- Home

- »

- Electronic & Electrical

- »

-

Docking Station Market Size, Share & Growth Report, 2030GVR Report cover

![Docking Station Market Size, Share & Trends Report]()

Docking Station Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Laptop, Smartphones), By Connectivity (Wired, Wireless), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-725-4

- Number of Report Pages: 94

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Docking Station Market Summary

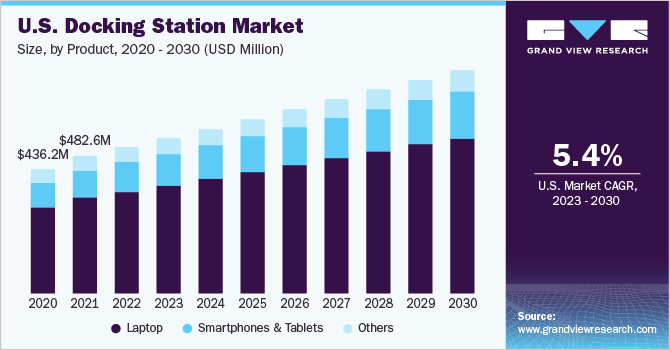

The global docking station market size was estimated at USD 1.51 billion in 2022 and is projected to reach USD 2.44 billion by 2031, growing at a CAGR of 6.1% from 2023 to 2030. The market growth is primarily driven by the rising popularity of the Bring-Your-Own-Device (BYOD) trend and the increasing adoption of remote and hybrid work models.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 37.4% in 2022.

- By product, the laptops segment accounted for the largest revenue share of 72.0% in 2022.

- By connectivity, the wired segment dominated the market and accounted for the largest revenue share of around 73% in 2022.

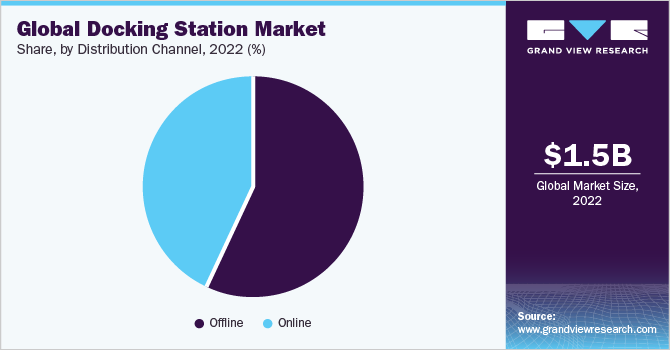

- By distribution channel, The offline segment dominated the market and held the largest revenue share of 57.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.51 Billion

- 2031 Projected Market Size: USD 2.44 Billion

- CAGR (2023-2030): 6.1%

- North America: Largest Market in 2022

In addition, the growing need for faster data transfer is fueling the demand for the aforementioned computing devices. Although the COVID-19 pandemic has been a major disruptor for businesses, manufacturers of laptops, notebooks, and associated accessories were not among them. With offices closed and most professionals reliant solely on personal devices to work from home, these products flew off the shelves in an otherwise quiet market for consumer electronics manufacturers. From market leader HP and premium player Apple to China's Lenovo and Asus, all major brands experienced a rapid increase in demand..

As the industry continues to thrive, brands are paying special attention to their target audience and have been reshaping their marketing strategies to attract customer attention. With the coronavirus pandemic, most of the brands operating in the industry had to focus on e-tailing or direct-to-consumer channels. The companies have also increased spending on sponsorships and partnerships to target larger audiences and increase brand visibility. Growth in the market for gaming consoles and technological advancements in several audiovisual devices have significantly increased the demand for these consoles.

Moreover, vendors operating in the gaming industry offer tailored products in several portable options such as Nintendo Switch with Neon Blue and Neon Red Joy-Console. In addition, with the rising number of gaming subscriptions and the growing popularity of e-sports, the demand for docking stations is expected to increase in the coming years. On the other hand, advancements in Bluetooth technology, such as the introduction of mesh networking, may limit the growth of the industry. However, digitalization is transforming value chains in different ways, and opening up new avenues for value addition and broader structural change. These factors are expected to boost the demand for smartphones, tablets, personal computers, and laptops, thereby, driving the market growth.

