- Home

- »

- Distribution & Utilities

- »

-

Electronic Load Market Size & Share, Industry Report, 2030GVR Report cover

![Electronic Load Market Size, Share & Trends Report]()

Electronic Load Market (2025 - 2030) Size, Share & Trends Analysis Report By Current (Alternating Current, Direct Current), By Application (Wireless Communication & Infrastructure, Energy, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-420-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Load Market Summary

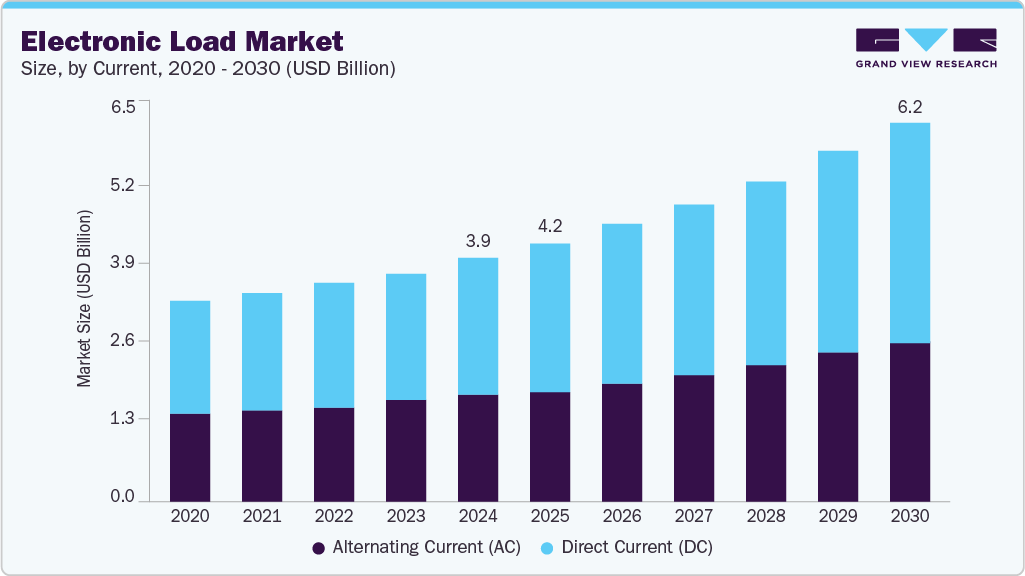

The global electronic load market size was estimated at USD 3.94 billion in 2024 and is projected to reach USD 6.19 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The increasing demand for reliable and efficient testing solutions in various industries, particularly aerospace, automotive, and renewable energy, is driving the market growth.

Key Market Trends & Insights

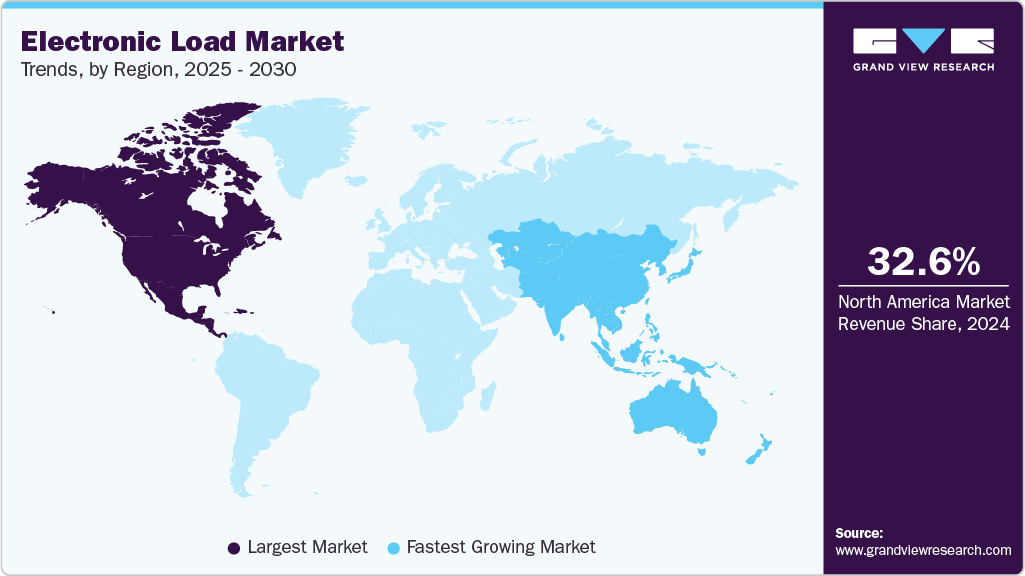

- The North America electronic load market held the largest revenue share of 32.63% in 2024.

