- Home

- »

- HVAC & Construction

- »

-

Electric Power Distribution Automation Systems Market, 2030GVR Report cover

![Electric Power Distribution Automation Systems Market Size, Share & Trends Report]()

Electric Power Distribution Automation Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Implementation (Substation Automation), By Application (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-398-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Power Distribution Automation Systems Market Summary

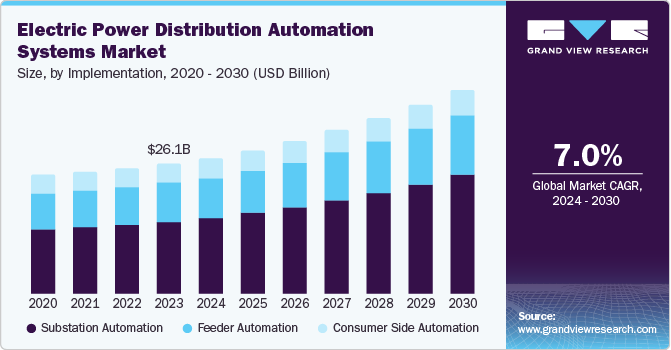

The global electric power distribution automation systems market size was valued at USD 26.1 billion in 2023 and is projected to reach USD 40.89 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The adoption of enterprise power distribution systems (EPDS) is driven by advancements in automation, significant energy sector investments, and global smart grid initiatives.

Key Market Trends & Insights

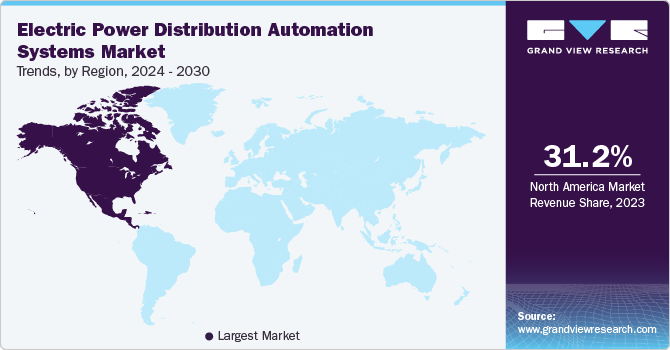

- North America electric power DAS market led the global market with a revenue share of 31.2% in 2023.

- Asia Pacific electric power DAS market is anticipated to witness the fastest CAGR of 8.8% over the forecast period.

- Based on implementation, the substation automation segment dominated the market, with a share of 55.9% in 2023.

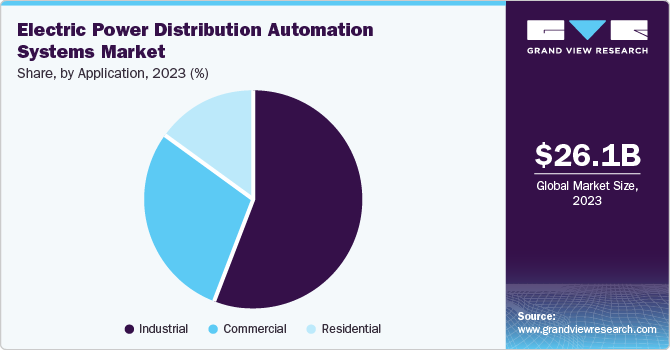

- Based on application, the industrial segment dominated the market in 2023, accounting for a share of 55.9%.

Market Size & Forecast

- 2023 Market Size: USD 26.1 Billion

- 2030 Projected Market Size: USD 40.89 Billion

- CAGR (2024-2030): 7.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

EPDS enhance grid efficiency, reduce power consumption, and improve operational reliability, making them crucial for modern power distribution networks and ensuring reliable electricity supply.One of the primary drivers of market growth is the need to replace outdated transmission and distribution systems, particularly in regions such as Asia Pacific, where utilities are under pressure to modernize their infrastructure. This is crucial for enhancing reliability and efficiency in power delivery as urbanization and electricity consumption continue to rise in developing countries such as China and India.

