- Home

- »

- Pharmaceuticals

- »

-

Eliquis (Apixaban) Market Size, Share, Industry Report, 2033GVR Report cover

![Eliquis (Apixaban) Market Size, Share & Trends Report]()

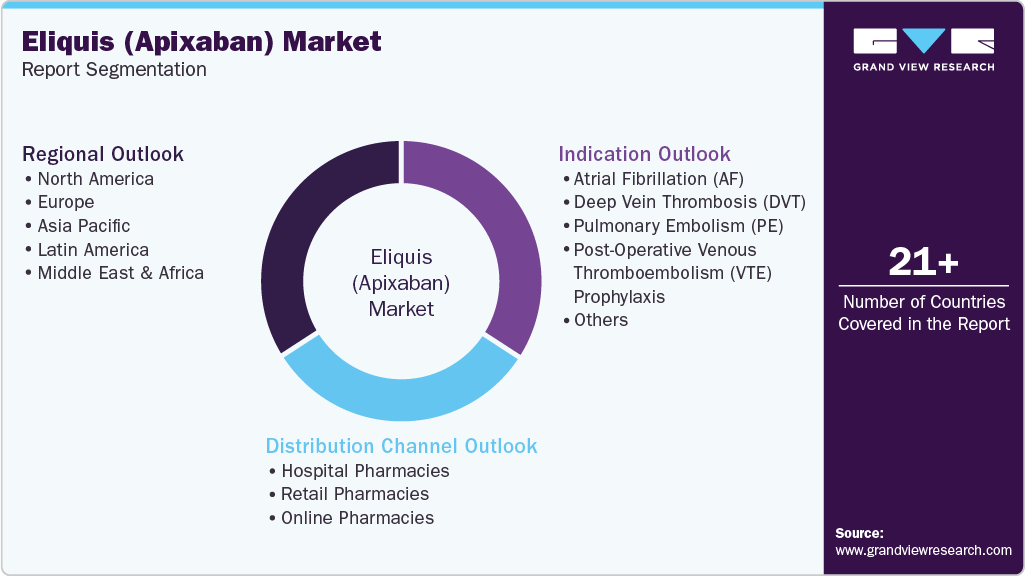

Eliquis (Apixaban) Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE)), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-673-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eliquis (Apixaban) Market Summary

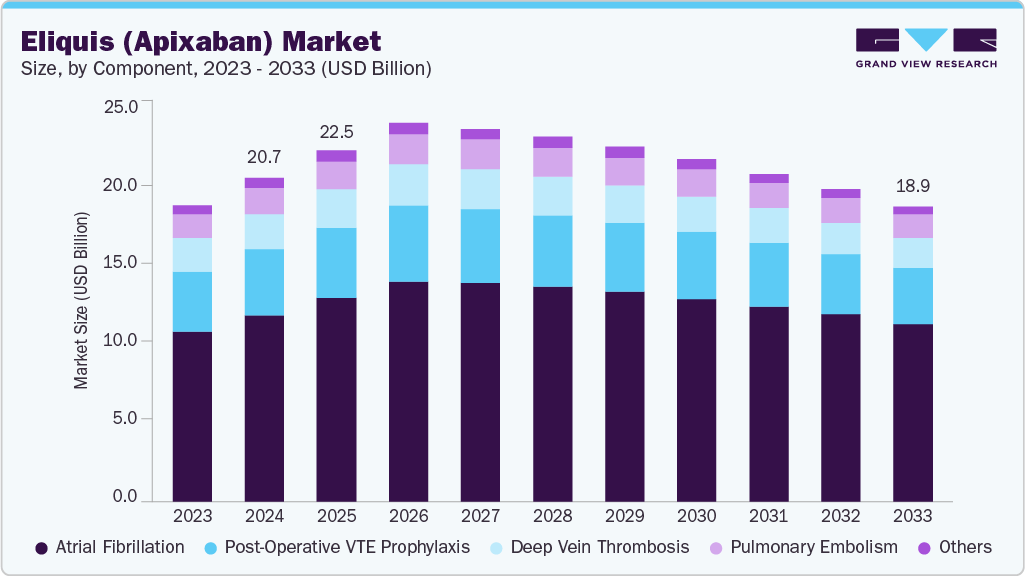

The global Eliquis (apixaban) market size was estimated at USD 20.70 billion in 2024 and is projected to reach USD 18.87 billion by 2033, with a decline of CAGR of -2.2% from 2025 to 2033, primarily due to loss of patent exclusivity, growing generic competition, and consequent price erosion across major markets.

