- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Global Dyes And Pigments Market Size & Growth Report, 2030GVR Report cover

![Dyes And Pigments Market Size, Share & Trends Report]()

Dyes And Pigments Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dyes (Reactive, Vat, Acid, Direct, Disperse), Pigment (Organic, Inorganic)), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-545-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dyes And Pigments Market Summary

The global dyes and pigments market size was valued at USD 40,086.0 million in 2023 and is projected to reach USD 57,772.0 million by 2030, growing at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Increasing demand from various application industries such as textiles, paints & coatings, construction, and plastics is expected to drive the market growth.

Key Market Trends & Insights

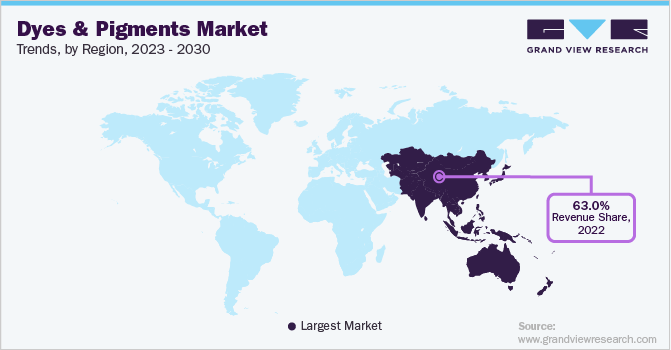

- Asia Pacific was the dominant regional market and accounted for over 63% of the global revenue share in 2022.

- Based on product, the reactive dyes segment dominated the market with a revenue share of more than 57% in 2022.

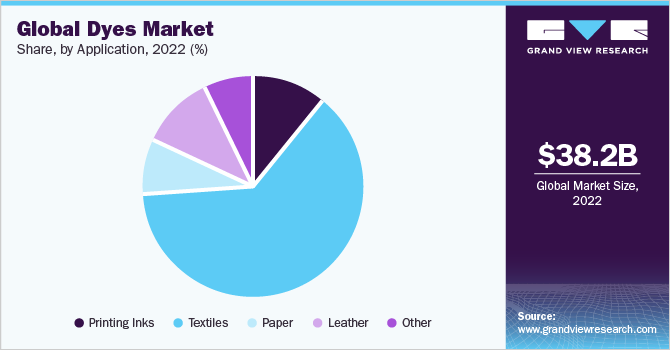

- Based on application, the textiles segment dominated the market with a share of over 62%, in terms of revenue, in 2022.

Market Size & Forecast

- 2023 Market Size: USD 40,086.0 Million

- 2030 Projected Market Size: USD 57,772.0 Million

- CAGR (2024-2030): 5.4%

- Asia Pacific: Largest market in 2023

Major producers are actively venturing into enhancing their products by utilizing advanced technologies for the efficient removal of hazardous pollutants during the manufacturing process. Manufacturers are likely to experience varied production costs due to volatility in the prices of raw materials, such as benzene. A wide distribution network in the market is achieved through both brick & mortar stores and online retailing.

The availability of products on e-commerce platforms has increased the client base of market participants. Rapid growth in the global construction industry has also been a key growth-driving factor for the overall market. Countries, such as U.S., U.K., China, Indonesia, India, Saudi Arabia, and UAE, exhibit significant growth potential in the global construction sector.

The rising population coupled with rapid industrialization has encouraged governments to increase their construction spending for infrastructural development. Thus, increasing construction expenditure across the world is expected to create a massive product demand in the coming years. However, increasing environmental concerns are resulting in policy changes across the globe, which is anticipated to restrain the market growth over the forecast period.

Factors, such as water pollution during the manufacturing processes, high metal content in pigments, and high water consumption in the textile industry to rinse dyes, are the major environmental threats. Stringent regulations have been imposed in regions, such as Europe, North America, and China, which may challenge market growth.

Product Insights

The reactive dyes segment dominated the market with a revenue share of more than 57% in 2022. These products are composed of highly colored organic substances and have primary applications in tinting textiles. They have a high resistance to fading and are available in a range of bright shades, which makes them suitable for coloring cotton and rayon. Moreover, they can form a covalent bond with fibers during the process of dyeing. It also includes a parent dye, a linking group, and an active group. These advantages enable them to inhibit characteristics, which are superior and preferable over other dyes used in cellulose fibers. The segment is estimated to expand further at the fastest CAGR from 2023 to 2030.

