- Home

- »

- Consumer F&B

- »

-

Dog Dental Chews Market Size, Share, Growth Report, 2030GVR Report cover

![Dog Dental Chews Market Size, Share & Trends Report]()

Dog Dental Chews Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dental Bones, Dental Sticks), By Ingredient Type, By Age Group, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dog Dental Chews Market Summary

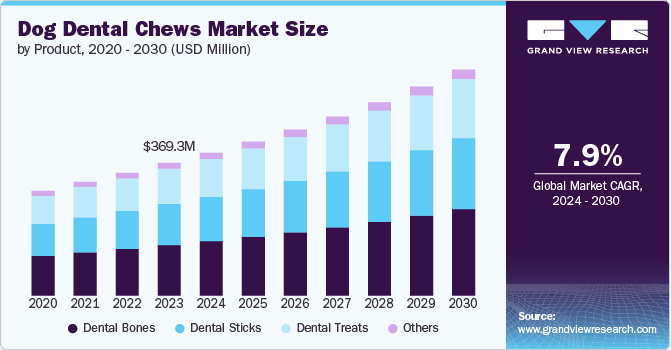

The global dog dental chews market size was estimated at USD 369.25 million in 2023 and is projected to reach USD 628.29 million by 2030, growing at a CAGR of 7.9% from 2024 to 2030. Increasing pet ownership and the growing trend of pet humanization have increased the focus on pets' overall health and well-being, leading to greater demand for effective dental care solutions.

Key Market Trends & Insights

- North America dog dental chews market accounted for a revenue share of 34.55% in 2023.

- Based on product, the dog dental bones segment accounted for a revenue share of 38.02% in 2023.

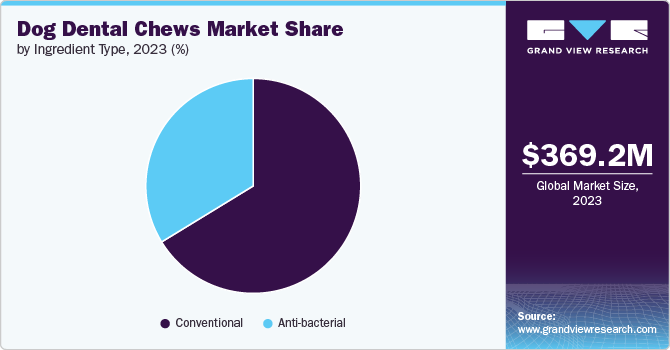

- Based on ingredient type, the conventional segment accounted for a revenue share of 66.27% in 2023.

- Based on age group, the adult dogs segment accounted for a revenue share of 58.92% in 2023.

- Based on application, the residential segment accounted for a revenue share of 87.18% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 369.25 Million

- 2030 Projected Market Size: USD 628.29 Million

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

Moreover, the rising awareness among pet owners about the significance of oral hygiene and its impact on pets' general health has further fueled the demand for dog dental chews. The market is also benefiting from a wide range of innovative and specialized dental chew products designed to address various needs and preferences.

The increasing awareness among pet owners about the importance of oral health for dogs is driving the market. Pet owners are becoming more informed about the consequences of poor dental hygiene, which can lead to severe health issues such as periodontal disease, tooth loss, and systemic infections. According to the American Veterinary Dental Society (AVDC), approximately 80% of dogs show signs of dental disease by the age of three. This heightened awareness has led to a surge in demand for products that help maintain oral health, including dental chews.

The rising number of pet owners and increased expenditure on pet care are driving the growth of the market. According to the American Pet Products Association (APPA), pet owners in the U.S. spent approximately USD 123 billion on pets in 2021, with a significant portion allocated to pet health products. This trend is mirrored globally, with pet ownership rates rising and pet care becoming a more significant part of household spending.

As pet owners become more willing to invest in high-quality products for their pets, the demand for specialized items like dental chews grows. Manufacturers are capitalizing on this trend by introducing premium products with advanced features, such as added vitamins, minerals, and natural ingredients that appeal to health-conscious pet owners. There is a growing preference among pet owners for natural and organic products, including dental chews. Consumers are increasingly concerned about the ingredients in pet products and their potential impact on their pets' health. This trend is reflected in the rising demand for dental chews made with natural, organic, and non-GMO ingredients.

