- Home

- »

- Next Generation Technologies

- »

-

Electric Boat Market Size And Share, Industry Report, 2030GVR Report cover

![Electric Boat Market Size, Share & Trends Report]()

Electric Boat Market (2025 - 2030) Size, Share & Trends Analysis Report By Boat Type (Leisure Boats, Fishing Boats, Pontoon & Deck Boats), By Propulsion Type (Outboard Electric, Inboard Electric, Hybrid), By Battery Type, By Power Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-611-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Boat Market Summary

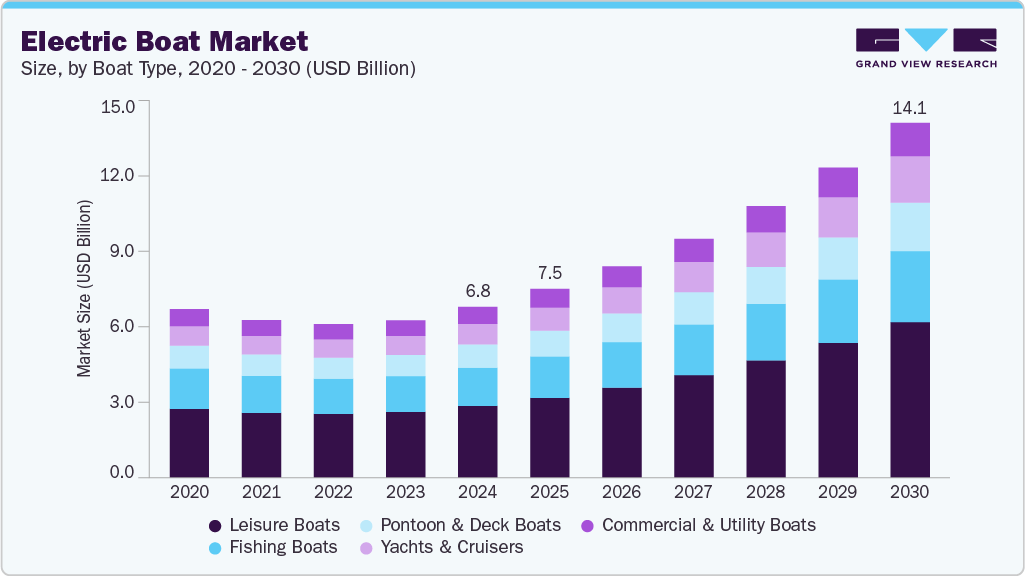

The global electric boat market size was estimated at USD 6.78 billion in 2024 and is projected to reach USD 14.09 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The market is gaining momentum, driven by stringent environmental regulations aimed at reducing emissions and achieving global carbon neutrality goals.