Inorganic pigments earned a higher share in the market as compared to organic pigments due to properties, such as good wetting, darker color, and leanness. However, the organic pigments segment is anticipated to register the fastest CAGR of 5.7%, in terms of revenue, from 2023 to 2030. Stringent regulations affecting the inorganic pigments demand are also likely to provide positive scope for organic pigments through internal substitution of the product.

Application Insights

The textiles segment dominated the market with a share of over 62%, in terms of revenue, in 2022. However, the printing ink segment is estimated to register the fastest CAGR from 2023 to 2030. The growing digital printing sector is anticipated to fuel the demand for dyes in printing inks application. Countries, such as India and China, are major producers of dyes, which are likely to provide positive scope for printing inks application across the Asia Pacific region.

Dyes are used in inks for infusing desired color and density. Dyes can produce more color and density per unit of mass than pigments. The dye-based inks can interact chemically with other ingredients. Hence, they deliver better prints than pigment-based inks, when combined with optical brighteners and color-enhancing agents. These factors are anticipated to boost product demand in the printing ink application segment.

Regional Insights

Asia Pacific was the dominant regional market and accounted for over 63% of the global revenue share in 2022. The market faces strict regulation scenarios that obstruct product usage as well as production in North America and Europe. Thus, the production facilities are being shifted to the Asia Pacific region owing to favorable manufacturing conditions and leniency in regulations. This is supported by the easy availability of raw materials and low-cost & skilled manpower.

Europe accounted for over 17% of the overall revenue share in 2022. The increasing production capacities of dyes in Europe are an indication of their increasing demand. For instance, Cathay Industries announced the expansion of its manufacturing footprint in South East Asia to meet the increasing demand for iron oxide pigments from the coating, plastics, and construction industries.

Key Companies & Market Share Insights

Major players in the market are involved in the research & development for the production of superior-quality colors that provide improved features. In addition, the companies are also engaging in technological collaborations to boost the efforts in R&D activities. The products are primarily distributed through company-owned distribution channels. Moreover, third-party distribution channels are also employed. The companies lay high emphasis on expanding their geographical reach to increase their market share. The global dyes & pigments industry is significantly fragmented owing to the presence of a large number of manufacturers across the globe. Some prominent players in the global dyes and pigments market include:

-

BASF SE

-

Clariant AG

-

DIC Corp.

-

Sudarshan Chemical Industries Ltd.

-

Atul Ltd.

-

Huntsman Corp.

-

Kronos Worldwide Inc.

-

Lanxess AG

-

Kiri Industries Ltd.

Dyes And Pigments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42,117.5 million

Revenue forecast in 2030

USD 57,772.0 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; India; China; Brazil

Key companies profiled

BASF SE; Clariant AG; DIC Corp.; Sudarshan Chemical Industries Ltd.; Atul Ltd.; Huntsman Corp.; Kronos Worldwide Inc.; Lanxess AG; Kiri Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dyes And Pigments Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dyes and pigments market report based on product, application, and region:

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Dyes

-

Reactive Dyes

-

Vat Dyes

-

Acid Dyes

-

Direct Dyes

-

Disperse Dyes

-

Others

-

-

Pigments

-

Organic

-

Inorganic

-

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Dyes

-

Printing Inks

-

Textiles

-

Paper

-

Leather

-

Others

-

-

Pigments

-

Paints & Coatings

-

Construction

-

Printing Inks

-

Others

-

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

India

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global dyes & pigments market size was estimated at USD 38.2 billion in 2022 and is expected to reach USD 40.1 billion in 2023.

b. The global dyes & pigments market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 57.8 billion by 2030.

b. The reactive dyes segment dominated the dyes and pigments market with a revenue share of more than 57% in 2022. These products are a type of synthetic dye used for coloring textiles, specifically for cellulosic fibers like cotton and rayon.

b. The textiles segment dominated the dyes market with a share of over 62%, in terms of revenue, in 2022. However, the printing inks segment is estimated to register the fastest CAGR from 2023 to 2030.

b. Asia-Pacific dominated the dyes & pigments market with a share of more than 63% in 2022. The growth in this region can be attributed to increasing consumer spending power, rapidly expanding economy, and the growth of end-use industries such as textiles, construction, and packaging, which are key consumers of dyes and pigments.

b. Some key players operating in the dyes & pigments market include Clariant AG, DIC Corporation, Sudarshan Chemical Industries Limited, Huntsman International LLC, Atul Ltd., Cabot Corporation, and DuPont.

b. Key factors that are driving the dyes & pigments market growth include increasing demand for dyes & pigments from the end-use industries such as textiles, construction, paints and coatings, and plastics is estimated to create new opportunities in the market space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.