Innovation in product development is a key driver in the dog dental chews market. Manufacturers are continuously introducing new and improved dental chews to meet the evolving needs of pets and their owners. This includes innovations in chew textures, flavors, and ingredients. For instance, some dental chews are designed with unique textures and shapes that enhance their cleaning effectiveness. Chews with dual-action features, such asthose that combine brushing and chewing actions, are becoming increasingly popular. Additionally, the inclusion of natural ingredients like coconut oil, green tea extract, and probiotics in dental chews is gaining traction. These innovations not only improve the effectiveness of the chews but also appeal to pet owners seeking natural and holistic solutions for their pets' health.

Product Insights

Dog dental bones accounted for a revenue share of 38.02% in 2023, due to their effectiveness and durability. These chews are specifically designed to clean dogs' teeth, control plaque, and reduce tartar buildup. Their rigid texture and structure provide a more robust and longer-lasting chewing experience compared to other types of dental chews. This functionality aligns with pet owners' preference for products that not only entertain their dogs but also contribute significantly to their dental health. Additionally, dental bones often come in various sizes and formulations tailored to different dog breeds and sizes, further driving their widespread adoption.

Dog dental sticks are expected to grow at a CAGR of 8.2% from 2024 to 2030, due to their convenience and ease of use. Unlike dental bones, which may be more challenging for some dogs to chew, dental sticks offer a more straightforward chewing experience. They are often designed to be easily digestible, and their texture aids in cleaning teeth and freshening breath without being too tough. Additionally, dental sticks are frequently available in a range of flavors and sizes, making them appealing to both dogs and their owners. This versatility and user-friendliness contribute to their rapid growth in the market.

Ingredient Type Insights

Conventional dental chews accounted for a revenue share of 66.27% in 2023 due to their established presence and proven effectiveness. Conventional ingredients used in these chews, such as various forms of abrasive materials or dental enzymes, have a long history of use and are widely trusted by pet owners and veterinarians. These traditional formulations have been extensively tested and refined, leading to a high level of consumer confidence. Conventional dental chews are also often more cost-effective compared to newer, experimental ingredients, which makes them an attractive option for budget-conscious consumers.

Antibacterial dental chews are expected to grow at a CAGR of 8.6% from 2024 to 2030. These chews contain specialized ingredients that target and inhibit the growth of harmful bacteria in the dog’s mouth, providing a higher level of dental care compared to standard chews. The inclusion of antibacterial agents helps prevent infections, reduce bad breath, and promote overall oral hygiene. With increasing awareness among pet owners about the importance of comprehensive dental care and the benefits of preventing bacterial growth, there is a growing demand for products that offer these advanced health benefits. This heightened awareness and focus on preventative health measures contribute to the fast-paced growth of the antibacterial segment in the market.

Age Group Insights

Dental chews for adult dogs accounted for a revenue share of 58.92% in 2023 due to their higher prevalence and the specific dental health needs that arise in this age group. As dogs age, they are more likely to develop dental issues such as plaque buildup, tartar, and gum disease. This makes dental chews a critical component of their oral care routine. The larger number of adult dogs compared to puppies or senior dogs also contributes to their dominant market share. Pet owners of adult dogs are more likely to invest in dental chews as a preventive measure or treatment for existing dental problems. The focus on addressing the specific oral health needs of adult dogs drives their significant presence in the market.

Dental chews for puppies are expected to grow at a CAGR of 10.3% from 2024 to 2030 owing to the increasing recognition of the importance of early dental care. Introducing dental chews during a puppy’s formative years helps establish good oral hygiene habits and can prevent future dental issues. Products formulated for puppies are designed to be gentle on their developing teeth while still providing dental benefits. The growing emphasis on preventive health care and the desire to start dental hygiene routines early are driving the demand for puppy-specific dental chews. As more pet owners become aware of the benefits of early intervention in dental health, the puppy segment is expanding rapidly within the market.

Application Insights

Residential applications accounted for a revenue share of 87.18% in 2023 driven by increasing utilization of these products in home settings. The home environment allows for regular administration of dental chews as part of a daily or weekly routine. This convenience, combined with the control that pet owners have over their dogs’ diets and care routines, makes residential use the most common application. Pet owners can easily integrate dental chews into their dogs’ daily activities, ensuring consistent use and benefiting from the product’s oral health advantages. The large number of households with pets globally supports the dominance of residential applications in the market.

