- Home

- »

- Agrochemicals & Fertilizers

- »

-

Electronic Grade Nitric Acid Market, Industry Report, 2030GVR Report cover

![Electronic Grade Nitric Acid Market Size, Share & Trends Report]()

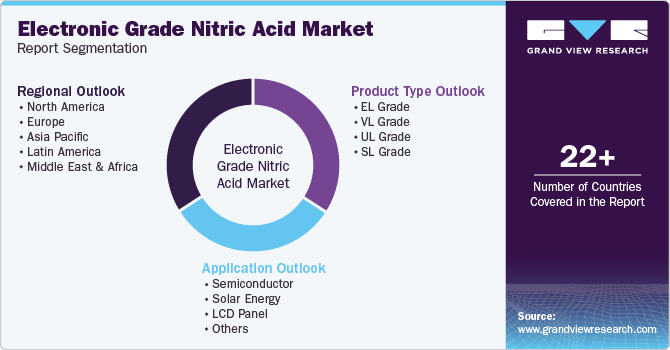

Electronic Grade Nitric Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (EL Grade, VL Grade, UL Grade, SL Grade), By Application (Semiconductor, Solar Energy, LCD Panel), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-467-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Grade Nitric Acid Market Summary

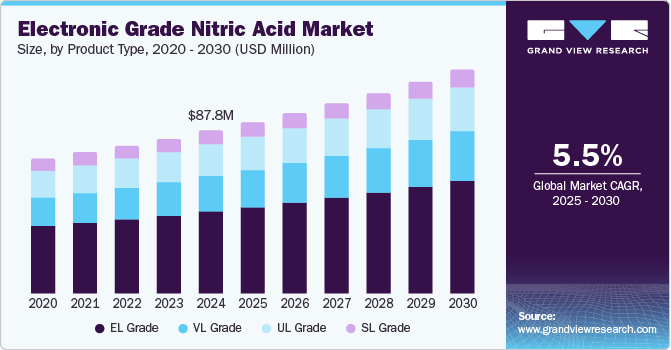

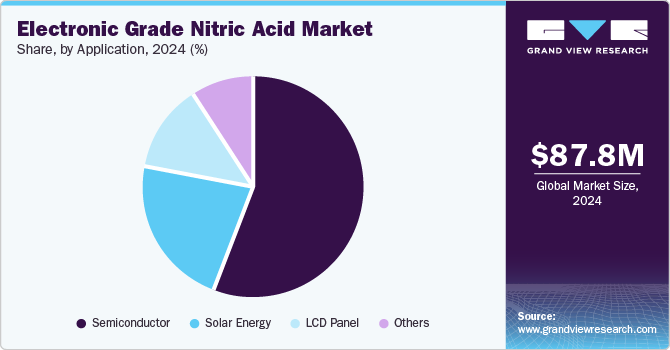

The global electronic grade nitric acid market size was valued at USD 87.8 million in 2024 and is projected to reach USD 120.5 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The growth of the global market for electronic-grade nitric acid is primarily driven by the increasing demand for electronic devices worldwide.

Key Market Trends & Insights

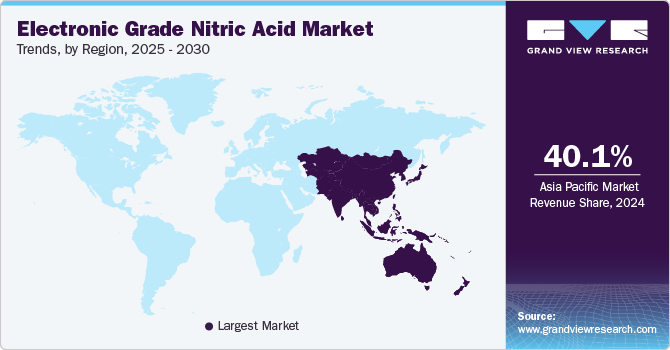

- Asia Pacific dominated the global electronic grade nitric acid industry and accounted for the largest revenue share of 40.1% in 2024.

- The North America electronic grade nitric acid market is expected to witness substantial growth over the forecast period.

- Based on application, the semiconductor segment dominated the global electronic-grade nitric acid market and accounted for the largest revenue share, 56.3%, in 2024.

