- Home

- »

- IT Services & Applications

- »

-

Electronic Cash Register Market Size, Industry Report, 2033GVR Report cover

![Electronic Cash Register Market Size, Share & Trends Report]()

Electronic Cash Register Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Product Type (Standard Electronic Cash Registers, Checkouts), By Component (Hardware, Software), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-634-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Cash Register Market Summary

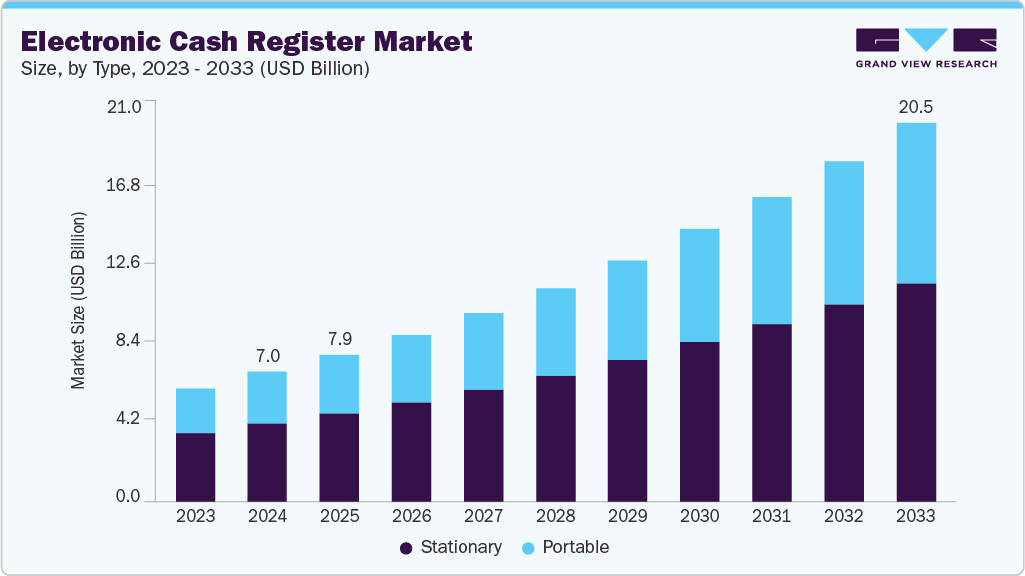

The global electronic cash register market size was estimated at USD 7.01 billion in 2024 and is projected to reach USD 20.48 billion by 2033, growing at a CAGR of 12.5% from 2025 to 2033 due to the digital transformation of the retail and hospitality industries, which are increasingly demanding more advanced, compact, and cost-efficient point-of-sale (POS) solutions. As small and medium-sized enterprises (SMEs) modernize their billing and transaction processes, the adoption of portable and integrated ECR systems has risen significantly.

Key Market Trends & Insights

- Asia Pacific electronic cash register market held the largest share of 40.2% in 2024.

- The Japan electronic cash register market is expected to grow rapidly in the coming years.

- By type, the stationary segment dominated the market and accounted for the revenue share of 60.5% in 2024.

- By product type, the POS system segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By component, the hardware segment dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.01 Billion

- 2033 Projected Market Size: USD 20.48 Billion

- CAGR (2025-2033): 12.5%

- Asia Pacific: Largest market in 2024

These systems streamline operations, enable real-time inventory tracking, and support various payment methods, including mobile wallets and contactless cards, capabilities that are significant in the consumer environment. The increasing demand for mobile POS (mPOS) and cloud-connected ECRs also contributes to the growth of the electronic cash register industry. Businesses are moving toward portable, tablet-based cash registers that offer flexibility, scalability, and integration with cloud-based inventory, CRM, and analytics software. These modern ECRs are particularly popular among startups, pop-up shops, delivery-based food chains, and field service vendors who need lightweight, yet powerful billing systems. The ability to operate wirelessly, connect with cloud applications, and accept digital payments has made mobile ECRs an essential tool in new-age commerce.

The rising penetration of digital payments globally also contributes to ECR market growth. As governments promote cashless economies and consumers shift toward contactless and card-based transactions, businesses must equip themselves with seamless payment systems that can handle multiple payment modes. This is especially pronounced in regions such as Asia-Pacific and parts of Africa, where smartphone penetration accelerates digital commerce in urban and semi-urban areas.

