- Home

- »

- Automotive & Transportation

- »

-

Dock And Yard Management Systems Market Report, 2033GVR Report cover

![Dock And Yard Management Systems Market Size, Share & Trends Report]()

Dock And Yard Management Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Insourcing), By Functionality, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-651-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dock And Yard Management Systems Market Summary

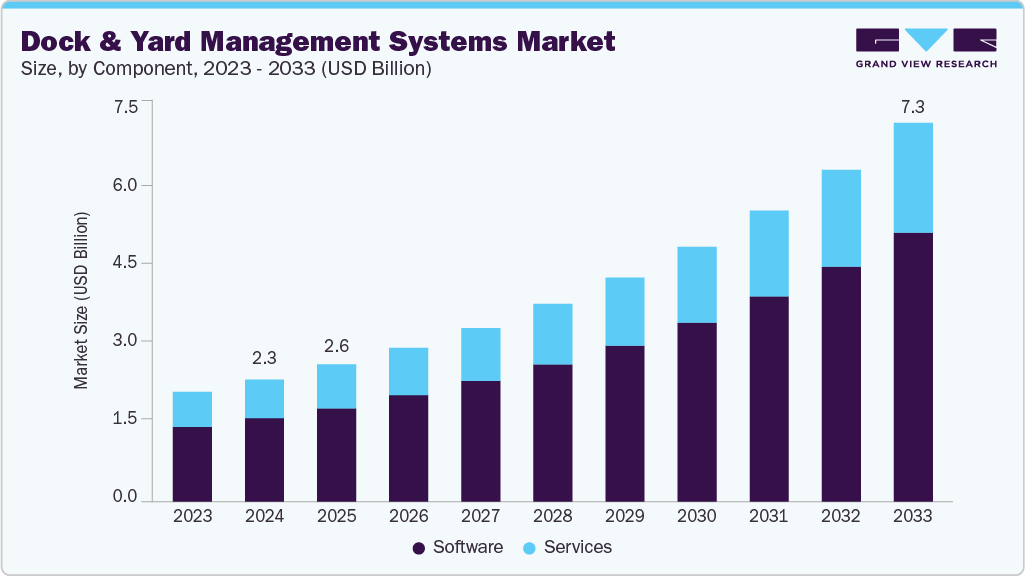

The global dock and yard management systems market size was estimated at USD 2.34 billion in 2024, and is projected to reach USD 7.27 billion by 2033, growing at a CAGR of 13.6% from 2025 to 2033. The dock and yard management systems market is gaining momentum, driven by the rising demand for real-time supply chain visibility, particularly in high-throughput logistics environments.