Commercial applications are expected to grow at a CAGR of 9.0% from 2024 to 2030 due to the increasing adoption of these products in professional pet care settings. Grooming salons, boarding kennels, and pet daycares are incorporating dental chews into their services to offer comprehensive care to the pets they handle. These facilities often purchase dental chews in bulk and provide them as part of their grooming or boarding packages, driving the demand for commercial-grade products. The growth in the number of professional pet care services and their emphasis on enhancing pet health contributes to the rapid expansion of the commercial segment in the market.

Distribution Channel Insights

The sales of dog dental chews through hypermarkets and supermarkets accounted for a revenue share of 32.18% in 2023 due to their extensive reach and accessibility to a broad consumer base. These retail outlets offer a wide variety of pet products, including dental chews, making them a convenient shopping destination for pet owners. Supermarkets benefit from high foot traffic and the ability to offer competitive pricing and promotional deals, which attract consumers seeking value and convenience. The broad product assortment and frequent promotions help supermarkets maintain their leading position in the distribution of dog dental chews, making them a preferred choice for many pet owners.

The sales of dog dental chews through online distribution channels are expected to grow at a CAGR of 9.6% from 2024 to 2030. E-commerce platforms provide a vast selection of products, allowing consumers to access a wide range of dental chews, including different brands, flavors, and formulations, from the comfort of their homes. The convenience of online shopping, combined with features such as price comparisons, customer reviews, and subscription services for regular deliveries, makes it an attractive option for pet owners. Additionally, the growth of digital marketing and targeted online promotions helps drive consumer traffic to e-commerce sites. The increasing preference for online shopping and the ease of accessing a diverse range of products contribute to the rapid expansion of the online channel in the market.

Regional Insights

North America dog dental chews market accounted for a revenue share of 34.55% in 2023 due to a combination of high pet ownership rates, advanced pet care practices, and a well-established retail infrastructure. In the U.S. and Canada, pet owners are highly invested in their pets' health, leading to a strong demand for products that improve dental hygiene. The region benefits from a mature market with numerous well-established brands and extensive distribution networks, including supermarkets, pet specialty stores, and online platforms. Additionally, North American consumers are willing to spend on premium pet products, which drives the demand for high-quality and innovative dental chews.

U.S. Dog Dental Chews Market Trends

The dog dental chews market in the U.S. is expected to grow at a CAGR of 7.5% from 2024 to 2030. The U.S. has one of the highest rates of pet ownership globally, with a significant number of households having dogs. This large pet population creates a robust demand for dental chews. There is a high level of awareness and education among U.S. pet owners regarding the importance of dental health for pets. This drives the demand for dental chews that promote oral hygiene. The U.S. market benefits from continuous innovation, with companies regularly introducing new and advanced dental chew formulations. These innovations cater to various needs, including dental health, flavor preferences, and specific dental issues.

Europe Dog Dental Chews Market Trends

The Europe dog dental chews market is expected to grow at a CAGR of 7.2% from 2024 to 2030, driven by increasing awareness of pet health and rising pet ownership across the region. European consumers are becoming more conscious of their pets’ oral hygiene, leading to higher demand for effective dental care solutions. Countries such as Germany, France, and the U.K. are leading the market with their emphasis on premium pet products and innovative dental care solutions. Additionally, the growing trend of pet humanization, where pets are treated with the same care and attention as family members, is driving the adoption of specialized dental chews. The presence of strong retail networks and a growing number of pet-focused stores and online platforms are also contributing to the market’s significant growth in Europe.

Asia Pacific Dog Dental Chews Market Trends

Asia Pacific dog dental chews market is expected to grow with a CAGR of 9.3% from 2024 to 2030, due to increasing pet ownership, rising disposable incomes, and growing awareness about pet health. Rapid urbanization and a burgeoning middle class in countries like China and India are driving higher spending on pets, including dental care products. The rise in pet adoption and the growing number of pet-friendly households are contributing to the surging demand for dog dental chews. Additionally, e-commerce growth in the region is facilitating greater access to a variety of pet products, including dental chews. The Asia Pacific market is also seeing a rise in local and international brands catering to the specific needs and preferences of pet owners in different countries, further fueling its rapid expansion.