Key Market Trends & Insights

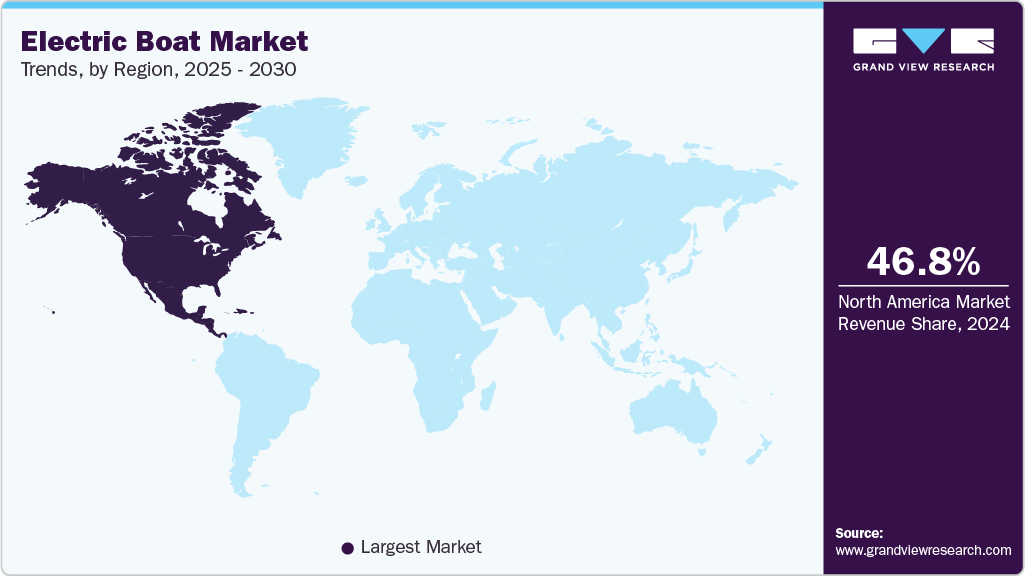

- The North America electric boat market accounted for 46.8% of the global share in 2024.

- The U.S. electric boat industry held a dominant position in 2024.

- By boat type, the leisure boats segment accounted for the largest share of 42.1% in 2024.

- By propulsion type, the outboard electric propulsion segment accounted for the largest share in 2024.

- By battery type, the lithium-ion batteries segment accounted for the largest share in 2024

Market Size & Forecast

- 2024 Market Size: USD 6.78 Billion

- 2030 Projected Market Size: USD 14.09 Billion

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2024

Advances in lithium-ion battery technology and high-efficiency electric motors have enhanced vessel range, performance, and reliability, making electric boats increasingly viable. Rising demand from environmentally conscious consumers and commercial operators further supports market expansion. However, the high upfront costs and limited charging infrastructure pose significant barriers, while concerns regarding range and overall performance continue to limit broader market penetration.Integration of solar-powered systems and smart propulsion technologies represents a major opportunity for the electric boat market.Rising environmental regulations are significantly driving the growth of the electric boat market. Governments worldwide are implementing stricter emission standards and carbon reduction targets, such as the International Maritime Organization’s (IMO) 2020 sulfur cap and the European Union’s Green Deal aiming for climate neutrality by 2050. These regulations mandate reduced greenhouse gas emissions and lower levels of water and air pollution from marine vessels. Consequently, boat manufacturers and operators are increasingly adopting electric propulsion systems to comply with these standards. As a result, demand for electric boats has been accelerated across both recreational and commercial sectors, with compliance serving as a key catalyst for market expansion.

Technological advancements in battery and motor efficiency are playing a pivotal role in accelerating the adoption of electric boats. These innovations are enhancing vessel range, speed, and overall reliability, making electric alternatives increasingly viable for both recreational and commercial use. For instance, in November 2022, Samsung Heavy Industries developed a liquid hydrogen fuel cell propulsion system for ships, receiving approval in principle from DNV. This milestone, achieved in collaboration with hydrogen technology partners, underscores growing momentum toward next-generation sustainable marine propulsion and highlights the industry’s focus on high-efficiency, low-emission alternatives to traditional marine engines.

Growing consumer demand for sustainable and quiet boating is a key driver for the electric boat market, as both recreational and commercial users increasingly seek environmentally friendly and low-noise alternatives. This trend is reinforced by strategic industry collaborations and significant capital investments to accelerate the adoption of electric propulsion technologies. For example, in November 2024, the International Electric Marine Association (IEMA) established an exclusive partnership with the Electric & Hybrid Marine Expo to promote maritime electrification through education and industry-wide cooperation. Also, in April 2022, Swedish electric boat manufacturer X Shore secured USD 50 million in funding to scale production of its Eelex 8000 model and advance research and development of zero-emission maritime solutions, underscoring the market’s strong growth potential.

