- Home

- »

- Next Generation Technologies

- »

-

Electric Vehicle Infotainment Market, Industry Report, 2030GVR Report cover

![Electric Vehicle Infotainment Market Size, Share & Trends Report]()

Electric Vehicle Infotainment Market (2024 - 2030) Size, Share & Trends Analysis Report By System, By Connectivity (Bluetooth, Cellular, Wireless, Wired Connectivity), By Vehicle (BEV, HEV), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-211-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Infotainment Market Summary

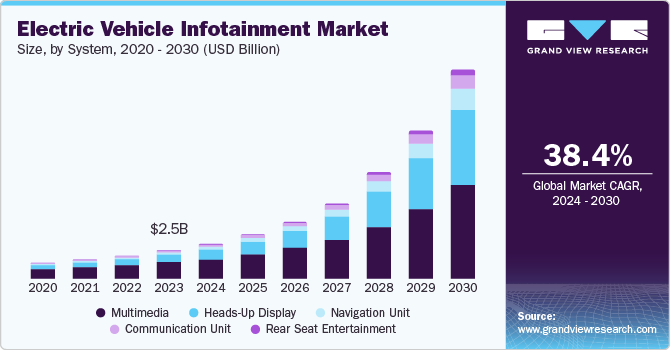

The global electric vehicle infotainment market size was valued at USD 2.52 billion in 2023 and is projected to reach USD 23.02 billion by 2030, growing at a CAGR of 38.4% from 2024 to 2030. The increasing consumer adoption of passenger and commercial electric vehicles (EV) drives the demand for the EV infotainment market.

Key Market Trends & Insights

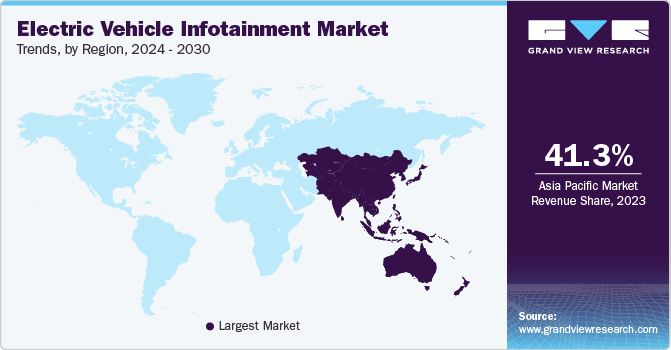

- Asia Pacific dominated the electric vehicle infotainment market and accounted for the largest revenue share of 41.3% in 2023.

- North America electric vehicle infotainment market is expected to register a significant CAGR over the forecast period.

- Based on system, the multimedia segment accounted for the largest revenue share of 55.7% in 2023.

- In terms of connectivity, the cellular segment is expected to experience a significant CAGR over the forecast period.

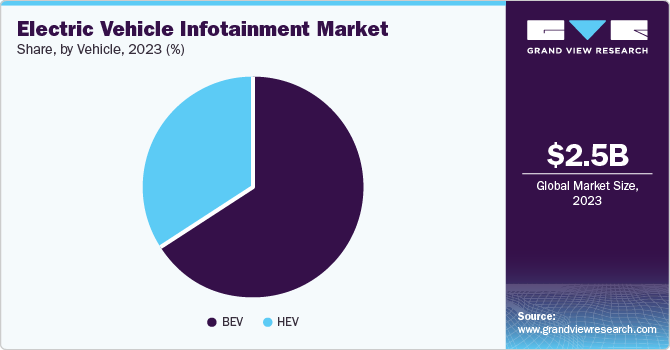

- Based on vehicle, BEV segment accounted for largest revenue share of the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.52 Billion

- 2030 Projected Market Size: USD 23.02 Billion

- CAGR (2024-2030): 38.4%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

The surging demand for GPS navigation-enabled infotainment systems also contributes to the market growth. The system facilitates mapping, traffic monitoring, and location tracking functions, increasing the infotainment system's functionality. Another factor, such as increasing usage of wireless connectivity with the EV infotainment system at a low cost, is propelling the market growth. Furthermore, the manufacturers are incorporating integrated center stacks in their EVs to improve control and engagement.

The use of a center stack provides touch capabilities and vertical integration. The curved center stack display enhances user experience with improved usability and cost-saving. The manufacturer providing different variants of infotainment systems, such as heads-up displays and rear-seat infotainment systems is another reason for market growth. Moreover, integrating operating systems such as Windows, Android, and Linux in EV infotainment systems further propels the market growth. The operating systems can support software downloads, updates, convenience functions, and connectivity. Implementing cloud technologies, Artificial Intelligence, and the Internet of Things has created new avenues for market growth.

Greater inclination in recent years towards electric vehicles has resulted in considerable demand for the infotainment system. The infotainment system enables enhanced safety for the passengers, and the integrated navigation system provides real-time traffic updates. Smartphone syncing features facilitate easy access to music streaming and calling apps. The major infotainment manufacturers are introducing technologies to enhance user experience.

