- Home

- »

- Communications Infrastructure

- »

-

E-commerce Market Size, Share And Growth Report, 2030GVR Report cover

![E-commerce Market Size, Share & Trends Report]()

E-commerce Market Size, Share & Trends Analysis Report By Product, By Model Type (Business-to-Business, Business-to-Consumer, Consumer-to-Consumer), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-684-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

E-commerce Market Size & Trends

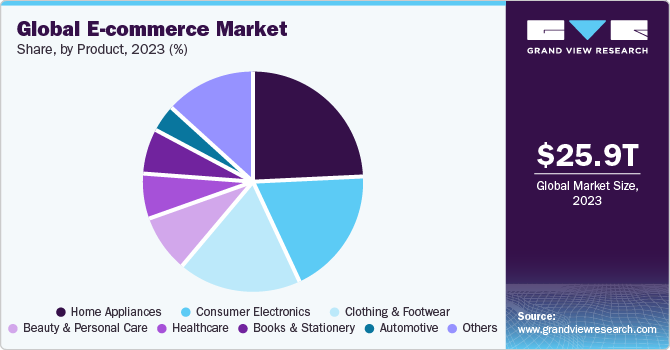

The global e-commerce market size was estimated at USD 25.93 trillion in 2023 and is projected to grow at a CAGR of 18.9% from 2024 to 2030. Changes in the purchasing habits of consumers have significantly facilitated the expansion of e-commerce. Due to time constraints, a need for a smooth shopping process, and the ease of online buying, consumers increasingly select the digital marketplace. With the increasing use of smartphones and tablets, mobile technology especially has been essential in allowing customers to buy seamlessly from any location.

In addition, the development of encryption technology and safe payment gateways has increased customer trust and promoted electronic transactions. The development of social media platforms has had a major effect on online shopping. Social media is an effective tool for marketing because it lets companies interact with their target market, highlight their goods, and increase traffic to their e-commerce websites.

Economic considerations such as financial resources and overall financial stability have a significant impact on the market. Consumers are more inclined to spend during periods of expansion in the economy, and businesses might witness higher demand for internet-based products. AI-powered chatbots, predictive analytics, and digital assistants have also become essential components of e-commerce customer care. These intelligent solutions offer real-time assistance, answer consumer queries, and aid in the buying decision-making process, thereby improving the entire customer experience.

Voice commerce emerged with the rise of voice-activated virtual assistants such as Amazon.com, Inc. Alexa, Microsoft Cortana, Apple Inc's Siri, Sony Xperia Hello, and Google Assistant. Voice-activated features are being integrated into e-commerce platforms, allowing users to browse for goods, place orders, and monitor shipments using voice queries. Voice commerce makes buying easier and simpler for consumers, particularly while doing it hands-free.

5G networks' lower latency makes real-time interactions possible, which makes events such as virtual shopping marketplaces and live broadcasting of new product launches more realistic. By utilizing 5G technology, e-commerce platforms can deliver superior multimedia content, improve mobile shopping experiences, and integrate new technologies that demand dependable and low-latency connectivity. To protect consumer data and stop illegal access, advanced encryption techniques, biometric authentication, and secure payment channels are crucial. E-commerce sites make significant investments in cybersecurity to preserve sensitive data and gain customers' trust, creating a safe atmosphere for online purchasing.

Market Concentration & Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The e-commerce environment is evolving as new firms and startups emerge. These upstarts frequently target specialized markets, creative business strategies, or technological innovations that are hindering established patterns and driving competition. The market is characterized by a plethora of participants ranging from multinational corporations to niche platforms.

Major companies include industrial giants such as Amazon.com, Inc. Alibaba.com, and Walmart, catering to certain markets or product categories. The basic engine of e-commerce growth is a shift in consumer behavior. With growing internet accessibility and smartphone usage, consumers today identify the ease of purchasing from the convenience of their locations. This shift is driven further by variables such as limitations on time, growing urbanization, and continuous digital transformation.

The shift to mobile commerce brings with it additional challenges in tailoring applications and websites for diverse mobile devices. It is critical to reach and maintain mobile-savvy consumers by providing a consistent and easy-to-use experience across multiple dimensions with various operating systems. Companies can spread their influence beyond domestic limits owing to the market ecosystem.

Targeting international markets allows for increased sales, exposure to various customer segments, and less reliance on a single market. Sustainability is becoming increasingly relevant for consumers, and e-commerce enterprises have the potential to align with these sustainability principles. Implementing eco-friendly packaging, lowering carbon footprints in logistics, and sustainable marketing goods can not only attract environmentally concerned customers but also help to boost the company's image.