- In terms of product type, the EL grade segment led the market and accounted for the largest revenue share of 50.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 87.8 Million

- 2030 Projected Market Size: USD 120.5 Million

- CAGR (2025-2030): 5.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

This acid is crucial in the cleaning and etching processes during semiconductor manufacturing and is essential for producing high-performance electronics. Electronic grade nitric acid is a highly pure form of nitric acid used in the electronics industry for cleaning and etching silicon wafers and other electronic components. It is produced through a multi-stage distillation process to achieve a purity level of 99.999% or higher. Additionally, technological advancements and the growth of industries such as electronics and semiconductors further propel the demand for high-purity nitric acid. The expansion of the electronics sector, especially in developing countries, coupled with the trend towards miniaturization of electronic components, further fuels market growth.

As the global emphasis on renewable energy sources intensifies, the demand for photovoltaic cells, which convert sunlight into electricity, has surged. Electronic-grade nitric acid is used in the texturization process of silicon wafers to improve the efficiency of photovoltaic cells. This application significantly contributes to the growing demand for electronic-grade nitric acid, driven by the expanding solar energy sector.

The ongoing trend towards miniaturization of electronic devices, coupled with advancements in technology, necessitates the use of high-purity chemicals like electronic grade nitric acid. The need for smaller, more complex devices with higher performance standards increases the reliance on materials that can ensure the highest levels of precision and cleanliness in manufacturing processes.

However, nitric acid is highly corrosive and toxic, posing substantial risks during production, transport, and storage. Handling nitric acid requires specific safety measures to protect workers and prevent environmental contamination. Regulatory bodies worldwide have imposed strict guidelines on using, storing, and disposing of hazardous chemicals, including nitric acid.

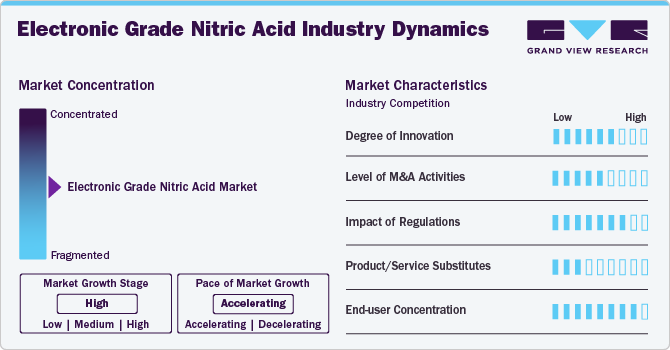

Market Concentration & Characteristics

The electronic grade nitric acid market growth stage is high, and the pace of the market growth is accelerating. The market is dominated by a few major chemical companies with extensive experience and capabilities in producing high-purity chemicals. These companies often have a global presence, with manufacturing plants close to key electronics manufacturing hubs in Asia, North America, and Europe.

Technological innovations primarily drive competition among these players to achieve higher purity levels, environmental and safety compliance, and the ability to provide comprehensive customer support and technical services. Additionally, the strategic positioning of production facilities near key electronics manufacturing hubs and the emphasis on efficient supply chain management are critical for meeting the industry's just-in-time delivery expectations.

Product Type Insights

The EL grade segment led the market and accounted for the largest revenue share of 50.4% in 2024. This growth is attributed to the continuous evolution and demand for more sophisticated electronic devices, such as smartphones, tablets, and wearables, which drives the need for high-purity chemicals in manufacturing processes. EL grade nitric acid, with its high purity, is essential in the etching and cleaning processes of semiconductor fabrication, directly correlating with the industry's growth.

VL grade is expected to grow at a CAGR of 5.9% over the forecast period. VL grade is widely used in manufacturing high-complexity integrated circuits. The demand for VLSI-grade chemicals, including nitric acid, is driven by the continuous push towards further miniaturization of electronic devices and the increasing complexity of semiconductor chips. Additionally, the demand for more energy-efficient and faster computing devices requires the production of more complex chips, directly influencing the demand for VLSI-grade nitric acid.

Application Insights

The semiconductor segment dominated the global electronic-grade nitric acid market and accounted for the largest revenue share, 56.3%, in 2024. Semiconductor manufacturing heavily relies on electronic-grade nitric acid for its high-purity properties. This chemical is crucial for etching and cleaning silicon wafers, meeting the stringent requirements of modern semiconductor devices.