These constant innovations in manufacturers' product offerings are further driving market growth. For instance, Continental AG provides the components required for an improved user experience in the new BMW iX. Continental's cockpit high-performance computer is incorporated into BMW's electric car, pushing for vehicle digitalization.

Cloud technology is transforming business across industries, and the automotive sector leverages the same to create a premium experience for end-users of electric vehicles. Car manufacturers like Volvo are leveraging innovative products by Qualcomm and Google to power the Volvo electric SUV's infotainment system.

System Insights

The multimedia segment accounted for the largest revenue share of 55.7% in 2023. The growing trend of connected and automated vehicles along with increasing demand for personalized and in-vehicle experiences driving the segment growth. The multimedia infotainment system enables the driver to access features such as a navigation system, calling, and music. Multimedia infotainment is also popular as it includes basic to some high-end functions and is compatible with low to high-end segment cars. In addition, the proliferation and smartphones and mobile devices has led to growing expectations for multimedia connectivity and functionality in vehicles.

The heads-up display segment is estimated to experience the fastest CAGR of 47.7% over the forecast period. The heads-up display presents the information at the driver’s line of sight on the windshield. Using projection systems and mirrors to display navigation, road speed, warning messages, and call information. The heads-up display enables the driver to operate the machine with reduced fatigue, enhancing the driver’s alertness concerning the outside environment. These are the major growth drivers for the adoption of heads-up displays.

Connectivity Insights

Wireless connectivity segment dominated the global industry in 2023. As the market penetration of smartphone technology increases, network connectivity is also becoming stronger to cater to the growing connectivity functionalities of smartphones. The internet connection through smartphones has enabled wireless and cellular infotainment connectivity. Wireless and cellular connectivity in EV infotainment systems is gaining traction due to high-speed connection and high data transfer speed. The internet connection-based wireless technology facilitates cloud data transfer in an advanced infotainment system. The expanding reach of wireless connectivity worldwide enables EV infotainment systems to provide a seamless driving experience while propelling market growth.

The cellular segment is expected to experience a significant CAGR over the forecast period. The growing trend of connecting smartphones to infotainment systems for accessing features such as music streaming and hands free calls driving growth of cellular segment. Cellular connectivity offers faster and more reliable data transfer improving the overall experience. Furthermore, rising advancements in technology such as 5G network and over-the-updates software, is further expected to propel segment growth.

Vehicle Insights

BEV segment accounted for largest revenue share of the global market in 2023. The rising carbon emissions and increasing preference for alternative fuel options led to the growth in adoption of battery electric vehicles. Government initiatives such as subsidies also lead to electric vehicle adoption. Integrating technologies such as cloud, AI, and IoT, along with increased screen size, in battery electric vehicles is leading to the increasing adoption of digital infotainment systems. Moreover, the rising popularity of rear-seat entertainment systems in battery-electric vehicles drives market growth.

The HEV segment is anticipated to witness the fastest CAGR from 2024 to 2030. The utility of infotainment systems in commercial vehicles is generally for navigation, tracking, and communication. However, advanced infotainment systems in commercial vehicles will enable the drivers to navigate the routes effectivity with the help of real-time traffic intel and maps. These factors are projected to help expand the market share of commercial vehicle types for EV infotainment systems.

Regional Insights

North America electric vehicle infotainment market is expected to register a significant CAGR over the forecast period. The increasing adoption of electronic vehicles, the presence of major technology companies, and the growing demand for connected and autonomous vehicles are the significant factors driving region growth. The high spending capacity among consumer demand for premium features such as connected car technologies, over-the-air updates, and interface designs drives region growth. Furthermore, the presence of major technologies and the automotive industry in the region further drives market growth. In addition, government regulations and safety standards drive the growth of EV infotainment in the area. For instance, the National Highway Traffic Safety Administration (NHTSA) has mandated the use of rearview cameras in all new vehicles, driving demand for advanced display systems and infotainment solutions.

U.S. Electric Vehicle Infotainment Market Trends

U.S. electric vehicle infotainment dominated the market in 2023. Growing demand for electric vehicles, coupled with rising technological advancements and consumer demand for premium experiences, fuels region growth. The growing trend of autonomous vehicles in the region is driving region growth, as these cars heavily rely on advanced infotainment systems. Continuous innovation and technologies and the growing number of EV manufacturers in the region are likely to propel region growth during the forecast period.

Europe Electric Vehicle Infotainment Market Trends

Europe electric vehicle infotainment market held a significant revenue share in 2023. The presence of major automobile manufacturers and technical advancements in the region are the key growth factors. Germany, France, and the UK majorly drive the region's growth. They are increasing sales of electric vehicles in the region owing to growing pollution and stricter laws and regulations enforced by the government, driving region growth. With rising disposable income and steady urbanization growth in the area, consumers are steadily looking for high-tech car features, such as advanced navigation, voice recognition, and entertainment options. Infotainment systems that offer these features are becoming more desirable. For instance, Europe’s urbanization population is projected to increase by around 83.7% by the end of 2050.