The adoption of solar-powered boats and smart propulsion systems is creating significant innovation opportunities within the electric boat market, aimed at extending battery life and enhancing the overall user experience. Industry players are increasingly investing in advanced solar-electric technology and production capacity to meet the growing demand for sustainable maritime solutions. For instance, in December 2023, Navalt introduced the Barracuda, India’s fastest solar-electric boat, featuring twin 50 kW motors and a 6 kW solar panel, designed for challenging sea conditions and seating 10 passengers. Additionally, in June 2022, Silent Yachts expanded its production capabilities by acquiring a new facility in Fano, Italy, to scale manufacturing of its luxury Silent 60 and 80 solar-electric yachts, demonstrating strong market traction in Europe.

High initial purchase costs and limited charging infrastructure remain significant challenges for the electric boat market, restricting broader adoption among both commercial operators and recreational users. Electric boats typically carry a premium price compared to traditional combustion-powered vessels, with entry-level models often starting above USD 100,000 and luxury or high-performance boats exceeding several hundred thousand dollars. For example, the Arc One electric wake sport boat, launched in 2022, is priced at around USD 300,000, reflecting the high cost of cutting-edge battery and motor technology. Additionally, insufficient widespread charging stations and marina infrastructure impede convenient recharging, limiting operational range and user flexibility. These factors collectively hinder market growth despite increasing technological advancements and environmental regulations.

Boat Type Insights

The leisure boats segment accounted for the largest share of 42.1% in 2024. Factors such as rising environmental regulations, advancements in battery and motor efficiency, growing consumer demand for sustainable and quiet boating, and increasing investments in luxury electric boat models is driving the segment growth. Stricter emission norms across the U.S. and Europe have encouraged recreational boaters to transition toward zero-emission alternatives. Technological improvements in lithium-ion and hydrogen-based propulsion systems have further enhanced performance and extended cruising range, making electric boats more viable for leisure activities.

The yachts & cruisers segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by surging demand for high-performance electric vessels, the expanding luxury marine tourism sector, growing adoption of fast charging technologies, and increasing consumer preference for silent, emission-free cruising. Manufacturers are actively launching premium electric yachts that align with both sustainability goals and performance expectations. For instance, in April 2024, ABT Sportsline GmbH, in collaboration with Marian, introduced the ABT | Marian M 800-R electric yacht. Equipped with a 450 kW powertrain, 121.5 kWh lithium-ion battery, and semi-glider hull, the vessel offers fast-charging support and multiple drive modes, representing a major leap in luxury electric marine innovation.

Propulsion Type Insights

The outboard electric propulsion segment accounted for the largest share in 2024, driven by the rising demand for compact, easy-to-install electric solutions and increasing consumer preference for low-maintenance, environmentally friendly boating systems. Factors such as the expanding availability of modular propulsion units and the growing popularity of electric pontoons, tenders, and fishing boats are also fueling the segment’s growth. In May 2023, Mercury Marine announced a partnership with JJE to co-develop high-voltage electric propulsion systems. This collaboration is focused on extending Mercury’s Avator electric product line into higher power categories, reinforcing the company’s position in marine electrification through advancements in motor and inverter technology.This strategic initiative reflects the growing momentum toward scalable and efficient outboard electric propulsion systems, positioning the segment for continued dominance in the evolving electric boat market.

The hybrid propulsion segment is projected to grow at a significant CAGR in the forecast period, driven by increasing demand for extended cruising range, fuel flexibility, and reduced emissions in both recreational and commercial marine applications. The ability to seamlessly switch between electric and conventional power sources offers operational versatility and cost savings, particularly in regions with developing charging infrastructure. Also, regulatory pressure to curb marine pollution is prompting boat owners and operators to adopt hybrid systems as a transitional solution toward full electrification.

Battery Type Insights

The lithium-ion batteries segment accounted for the largest share in 2024, driven by increasing adoption of high-energy storage solutions, rising demand for lightweight and compact battery systems, and growing investments in sustainable marine technologies. Lithium-ion batteries offer superior charge cycles, faster charging times, and better energy-to-weight ratios than traditional alternatives, making them the preferred choice for electric boat manufacturers and consumers. In June 2024, Microvast partnered with Norwegian electric motor specialist Evoy to supply high-power MV-I lithium-ion battery packs for electric leisure boats. The collaboration focuses on improving safety, energy density, and environmental sustainability, supporting Evoy’s goal to deliver high-performance, emission-free boating solutions. This reflects the ongoing shift toward advanced lithium-ion solutions in the marine sector.