Another significant driver of market growth is the growing demand for electricity across various sectors, including commercial establishments such as hospitals, hotels, and data centers. This surge in demand drives the adoption of distribution automation systems (DAS) to prevent outages and ensure a continuous power supply. Furthermore, investment in smart grids is a major trend influencing the market, with smart grids utilizing advanced technologies to improve the reliability and efficiency of electricity distribution. These initiatives attract investments from both public and private sectors, driving market growth.

The market is also driven by technological advancements in automation, which facilitate the development of more sophisticated electric power distribution systems. Innovations such as field devices (smart transformers, voltage regulators) are increasingly essential for optimizing power distribution and minimizing waste. Moreover, regulatory support and policy initiatives to promote renewable energy integration and enhance grid resilience contribute to market growth, with government policies often including financial incentives for upgrading existing infrastructure and implementing automation technologies.

Implementation Insights

Substation automation dominated the market, with a share of 55.9% in 2023. It plays a crucial role in ensuring grid reliability and operational efficiency, enabling utilities to gain real-time insights into grid performance. By deploying intelligent devices and sensors, utilities can monitor critical parameters, detect and isolate faults, and optimize power flow, voltage regulation, and load balancing, ultimately ensuring uninterrupted electricity supply.

Feeder automation is expected to witness a significant growth of 6.7% over the forecast period. The feeder automation system’s efficient fault management capabilities enable accurate fault detection, isolation, and restoration within distribution networks. Upon fault occurrence, the system automatically reroutes power flow, restoring service to unaffected areas while isolating the affected section, ensuring uninterrupted power supply and minimal customer disruption.

Application Insights

Industrial segment dominated the market in 2023, accounting for a share of 55.9%. Segment growth in the market is attributable to escalating demand for reliable and efficient electricity in sectors such as utilities, oil & gas, and manufacturing. Smart grid advancements enable real-time monitoring and control, while the push for sustainability and renewable energy integration drives the adoption of these systems.

Commercial applications are expected to grow rapidly, registering a CAGR of 6.7% over the forecast period. The commercial sector is increasingly embracing electric power DAS to ensure reliable power supply in hotels, hospitals, and data centers. These systems optimize operational efficiency through real-time monitoring and control, reducing outages and costs. Smart grid initiatives and regulatory pressures for sustainability and energy efficiency further drive adoption.

Regional Insights

North America electric power DAS market led the global market with a revenue share of 31.2% in 2023, driven by infrastructure modernization, increasing demand for efficiency and reliability, and investments in smart grid technologies. Regulatory support for sustainability initiatives and the presence of major industry players foster innovation and competition, propelling market growth in North America.

U.S. Electric Power Distribution Automation Systems Market Trends

The electric power distribution automation systems market in the U.S. dominated North America in 2023. The U.S. is driving the modernization of aging infrastructure to enhance reliability and efficiency in power delivery, driven by growing demand from commercial sectors. Investments in smart grid technologies and regulatory support for sustainability initiatives are fueling innovation and adoption of automation systems, solidifying the country as a leader in distribution automation.

Europe Electric Power Distribution Automation Systems Market Trends

Europe electric power distribution automation systems market was identified as a lucrative region in this industry due to initiatives by the European Union on energy efficiency and renewable energy. The EU’s commitment to sustainability and renewable energy integration, and increasing demand from commercial and industrial sectors. Regulatory frameworks and financial incentives support adoption, solidifying Europe’s position as a key player in the global market.

The electric power distribution automation systems market in Germany is gaining traction within Europe, driven by Germany’s commitment to renewable energy integration and grid digitalization. The government’s plans to deploy smart meters and upgrade high-voltage transmission infrastructure support industrial growth and electrification targets. As a leader in smart grid development, Germany’s initiatives drive adoption of distribution automation systems across the region, positioning it as a key player in the European market.