Key Market Trends & Insights

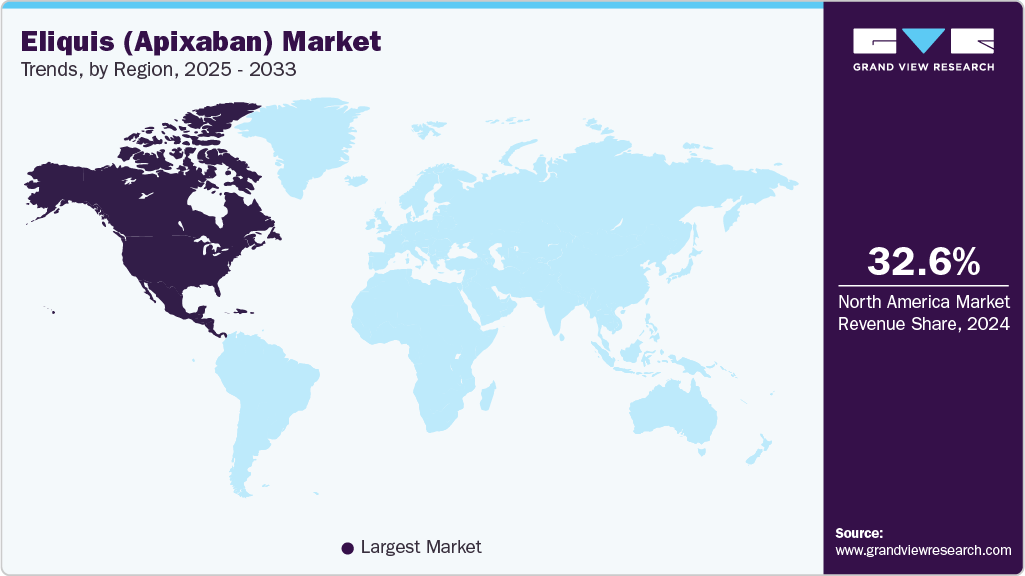

- North America Eliquis (apixaban) market held the largest share of 32.56% of the global market in 2024.

- The U.S. market is expected to register significant CAGR over the forecast period, while maintaining a dominant share in 2024.

- By indication, the atrial fibrillation segment led the market in 2024 with a share of 57.61%.

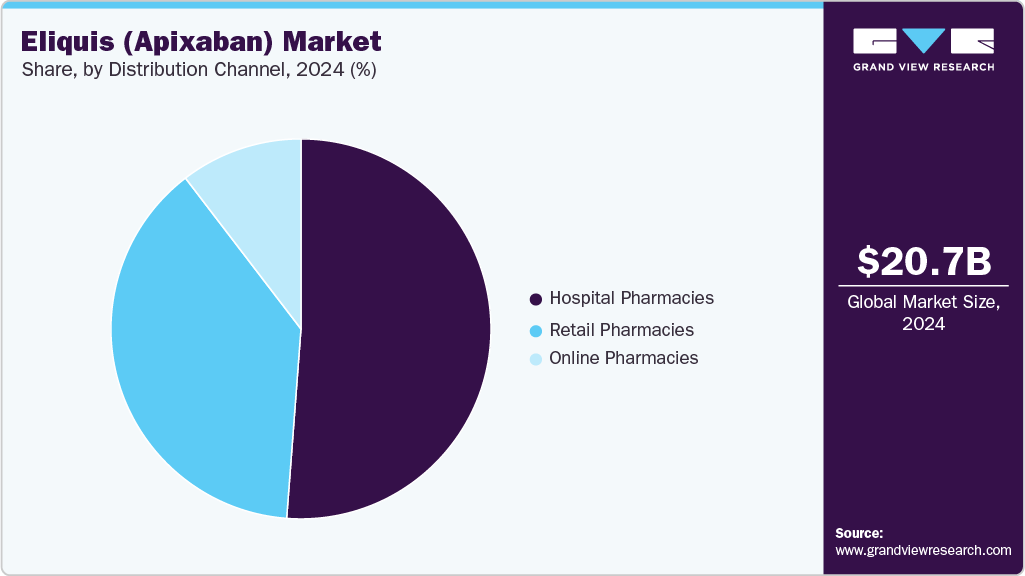

- By distribution channel, the hospital pharmacies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.70 Billion