The market is anticipated to witness an intentional push in the upcoming years to reach emerging markets, expanding online purchasing options to regions with growing internet connectivity. The contactless payment use will continue to pick up further momentum. The widespread use of mobile wallets, digital payment apps, and contactless payment techniques will provide customers with a safe and practical means to make transactions.

Furthermore, the routine to engage in real-time, stream videos seamlessly, and take in improved mobile experiences. Adopting 5G technology will put e-commerce companies in a better position to deploy high-performance applications and meet the expectations of an increasingly interconnected and heavily data-driven future.

Model Type Insights

The business-to-business (B2B) segment accounted for largest market share around 70% in 2023. The dominance of the B2B e-commerce platforms is becoming more integrated with other business tools and systems, such as ERP software and customer relationship management (CRM) systems. The connection improves the overall efficiency of B2B transactions by streamlining operations.

E-commerce platforms enhance cross-border trade by allowing firms to source goods and services from overseas vendors. As the volume of business-to-business interactions grows, cybersecurity will become an important issue. To protect sensitive corporate data, financial transactions, and intellectual property, e-commerce platforms are continuing to invest in advanced cybersecurity solutions.

The B2C segment is projected to witness the highest growth rate over the forecast period. Social media platforms have emerged as key drivers of B2C e-commerce growth. The implementation of social commerce features such as shoppable content and direct purchasing opportunities shifts social media platforms into dynamic marketplaces where customers can effortlessly discover, investigate, and purchase goods. The rise of digital natives, or those who grew up in a digitally linked society, has created a significant impact on the landscape of B2C market growth. These tech-savvy consumers are inclined to embrace online buying, which contributes to the digital marketplace's continued expansion.

Product Insights

Consumer electronics segment accounted for a significant market share of around 15% in 2023. A significant driver is the growing integration of consumer electronic devices with seamless interaction opportunities. Smartphones, smartwatches, tablets, and other gadgets employ 5G technology to provide faster internet speeds, lower latency, and enhanced connectivity, boosting the entire user experience.

E-commerce platforms such as Amazon.com, Inc. and Flipkart.com are positioning themselves as go-to places for consumer electronics buying. Major e-commerce platforms actively promote cross-border consumer electronics trade. It helps customers to access a wider selection of products, thereby helping manufacturers enter new markets, and promoting growth for both parties.

The home appliances segment growth can be attributed to the technological improvements in augmented reality (AR) and virtual reality (VR), which contribute highly to the expansion of the e-commerce home & kitchen segment. Geographic restrictions have been cut down by e-commerce, allowing buyers to gain access to an international marketplace for home and kitchen products.

The home appliances segment is mainly focused on visual appeal, which e-commerce companies capitalize on by providing high-quality visual material. Social media platforms such as Instagram, Facebook, and Pinterest play a crucial role in showing home and kitchen products. These platforms are used by influencers and brands to create visually captivating material that promotes consumers and drives them to make transactions on e-commerce sites.

Regional Insights

North America accounted for over 36% market value share of the market in 2023 and is expected to grow at a CAGR of 16.9% from 2024 to 2030. Cross-border e-commerce has provided chances for North American E-commerce enterprises. The digital marketplace allows firms to reach consumers all over the world and tap into international markets for extended growth. Mobile payment systems such as Phone Pay, Apple Pay, Google Pay, and Samsung Pay are gaining growing popularity across North America. These digital wallets make transactions safer and more convenient, eliminating reliance on conventional payment methods.

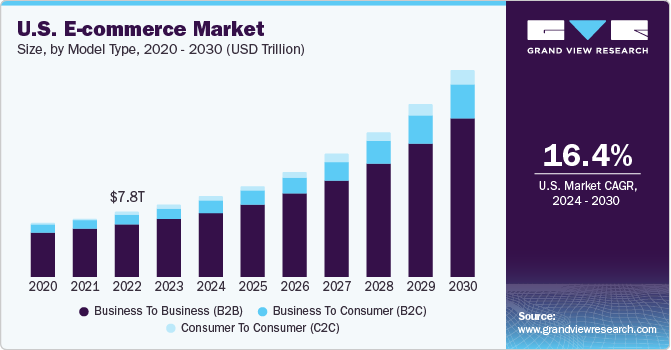

U.S. E-commerce Market Trends

The e-commerce market in the U.S. is projected to grow at a CAGR of 16.4% from 2024 to 2030. The market in the U.S. is rapidly evolving, driven by the integration of modern technologies that improve streamline operations, and user experiences, and provide new avenues for innovation.