Key Brands are offering a wide range of products keeping in mind the millennial and Gen-Z generations, resulting in a plethora of opportunities in the industry. In June 2018, Smart-Things introduced new docking/charging stations, sDock Fix and sDock Nano, for iPad and iPhones. With this product launch, the company expanded its line of iPad and iPhone docking stations, providing integrators with additional options for touchscreen home control stations.

Product Insights

The laptops segment accounted for the largest revenue share of 72.0% in 2022. The primary factor driving the demand for this segment is the increasing scope of application of docking stations in several industries, including e-commerce, supply chain, and warehouse management, among others. Furthermore, with the rising trend of convenient work culture in corporate offices and the growing number of startups and remote workers, the demand for flexible workplaces is increasing worldwide. The use of these docking stations aid in upgrading meeting rooms and lounges, making workplaces more convenient, and converting workstations into standing desks are expected to drive the demand for docking stations for laptops.

However, the smartphone and tablet segment is expected to witness the fastest CAGR of 6.4% during the forecast period. With the growing enthusiasm for online video games, such as Call of Duty, PlayerUnknown’s Battlegrounds, Fortnite, and Grand Theft Auto, worldwide, the demand for smartphones and tablets docking stations is increasing. Some docking station manufacturers have established partnerships with smartphone companies to launch new innovative products. For instance, in July 2021, Targus, a global pioneer in laptop covers and mobile computing accessories, partnered with Samsung to launch a DeX-enabled Universal USB-C Phone Dock. Thus, all the above-mentioned are expected to propel segment growth during the forecast period.

Connectivity Insights

The wired segment dominated the market and accounted for the largest revenue share of around 73% in 2022. Wired docking stations are widely used in the IT industry owing to the high degree of convenience associated with these products. These devices enable high-speed data transfer, which is crucial in the IT industry. Wired docking stations connect portable devices to monitors or desktops through an HDMI cable or DisplayPort. Wireless systems can be easily affected due to channel congestion and Internet issues may reduce data transfer speed and reliability. Thus, wired products are widely preferred over wireless devices.

The wireless docking station segment is expected to witness the highest CAGR of 6.3% during the forecast period. Over the past few years, wireless connectivity of devices is gaining popularity owing to the high degree of convenience associated with it. Factors such as growing flexibility in workplaces and increasing use of electronic devices are opening up new avenues for the market. Manufacturers in the industry have been incorporating wireless technologies, such as Wi-Fi, Bluetooth, and WiGig, in their products, considering the growing demand.

Distribution Channel Insights

The offline segment dominated the market and held the largest revenue share of 57.4% in 2022. Rising internet penetration among consumers and target marketing done by companies to reach all customer touchpoints are key factors fueling the growth of this segment. The rapid expansion of e-commerce, along with growing digitalization, especially among the young and millennial population at a global level, is also driving the online sales of docking stations. Additionally, easy payment transactions and the busy lifestyles of consumers are boosting online product sales. E-commerce is likely to witness significant growth in the coming years on account of the availability of a variety of branded docking stations comprising various features at convenient prices, along with lucrative discounts.

Most consumers prefer offline stores when buying laptop and PC accessories such as docking stations due to the exclusive offerings by product specialists and after-sale services. There are many brick-&-mortar stores such as Target, Walmart, and Old Navy in the U.S. and worldwide that sell docking stations. These stores provide consumers a hands-on experience of how the product works and offer customers various options based on their requirements and budget.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 37.4% in 2022. The rising enthusiasm for e-sports among millennials and children in the region is surging the demand for docking stations. These consumer trends are anticipated to boost the demand for laptops, PCs, and smartphones which will, in turn, augment the demand for a docking station. The Asia Pacific region is estimated to be one of the major markets for docking stations in the coming years. In addition, Asian countries have witnessed rapid growth in the IT industry, rising automation in manufacturing industries, and ascending penetration of online video games. These factors have opened up new growth avenues for docking stations owing to the large-scale application of computers, laptops, tablets, and smartphones in the aforementioned industries.