The lead-acid batteries segment is expected to register a notable CAGR from 2025 to 2030, driven by its cost-effectiveness, widespread availability, and established manufacturing infrastructure. Despite the rise of lithium-ion alternatives, lead-acid batteries remain favored for entry-level and smaller electric boats due to their reliability and lower upfront costs. Additionally, ongoing improvements in lead-acid battery technology, such as enhanced deep-cycle capabilities and maintenance-free designs, are helping sustain their relevance in the evolving electric boating market.

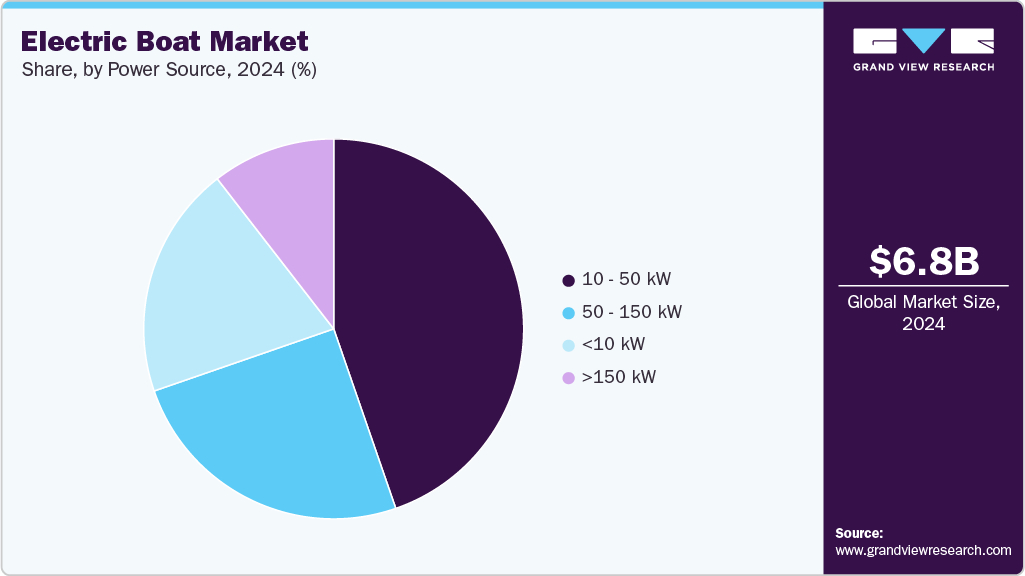

Power Source Insights

The 10-50 kW segment accounted for the largest share in 2024, driven by its suitability for a wide range of recreational and small commercial electric boats. This power range offers an optimal balance between performance and energy efficiency, making it ideal for leisure boating applications. Growing consumer preference for quiet, eco-friendly boating experiences further supports the segment’s dominance. Also, advancements in motor technology and battery integration have enhanced the reliability and affordability of systems within this range.

The 50-150 kW segment is expected to register a notable CAGR from 2025 to 2030, owing to its ability to deliver higher performance suitable for mid-sized recreational and commercial electric boats. This power range supports increased speed and range capabilities, meeting the growing demand for versatile and efficient electric vessels. In September 2022, Swedish electric boat manufacturer X Shore launched the X Shore 1, a 21-foot electric boat powered by a 125-kW motor and 63-kWh battery. With a top speed of 30 knots and a 50-nautical-mile range, the model targets more affordable e-mobility on water, exemplifying the segment’s potential for combining performance with accessibility.