- The electronic load market in the U.S. is witnessing significant demand, particularly in the growing electric vehicle (EV) sector.

- By current, the DC segment held the largest market share in 2024 and is expected to grow at the fastest CAGR of 8.4% over the forecast period.

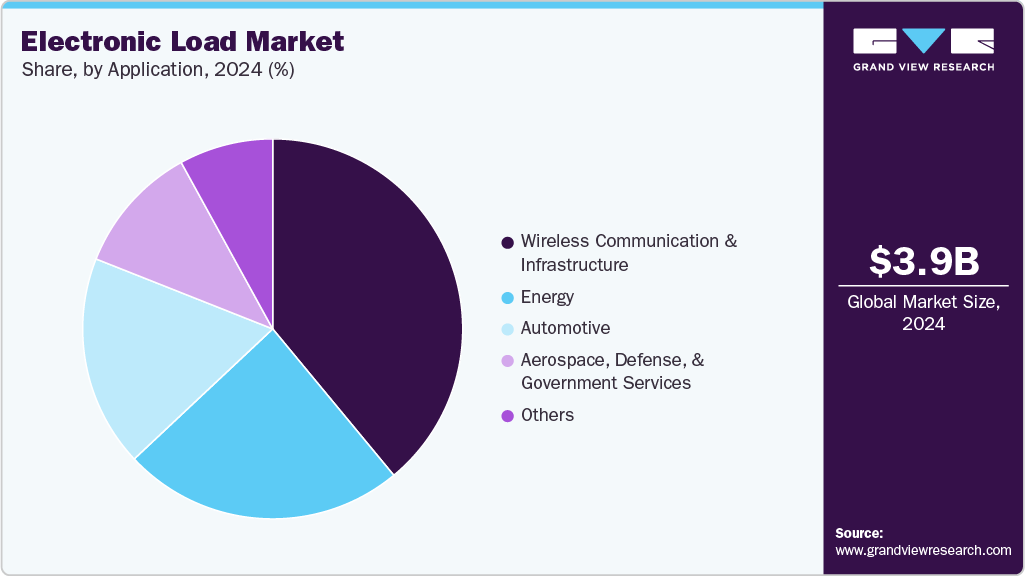

- By application,the wireless communication and infrastructure segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.94 Billion

- 2030 Projected Market Size: USD 6.19 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

The growing need for high-power testing capabilities, driven by the development of electric vehicles, renewable energy systems, and advanced aerospace applications, is fueling the demand for electronic loads. Electronic loads are used to simulate real-world operating conditions, allowing manufacturers to test and validate the performance of their products, such as power supplies, batteries, and fuel cells. The demand for electronic loads is accelerated by the increasing complexity of modern power systems, which require more sophisticated testing solutions. Another factor contributing to market growth is the increasing focus on renewable energy and energy efficiency. As governments and industries strive to reduce their carbon footprint, there is a growing need for testing solutions that can simulate the performance of renewable energy systems, such as solar panels and wind turbines.

Electronic loads are used to test the performance of these systems, ensuring that they operate efficiently and effectively. For example, in the solar industry, electronic loads are used to test the performance of solar panels and inverters, simulating real-world operating conditions to ensure that they meet the required performance standards. Electronic loads allow manufacturers to simulate a wide range of operating conditions, including fault conditions, to ensure that their products can operate reliably and efficiently in real-world applications.

Current Insights

The market is segmented into alternating current (AC) and direct current (DC). The DC segment held the largest market share in 2024 and is expected to grow at the fastest CAGR of 8.4% over the forecast period. DC electronic loads are designed to simulate the load of DC power currents, such as those found in batteries, power supplies, and fuel cells. These loads test and characterize DC power currents, ensuring they can handle various load conditions, including high-power and high-voltage applications. DC electronic loads are commonly used in industries such as telecommunications, data centers, and electric vehicles, where DC power currents are widely used. They are also used in research and development, product testing, and quality control applications. The DC electronic load segment is expected to grow over the coming years as the demand for DC power currents increases in various industries, driven by the adoption of electric vehicles and the growth of data centers.