Key Market Trends & Insights

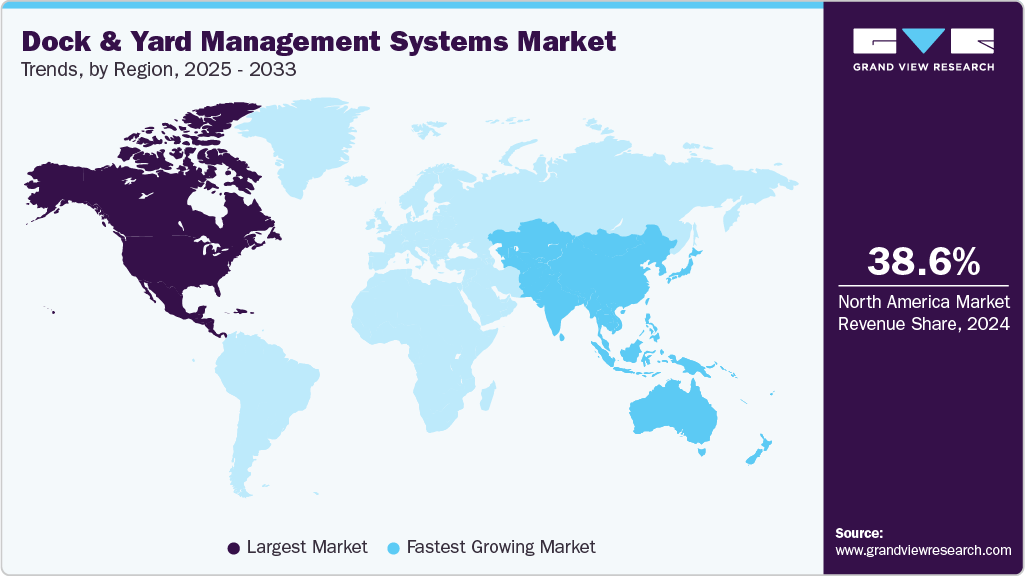

- North America dock and yard management systems market accounted for a 38.6% share of the overall market in 2024.

- The dock and yard management systems industry in the U.S. held a dominant position in 2024.

- By component, the software segment accounted for the largest share of 68.2% in 2024.

- By deployment, the on-premise segment held the largest market share in 2024.

- By functionality, the yard visibility & asset tracking segment dominated the market in 2024.

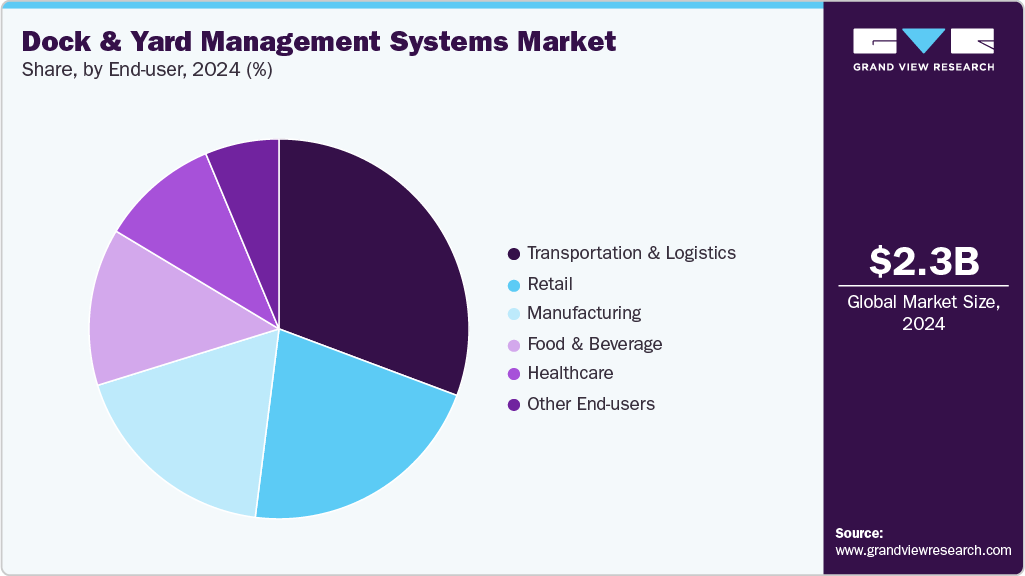

- By End User, the transportation & logistics segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.34 Billion

- 2033 Projected Market Size: USD 7.27 Billion

- CAGR (2025-2033): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growth in e-commerce and the need for rapid, accurate fulfillment are pushing businesses to invest in automated dock scheduling and yard tracking tools. Also, ongoing labor shortages across warehousing and yard operations are accelerating the adoption of digital task and shunter management solutions to reduce manual dependency and errors. AI-powered predictive scheduling and dynamic dock assignment present strong opportunities for next-generation systems that optimize throughput and reduce congestion. However, high initial implementation and integration costs remain a critical challenge, especially for small and mid-sized facilities lacking advanced IT infrastructure.The growth of e-commerce and the increasing need for high-velocity fulfillment are driving demand for advanced dock and yard management systems. As online retail expands, so does the pressure on distribution centers to process higher volumes of goods with shorter turnaround times. In 2024, U.S. e-commerce sales reached USD 1.19 trillion, representing 16.1% of total retail sales, according to the U.S. Census Bureau. Similarly, India’s e-commerce market is expected to surge from USD 123 billion in 2024 to USD 292.3 billion by 2028, growing at a CAGR of 18.7%, as per India Brand Equity Foundation. These trends necessitate more efficient scheduling, gate operations, and yard visibility to meet tight delivery windows and ensure seamless last-mile fulfillment.