Regional Insights

The North America electric boat market accounted for 46.8% of the global share in 2024, driven by strong consumer preference for sustainable boating solutions and ongoing investments in clean marine technologies. Growing environmental regulations and the push for reduced emissions are accelerating the shift from conventional to electric propulsion systems. For instance, in April 2025, RAD Propulsion, Zero Marine, and RS Electric Boats supplied two Pulse 63 electric RIBs powered by RAD 40 drives for the Oxford-Cambridge Boat Race. This milestone highlights the rising use of electric propulsion in high-profile sporting events, promoting cleaner waterways and sustainability in competitive boating.

Additionally, technological innovation and enhanced battery capabilities are expanding market potential in North America. For example, in December 2024, Blue Innovations Group announced the launch of the R30, a 30-foot electric boat featuring an 800bhp dual-motor powertrain, 221kWh battery pack, and solar canopy. Designed for up to 12 passengers with an 8-hour runtime, the R30 underscores the region’s focus on advanced electric boating technology and expanded user capabilities.

In Canada, the electric boat market is being propelled by government incentives promoting clean energy adoption and increasing awareness of environmental conservation in recreational boating. Initiatives supporting renewable energy integration and stricter emissions standards for watercraft are encouraging manufacturers and consumers alike to transition towards electric boats. In Mexico, the electric boat market is gaining momentum due to rising tourism activities along coastal and inland waterways combined with growing investments in sustainable marine infrastructure. The expanding interest in eco-friendly water transport solutions is supported by government policies encouraging cleaner technologies to preserve marine biodiversity and improve air quality.

U.S. Electric Boat Market Trends

The U.S. electric boat industry held a dominant position in 2024. The market is witnessing significant transformation, supported by increased investments in upscale electric boating models, an expanding retail presence, and growing consumer demand for user-friendly, high-performance vessels. An important transformation is being experienced in the market, with improved accessibility and adoption across recreational and commercial segments. For instance, in August 2024, a partnership between Halevai and Lyman-Morse was established to produce high-performance, easy-to-operate electric day boats, combining advanced technology with expert craftsmanship to enhance the upscale electric boating segment. Also, in May 2025, the opening of EMO Electric’s first retail store at Atlantic Cove Marina in Long Island expanded local consumer access by providing demos and increasing awareness of electric boating. These developments are expected to drive sustained growth in the U.S. electric boat market.

Asia Pacific Electric Boat Market Trends

The Asia Pacific electric boat industry was identified as a lucrative region in 2024, driven by increasing governmental focus on sustainable maritime solutions, rising investments in renewable energy integration, and expanding urban water transport infrastructure. Supportive policies aimed at reducing carbon emissions and promoting clean technologies are accelerating the adoption of electric boats across the region. For instance, in December 2023, Mazagon Dock Shipbuilders Ltd and Navalt launched ‘Saur Shakthi,’ India’s fastest solar-electric boat, equipped with twin 50-kW motors and marine-grade lithium iron phosphate (LFP) batteries, marking a significant advancement in India’s green maritime initiatives.

Also, in April 2025, Singapore is set to deploy its first solar-powered electric Pyxis R ferries on the Singapore River, featuring solar panels generating 22 kWh daily and vehicle-to-grid technology, which will reduce reliance on the electricity grid and promote sustainable urban transport. These developments underscore the region’s commitment to advancing electric boating, suggesting robust market growth prospects across Asia Pacific.

The China electric boat market held a substantial market share in 2024. The electric boat market in China is experiencing rapid growth, driven by strong government initiatives promoting clean energy adoption, extensive investments in inland waterway electrification, and growing demand for eco-friendly passenger vessels. Regulatory support and strategic focus on reducing emissions in major waterways have accelerated the shift towards electric propulsion. For instance, in May 2022, China launched the CHANG JIANG SAN XIA 1, the world’s largest battery-powered cruise ship, operating on the Yangtze River with a capacity of 1,300 passengers. The success of this vessel is encouraging further expansion of electric shipbuilding across inland waterways, supported by the China Classification Society and domestic shipyards, reflecting the country’s commitment to sustainable maritime innovation.