- 2033 Projected Market Size: USD 18.87 Billion

- CAGR (2025-2033): -2.2%

- North America: Largest market in 2024

The increasing global burden of atrial fibrillation (AF) and venous thromboembolism (VTE) has emerged as a major driver for the Eliquis (Apixaban) market. AF significantly raises the risk of stroke, prompting greater use of anticoagulants for long-term prevention. In June 2022, the Journal of Clinical Medicine published a meta-analysis of over 3.9 million adults with atrial fibrillation, assessing apixaban's safety and effectiveness. The study found that apixaban had favorable outcomes compared to other anticoagulants, with lower stroke risks, mortality, and major bleeding. Eliquis has become a preferred option due to its favorable safety profile and minimal need for monitoring. Clinical guidelines in cardiology have expanded the use of direct oral anticoagulants, leading to broader adoption across primary and specialty care. As AF and VTE cases rise, particularly among aging populations, the demand for reliable and easy-to-administer anticoagulants such as Eliquis continues to grow.

Shifts in clinical practice toward direct oral anticoagulants have strengthened Eliquis's market position. Healthcare providers value DOACs for their predictable pharmacokinetics, fixed dosing, and lower risk of major bleeding events than warfarin. Eliquis has shown superior results in large-scale trials, contributing to its high prescription rates worldwide. Patients benefit from simplified treatment regimens that improve adherence and reduce healthcare visits. As transitioning from traditional anticoagulants to DOACs accelerates, Eliquis is well-positioned to capture a growing share of the global anticoagulant market.

Market Concentration & Characteristics

The Eliquis (Apixaban) market reflects a moderate to high degree of innovation, primarily focused on clinical trials, real-world evidence generation, and lifecycle management strategies. Innovations in distribution channels improved formulations, extended indications, and combination therapies with other cardiovascular drugs. Despite its established mechanism of action, continuous investment in post-market studies supports differentiation from other DOACs. Ongoing digital health integration and patient adherence tools also contribute to innovation in treatment delivery. This innovation sustains Eliquis’s competitive advantage in a maturing anticoagulant landscape.

High development costs and extensive clinical trial requirements are major barriers to entry into the Eliquis market. New entrants must demonstrate strong efficacy and safety to compete with established players and meet stringent regulatory standards. Brand loyalty, physician trust, and global marketing networks also restrict the success of generic alternatives or new formulations. Although nearing expiration, intellectual property protections have limited competitive erosion. Manufacturing precision and quality assurance further add to entry complexity for biosimilars or novel anticoagulants.

Regulatory frameworks significantly influence the Eliquis market, particularly regarding approval timelines and labeling requirements. Health authorities closely monitor post-marketing safety data due to the drug's wide use in high-risk populations. Pharmacovigilance obligations and black box warnings are strictly enforced, affecting how the indication is promoted and prescribed. Changes in reimbursement policies and clinical guidelines also shape demand patterns. Compliance with evolving regulations is critical to maintaining Eliquis's market presence and reputation.

The market faces moderate substitution threats from other DOACs, such as Xarelto and Pradaxa, which offer similar clinical benefits. Warfarin remains a cost-effective alternative in some regions, although its use is declining. Aspirin may be used in low-risk patients, reducing the need for stronger anticoagulants in select cases. However, Eliquis’s superior safety profile and ease of administration give it an edge over many substitutes. Long-term outcomes and reduced bleeding risk remain favored among available options.

Eliquis has expanded steadily across North America, Europe, and Asia Pacific, supported by strong distribution partnerships and an increasing cardiovascular disease burden. Growth in emerging markets is driven by improving access to diagnostics and rising healthcare expenditure. Market penetration deepens in Latin America and the Middle East through specialist networks and urban hospital systems. Regulatory approvals and alignment with international treatment guidelines also support geographic expansion. Eliquis is expected to gain further share in under-treated patient populations worldwide as awareness improves.

Indication Insights

The Atrial Fibrillation (AF) segment dominated the market with the largest revenue share of 57.61% in 2024, driven by the high global prevalence of AF and its association with elevated stroke risk. In April 2025, the Heart Rhythm Society (HRS) introduced a framework to establish AFib Centers of Excellence, outlining five key standards to enhance care quality. With AF affecting 10.5 million U.S. adults, the initiative aimed to improve early diagnosis, reduce complications, and support specialized, consistent treatment. Eliquis has become a preferred therapy among cardiologists due to its demonstrated safety profile and reduced bleeding risk compared to older anticoagulants. The fixed-dose regimen without routine INR monitoring enhances patient adherence and clinical convenience. Widespread inclusion in clinical guidelines has reinforced its frontline status in AF-related stroke prevention.