Warehouses and yard facilities across North America and Europe continue to face high turnover and difficulty in recruiting shunters, yard jockeys, and gate operators. This has created a strong demand for systems that can optimize resource allocation, automate scheduling, and enable real-time coordination among limited staff. For instance, in August 2024, FourKites integrated EAIGLE’s AI and computer vision technology into its Dynamic Yard and Appointment Manager solutions. The platform enables autonomous gate operations, AI-driven yard audits, and continuous trailer monitoring, thereby reducing reliance on manual labor for gate checks and yard moves. This shift toward automation underscores how digital yard management systems are helping companies mitigate operational bottlenecks caused by labor shortages, especially during peak logistics cycles.

The integration of AI and computer vision is opening new opportunities for predictive scheduling and dynamic dock assignment in yard and dock management systems. These technologies can analyze real-time conditions such as inbound truck ETAs, dock availability, and resource constraints to automatically adjust dock allocations and prioritize high-urgency loads. This results in reduced dwell times, optimized labor deployment, and minimized bottlenecks. For instance, in February 2025, Loadsmar launched a Yard Management System integrated with Opendock and NavTrac to unify gate, yard, and dock operations. The platform digitizes truck movement tracking, driver check-ins, and asset visibility using AI, OCR, and computer vision. Thus, enabling real-time dynamic scheduling and automated resource allocation.

One of the major challenges in the dock and yard management systems market is the high upfront cost associated with implementing advanced solutions, particularly those leveraging AI, IoT, computer vision, and real-time tracking. These systems often require significant infrastructure upgrades, integration with legacy warehouse management systems (WMS), transportation management systems (TMS), and training for staff, making adoption difficult for small to mid-sized enterprises. For example, many AI-enabled solutions, such as those recently introduced by FourKites, Loadsmart, and EPG require not only software investment but also hardware installations including yard cameras, sensors, and RFID systems. Also, aligning these platforms with multiple internal and external IT systems often involves custom development work and extended deployment timelines.

Component Insights

The software segment accounted for the largest share of 68.2% in 2024, driven by the increasing adoption of cloud-based yard and dock management platforms, rising demand for real-time visibility across supply chains, growing complexity in scheduling and resource allocation, and the need to handle higher shipment volumes without expanding physical infrastructure. This growth is further supported by the shift toward digitization of logistics operations, as companies seek scalable and integrated solutions to improve yard throughput and reduce manual dependencies. For instance, in April 2025, C3 Solutions enhanced its dock scheduling and yard automation tools to address ecommerce-driven delivery pressures. Its C3 Hive platform enables remote check-ins, real-time driver updates, and automated scheduling, thereby helping facilities scale throughput without expanding yard size.

The components segment is expected to grow at a highest CAGR from 2025 to 2033. Factors such as increasing demand for advanced sensors and IoT devices, rising investments in automated gate hardware, the proliferation of RFID and GPS-enabled tracking systems, and growing emphasis on enhancing yard safety and equipment utilization support the segment growth.Also, the push for infrastructure modernization across distribution centers and logistics hubs to support real-time operational intelligence is further contributing to the adoption of high-performance hardware components across dock and yard management systems.

Deployment Insights

The on-premise segment accounted for the largest share in 2024. This dominance can be attributed to strong demand for data control, system customization, and cybersecurity in large-scale logistics environments. Factors such as the increasing preference among enterprises for locally managed infrastructure, compliance with stringent data privacy regulations, reduced latency in mission-critical operations, and greater integration flexibility with legacy warehouse systems are fueling the segment’s growth.

The cloud segment is expected to grow at a significant CAGR during the forecast period. This growth is driven by rising demand for scalable and remotely accessible yard and dock solutions, lower upfront infrastructure costs, faster deployment cycles, and increasing adoption among small and mid-sized enterprises. Also, cloud-based systems support real-time updates, centralized data management, and seamless multi-site coordination, making them ideal for modern, distributed logistics operations.

