- Home

- »

- Communications Infrastructure

- »

-

Dynamic Positioning System Market, Industry Report, 2033GVR Report cover

![Dynamic Positioning System Market Size, Share & Trends Report]()

Dynamic Positioning System Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment Class (Class 1, Class 2, Class 3), By Fit, By System (Thruster & Propulsion Systems, Power Management Systems), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-694-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dynamic Positioning System Market Summary

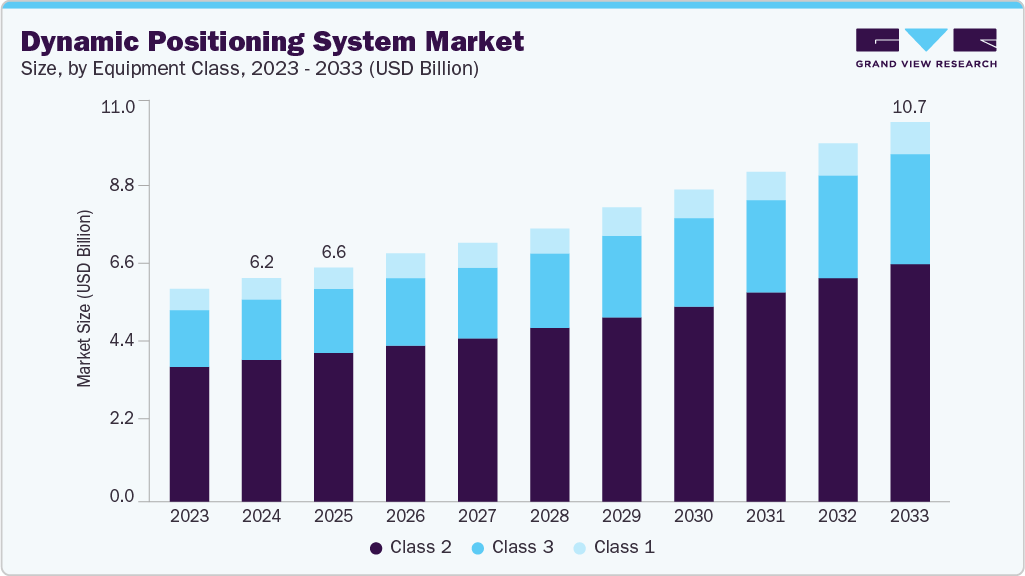

The global dynamic positioning system market size was estimated at USD 6.25 billion in 2024 and is projected to reach USD 10.71 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The surge in deepwater and ultra-deepwater oil and gas exploration is a major factor driving the demand for dynamic positioning systems (DPS).

Key Market Trends & Insights

- Europe dominated the global dynamic positioning system market with the largest revenue share of over 34.10% in 2024.

- The dynamic positioning system industry in the U.S. is expected to grow significantly over the forecast period.

- By equipment class, the class 2 segment led the market with the largest revenue share of 59.50% in 2024.

- By fit, the linefit segment dominated the industry in 2024.

- By system, the DP control system segment dominated industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD USD 6.25 Billion

- 2033 Projected Market Size: USD 10.71 Billion

- CAGR (2025-2033): 6.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The growth of global maritime trade and expanding port infrastructure projects has increased the demand for specialized vessels used in dredging, construction, and offshore support. These operations often occur in constrained or busy waterways where precise positioning is essential. Dynamic positioning systems enable such vessels to maintain stability and accuracy during critical tasks, enhancing safety, efficiency, and operational control in complex maritime environments.In these challenging offshore environments, conventional anchoring or mooring methods are often impractical or unsafe due to water depth and seabed conditions. Precise vessel positioning becomes essential for critical operations such as drilling, maintenance, well intervention, and subsea construction. DPS-equipped vessels ensure stability and exact positioning by automatically adjusting thrusters and propulsion systems in response to environmental forces like wind, waves, and currents. Regions such as the Gulf of Mexico, Brazil’s pre-salt basin, and offshore West Africa are witnessing strong offshore exploration activities, creating a significant need for advanced DPS technology to support complex and high-risk offshore energy projects.