The Pulmonary Embolism (PE) segment is projected a declining CAGR of -2.7% over the forecast period due to increasing awareness of venous thromboembolism and rising incidence among hospitalized and post-surgical patients. Eliquis offers a convenient oral alternative to traditional injectable therapies, improving treatment initiation in acute and extended phases. Its proven efficacy in reducing recurrence risk supports long-term management of PE. The growing use of imaging technologies has improved PE detection rates, expanding the treatment pool. Patient preference for oral therapies is further accelerating market adoption.

Distribution Channel Insights

The hospital pharmacies segment held a significant share of the Eliquis (apixaban) market in 2024 with a share of 54.73%, driven by its central role in initiating therapy during acute care episodes such as stroke, deep vein thrombosis (DVT), or pulmonary embolism (PE). Hospitals are primary settings for diagnosis and treatment initiation, particularly for newly detected atrial fibrillation or post-operative VTE prophylaxis. Inpatient prescribing is supported by integrated care teams and protocol-based management, ensuring rapid initiation of anticoagulation therapy. Hospital pharmacies benefit from bulk procurement and centralized inventory management, facilitating uninterrupted drug availability. Moreover, transitions from inpatient to outpatient settings often begin with hospital prescriptions, reinforcing their importance in the overall treatment pathway.

The online pharmacies segment is projected to grow at a CAGR of 0.7% over the forecast period, driven by the increasing adoption of digital health platforms and home delivery services. Patients managing chronic conditions are turning to online channels for prescription refills to avoid travel and reduce wait times. Competitive pricing, subscription models, and automated refill services are improving patient retention in this channel. Eliquis’s fixed-dose regimen and predictable usage patterns suit online fulfillment. Mobile apps and digital platforms simplify ordering, especially for tech-savvy and younger caregivers. Growing comfort with e-commerce across healthcare is expanding this segment’s reach.

Regional Insights

North America Eliquis (apixaban) market held the largest share of 32.56% in 2024, due to the high prevalence of atrial fibrillation and widespread clinical adoption of DOACs: advanced diagnostic capabilities and robust healthcare infrastructure support early identification and long-term management of thromboembolic disorders. Eliquis benefits from favorable positioning in treatment guidelines and strong trust among cardiologists. Ongoing clinical trials and post-marketing surveillance continue to reinforce its safety and efficacy. High prescription rates are also driven by growing awareness among aging populations. Strategic partnerships and effective distribution channels further strengthen its market hold across the region.

U.S. Eliquis (Apixaban) Market Trends

The U.S. holds the largest share in the North America Eliquis (apixaban) market owing to strong physician preference for DOACs in stroke prevention and VTE treatment. The country has a large base of patients requiring long-term anticoagulation due to high rates of cardiovascular disease. Insurance coverage and formulary inclusion have facilitated consistent access to the drug. Real-world data and comparative studies have positioned Eliquis favorably against other anticoagulants. Marketing and educational initiatives by Bristol Myers Squibb and Pfizer sustain brand visibility. The growing elderly population and sedentary lifestyles continue to expand the market scope.

Europe Eliquis (Apixaban) Market Trends

Europe represents a significant region in the global Eliquis (apixaban) market due to its structured healthcare systems and rising cardiovascular disease burden. Countries across the region have incorporated DOACs into national treatment protocols, reinforcing Eliquis adoption. Clinical outcomes showing reduced bleeding risks and high efficacy have driven prescribing trends. The availability of cardiology specialists and integrated care models has enhanced treatment continuity. Market expansion is also supported by streamlined reimbursement pathways and expanding hospital formularies. As populations age, the need for stroke and clot prevention therapies is steadily increasing.

UK Eliquis (Apixaban) market has gained traction as a first-line therapy for atrial fibrillation and deep vein thrombosis. National treatment guidelines recommend DOACs, including Eliquis, for patients requiring long-term anticoagulation. General practitioners and specialists favor its fixed-dose oral regimen for its ease of use and adherence. The UK’s emphasis on outcome-based care supports continued preference for drugs with proven safety records. Increasing cardiovascular risk among aging citizens is contributing to higher demand. A strong supply chain presence ensures consistent availability across public and private healthcare settings.

