- Home

- »

- Next Generation Technologies

- »

-

Embedded AI Market Size & Share, Industry Report, 2030GVR Report cover

![Embedded AI Market Size, Share & Trends Report]()

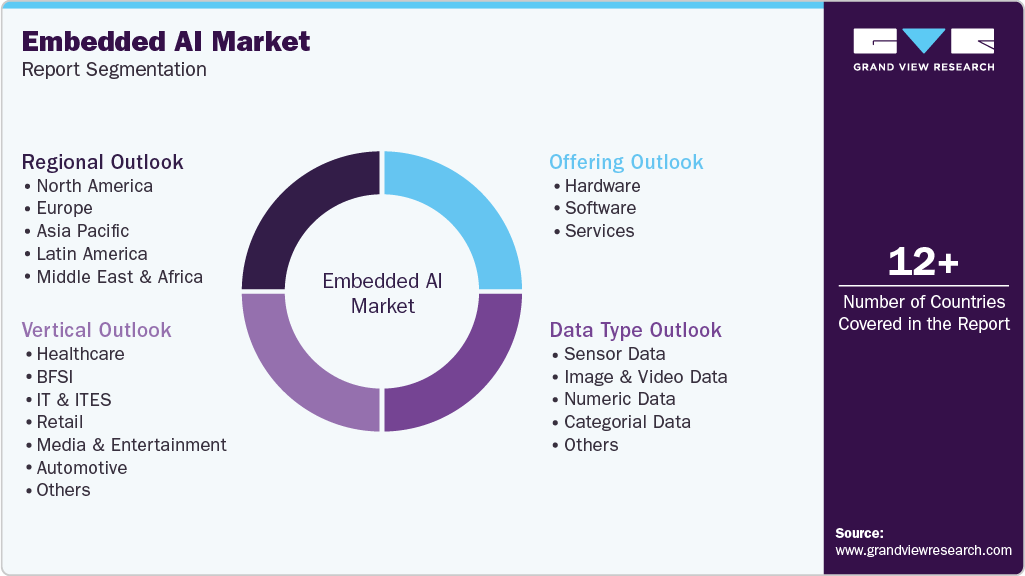

Embedded AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering, By Data Type (Sensor Data, Image And Video Data, Numeric Data, Categorial Data), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-438-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Embedded AI Market Summary

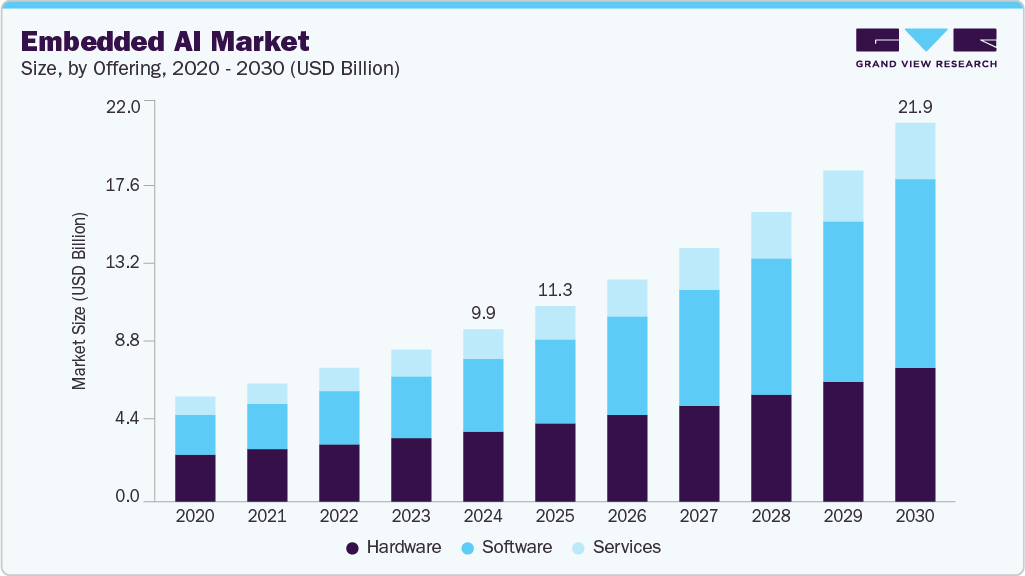

The global embedded AI market size was estimated at USD 9,966.3 million in 2024, and is projected to reach USD 21,930.4 million by 2030, growing at a CAGR of 14.1% from 2025 to 2030. The rising need for intelligent and autonomous systems that offer personalized experiences, along with the expansion of connected devices and IoT ecosystems for improved communication, will further stimulate market growth.