Type Insights

The stationary segment dominated the market and accounted for the revenue share of 60.5% in 2024, driven bythe need for advanced point-of-sale (POS) integration with inventory, loyalty programs, and customer relationship management (CRM) systems. Stationary registers are more likely to be integrated with full-fledged back-end enterprise systems, enabling businesses to track real-time sales data, manage multi-location inventories, and run customer engagement campaigns efficiently. Their fixed installation makes integrating with larger retail ecosystems easier, including barcode scanners, cash drawers, receipt printers, and surveillance systems.

The portable segment is anticipated to grow at the highest CAGR during the forecast period due to the global shift toward flexible, mobile, and customer-centric retail and service models. Businesses increasingly require mobility in their operations, whether it is a street vendor, pop-up store, delivery personnel, food truck, or a mobile healthcare unit. Portable ECRs, such as mobile POS (mPOS) systems, are designed to meet these evolving needs by offering lightweight, compact, and wireless solutions that enable on-the-go transactions without the limitations of fixed infrastructure.

Product Type Insights

ThePOS systems segment dominated the market and accounted for the largest revenue share in 2024,driven by the global shift toward digital transactions and integrated commerce solutions. Businesses no longer seek standalone cash registers; instead, they prefer multifunctional POS systems that combine billing, inventory management, customer data analytics, and payment processing into one seamless platform. Cloud-based POS solutions are especially popular among retailers and restaurants due to their flexibility, scalability, and ability to support omnichannel operations.

The checkouts segment is expected to grow at a significant CAGR during the forecast period due tothe growing sustained demand, particularly from high-traffic retail formats such as supermarkets, hypermarkets, and warehouse clubs. The growing need to reduce customer wait times, improve throughput, and optimize checkout efficiency has led to innovations such as hybrid manned/self-checkout counters. Moreover, integrating AI, touchless payment systems, and anti-theft technologies has modernized the traditional checkout area, transforming it into a smart touchpoint that supports real-time promotions and customer identification.

Component Insights

Thehardware segment dominated the market and accounted for the largest revenue share in 2024, fueled by the need for durable, high-performance, and modular devices that can withstand continuous usage in demanding retail and service environments. The increasing deployment of peripherals, such as barcode scanners, receipt printers, cash drawers, and customer-facing displays, is driving hardware upgrades across retail chains and hospitality businesses. Moreover, demand for ruggedized or portable hardware is rising in outdoor environments and mobile businesses.

The software segment is expected to grow at a significant CAGR during the forecast period due to the rising importance of cloud-based POS software, real-time analytics, and data-driven decision-making. ECR software now goes beyond simple transaction recording to offer advanced functionalities such as inventory management, multi-location tracking, sales forecasting, staff scheduling, and customer relationship management. Businesses increasingly prefer Software-as-a-Service (SaaS) models for their low upfront cost, ease of updates, and remote accessibility.