Eliquis (Apixaban) market in Germany is driven by high disease burden and proactive cardiovascular care practices. A large network of cardiac centers has facilitated the drug’s early adoption and widespread use. Physicians prefer Eliquis for its predictable dosing and reduced need for monitoring, improving patient compliance. Market growth is supported by expanding insurance coverage and growing awareness among both physicians and patients. Research collaborations and academic endorsements continue to validate its long-term use. Demographic trends such as an aging population further contribute to market expansion.

France Eliquis (Apixaban) market has shown a strong uptake of Eliquis due to its integration into cardiology guidelines and the increasing prevalence of thromboembolic events. Hospital systems and outpatient clinics have rapidly shifted from traditional anticoagulants to DOACs. Eliquis is favored for its reduced bleeding risk, which aligns with France’s focus on patient safety and quality care. Public and private sector physicians have demonstrated high trust in its therapeutic performance. Awareness campaigns and physician training programs have enhanced clinical confidence. The growing number of elderly and chronic care patients supports sustained demand.

Asia-Pacific Eliquis (Apixaban) Market Trends

Asia Pacific Eliquis (apixaban) market is expected to register a declining CAGR of -1.9% over the forecast period due to rising healthcare access and increasing prevalence of cardiovascular disease. Rapid urbanization and lifestyle changes have elevated the risk of atrial fibrillation and stroke. Healthcare providers are adopting DOACs due to their safety and ease of use compared to warfarin. Pharmaceutical companies are expanding their footprint through regional partnerships and education programs. Growing awareness among patients is encouraging earlier diagnosis and treatment. The large population base provides strong potential for future volume growth.

Japan Eliquis (Apixaban) market remains a prominent market in Asia Pacific due to its aging population and high incidence of atrial fibrillation. Physicians prefer Eliquis due to its efficacy in stroke prevention and improved safety profile. The country’s focus on preventive cardiology has accelerated the adoption of modern anticoagulants. Real-world evidence and local studies have reinforced confidence in long-term usage. Increasing physician training and patient outreach have supported prescription rates. Market performance is further enhanced by efficient distribution and regulatory clarity.

Eliquis (Apixaban) market in China is experiencing rapid growth due to rising rates of stroke, heart disease, and aging demographics. Improved access to tertiary care centers is driving demand for reliable oral anticoagulants. DOACs are being integrated into treatment pathways for atrial fibrillation and venous thromboembolism. Eliquis stands out for its safety profile, which appeals to clinicians and patients. Educational initiatives and expanding awareness have increased treatment adherence and trust. Market opportunities continue to grow as healthcare infrastructure improves in Tier 2 and Tier 3 cities.

Latin America Eliquis (Apixaban) Market Trends

The Eliquis market in Latin America is gaining momentum, supported by increasing diagnosis of cardiovascular disorders and expansion of private healthcare services. Urban centers across the region are seeing higher uptake of DOACs due to physician familiarity and patient education. Eliquis is favored for its simple dosing and reduced monitoring requirements. Market presence is strengthened through collaborations with local distributors and medical associations. Rising healthcare expenditure in key countries is supporting the adoption of advanced anticoagulation therapies. As awareness spreads, more patients are shifting from older treatments to Eliquis.

Brazil Eliquis (Apixaban) market is leading in Latin America’s Eliquis market due to its large population and high incidence of atrial fibrillation. Private hospitals and cardiology centers have driven adoption through structured treatment protocols. The availability of DOACs in national health plans and their use in outpatient care have boosted uptake. Eliquis is well-positioned due to its strong performance in bleeding risk reduction. Physician preference for evidence-based therapies has supported brand loyalty. Ongoing awareness efforts continue to grow the eligible patient population.

Middle East & Africa Eliquis (Apixaban) Market Trends

The MEA region is witnessing gradual expansion of the Eliquis market, particularly in urban hospitals and specialty care centers. Cardiovascular disease is on the rise, prompting increased use of oral anticoagulants for long-term stroke prevention. Private healthcare investments and broader diagnostic availability support market growth. Physicians prefer DOACs more due to simplified dosing and lower complication rates. As health literacy improves, more patients are seeking preventive therapies. Strategic partnerships are helping improve regional access and distribution efficiency.