Asia Pacific E-commerce Market Trends

Asia Pacific e-commerce market remained the highest growing in 2023, growing at a CAGR of 20.2% from 2024 to 2030. Economic expansion in various APAC countries has resulted in a rise in middle-class spending habits. As a result, customers have more buying power, which is fueling the expansion of online retail as consumers seek convenience, a wide range of products, and reasonable prices from e-commerce platforms. APAC countries such as China, India, and Japan have launched digitalization initiatives to encourage companies and individuals to embrace online technologies.

The e-commerce market in China is projected to grow at a CAGR of 16.2% from 2024 to 2030. The increasing penetration of digital channels, mobile devices, and social networking platforms are collectively driving the demand for a seamless omnichannel market in China.

Japan e-commerce market is projected to grow at a CAGR of 19.1% from 2024 to 2030. Japan boasts a very high internet penetration rate, with a significant portion of the population using their mobile phones for online activities. Delivery services in Japan are known for their speed and efficiency. This gives consumers confidence when shopping online, knowing they'll receive their purchases quickly.

The e-commerce market in India is projected to grow at a CAGR of 23.6% from 2024 to 2030. The country has witnessed a remarkable surge in e-commerce platforms catering to diverse consumer needs from electronics and fashion to groceries and services, which has further extended consumers' access to goods and services, providing them a convenient and efficient way to shop online.

Europe E-commerce Market Trends

Europe e-commerce marketis growing significantly at a CAGR of 19.4% from 2024 to 2030. The shifting preferences of European consumers for convenience and flexibility are prompting them to consider online shopping, thereby driving the growth of the European B2C market. The convenience and accessibility offered by e-commerce platforms have revolutionized the way consumers shop for clothing, footwear, beauty & personal care products, consumer electronics, and other items.

The e-commerce market in UK is growing significantly at a CAGR of nearly 16.4% from 2024 to 2030. With a robust economy and high levels of disposable income, U.K. consumers have a high spending power to invest in various clothing brands and footwear. The elevated purchasing power is enabling individuals in the U.K. to prioritize the quality of the products they are purchasing, which is driving the demand for high-end brands, designer labels, and premium-quality products.

Germany e-commerce market is growing significantly at a CAGR of 21.1% from 2024 to 2030. A large portion of the German population has reliable internet access, and ownership of smartphones and tablets is on the rise. This creates a strong demand for online shopping.

The e-commerce market in France is growing significantly at a CAGR of 20.4% from 2024 to 2030. France can be considered a global fashion hub characterized by the presence of various fashion houses, luxury brands, and designer labels, such as Chanel, Dior, Louis Vuitton, and Balmain, among others, favored by consumers valuing high-quality and fashionable apparel. The global reach of e-commerce platforms is allowing French apparel brands to expand their customer base beyond conventional brick-and-mortar stores and reach international markets.

Middle East & Africa E-commerce Market Trends

Middle East & Africa E-commerce market is anticipated to witness significant growth from 2024 to 2030 at a CAGR of 22.8%. Digital transformation of conventional industries in the region is driving the adoption of e-commerce. Industries, such as retail, healthcare, and education, are adopting digitization, leading to the integration of e-commerce solutions into their business models.

E-commerce market in KSA is anticipated to witness significant growth at a CAGR of 23.9% from 2024 to 2030. The increasing digital literacy among consumers in KSA bodes well for the growth of the KSA B2C market. In April 2024, Amazon .com, Inc. rolled out an international registration system in KSA. It would help the sellers in the country access hundreds of millions of new customers worldwide.

Key E-commerce Company Insights

Some of the key players operating in the market include Amazon.com, Inc.; Alibaba.com; and Walmart among others.

-

Amazon.com, Inc. is a worldwide technology and e-commerce firm where it offers a wide range of products such as consumer electronics, apparels, and groceries among others. Adding on the media and entertainment segment includes Amazon Music, Amazon Prime Video, Amazon Virtual Assistant among others.

-

Alibaba.com is wholesale marketplace where it covers a wide range of services E-commerce, logistics, finance, and entertainment. The company’s product categories comprise of consumer electronics, home & garden, beauty, sports & entertainment, medical devices, apparel, and accessories among others.

Zalando; and Shopee are some of the emerging market participants in the call and contact center outsourcing market.