The expansion in emerging markets such as Southeast Asia, the Middle East, and West Africa is opening new growth avenues for dynamic positioning system (DPS) providers. These regions are experiencing a rise in offshore oil and gas exploration, driven by resource development initiatives and energy security needs. Additionally, naval modernization programs are boosting demand for advanced maritime technologies, including DPS. The growth of local shipbuilding industries in countries like Singapore, Indonesia, and the UAE is further fueling regional demand, as new offshore support vessels, naval ships, and specialized marine platforms are equipped with dynamic positioning capabilities. This emerging momentum offers significant opportunities for both DPS manufacturers and service providers seeking global expansion.

The high initial cost of installing dynamic positioning systems is a key restraint, particularly for Class 2 and Class 3 setups. These systems require costly components such as advanced thrusters, precision sensors, complex control units, and redundant power systems. For smaller operators or vessels with less critical operational needs, the significant capital expenditure may outweigh the perceived benefits, making DPS adoption financially challenging in cost-sensitive market segments.

Equipment Class Insights

The class 2 segment dominated the dynamic positioning system market with a revenue share of 59.50% in 2024. Class 2 systems offer fault tolerance, ensuring vessel stability even if a single fault occurs, making them ideal for critical offshore operations such as platform supply, subsea construction, and maintenance tasks. The rising demand for offshore support vessels (OSVs) and construction vessels in deepwater projects is boosting adoption. Additionally, stricter regulatory standards from classification societies require Class 2 DP systems for certain offshore operations, driving retrofits and new installations. Emerging offshore markets in Asia Pacific, the Middle East, and Latin America further contribute to this segment’s growth by increasing vessel demand with Class 2 compliance.

The class 3 segment is anticipated to grow at the fastest CAGR of 7.4% during the forecast period. Ultra-deepwater exploration and production (E&P) activities demand the highest levels of operational safety, especially in challenging offshore environments. In such settings, any vessel failure can result in catastrophic environmental damage, operational downtime, and significant financial losses. Class 3 dynamic positioning systems are specifically designed for these high-risk operations, offering full redundancy and protection against critical failures, including fire or flooding in any compartment. Their advanced fault tolerance ensures uninterrupted vessel positioning during deepwater drilling, subsea construction, and complex offshore operations, making them indispensable for ultra-deepwater projects worldwide.

Fit Insights

The linefit segment dominated the dynamic positioning system industry with the largest revenue share in 2024. Vessel owners increasingly prefer factory-installed dynamic positioning (DP) systems as part of new vessel construction, known as linefit installations. These integrated systems offer seamless compatibility with the vessel’s propulsion, power management, and control architecture, enhancing operational efficiency and reliability. Factory-installed DP systems also come with comprehensive warranty coverage and technical support, reducing long-term maintenance risks. Moreover, integrating the system during construction eliminates the need for expensive and complex retrofitting later. This preference for ready-to-deploy, manufacturer-backed solutions is driving significant growth in the linefit segment of the DPS market.

The retrofit segment is expected to grow at a significant CAGR during the forecast period. As offshore support vessels, drillships, and platform vessels age, their original dynamic positioning systems often become outdated or inefficient. Retrofitting these vessels with modern DPS technology improves positioning precision, system reliability, and operational safety. This approach allows operators to extend the service life of their fleets and meet evolving industry standards without the significant expense of commissioning new vessels, making retrofitting a cost-effective fleet modernization strategy.

System Insights

The DP control system segment dominated the dynamic positioning system industry with the largest revenue share in 2024. The rise of autonomous and smart vessels is significantly driving demand for advanced dynamic positioning (DP) control systems. These vessels rely on highly automated, intelligent systems for precise navigation and station-keeping without direct human control. DP systems integrated with predictive analytics, AI algorithms, and adaptive control technologies enable autonomous vessels to respond dynamically to environmental changes like wind, waves, and currents. This capability is critical for offshore operations, unmanned support vessels, and remote monitoring applications, positioning advanced DP control systems as a key enabler of next-generation maritime autonomy.