The electric boat market in Japan held a significant share in 2024. The market is influenced by the steady government support for renewable energy adoption, advancements in compact and efficient battery technologies, and increasing consumer preference for low-emission recreational vessels. The nation’s commitment to reducing maritime pollution and promoting sustainable tourism has further propelled market growth. For instance, ongoing collaborations between local manufacturers and research institutes are focused on developing lightweight electric propulsion systems tailored for Japan’s coastal and inland waterways. These efforts are expected to enhance the market’s competitiveness and encourage wider acceptance of electric boats across commercial and leisure segments.

Europe Electric Boat Market Trends

The Europe electric boat industry was identified as a lucrative region in 2024. The European electric boat market is witnessing significant transformation, driven by rising government incentives for zero-emission vessels, increasing consumer demand for sustainable leisure boating, and stringent environmental regulations across member states. These factors are accelerating the adoption of electric propulsion systems in both recreational and commercial segments. For instance, in March 2025, Frauscher and Evoy Vita deepened their collaboration with the launch of the Frauscher 740 Mirage Air, an electric day boat featuring Evoy’s Breeze 120+ hp motor. This partnership advances luxury, zero-emission boating across Europe’s high-demand recreational markets. Consequently, Europe is poised to remain a key growth hub in the global electric boat industry.

The Germany electric boat market is being shaped by increasing government support for clean energy technologies, growing investments in hydrogen and fuel cell propulsion, and rising consumer awareness of sustainable boating alternatives. These drivers are fostering innovation and adoption of zero-emission vessels within Germany’s extensive inland waterway network. For instance, in April 2024, Torqeedo GmbH announced its collaboration with Eichberger Schiffservice GmbH to equip the fuel cell-powered "Kingfisher" houseboat with its Deep Blue electric drive system. Funded under Bavaria’s Energy Research Programme, this project aims to deliver emission-free, multi-day cruises across German inland waterways. As a result, Germany is expected to play a leading role in advancing clean propulsion solutions in Europe’s electric boat market.

The electric boat market in UK is being driven by increasing government initiatives to reduce maritime emissions, growing investments in sustainable marine technologies, and expanding research efforts focused on decarbonization. These factors are accelerating the adoption of electric boats across commercial and academic sectors. For instance, in April 2025, the University of Plymouth became the first UK university to add an electric boat, the ZENOW RS Pulse, to its research fleet. This net-zero emission vessel supports marine decarbonization efforts and enhances education and research opportunities in sustainable maritime technology. Consequently, the UK market is positioned for significant growth in the transition toward greener boating solutions.

Key Electric Boat Company Insights

Some of the key players operating in the market include Yamaha Motor Co., Ltd., Vision Marine Technologies, Duffy Electric Boat Company, RAND Boats ApS, and SVP Yachts d.o.o.

-

Founded in 1955 and headquartered in Iwata, Japan, Yamaha Motor Co., Ltd. specializes in electric propulsion systems and marine engines. The company offers high-performance electric outboard motors and advanced battery technologies for recreational and commercial boats. Yamaha focuses on motor efficiency, durability, and environmental sustainability. It operates globally, serving diverse customers in the boating industry while continuously investing in research and development to advance clean marine mobility solutions.

-

Founded in 2011 and headquartered in Montreal, Canada, Vision Marine Technologies develops electric propulsion systems for boats. The company designs and manufactures electric outboard motors and integrated battery systems aimed at reducing emissions and noise pollution. Vision Marine Technologies provides sustainable marine mobility solutions and collaborates with global boat manufacturers to promote the adoption of eco-friendly electric boating technologies.

Key Electric Boa Companies:

The following are the leading companies in the electric boat market. These companies collectively hold the largest market share and dictate industry trends.

- Yamaha Motor Co., Ltd.