Functionality Insights

The yard visibility & asset tracking segment accounted for the largest share in 2024, driven by increasing demand for real-time location tracking, growing deployment of RFID and GPS technologies, rising need to reduce trailer dwell times, and heightened focus on improving yard throughput. These systems enhance operational transparency, helping logistics managers proactively identify bottlenecks and inefficiencies.Many logistics operators are now leveraging digital twin models and geo-fencing technologies to improve trailer-level visibility and event-based alerts.

The mobile task & shunter management segment is expected to register a notable CAGR from 2025 to 2033. This growth is supported by the rising adoption of handheld devices and mobile apps to assign and monitor tasks, increasing emphasis on autonomous yard movements, and the need for dynamic reallocation of resources to address real-time changes. The segment is also benefiting from the integration of AI and route optimization tools, which streamline trailer movements and boost labor productivity.

End User Insights

The transportation & logistics segment accounted for the largest share in 2024. Leading logistics tech firms are developing unified platforms that connect gate, yard, and dock workflows with AI-based tracking and scheduling. Companies are also integrating computer vision and telematics to enhance trailer visibility, optimize asset utilization, and minimize delays across distribution yards. Factors such as the increasing e-commerce volumes, demand for efficient dock scheduling and yard coordination, widespread automation of fleet operations, and the need for real-time in-yard asset visibility is supporting the segment growth.

The retail segment is expected to register a notable CAGR from 2025 to 2033, owing to its growing dependence on time-sensitive inventory flows, high-volume distribution requirements, and the need for efficient last-mile coordination. Dock and yard management systems help retailers streamline inbound and outbound shipments, reduce trailer dwell times, and improve scheduling accuracy across busy retail distribution centers. For instance, major retailers are adopting real-time yard visibility tools integrated with appointment scheduling and automated gate check-ins to prevent bottlenecks during peak fulfillment periods and maintain service-level targets in omnichannel operations.

Regional Insights

The North America dock and yard management systems market accounted for 38.6% of the global share in 2024. The dock and yard management systems market in North America is being driven by widespread digitization of logistics workflows, growing pressure to reduce dwell times and detention costs, increasing labor shortages in warehousing operations, and expanding e-commerce fulfillment networks. Companies are rapidly adopting digital scheduling and real-time yard visibility tools to improve throughput and reduce reliance on manual coordination. For instance, in July 2024, Opendock partnered with Qued to streamline carrier-led dock scheduling by integrating with carrier TMS systems. The collaboration reduces manual appointment booking, enhances automation, and improves synchronization between warehouse and transportation systems.

U.S. Dock And Yard Management Systems Market Trends

The U.S. dock and yard management systems industry held a dominant position in 2024. The market is witnessing strong momentum, driven by increasing pressure to optimize loading and unloading efficiency, growing warehouse throughput demands, and the need to minimize detention and demurrage costs through intelligent scheduling systems. For instance, in April 2024, Redwood Logistics partnered with Velostics to integrate unified dock and yard scheduling into its TMS platform. This collaboration digitizes scheduling and gate workflows for shippers, brokers, and consignees, enhancing visibility, reducing delays, and significantly lowering operational bottlenecks.

The Canada dock and yard management systems market is expanding due to increasing demand for visibility across logistics networks, a growing emphasis on reducing detention and dwell times, and rising investment in automation to address labor constraints in transportation hubs. As Canadian retailers and 3PLs scale their omnichannel operations, the need for integrated yard execution platforms is gaining momentum. For instance, in February 2022, Canadian technology firm C3 Solutions launched C3 Hive, a last-mile visibility tool integrated into its dock and yard management platform. The solution enables real-time ETA updates, driver communication, and advance check-ins to reduce dwell time and improve site coordination.

Europe Dock And Yard Management Systems Market Trends

The Europe dock and yard management systems industry was identified as a lucrative region in 2024. The European dock and yard management systems market is witnessing significant transformation, driven by rising sustainability mandates, increasing focus on cold chain logistics optimization, adoption of multimodal transport hubs, and integration of EU-wide digital freight and customs management systems. These shifts are prompting logistics operators to invest in dock and yard software that supports emissions tracking, temperature-sensitive cargo handling, and synchronized scheduling across rail, road, and port facilities.