Germany electric vehicle infotainment market dominated the global industry in 2023. The EV infotainment market growth in the European region is attributed to the presence of major automotive manufacturers, the availability of workforce, and technological innovations. Germany is one of the largest automotive manufacturers in the world and a leader in Europe. The rising demand for EVs in the region and stringent emission norms mandated by the authorities are also major factors in the market growth.

Asia Pacific Electric Vehicle Infotainment Market Trends

Asia Pacific dominated the electric vehicle infotainment market and accounted for the largest revenue share of 41.3% in 2023. Increasing adoption of electric vehicles in countries like China, Japan, and South Korea, driven by government incentives, investments in EV infrastructure, and growing environmental concerns, is a key factor driving EV infotainment growth in the region. With rising disposable income, consumers increasingly seek connected car technologies and advanced infotainment systems that integrate seamlessly with their digital lives. In addition, increasing adoption of the latest technologies by key manufacturers, such as AI, cloud computing, IoT, and others, enhances performance for EV infotainment systems. Furthermore, major regional technology firms, such as Alibaba, Tencent, and Baidu, that provide information solutions further drive region growth. Moreover, strategic collaborations between automakers and technology companies are further leading to the development of advanced infotainment solutions in the region.

China electric vehicle infotainment market dominated the market in 2023. Increasing urbanization, expanding automotive sectors, and growing sustainability trends are major factors driving the adoption of electric vehicles, which has led to EV infotainment growth. In 2023, China accounted for around 60% of the global registration of electric cars. Furthermore, government initiatives and investments in EV infrastructure drive China's EV infotainment growth. For instance, China's "Made in China 2025" initiative aims to promote the development of advanced automotive technologies, including EV infotainment systems.

Key Electric Vehicle Infotainment Company Insights

Some of the key companies operating in electric vehicle infotainment market include ALPINE ELECTRONICS, Inc., Continental AG, HARMAN International, DENSO CORPORATION, and others. To address the rapidly growing competition in the market, key industry participants are adopting strategies such as enhanced R & D effort, innovation backed new product launches, service differentiation, and collaborations to attain improved technological expertise and other capabilities.

-

HARMAN International, a prominent engineering solutions company, offers multiple industry solutions, including automotive, consumer, professional, and digital transformation solutions for strategic business units. The automotive solutions offered by the company include Ready Care, Ready Connect, Ready Display, Ready Upgrade, Ready Vision, Automotive Engineering Services, Ignite Store, Seat Sonic, and others.

-

Robert Bosch GmbH, a global engineering and technology company, operates in a wide range of sectors, such as industrial, technology, energy, and consumer goods. The company offers a wide range of products and services, including power tools, electronics, home appliances, cloud computing, automotive, IoT, and many more.

Key Electric Vehicle Infotainment Companies:

The following are the leading companies in the electric vehicle infotainment market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- HARMAN International (Samsung)

- ALPINE ELECTRONICS, Inc.

- Pioneer Corporation

- Continental AG

- Robert Bosch GmbH

- Garmin Ltd.

- Clarion

- DENSO CORPORATION

- Visteon Corporation

Recent Developments

-

In April 2024, HARMAN Automotive and TATA MOTORS expanded their partnership, with Tata Motors selecting HARMAN’s ignite as its in-vehicle distribution store. The HARMAN ignite store is expected to enhance Tata Motors ARCADE.ev, a built-in app suite available in Nexon. EV and Punch. EV vehicles. The collaboration aims to bring accessible, reliable, and safe mobility experiences, enhancing customer in-vehicle overall experiences.

-

In January 2024, Bosch and Qualcomm technologies introduced a new central vehicle computer that can run infotainment and advanced driver assistance systems (ADAS) on a single chip. The newly launched chip is designed to enable automakers to implement a unified central computer and software-defined vehicle architecture. The newly launched product, also known as the cockpit and ADAS integration platform, is based on Qualcomm's Snapdragon Ride Flex System-on-Chip (SoC) and offers various features, such as infotainment, ADAS, and automated driving, to revolutionize the automotive industry.

Electric Vehicle Infotainment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.27 billion

Revenue Forecast in 2030

USD 23.02 billion

Growth rate

CAGR of 38.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

System, connectivity, vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Panasonic Corporation; HARMAN International (Samsung); ALPINE ELECTRONICS, Inc.; Pioneer Corporation; Continental AG; Robert Bosch GmbH; Garmin Ltd.; Clarion; DENSO CORPORATION; Visteon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Infotainment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle infotainment market report based on system, connectivity, vehicle, and region:

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Multimedia

-

Heads-Up Display

-

Navigation Unit

-

Communication Unit

-

Rear Seat Entertainment

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

Cellular

-

Wireless

-

Wired Connectivity

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

BEV

-

HEV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.