The thrusters & propulsion systems segment is expected to grow at a significant CAGR during the forecast period. Thrusters play a vital role in station-keeping, enabling vessels to maintain precise positioning in challenging marine environments. In Class 2 and Class 3 dynamic positioning systems, thrusters are critical for maneuverability and system redundancy, ensuring continued operation even if one component fails. They counteract environmental forces like wind, waves, and currents, making them indispensable for offshore operations that demand high safety standards and reliable vessel control under adverse conditions.

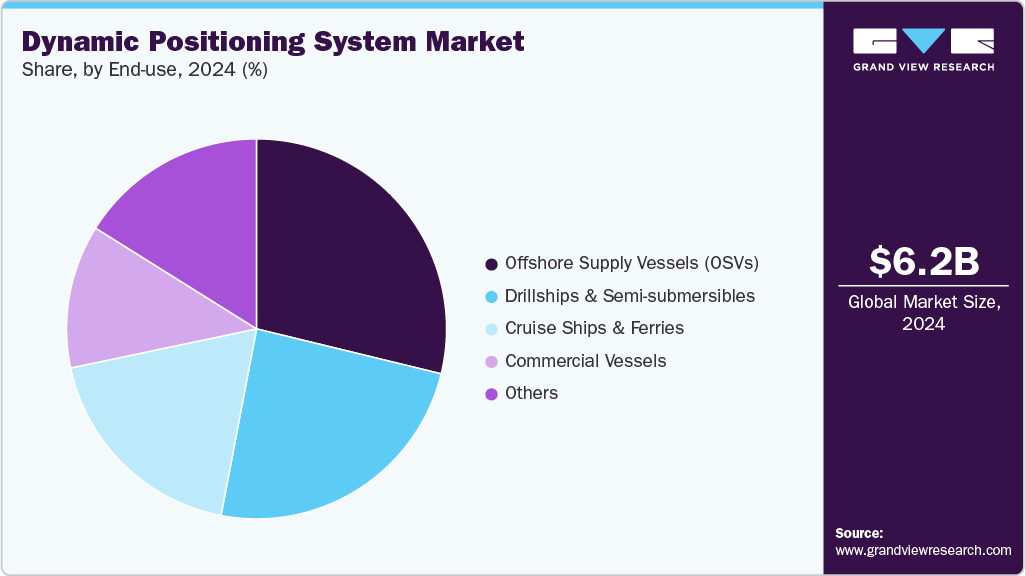

End-use Insights

The offshore supply vessels (OSVs) segment dominated the market with the largest revenue share in 2024. The rapid expansion of offshore wind energy projects, especially in Europe and Asia, is a key driver for the offshore supply vessels (OSVs) segment in the dynamic positioning system market. Offshore wind farm installation, maintenance, and cable-laying operations require precise positioning in harsh marine environments, making advanced DP systems essential. OSVs equipped with dynamic positioning capabilities are critical for transporting equipment, personnel, and supporting offshore construction tasks. The continued growth of renewable energy initiatives is thus fueling strong demand for DP-enabled OSVs, particularly in emerging offshore wind markets.

The cruise ships and ferries segment is expected to grow at a significant CAGR during the forecast period. Cruise ships increasingly use dynamic positioning systems (DPS) for precise maneuvering and mooring, especially in congested ports or sensitive coastal areas where anchoring is restricted or impractical. DPS allows vessels to maintain exact positions without physical anchors, enhancing safety during docking and undocking operations. This capability ensures efficient port calls, reduces the risk of collisions or groundings, and supports smooth operations in areas with limited docking infrastructure.