The Germany dock and yard management systems market is being shaped by increasing demand for intelligent automation, greater emphasis on real-time scheduling, rising logistics volumes across manufacturing and retail sectors, and the need to eliminate manual bottlenecks at busy hubs. These trends reflect a nationwide shift toward streamlining logistics flows through advanced digital infrastructure and seamless coordination tools. For instance, in March 2025, EPG (Ehrhardt Partner Group) acquired Berlin-based dock and yard management software company byways to integrate its real-time coordination platform into the EPG ONE Suite. The move is aimed at eliminating inefficiencies caused by delays and manual processes by enabling intelligent automation and synchronized communication between warehouses, carriers, and suppliers.

The UK dock and yard management systems market is witnessing growing momentum, driven by heightened investment in logistics infrastructure, increased adoption of automation in last-mile hubs, rising pressure to optimize limited urban yard space, and a growing focus on sustainable yard operations. These dynamics reflect the country’s strategic emphasis on improving operational throughput and digitizing critical yard functions in densely populated logistics corridors. In October 2024, the UK organizers announced YARDX, the world’s first exhibition focused exclusively on yard operations and industrial outdoor storage. Scheduled for June 2025, the event aims to spotlight innovations in yard management across logistics, retail, ports, and manufacturing sectors. This indicates the country’s proactive stance in fostering innovation and collaboration across yard operations, positioning the UK as a regional leader in next-generation dock and yard management systems.

Asia Pacific Dock And Yard Management Systems Market Trends

The Asia Pacific dock and yard management systems industry emerged as a fastest growing region over the forecast period, driven by rapid expansion of port infrastructure, growing regional e-commerce activity, increasing adoption of automation in logistics hubs, and rising investments in smart warehouse ecosystems. Countries such as China, India, and Singapore are heavily investing in digital logistics technologies to improve supply chain throughput and resilience. The presence of major dockyards like Zhoushan Asia Pacific Dockyard in China and ASL Marine in Singapore further underscores the need for advanced yard visibility, automated scheduling, and efficient asset coordination to handle rising cargo volumes across the region. This reflects a broader shift toward digital transformation in Asia’s logistics and maritime sectors.

The China dock and yard management systems industry held a substantial market share in 2024. The dock and yard management systems market in China is experiencing rapid growth, driven by the country's strong focus on digitalizing logistics operations, government-led smart port initiatives, increasing throughput at inland container depots, and the rising integration of AI and computer vision technologies into yard operations. China’s “New Infrastructure” strategy, which promotes technologies such as 5G, IoT, and AI across industrial sectors, is accelerating the adoption of intelligent yard solutions to optimize turnaround times, reduce manual intervention, and enhance real-time tracking of cargo and equipment.

The Japan dock and yard management systems industry held a significant share in 2024. In Japan, the dock and yard management systems market is influenced by the steady adoption of lean logistics practices, high urban density requiring precise dock scheduling, an aging workforce prompting automation, and strong compliance requirements for cargo handling and transport documentation. Japan's emphasis on space optimization and operational efficiency in constrained logistics hubs is pushing the adoption of advanced scheduling and asset tracking tools to reduce congestion and improve flow within urban distribution centers.

Key Dock And Yard Management Systems Company Insights

Some of the key players operating in the market include Blue Yonder Group, Inc., Manhattan Associates, Inc., C3 Solutions, Inc., Descartes Systems Group Inc., and 4SIGHT Connect.

-

Founded in 1985 and headquartered in Scottsdale, Arizona, U.S., Blue Yonder Group, Inc. is a leading provider of AI-driven supply chain and retail solutions. The company offers integrated platforms for warehouse, transportation, and yard management, enabling end-to-end logistics optimization. Blue Yonder serves sectors such as manufacturing, retail, and third-party logistics, and leverages machine learning, predictive analytics, and real-time data to improve supply chain agility and responsiveness.

