disposable Medical Gloves Company Insights

The market has been characterized by the presence of a wide array of large-scale and small-scale manufacturers, thereby resulting in a significant level of concentration. In addition, the global UV disinfection equipment market consists of various international as well as domestic players who are engaged in the designing, developing, and marketing of a diversified array of disposable medical gloves. Key players in the market are focusing on various strategies, including acquisition, regional expansion, and product innovation, to achieve competitive advantage and, thereby, develop a strong foothold in the industry.

For instance, in February 2022, Kimberly-Clark Worldwide, Inc. launched the Kimtech Opal Nitrile Gloves, designed to protect against chemical splash and microbial hazards. These gloves offer efficiency by being latex-free and devoid of vulcanizing agents, minimizing the risk of skin reactions associated with Type I & Type IV allergies typically linked to glove usage.

Key Disposable Medical Gloves Companies:

The following are the leading companies in the disposable medical gloves market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these disposable medical gloves companies are analyzed to map the supply network.

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health

- Semperit AG Holding

- Rubberex

- Dynarex Corporation

- B. Braun Melsungen AG

Recent Developments

-

In April 2022, Unigloves launched a new biodegradable disposable nitrile gloves named BioTouch. Such launches are expected to augment the market growth during the forecast period

-

In November 2022, Vizient, Inc. signed an agreement with SafeSource Direct, LLC, the manufacturer of personal protective equipment (PPE), for chemo-rated nitrile gloves. The agreement aims to establish 12 operational lines producing more than 2 billion gloves yearly by January 2024

Disposable Medical Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.49 billion

Revenue forecast in 2030

USD 12.49 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Russia; Spain; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; Middle East & Africa; South Africa

Key companies profiled

Ansell Ltd.; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Supermax Corporation Berhad; Kossan Rubber Industries Bhd.; Cardinal Health; Semperit AG Holding; Rubberex; Dynarex Corp.; B. Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Medical Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the disposable medical gloves market report based on material, product, application, end-use, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Powdered

-

Powder-free

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Examination

-

Surgical

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The disposable medical gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 12.49 billion by 2030.

b. North America region dominated the market in 2023 by accounting for a share of 36.9%. Rising instances of chronic illnesses, including obesity, are likely to further increase healthcare expenditure, thereby benefitting the market growth.

b. Some of the key players operating in the disposable medical gloves market include: Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Bhd., Cardinal Health, Semperit AG Holding, Rubberex, Dynarex Corporation, B. Braun Melsungen AG.

b. Key factors that are driving the disposable medical gloves market growth include increasing prevalence of infectious diseases and viral outbreaks coupled with increasing healthcare expenditure.

b. Disposable medical gloves market size was estimated at USD 6.93 billion in 2023 and is expected to be USD 7.49 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."