Asia Pacific Electric Power Distribution Automation Systems Market Trends

Asia Pacific electric power distribution automation systems market is anticipated to witness the fastest CAGR of 8.8% over the forecast period due to rapid urbanization, population growth, and grid expansion in countries such as China and India. Smart city initiatives, clean energy integration, and industrial sector growth also boost adoption, making Asia Pacific a key player in the electric power distribution automation landscape.

The electric power distribution automation systems market in China is projected to grow rapidly in the coming years, driven by urbanization and population growth. China’s efforts to modernize its energy infrastructure, integrate renewable energy sources, and enhance efficiency and reliability are key drivers. Significant investments in smart grid initiatives support the widespread adoption of distribution automation systems, solidifying China’s position as a leader in this market segment.

Key Electric Power Distribution Automation Systems Company Insights

Some of the key companies in the electric power distribution automation systems market include MYR Group Inc.; THE KANSAI ELECTRIC POWER CO., INC.; Hitachi Energy Ltd.; Siemens; and others. Companies prioritize innovation, strategic partnerships, and acquisitions to expand their market presence and product offerings, while emerging players fuel competition and drive technological advancements.

-

Hitachi Energy Ltd. is a provider of power grid solutions, offering a comprehensive range of products and services for transmission and distribution. The company offers digital grid solutions, including distribution automation systems, to improve grid reliability, efficiency, and resilience. Its portfolio features intelligent substations, smart grid sensors, and advanced control systems.

-

General Electric Company offers a diverse range of products and services for transmission and distribution, including substation automation, feeder automation, and distribution management systems. Leveraging AI and ML, GE’s solutions enhance grid performance and facilitate renewable energy integration.

Key Electric Power Distribution Automation Systems Companies:

The following are the leading companies in the electric power distribution automation systems market. These companies collectively hold the largest market share and dictate industry trends.

- MYR Group Inc.

- THE KANSAI ELECTRIC POWER CO., INC.

- Hitachi Energy Ltd.

- Siemens

- General Electric Company

- Cisco Systems Inc.

- Schneider Electric

- ABB

- Eaton

- Power Grid Corporation of India Limited (POWERGRID), Ministry of Power

Recent Developments

-

In August 2024, Hitachi Energy launched the Relion REF650 multi-application protection and control relay, enhancing its distribution automation offering with advanced features and benefits, solidifying its strong position in power automation and communication.

-

In May 2024, ABB acquired Siemens’ Wiring Accessories business in China, expanding its smart buildings portfolio with products such as smart home systems. The deal included a vast distributor network and over 350 employees, closing within a year.

Electric Power Distribution Automation Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.21 billion

Revenue forecast in 2030

USD 40.89 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Implementation, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

MYR Group Inc.; THE KANSAI ELECTRIC POWER CO., INC.; Hitachi Energy Ltd.; Siemens; General Electric Company; Cisco Systems Inc.; Schneider Electric; ABB; Eaton; Power Grid Corporation of India Limited (POWERGRID), Ministry of Power

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Power Distribution Automation Systems Market Report Segmentation

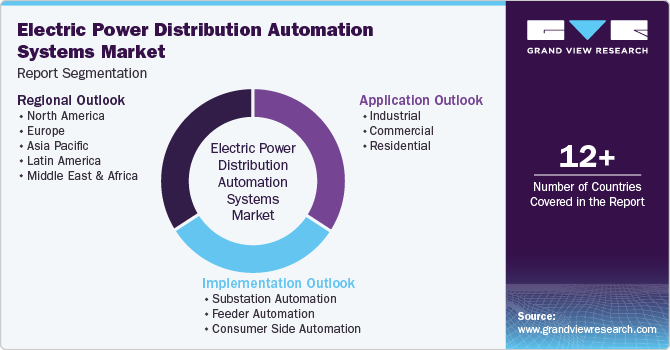

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global electric power DAS market on the basis of implementation, application, and region:

-

Implementation Outlook (Revenue, USD Million, 2018 - 2030)

-

Substation Automation

-

Feeder Automation

-

Consumer Side Automation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.