The subsequent rise in demand for laptops, PCs, and smartphones is, in turn, projected to drive the market over the forecast period. Over the forecast period, the Middle East & Africa region is projected to witness significant demand for a docking station. Consumers looking for replacing their older technology across the region which is further expected to boost the demand for desktops and laptops in the coming years which will, in turn, promote the demand for the docking station in the forecast period..

Key Companies & Market Share Insights

The key players in the industry face intense competition from each other as some of them are among the top manufacturers of electronics and also deal in docking stations. These companies have a large customer base owing to the presence of strong and vast distribution networks to cater to both regional and international consumers. The impact of major players on the industry is quite high as a majority of them are characterized by a global presence. Major players are making efforts to strengthen their presence across new regions in the global market through partnerships with the established distributor.

-

In April 2022, Targus, a leading manufacturer of laptop covers and mobile computing accessories, announced the release of two new Thunderbolt 3 Docks, which have Thunderbolt speed for high-resolution graphics and are designed to fulfil the demanding needs of creative professionals and studios

-

In April 2022, Kensington-a sub-brand of ACCO Brands, the international pioneer in desktop computing and mobility solutions for IT, business, and home office professionals-launched the “Blackbelt Rugged Case” with integrated Mobile Dock for surface Pro 8. It comprises a full-featured docking station with military-grade device protection in a slim and sturdy design

-

In March 2022, Dell Technologies Inc. launched a powerful 14-inch mobile workstation, the world’s smallest 14-inch 16:10 business PC, and the world’s first docking station with a wireless charging stand for Qi-enabled smartphones and earbuds

Some of the prominent players in the global docking station market include:

-

Targus Corporation

-

StarTech.com

-

Dell Technologies Inc.

-

ACCO Brands Corporation

-

HP Development Company

-

Lenovo Group Limited

-

Plugable Technologies

-

Toshiba Corporation

-

Acer Inc.

-

Samsung Electronics Co. Ltd

Docking Station Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,623.0 million

Revenue forecast in 2030

USD 2,444.5 million

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, connectivity, distribution channel, region

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Targus Corporation; Dell Technologies Inc.; StarTech.com; ACCO Brands Corporation; HP Development Company L.P; Lenovo Group Limited; Plugable Technologies; TOSHIBA CORPORATION; Acer Inc.; Samsung Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Docking Station Market Report Segmentation

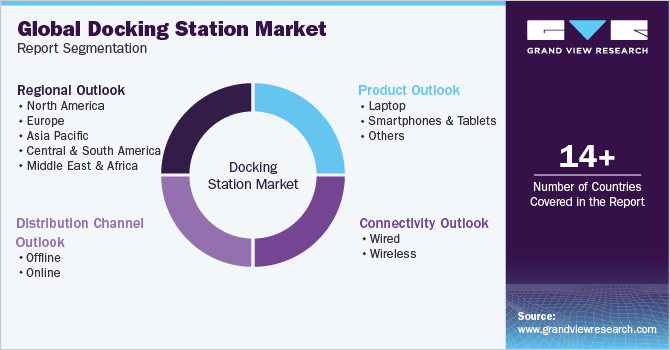

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global docking station market on the basis of product, connectivity distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Laptop

-

Smartphones & Tablets

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global docking station market size was estimated at USD 1518.9 million in 2022 and is expected to reach USD 1622.9 million in 2023

b. The global docking station market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 2,444.5 million by 2030.

b. Laptops dominated the global docking station market with a share of 72.0% in 2022. This is attributable to the ability of these products to allow the laptops to connect with other devices to convert them into desktop computers.

b. Some key players operating in the global docking station market include The Targus Corp.; StarTech.com; Dell Technologies, Inc.; ACCO Brands Corp.; HP Development Company; Lenovo Group Ltd.; Plugable Technologies; Toshiba Corp.; Apple, Inc.; and Samsung Group.

b. Key factors that are driving the docking station market growth include the increased importance of these devices for numerous applications, growing popularity of the Bring-Your-Own-Device (BYOD) work culture to reduce expenses and increase flexibility and efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.