Key Market Trends & Insights

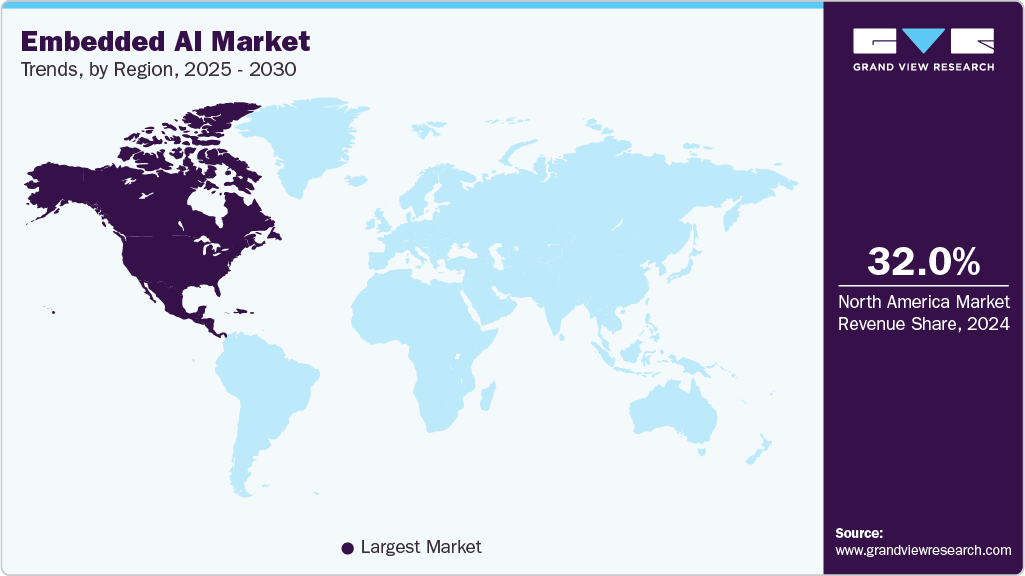

- North America dominated the global embedded AI market with the largest revenue share of 32.0% in 2024.

- The embedded AI market in the U.S. led the North America market and held the largest revenue share in 2024.

- By offerings, software segment led the market and held the largest revenue share of 41.9% in 2024.

- By vertical, the automotive segment held the dominant position in the market and accounted for the leading revenue share of 18.3% in 2024.

- By vertical, the healthcare segment is expected to grow at the fastest CAGR of 18.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 9,966.3 Million

- 2030 Projected Market Size: USD 21,930.4 Million

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

- Europe: Fastest growing market

The increasing demand for more powerful and energy-efficient processors is driven by the need to effectively manage complex AI algorithms and integrate with Image & Video Data-based AI services, enhancing scalability and providing users with opportunities to utilize embedded AI solutions.

The growing demand for advanced technologies that deliver personalized and adaptive experiences is driving the acceptance of embedded AI solutions in the market. The push for personalized interactions has led to the incorporation of AI capabilities into several embedded systems. By utilizing embedded AI, devices and applications can analyze user data, preferences, and behaviors to offer customized recommendations, suggestions, and responses, thereby boosting user satisfaction and engagement. In addition, embedded AI solutions can facilitate autonomous behavior in devices and systems, minimizing the need for continuous user input. This is especially valuable in areas like autonomous vehicles, smart home automation, and industrial automation, where AI algorithms can support intelligent decision-making and automated actions.