The AC segment held a revenue share of 43.0% in 2024. AC electronic loads are designed to simulate the load of AC power currents, such as those found in power grids, generators, and inverters. These loads test and characterize AC power currents, ensuring that they can handle various load conditions, including high-power and high-frequency applications. AC electronic loads are commonly used in aerospace, automotive, and renewable energy industries, where AC power currents are prevalent. They are also used in research and development, product testing, and quality control applications. The AC electronic load segment is expected to grow over the coming years with the surging demand for AC power currents in various industries.

Application Insights

The market has been segmented on the basis of applications into wireless communication and infrastructure, energy, automotive, aerospace, defense, government services, and others. The wireless communication and infrastructure segment held the largest revenue share in 2024. This segment includes testing and validating wireless communication systems, such as base stations, cell towers, and other infrastructure equipment. The surging demand for high-speed data transmission and the proliferation of 5G networks drive the growth of electronic loads in this segment.

The energy segment is expected to record the fastest CAGR over the forecast period and is a major application area for electronic loads, encompassing the testing and validation of power generation, transmission, and distribution systems. Electronic loads simulate various load conditions, such as peak demand, to test the performance and efficiency of power generation systems, such as solar panels and wind turbines. In addition, electronic loads are used to test the performance of power transmission and distribution systems, including grid-scale energy storage systems. The growing demand for renewable energy, currents, and the need for efficient energy management are expected to drive the demand for electronic loads in this segment.

Aerospace, defense, and government services segment is also a critical application area for electronic loads, driven by the need for high-reliability and high-performance testing of military and aerospace systems. Electronic loads are used to test and validate the performance of military and aerospace power systems, including radar systems, communication systems, and navigation systems.

Regional Insights

The North America electronic load market held the largest revenue share of 32.63% in 2024. The region's strong focus on technological advancements and innovation is a major contributor. North America, particularly the U.S., is home to several leading tech companies and research institutions constantly pushing the boundaries of electronic systems. The presence of these companies results in a high demand for electronic load testing equipment to ensure the reliability and performance of new electronic products. For example, companies such as Apple, Google, and Tesla, based in North America, require sophisticated electronic load testing for their cutting-edge devices and electric vehicles.

U.S. Electronic Load Market Trends

The electronic load market in the U.S. is witnessing significant demand, particularly in the growing electric vehicle (EV) sector. Companies such as Tesla, General Motors, and Ford are investing heavily in EV development, which necessitates rigorous testing of batteries, charging systems, and power electronics. Electronic loads play a critical role in this testing, helping manufacturers optimize the performance and longevity of EV components. As the U.S. continues to push for greater adoption of electric vehicles, the demand for sophisticated electronic load testing equipment is expected to grow accordingly.

Europe Electronic Load Market Trends

The electronic load market in Europe has a stringent regulatory environment and high energy efficiency standards, which are expected to propel the market growth. The European Union's Ecodesign Directive and Energy Labelling Regulation require manufacturers to continuously improve the energy efficiency of their products. This has led to increased demand for electronic loads in research & development and quality control processes. For instance, companies producing household appliances, IT equipment, and industrial machinery use electronic loads more frequently to ensure compliance with these regulations and optimize the energy consumption of their products.

Asia Pacific Electronic Load Market Trends

The electronic load market in Asia Pacific is expected to grow at the fastest CAGR of 8.9% over the forecast period, as it is home to a large number of electronics manufacturers and semiconductor companies. Countries such as Taiwan, South Korea, and China are global leaders in producing smartphones, computers, and other electronic devices. These industries rely heavily on electronic loads for product testing and quality assurance. For example, companies such as Samsung and TSMC use electronic loads to test the power consumption and efficiency of their latest chip designs and electronic components.

China Electronic Load Market Trends

China’s electronic load market is witnessing robust expansion, driven by its dominance in electric vehicle manufacturing, renewable energy integration, and semiconductor production. The country’s aggressive push toward electrification and energy efficiency, especially in EVs and large-scale energy storage systems, is significantly accelerating the demand for sophisticated DC and regenerative electronic loads. Supportive government policies aimed at fostering clean energy and indigenous technological advancement have further solidified China’s position in the global electronic load industry.

Key Electronic Load Company Insights

The market is characterized by intense competition and rapid technological advancements. Key players in this sector continuously strive to innovate and expand their product portfolios to meet the growing demand across various industries, including aerospace, defense, automotive, and renewable energy.