-

Zalando is an online fashion platform where customers can shop from a variety of categories, offering an overall shopping experience. The company’s product categories include clothing, shoes, accessories, streetwear, and sportwear. Zalando customers have marked its presence in Germany and other parts of the European markets.

-

Shopee is an online shopping platform marking its presence across Southeast Asia, such as Thailand, Singapore, Indonesia, and Malaysia, among others. The platform utilizes the use of data analytics and AI to enhance its offerings and customize recommendations according to client requirements.

Key E-commerce Companies:

The following are the leading companies in the e-commerce market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Alibaba.com

- ASOS

- Costco Wholesale Corporation

- Dangdang

- eBay Inc.

- Flipkart.com

- JD.com

- Lazada

- MercadoLibre S.R.L.

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Zalando

Recent Developments

-

In February 2024, Wix, a software company, partnered with Global-e Online to facilitate cross-border eCommerce directly to consumers. The collaboration offers Wix merchants a solution for selling across borders. This partnership enhances Wix’s eCommerce features, empowering sellers to grow their businesses through access to Global-e's international services and offering them the chance to break into and sell in new markets.

-

In November 2023, Amazon.com, Inc. and West Bengal Industrial Development Corporation (WBIDC) signed a Memorandum of Understanding (MoU) to increase West Bengal exports. Through this collaboration, the focus would be on leveraging Amazon.com, Inc's platform to foster and accelerate the export of merchandise from West Bengal organizations.

-

In October 2023,Flipkart.com Flipkart launched the 'Flipkart Commerce Cloud,' a retail intelligence service for international retailers and e-commerce firms. This initiative aims to deliver complete retail intelligence and AI-driven services tailored to the specific needs of retail organizations. The platform provides a variety of solutions that improve the capabilities of merchants and e-commerce businesses across the globe.

-

In June 2023, techstars and eBay Inc. have announced a strategic partnership that will result in the introduction of "techstars Future of Ecommerce powered by eBay Inc." Through this partnership the firms aimed to capitalize on both organizations' strengths to stimulate innovation and support companies in the ecommerce sector. The program, supported by eBay Inc., will empower developing entrepreneurs with guidance, tools, and opportunities to shape the future of e-commerce.

E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.46 trillion

Market Value forecast in 2030

USD 83.26 trillion

Growth rate

CAGR of 18.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Market Value in USD billion/trillion and CAGR from 2024 to 2030

Report coverage

Market Value forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, model type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Australia; Brazil; Argentina; UAE; KSA; South Africa

Key companies profiled

Amazon.com, Inc.; Alibaba.com; ASOS; Costco; Wholesale Corporation; Dangdang; eBay Inc.; Flipkart.com; JD.com; Lazada; MercadoLibre S.R.L.; Shopify; Shopee; Walmart; Wayfair LLC; Zalando

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Market Report Segmentation

This report forecasts market value growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global e-commerce market report based on product, model type, and region:

-

Model Type Outlook (Market Value, USD Billion, 2018 - 2030)

-

Business To Business (B2B)

-

Business To Consumer (B2C)

-

Consumer To Consumer (C2C)

-

-

Product Outlook (Market Value, USD Billion, 2018 - 2030)

-

Automotive

-

Beauty & Personal Care

-

Books & Stationery

-

Consumer Electronics

-

Home Appliances

-

Clothing & Footwear

-

Healthcare

-

Others

-

-

Regional Outlook (Market Value, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce market size was estimated at USD 25.93 trillion in 2023 and is expected to reach USD 29.46 trillion in 2024.

b. The global e-commerce market is expected to grow at a compound annual growth rate of 18.9% from 2024 to 2030 to reach USD 83.26 trillion by 2030.

b. Asia Pacific dominated the e-commerce market with a share of nearly 40.0% in 2023. It is attributed to economic expansion in various APAC countries has resulted in a rise in middle-class spending habits. As a result, customers have more buying power, which is fueling the expansion of online retail as consumers seek convenience, a wide range of products, and reasonable prices from e-commerce platforms.

b. Some key players operating in the e-commerce market include Amazon.com, Inc.; Alibaba.com; ASOS; Costco; Wholesale Corporation; Dangdang; eBay Inc.; Flipkart.com; JD.com; Lazada; MercadoLibre S.R.L.; Shopify; Shopee; Walmart; Wayfair LLC; Zalando.

b. Implementation of 4G and 5G technology for connectivity purposes is expected to have a positive impact on the market growth as it provides an uninterrupted, seamless experience to the user. Moreover, the adoption of smartphones is gaining momentum at a significant rate, thus increasing the exposure of online shopping for the customer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."