- Vision Marine Technologies

- Duffy Electric Boat Company

- RAND Boats ApS

- SVP Yachts d.o.o. (Greenline)

- ElectraCraft, Inc.

- Frauscher Bootswerft GmbH

- X Shore AB

- Pure Watercraft Inc.

- Volvo Penta Corporation

Recent Developments

-

In May 2025, Australian boatbuilder Incat launched Hull 096, the world’s largest battery-powered ship at 130 meters, designed for ferry service between Buenos Aires and Uruguay. Capable of carrying 2,100 passengers and 225 vehicles, it marks a milestone in sustainable electric shipping technology.

-

In February 2025, Vision Marine Technologies deepened its partnership with Electrified Marina, a leading 100% electric watercraft dealer. This collaboration aims to expand adoption of Vision Marine's E-Motion electric propulsion technology, boosting the availability of high-performance electric boats on the East Coast.

-

In December 2024, Porsche AG and Frauscher Shipyard unveiled the Frauscher x Porsche 850 Fantom, a high-performance electric sports boat powered by the all-electric drive unit of the Porsche Macan Turbo. The model joins the earlier eFantom in a limited First Edition of 25 units.

-

In September 2024, Axopar launched its fully electric AX/E sub-brand in partnership with Evoy, featuring models powered by Evoy’s high-output electric motors with up to 300+ HP. Debuted at the Cannes Yachting Festival, AX/E advances sustainable, performance-focused adventure boating.

-

In March 2024, Genevo Marine announced the E8, an 8.2m luxury electric boat featuring a 400kW motor and 132kWh battery. Its lightweight carbon fiber hull, made from recycled aerospace materials, combines performance with sustainability, setting new standards in eco-friendly electric boating.

Electric Boat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.49 billion

Revenue Forecast in 2030

USD 14.09 billion

Growth rate

CAGR of 13.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Boat type, propulsion type, battery type, power source, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Yamaha Motor Co. Ltd.; Vision Marine Technologies; Duffy Electric Boat Company; RAND Boats ApS; SVP Yachts d.o.o. (Greenline); ElectraCraft, Inc.; Frauscher Bootswerft GmbH; X Shore AB; Pure Watercraft Inc.; Volvo Penta Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Boat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric boat market report based on boat type, propulsion type, battery type, power source, and region.

-

Boat Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Leisure Boats

-

Fishing Boats

-

Pontoon & Deck Boats

-

Yachts & Cruisers

-

Commercial & Utility Boats

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Outboard Electric Propulsion

-

Inboard Electric Propulsion

-

Hybrid Propulsion

-

Solar-Integrated Systems

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion Batteries

-

Lead-acid Batteries

-

Other Advanced Chemistries

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

<10 kW

-

10-50 kW

-

50-150 kW

-

>150 kW

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric boat market size was estimated at USD 6.78 billion in 2024 and is expected to reach USD 14.09 billion in 2030.

b. The global electric boat market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 14.09 billion by 2030.

b. The North America electric boat market accounted for 46.8% of the global share in 2024. The electric boat market in North America is being driven by strong consumer preference for sustainable boating solutions and ongoing investments in clean marine technologies. Growing environmental regulations and the push for reduced emissions are accelerating the shift from conventional to electric propulsion systems

b. Some key players operating in the electric boat market include Yamaha Motor Co., Ltd. (Torqeedo GmbH), Vision Marine Technologies, Duffy Electric Boat Company, RAND Boats ApS, SVP Yachts d.o.o. (Greenline), ElectraCraft, Inc., Frauscher Bootswerft GmbH, X Shore AB, Pure Watercraft Inc., Volvo Penta Corporation.

b. Key factors that are driving the market growth include stringent environmental regulations aimed at reducing emissions and achieving global carbon neutrality goals. Advances in lithium-ion battery technology and high-efficiency electric motors have enhanced vessel range, performance, and reliability, making electric boats increasingly viable

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.