Regional Insights

The dynamic positioning system market in North America is anticipated to register considerable growth from 2025 to 2033. North America’s offshore oil and gas sector, especially in the Gulf of Mexico, drives strong demand for dynamic positioning systems. Precise station-keeping is critical for drilling, subsea construction, and maintenance operations in deepwater environments. DPS-equipped vessels ensure operational safety, efficiency, and compliance with stringent offshore industry standards in these regions.

U.S. Dynamic Positioning System Market Trends

The dynamic positioning system industryin the U.S. is expected to grow significantly at a CAGR of 5.8% from 2025 to 2033. The U.S. offshore wind sector is rapidly expanding, particularly along the Massachusetts, New York, Atlantic, and Gulf coasts. These projects demand DPS-equipped vessels for critical tasks like turbine installation, cable-laying, and maintenance in dynamic marine environments. This growing renewable energy push is a key driver for DPS adoption in the U.S.

Europe Dynamic Positioning System Market Trends

The Europe dynamic positioning system industry held the largest revenue share of 34.10% in 2024. Europe’s dominance in offshore wind energy, particularly in the North Sea, drives strong demand for dynamic positioning systems. With targets of 120 GW by 2030 and 300 GW by 2050, offshore wind projects rely on DPS-equipped vessels for safe installation, maintenance, and cablingmaking offshore renewables a key market growth driver.

The UK dynamic positioning system marketis expected to grow rapidly in the coming years. The UK’s strict maritime regulations and classification standards mandate advanced dynamic positioning (DP) systems for offshore operations. These rules emphasize vessel safety, operational redundancy, and environmental protection. This regulatory framework aligns with the Maritime 2050 strategy, promoting digital transformation and encouraging the adoption of high-tech DP solutions across the maritime sector.

The dynamic positioning system market in Germanyheld a substantial market share in 2024. Germany’s Baltic and North Sea subsea infrastructure projects, like undersea cable laying (NordLink, Baltic Cable), hydrogen pipeline developments, and offshore construction, drive demand for DP-equipped vessels. Additionally, smart port initiatives in Hamburg and Bremerhaven require precise DP-enabled dredging and port operations, boosting the adoption of advanced dynamic positioning systems in maritime projects.

Asia Pacific Dynamic Positioning System Market Trends

Asia Pacific held a significant share in the global dynamic positioning system industry in 2024. Asia-Pacific’s dominant shipbuilding nations, like China, South Korea, and Japan, are driving DPS market growth by manufacturing new vessels equipped with advanced dynamic positioning systems. These shipyards also support retrofitting older fleets with modern DPS, leveraging integrated technologies at the construction stage to meet growing offshore, commercial, and naval market demands across the region.

The Japan dynamic positioning system marketis expected to grow rapidly in the coming years. Japan’s emerging offshore wind farms, such as Ishikari Bay (112 MW) and Akita-Noshiro (140 MW), are driving demand for dynamic positioning systems. These projects require DP-equipped vessels for accurate positioning during turbine installation, subsea cabling, and maintenance operations, supporting Japan’s expanding offshore renewable energy infrastructure and maritime service sector.

The dynamic positioning system market in Chinaheld a substantial revenue share in 2024. China’s dominance in global shipbuilding drives significant demand for dynamic positioning systems. Leading shipyards produce a vast number of DP-equipped vessels while retrofitting existing fleets with advanced systems. Competitive manufacturing costs and strong domestic demand make China a key hub for both newbuild and retrofit DPS installations in the maritime sector.

Key Dynamic Positioning System Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, Sonardyne introduced SPRINT‑Nav DP, a compact hybrid inertial and Doppler Velocity Log (DVL) positioning system tailored for shallow-water DP operations. It allows vessels to maintain precise station-keeping up to 230 meters depth even in GNSS-denied environments without deploying external reference sensors. This system will be factory pre-calibrated and ready to use, and ideal for offshore wind, nearshore construction, and subsea work.