The solar energy application segment is expected to grow at a CAGR of 5.9% over the forecast period. Electronic-grade nitric acid is increasingly used in the cleaning and etching processes of photovoltaic cells, essential for producing high-efficiency solar panels. The demand in this sector is propelled by the global shift towards renewable energy sources, which requires high-purity chemical solutions to optimize the performance and durability of solar panels.

Regional Insights

The North America electronic grade nitric acid market is expected to witness substantial growth over the forecast period. The regional growth is mainly propelled by advanced semiconductor manufacturing and the growing solar energy sector. In addition, emphasis on renewable energy and technological advancements further enhances the product demand, establishing it as a crucial component in the manufacturing and utilizing high-tech and clean energy solutions.

U.S. Electronic Grade Nitric Acid Market Trends

The U.S. electronic-grade nitric acid industry dominated the North American market and accounted for the largest revenue share in 2024. Due to its high purity, electronic-grade nitric acid is crucial for producing semiconductors and electronics. As the U.S. invests in renewable energy and high-tech industries, electronic-grade nitric acid remains vital for ensuring the production of high-quality electronic devices.

Asia Pacific Electronic Grade Nitric Acid Market Trends

Asia Pacific dominated the global electronic grade nitric acid industry and accounted for the largest revenue share of 40.1% in 2024. Regional growth is driven by the expansion of electronics and solar energy industries, particularly in countries like China, Japan, South Korea, and Taiwan. These nations are at the forefront of semiconductor manufacturing and solar panel production, driving significant demand for high-purity chemicals.

China's electronic grade nitric acid market led the Asia Pacific market and held the largest revenue share in 2024. China is a global leader in semiconductor production and solar panel manufacturing. China's demand for high-purity chemicals, including electronic grade nitric acid, is substantial. This demand is supported by the country's strategic initiatives towards technological advancement and renewable energy, making China a crucial market in the global landscape for electronic-grade nitric acid.

Europe Electronic Grade Nitric Acid Market Trends

Europe's electronic grade nitric acid market is expected to grow at a CAGR of 5.4% from 2025 to 2030, owing to the region’s commitment to environmental sustainability and innovation, which are integral to the sophisticated processes of etching and cleaning semiconductor materials. This demand is further amplified by Europe's strategic initiatives to bolster its technological infrastructure and reduce its carbon footprint by adopting clean energy technologies.

Key Electronic Grade Nitric Acid Company Insights

Key players in the electronic-grade nitric acid market include Mitsubishi Chemical Corporation, Everest Kanto Cylinder, BASF SE, and others. These companies adopt strategies such as partnerships, mergers, and investments in R&D to enhance product purity and expand market share. Furthermore, they focus on technological advancements and strategic expansions near major electronics hubs to meet growing demand for high-purity chemicals.

-

EuroChem operates globally, providing a wide range of agricultural products to help increase crop yield and food production. EuroChem has become one of the largest fertilizer producers worldwide, with significant operations and distribution networks across Europe, Asia, the Americas, and other key markets.

-

BASF focuses on innovation and development in the chemical industry, holding a prominent position globally across various sectors, including chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The company’s portfolio includes plastics, performance products, chemicals, and crop protection products, and oil and gas.

Key Electronic Grade Nitric Acid Companies:

The following are the leading companies in the electronic grade nitric acid market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Chemical Corporation

- Everest Kanto Cylinder

- BASF SE

- Columbus Chemicals

- UBE Corporation

- T. N. C. Industrial

- KMG Electronic Chemicals

- EuroChem

- Asia Union Electronic Chemicals

- Juhua Group

Recent Developments

-

In November 2024, UBE Corporation announced plans to increase its production capacity of high-purity electronic grade nitric acid by approximately 30.0% at Ube Chemical Factory. This expansion aimed to meet growing demand in the semiconductor industry, driven by advancements in technologies such as generative AI and data centers.

Electronic Grade Nitric Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.4 million

Revenue forecast in 2030

USD 120.5 million

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

Mitsubishi Chemical Corporation; Everest Kanto Cylinder; BASF SE; Columbus Chemicals; UBE Corporation; T. N. C. Industrial; KMG Electronic Chemicals; EuroChem; Asia Union Electronic Chemicals; Juhua Group.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Grade Nitric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global electronic grade nitric acid market report based on, product type, application, and region.

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

EL Grade

-

VL Grade

-

UL Grade

-

SL Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Semiconductor

-

Solar Energy

-

LCD Panel

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.