-

Founded in 2000 and headquartered in Montreal, Canada, C3 Solutions, Inc. is a specialized provider of dock scheduling and yard management software. The company’s key products, C3 Reservations, C3 Yard, and C3 Hive, support real-time scheduling, remote driver check-ins, and live yard visibility. Serving customers across North America and Europe, C3 Solutions helps retailers, manufacturers, and logistics providers reduce dwell time, improve throughput, and optimize yard coordination through intelligent automation and workflow management.

Key Dock And Yard Management Systems Companies:

The following are the leading companies in the dock and yard management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Manhattan Associates, Inc.

- Blue Yonder Group, Inc.

- C3 Solutions, Inc.

- Descartes Systems Group Inc.

- 4SIGHT Connect (4sight Solution)

- Epicor Software Corporation

- Oracle Corporation

- SAP SE

- Infor, Inc.

- Zebra Technologies Corporation

Recent Developments

-

In February 2025, FreightPOP launched its Dock Scheduling feature to optimize dock appointments and streamline supply chain workflows. The solution enhances real-time visibility, automates scheduling, and improves coordination between shippers, carriers, and warehouse teams.

-

In July 2024, Opendock partnered with Qued to streamline carrier-led dock scheduling by integrating with carrier TMS systems. The collaboration simplifies appointment booking, reduces manual tasks, and enhances automation across warehouse and transportation workflows.

-

In July 2024, Kaleris acquired CAMS Software to integrate its Prospero Transportation Management System with the Kaleris Yard Management System, creating a unified platform for grocers and wholesalers. The solution enables end-to-end control over inbound and outbound logistics, combining route planning, dispatch, ELD-based compliance tracking, dock scheduling, and asset dwell optimization.

-

In January 2024, C3 Solutions introduced new features to its Yard and Dock Management platform, including a digital driver onboarding system with unified login. The update improves security, reduces manual errors, and enhances operational efficiency for gate and dock processes.

Dock And Yard Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.62 billion

Revenue forecast in 2033

USD 7.27 billion

Growth rate

CAGR of 13.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, functionality, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Manhattan Associates, Inc., Blue Yonder Group, Inc., C3 Solutions, Inc., Descartes Systems Group Inc., 4SIGHT Connect (4sight Solution), Epicor Software Corporation, Oracle Corporation, SAP SE, Infor, Inc., Zebra Technologies Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dock And Yard Management Systems Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dock and yard management systems market report based on component, deployment, functionality, end user, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Yard Visibility & Asset Tracking

-

Dock Scheduling & Appointment Management

-

Fleet & Equipment Resource Optimization

-

Gate Entry & Exit Management

-

Dock Door & Slot Allocation

-

Inventory Management & Cross-Docking

-

Analytics & Operational Intelligence

-

Mobile Task & Shunter Management

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation & Logistics

-

Retail

-

Manufacturing

-

Food & Beverage

-

Healthcare

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dock and yard management systems market size was estimated at USD 2.34 billion in 2024 and is expected to reach USD 7.27 billion in 2033.

b. The global dock and yard management systems market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2033 to reach USD 7.27 billion by 2033.

b. The North America dock and yard management systems market accounted for 38.6% of the global share in 2024. The dock and yard management systems market in North America is being driven by widespread digitization of logistics workflows, growing pressure to reduce dwell times and detention costs, increasing labor shortages in warehousing operations, and expanding e-commerce fulfillment networks

b. Some key players operating in the dock and yard management systems market include Manhattan Associates, Inc., Blue Yonder Group, Inc., C3 Solutions, Inc., Descartes Systems Group Inc., 4SIGHT Connect (4sight Solution), Epicor Software Corporation, Oracle Corporation, SAP SE, Infor, Inc., Zebra Technologies Corporation

b. Key factors that are driving the market growth include rising demand for real-time supply chain visibility, particularly in high-throughput logistics environments. Growth in e-commerce and the need for rapid, accurate fulfillment are pushing businesses to invest in automated dock scheduling and yard tracking tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.