Saudi Arabia’s Eliquis (Apixaban) market is growing steadily, driven by increasing rates of obesity, diabetes, and heart disease. Leading hospitals have adopted Eliquis for stroke prevention in atrial fibrillation patients due to its clinical profile. Healthcare providers favor its ease of administration and reduced risk of adverse effects. Awareness campaigns and specialist training are contributing to rising prescription rates. The private healthcare sector continues to expand, increasing the availability of advanced treatments. Eliquis is expected to maintain strong demand as more patients seek long-term cardiovascular management.

Key Eliquis (Apixaban) Company Insights

Bristol-Myers Squibb Company and Pfizer Inc. lead the Eliquis (Apixaban) market through a strong co-commercialization strategy and established clinical outcomes in stroke prevention. Johnson & Johnson Private Limited and Sanofi maintain solid positions by leveraging extensive cardiovascular portfolios and robust provider networks. Novartis AG and AstraZeneca are expanding their market presence through distribution-channeled research initiatives and broader anticoagulation therapy coverage. GSK plc, Teva Pharmaceutical Industries Ltd., and Mylan NV support competitive pricing and regional access through generics and distribution efficiencies. F. Hoffmann-La Roche Ltd. is gradually advancing by aligning cardiovascular efforts with evolving patient needs. The market remains dynamic with rising adoption, increasing therapeutic demand, and strategic competition across global regions.

Key Eliquis (Apixaban) Companies:

The following are the leading companies in the eliquis (apixaban) market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Mylan NV

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GSK plc

- Novartis AG

- AstraZeneca

- Johnson & Johnson Private Limited

- Bristol-Myers Squibb Company

Recent Developments

-

In August 2024, Pfizer announced that the U.S. Department of Health and Human Services set a maximum fair price of USD 231 for a 30-day supply of Eliquis under the Inflation Reduction Act. This price will take effect for Medicare beneficiaries starting January 1, 2026. Pfizer confirmed the pricing would also apply to 340B-covered entities if it is lower than their ceiling price.

-

In February 2024, Roche launched three new coagulation tests for edoxaban, rivaroxaban, and apixaban in CE-marked countries. These assays support clinical decisions in managing stroke risk and thromboembolic conditions and help monitor heparin therapy. The tests are integrated into cobas t analyzers and offer standardized, automated results with reduced contamination and evaporation risk.

-

In August 2023, Bristol Myers Squibb (BMS) acknowledged Eliquis’ selection for Medicare price negotiation under the Inflation Reduction Act due to its high Medicare spending.

Eliquis (Apixaban) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.46 billion

Revenue forecast in 2033

USD 18.87 billion

Growth rate

CAGR of -2.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

F. Hoffmann-La Roche Ltd.; Mylan NV; Teva Pharmaceutical Industries Ltd.; Sanofi; Pfizer Inc.; GSK plc; Novartis AG; AstraZeneca; Johnson & Johnson Private Limited; Bristol-Myers Squibb Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eliquis (Apixaban) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Eliquis (apixaban) market report based on indication, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Atrial Fibrillation (AF)

-

Deep Vein Thrombosis (DVT)

-

Pulmonary Embolism (PE)

-

Post-Operative Venous Thromboembolism (VTE) Prophylaxis

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Eliquis (apixaban) market size was estimated at USD 20.70 billion in 2024 and is expected to reach USD 22.46 billion in 2025.

b. The Eliquis (apixaban) market is projected to decline at a CAGR of -2.15% from 2025 to 2033 to reach USD 18.87 billion by 2033.

b. Based on indication, the atrial fibrillation (AF) segment dominated the market with the largest revenue share of 57.61% in 2024, driven by the high global prevalence of AF and its association with elevated stroke risk.

b. The key players in the Eliquis (apixaban) market are Bristol-Myers Squibb and Pfizer, which co-market the branded product globally. Together, they dominate the apixaban segment due to strong clinical evidence and strategic patent protection. Emerging generic competitors include Teva, Hetero Labs, Aurobindo Pharma, and Natco Pharma, which have launched or plan to launch generic apixaban in various markets, especially as patents begin to expire.

b. The decline of the Eliquis (apixaban) market is primarily driven by the entry of generic versions, leading to price erosion and reduced market share for the branded drug. Patent expirations, especially in international markets, intensify competition. Additionally, pricing pressures from healthcare systems, increased use of alternative anticoagulants, and regulatory shifts in reimbursement policies contribute to the declining revenue trajectory.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.