-

In April 2024, Wartsila Corporation introduced an advanced thruster and propulsion control package to enhance offshore dynamic positioning (DP) performance. The company unveiled a suite featuring its WST‑E embedded electric steerable thruster, new WST‑R retractable thrusters, and an enhanced ProTouch remote propulsion control interface. The retractable models include an 8° tilted propeller shaft, boosting effective thrust by 15–20%, reducing installed power needs, and lowering fuel consumption and emissions. The compact embedded electric design enables installation in constrained spaces, while ProTouch simplifies operator interaction through a cleaner interface for improved real‑time DP accuracy. This innovation enhances positioning precision, operational efficiency, and contributes to vessel decarbonization.

-

In February 2023, Volvo Penta AB announced that it is now offering its GPS-based Dynamic Positioning System (DPS) across its twin V6 and V8 propulsion packages. The system enables precise, automatic station-keeping during docking and idling,allowing boats to hold position against wind and currentwith simple joystick control, enhancing ease and reliability.

Key Dynamic Positioning System Companies:

The following are the leading companies in the dynamic positioning system market. These companies collectively hold the largest market share and dictate industry trends.

- Kongsberg Gruppen ASA

- Wartsila Corporation

- ABB Ltd.

- GE Vernova

- L3Harris Technologies, Inc.

- Navis Engineering Oy

- Marine Technologies LLC

- Moxa Inc.

- Japan Radio Company Ltd.

- AB Volvo Penta

- Brunvoll AS

- Praxis Automation Technology B.V.

- Sirehna

- Twin Disc Inc.

- Sonardyne, Inc.

Dynamic Positioning System Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6.57 billion

Revenue forecast in 2033

USD 10.71 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report organization size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Equipment class, fit, system, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Kongsberg Gruppen ASA; Wartsila Corporation; ABB Ltd.; GE Vernova; L3Harris Technologies, Inc.; Navis Engineering Oy; Marine Technologies LLC; Moxa Inc.; Japan Radio Company Ltd.; AB Volvo Penta; Brunvoll AS; Praxis Automation Technology B.V.; Sirehna; Twin Disc Inc.; Sonardyne, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dynamic Positioning System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the dynamic positioning system marketreport based on equipment class, fit, system, end-use, and region.

-

Equipment Class Outlook (Revenue, USD Billion, 2021 - 2033)

-

Class 1

-

Class 2

-

Class 3

-

-

Fit Outlook (Revenue, USD Billion, 2021 - 2033)

-

Linefit

-

Retrofit

-

-

System Outlook (Revenue, USD Billion, 2021 - 2033)

-

Position Reference & Tracking Systems

-

Thruster & Propulsion Systems

-

Power Management Systems

-

DP Control Systems

-

Motion & Environment Sensors

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial Vessels

-

Cruise Ships & Ferries

-

Drillships & Semi-Submersibles

-

Offshore Supply Vessels (OSVs)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dynamic positioning system market size was estimated at USD 6.25 billion in 2024 and is expected to reach USD 6.57 billion in 2025.

b. The global dynamic positioning system market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 10.71 billion by 2033.

b. The linefit segment dominated the market and accounted for the largest revenue share of 63.85% in 2024. Vessel owners increasingly prefer factory-installed dynamic positioning (DP) systems as part of new vessel construction, known as linefit installations. These integrated systems offer seamless compatibility with the vessel’s propulsion, power management, and control architecture, enhancing operational efficiency and reliability.

b. Key players operating in the Kongsberg Gruppen ASA, Wartsila Corporation, ABB Ltd., GE Vernova, L3Harris Technologies, Inc., Navis Engineering Oy, Marine Technologies LLC, Moxa Inc., Japan Radio Company Ltd., AB Volvo Penta, Brunvoll AS, Praxis Automation Technology B.V., Sirehna, Twin Disc Inc, and Sonardyne, Inc.

b. The growth of global maritime trade and expanding port infrastructure projects has increased the demand for specialized vessels used in dredging, construction, and offshore support. These operations often occur in constrained or busy waterways where precise positioning is essential. Dynamic positioning systems enable such vessels to maintain stability and accuracy during critical tasks, enhancing safety, efficiency, and operational control in complex maritime environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.