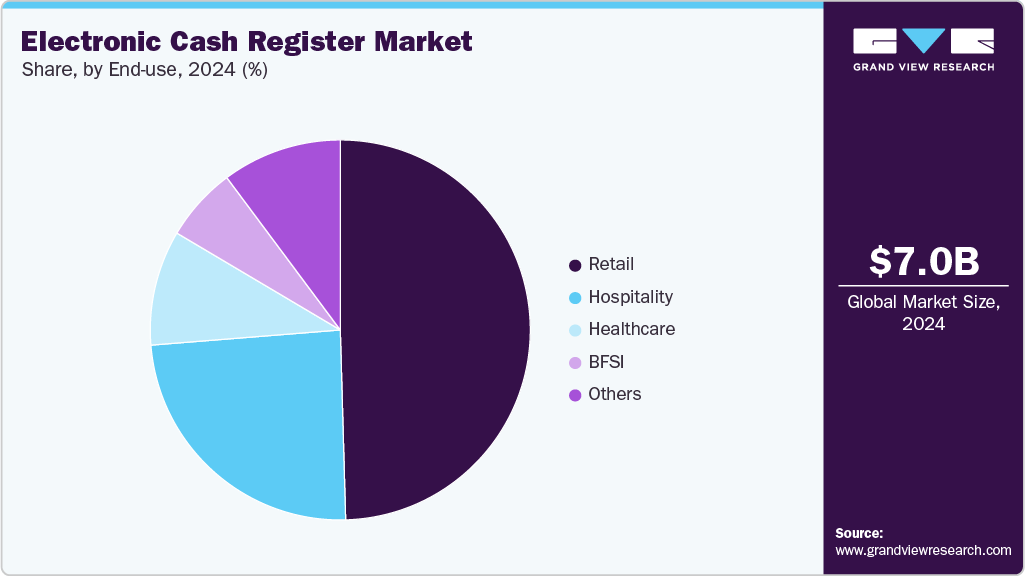

End-use Insights

The retail segment dominated the market and accounted for the largest revenue share in 2024, driven by the increased modernization of point-of-sale infrastructure across small, mid-sized, and large retail chains. The emergence of omnichannel commerce, click-and-collect models, and consumer demand for frictionless shopping experiences have prompted retailers to deploy ECRs that support integrated payments, real-time inventory syncing, and customer engagement tools.

The hospitality segment is expected to grow at a significant CAGR over the forecast period.The hospitality segment, including restaurants, cafés, hotels, and QSR chains, is driving ECR adoption due to its need for quick, personalized, and mobile ordering and billing systems. The rise of tableside ordering, contactless payment, and online-to-offline (O2O) integrations in the food and beverage industry has accelerated the shift from traditional cash registers to intelligent POS systems.

Regional Insights

North America electronic cash register held a significant share in the global market in 2024, driven by the widespread adoption of cloud-based POS systems and demand for real-time retail analytics among large and mid-sized enterprises. The region’s mature digital infrastructure enables seamless integration of ECRs with loyalty programs, AI-powered customer insights, and omnichannel sales platforms. Additionally, the push for data-driven inventory and workforce optimization in sectors like quick-service restaurants and specialty retail is fueling demand for intelligent ECRs.

The electronic cash register market in the U.S. is expected to grow significantly at a CAGR of 10.3% from 2025 to 2033, due to the rise of self-checkout systems and consumer preference for contactless payments, which are key market drivers. Large retail chains and grocery giants are rapidly replacing legacy registers with touchscreen-enabled, AI-integrated ECRs that support frictionless, unattended transactions.

Europe Electronic Cash Register Industry Trends

The electronic cash register market in Europe is anticipated to register considerable growth from 2025 to 2033 due to the region’s strong focus on fiscal compliance and electronic invoicing mandates. Countries such as Italy, Spain, and France have enforced stringent tax recording and e-receipt regulations, pushing retailers and hospitality providers to adopt certified ECRs.

The UK electronic cash register market is expected to grow rapidly in the coming years, owing to the surge in hybrid retail models, especially in the wake of post-Brexit e-commerce integration. Retailers are investing in versatile ECRs that can handle both in-store and online transactions, return processing, and real-time order fulfillment. The rising popularity of pop-up stores, local markets, and food trucks has also driven demand for lightweight, portable cash registers with multi-payment capabilities.

Electronic cash register market in Germany held a substantial market share in 2024 due tothe modernization of retail infrastructure in line with stringent fiscal laws under the KassenSichV regulation. This regulation mandates tamper-proof electronic recording systems and digital receipt issuance, compelling businesses to upgrade or replace older registers with compliant ECRs. Moreover, the country's large base of mid-sized retailers and family-owned businesses is increasingly adopting advanced ECRs that integrate with ERP systems, digital payment solutions, and inventory tracking tools.

Asia Pacific Electronic Cash Register Industry Trends

Asia Pacific dominated the global market with the largest revenue share of 40.2% in 2024, due torapid urbanization, retail digitization, and the expansion of organized retail chains are accelerating the ECR market. The shift from cash-based transactions to mobile wallets and UPI-enabled payments in countries like India and Indonesia has increased the adoption of compact, affordable ECRs.

The Japan electronic cash register market is expected to grow rapidly in the coming years, driven by technological innovation and demand for automation in the retail and hospitality sectors. The country's aging population and labor shortages are pushing convenience stores and restaurants to adopt AI-enabled, multilingual self-checkout ECRs that reduce reliance on human staff. Additionally, Japan’s highly digitized consumer base expects integrated payment options, making advanced ECRs a necessity in modern service environments.