Key Dog Dental Chews Company Insights

The market is characterized by the presence of numerous players, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. They respond to market demands with new products and improved nutritional profiles. This dynamic environment drives companies to focus on research and development, ensuring their products are not only effective in maintaining oral health but also appealing to both pets and their owners.

Furthermore, the competitive nature of the market encourages brands to invest in marketing strategies and educational campaigns to raise awareness about the importance of dental hygiene in dogs. Collaborations with veterinarians and endorsements from pet health experts are commonly used to build credibility and trust among consumers.

Key Dog Dental Chews Companies:

The following are the leading companies in the dog dental chews market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Inc.

- Nestlé Purina PetCare

- Colgate-Palmolive Company

- Merrick Pet Care, Inc.

- The J.M. Smucker Company

- Blue Buffalo Co., Ltd.

- WellPet LLC

- Spectrum Brands Holdings, Inc.

- Nutri-Vet Wellness LLC

- Arm & Hammer

Recent Developments

-

In March 2024, PetIQ launched Minties dental treats for large-sized dogs, expanding the brand's offerings to now include products for large, medium, and small dogs. The new treats feature five natural breath fresheners-parsley, alfalfa, fennel, peppermint, and dill-and are designed with bumps and divots to help remove tartar and plaque, promoting dental health and fresh breath.

-

In March 2024, NPIC introduced Flossta by N-Bone, a new dental chew for dogs designed to clean teeth and gums in hard-to-reach areas. Formulated with natural herbs like fennel and parsley to freshen breath, Flossta chews come in beef liver, chicken, and mint flavors. They are free from wheat, corn, and artificial ingredients.

-

In February 2024, Blue Buffalo introduced a new dental chew for dogs made with natural ingredients. Patented in December 2023, the chews feature 50 ridges and grooves to clean teeth, support gum health, and freshen breath. The spearmint-flavored chews contain real chicken for a meaty taste and are designed to safely control tartar and plaque, avoiding the dental damage caused by harder chew objects.

Dog Dental Chews Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 397.23 million

Revenue forecast in 2030

USD 628.29 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient type, age group, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Mars, Inc.; Nestlé Purina PetCare; Colgate-Palmolive Company; Merrick Pet Care, Inc.; The J.M. Smucker Company; Blue Buffalo Co., Ltd.; WellPet LLC; Spectrum Brands Holdings, Inc.; Yasso; Nutri-Vet Wellness LLC; Arm & Hammer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dog Dental Chews Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dog dental chews market report based on the product, ingredient type, age group, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Bones

-

Dental Sticks

-

Dental Treats

-

Others

-

-

Ingredient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-bacterial

-

Conventional

-

-

Age Group Outlook (Revenue, USD Million, 2018 -2030)

-

Puppy

-

Adult

-

Senior

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Veterinary Hospitals

-

Pet Care Centers

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/Supermarkets

-

Specialty Stores

-

Veterinary Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dog dental chews market size was estimated at USD 369.25 million in 2023 and is expected to reach USD 397.23 million in 2024.

b. The global dog dental chews market is expected to grow at a compounded growth rate of 7.9% from 2024 to 2030 to reach USD 628.29 million by 2030

b. Dog dental bones accounted for largest revenue share of 38.0% in 2023 due to their effectiveness and durability. Their rigid texture provides a robust, long-lasting chewing experience, helping to clean teeth, control plaque, and reduce tartar. The variety of sizes and formulations for different breeds drives their widespread use

b. Some key players operating in dog dental chews market include Mars, Inc.; Nestlé Purina PetCare; Colgate-Palmolive Company; Merrick Pet Care, Inc.; The J.M. Smucker Company; Blue Buffalo Co., Ltd.; WellPet LLC; Spectrum Brands Holdings, Inc.; Yasso; Nutri-Vet Wellness LLC; Arm & Hammer.

b. Key factors that are driving the market growth include the increasing pet ownership worldwide, coupled with growing awareness of pet dental health. Pet humanization trends are leading owners to prioritize their dogs' overall well-being, including oral hygiene. Rising disposable incomes in many regions allow pet owners to spend more on premium pet care products. The convenience and preventative nature of dental chews, as opposed to more difficult tooth-brushing routines, appeals to busy pet owners.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.