-

Keysight Technologies offers various programmable electronic loads used across automotive, aerospace, defense, and general industrial applications. The company is known for its robust R&D capabilities and technological innovation.

-

Chroma ATE Inc. offers advanced power testing instruments widely used in the electronics, automotive, and battery testing sectors. The company offers high-efficiency and precision solutions, particularly in programmable DC and AC electronic loads.

Key Electronic Load Companies:

The following are the leading companies in the electronic load market. These companies collectively hold the largest market share and dictate industry trends.

- B&K Precision Corporation

- JOJO Technologies Co., Ltd.

- Changzhou Tonghui Electronic Co. Ltd.

- Teledyne LeCroy

- Chroma ATE Inc.

- Keysight Technologies

- RIGOL TECHNOLOGIES, Co. LTD

- NATIONAL INSTRUMENTS CORP

- Scientific Mes-Technik Pvt. Ltd.

- b2 electronics GmbH

- Bestmach

- Hantek

- Good Will Instrument Co., Ltd.

- MASTECH DIGITAL, INC.

- HIOKI E.E. CORPORATION

Recent Developments

-

In April 2024, Tektronix acquired EA Elektro-Automatik to significantly enhance its power portfolio aimed at engineers involved in electrification efforts.

-

In April 2024, Rohde and Schwarz presented a new R&S NGC100 power supply series with a market-leading function targeting R&D labs, battery simulation, and power electronics.

Electronic Load Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.20 billion

Revenue forecast in 2030

USD 6.19 billion

Growth Rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Current, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

B&K Precision Corporation; JOJO Technologies Co., Ltd.; Changzhou Tonghui Electronic Co. Ltd.; Teledyne LeCroy; Chroma ATE Inc.; Keysight Technologies; RIGOL TECHNOLOGIES, Co. LTD; NATIONAL INSTRUMENTS CORP; Scientific Mes-Technik Pvt. Ltd.; b2 electronics GmbH; Bestmach; Hantek; Good Will Instrument Co., Ltd.; MASTECH DIGITAL, INC.; HIOKI E.E. CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

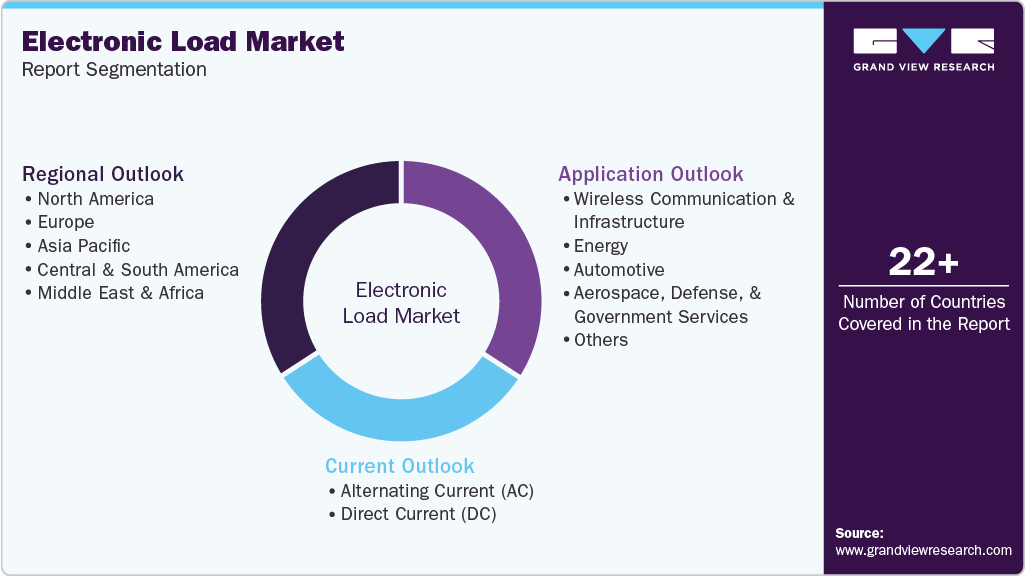

Global Electronic Load Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic load market report based on current, application, and region.

-

Current Outlook (Revenue, USD Million, 2018 - 2030)

-

Alternating Current (AC)

-

Direct Current (DC)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wireless Communication and Infrastructure

-

Energy

-

Automotive

-

Aerospace, Defense, and Government Services

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.