Electronic cash register market in China held a substantial market share in 2024, due to the growth in mobile commerce and digital ecosystems, which is propelling the ECR market, especially among small businesses and rural merchants. Integration with super apps like Alipay and WeChat Pay has led to high demand for ECRs that support QR payments, dynamic pricing, and cloud-based inventory syncing. Furthermore, local ECR manufacturers are developing cost-effective, feature-rich systems, intensifying market penetration in tier-2 and tier-3 cities.

Key Electronic Cash Register Company Insights

Key players operating in the electronic cash register industry are NCR VOYIX,Toshiba Corporation, Diebold Nixdorf, and Epson America, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Diebold Nixdorf expanded its U.S. production capabilities by launching a new retail technology manufacturing line at its Ohio facility. This development supports the company’s strategic focus on self-service checkouts and kiosk systems tailored for domestic grocery, quick service restaurant (QSR), general merchandise, and fuel and convenience retailers. By integrating this in-house manufacturing with its broader supply chain strategy, Diebold Nixdorf aims to enhance product quality, responsiveness, and customer focus while gaining greater control and predictability over its global production processes.

-

In February 2025, NCR Voyix announced a new agreement with Worldpay, a UK-based payments technology provider. Through this partnership, NCR Voyix will offer an integrated, cloud-based software and payments solution tailored for retailers and restaurants. By incorporating Worldpay’s advanced acquiring services, the collaboration aims to streamline payment acceptance and enhance the overall customer experience across NCR Voyix's platform.

Key Electronic Cash Register Companies:

The following are the leading companies in the electronic cash register market. These companies collectively hold the largest market share and dictate industry trends.

- Bixolon Co., Ltd.

- Casio Computer Co., Ltd.

- Dell Technologies Inc.

- Diebold Nixdorf

- Elo Touch Solutions

- Epson America, Inc.

- Forbes Technosys Ltd.

- Foxconn Technology Group

- Fujitsu Ltd.

- Hewlett-Packard Company

- NCR VOYIX

- Panasonic Corporation

- Posiflex Technology, Inc.

- Royal Consumer Information Products, Inc.

- Sunmi Technology

- SAM4S

- Sharp Corporation

- Toshiba Corporation

Electronic Cash Register Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.96 billion

Revenue forecast in 2033

USD 20.48 billion

Growth rate

CAGR of 12.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, product type, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Bixolon Co., Ltd.; Casio Computer Co., Ltd.; Dell Technologies Inc.; Diebold Nixdorf; Elo Touch Solutions; Epson America, Inc.; Forbes Technosys Ltd.; Foxconn Technology Group; Fujitsu Ltd.; Hewlett-Packard Company; NCR Corporation; Panasonic Corporation; Posiflex Technology, Inc.; Royal Consumer Information Products, Inc.; Sunmi Technology; SAM4S; Sharp Corporation; Toshiba Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Cash Register MarketReport Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the electronic cash register market report based on type, product type, component, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Stationary

-

Portable

-

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standard electronic cash registers

-

Checkouts

-

POS system

-

Personal electronic cash registers

-

Mobile POS systems

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail

-

Hospitality

-

Healthcare

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electronic cash register market size was estimated at USD 7.01 billion in 2024 and is expected to reach USD 7.96 billion in 2025.

b. The global electronic cash register market is expected to grow at a compound annual growth rate of 12.5% from 2025 to 2033 to reach USD 20.48 billion by 2033.

b. The stationary segment dominated the market and accounted for the revenue share of 60.5% in 2024, driven by the need for advanced point-of-sale (POS) integration with inventory, loyalty programs, and customer relationship management (CRM) systems.

b. Some key players operating in the electronic cash register market include Bixolon Co., Ltd., Casio Computer Co., Ltd., Dell Technologies Inc., Diebold Nixdorf, Elo Touch Solutions, Epson America, Inc., Forbes Technosys Ltd., Foxconn Technology Group, Fujitsu Ltd., Hewlett-Packard Company, NCR Corporation, Panasonic Corporation, Posiflex Technology, Inc., Royal Consumer Information Products, Inc., Sunmi Technology, SAM4S, Sharp Corporation, Toshiba Corporation

b. The key factors include digital transformation of the retail and hospitality industries, which increasingly demand more advanced, compact, and cost-efficient point-of-sale (POS) solutions. As small and medium-sized enterprises (SMEs) modernize their billing and transaction processes, the adoption of portable and integrated ECR systems has risen significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.