Offering Insights

The software segment led the market with the largest revenue share of 41.9% in 2024. Embedded AI software is vital in the market, offering essential algorithms, frameworks, and libraries that empower AI capabilities within embedded systems. This software harnesses the potential of AI in embedded devices, facilitating intelligent decision-making, real-time data analysis, and improved functionality across diverse industries. By enabling local data processing and interpretation, embedded AI software enhances device autonomy, boosts performance, and enriches user experiences. Moreover, the proliferation of connected devices and the rising demand for real-time data processing are fueling the need for sophisticated embedded AI solutions. This trend is evident in sectors such as automotive, healthcare, and industrial automation, where embedded AI software is revolutionizing operations and user interactions. As technology continues to evolve, the embedded AI software industry is expected to grow rapidly, driven by innovations that enable smarter, more adaptable, and cost-effective solutions

The hardware segment is predicted to experience at the fastest CAGR over the forecast period. The growth is driven by the increasing demand for more powerful and energy-efficient processors capable of handling complex AI algorithms. As AI applications become more sophisticated and resource-intensive, the need for advanced hardware solutions, such as high-performance CPUs, GPUs, and specialized AI accelerators, is surging. This trend is further fueled by the growing adoption of autonomous and intelligent systems that require tailored experiences, prompting manufacturers to innovate and enhance their hardware offerings. In addition, the rise of edge computing is reshaping the landscape, as devices increasingly process data locally, reducing reliance on Image & Video Data services and enabling faster decision-making.

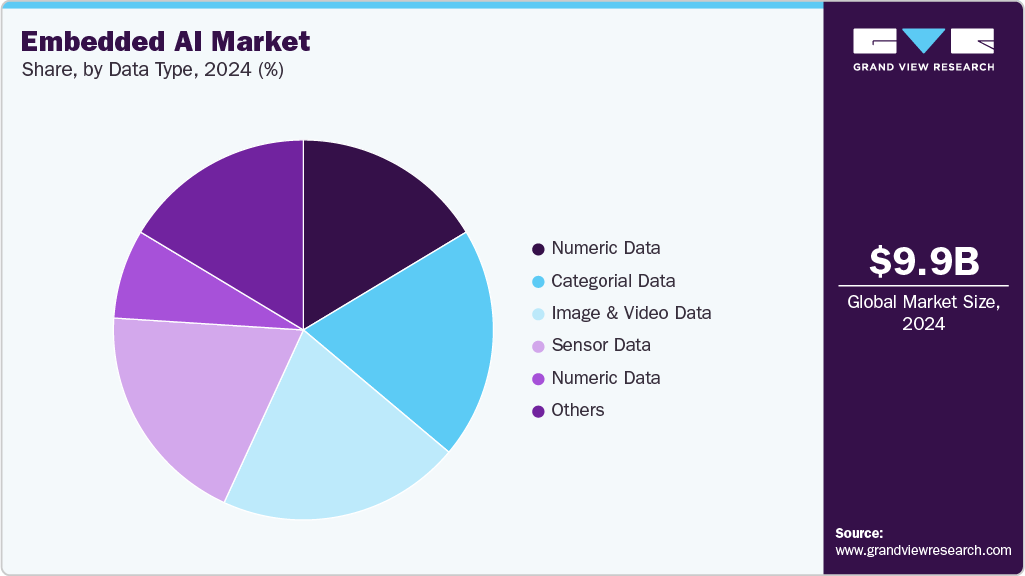

Data Type Insights

The numeric data segment led the market with the largest revenue share of 24.8% in 2024. Numeric data serves as the backbone for training and optimizing AI models, enabling systems to make data-driven decisions across various applications, including smart cities, healthcare, and industrial automation. As organizations seek to enhance operational efficiency and resource utilization, the ability to analyze historical patterns and trends using numeric data is becoming vital. The competence to analyze data locally in real-time reduces latency and reliance on Image & Video Data-based processing, further boosting performance and responsiveness. This focus on numeric data not only enhances operational efficiency but also contributes to significant cost savings, solidifying its position as a dominant force in the embedded AI industry.

The sensor data segment is estimated to grow at the fastest CAGR over the forecast period. The rise of smart devices, such as fitness trackers and home automation systems, exemplifies the utility of sensor data, which collects vital information like heart rates, sleep patterns, and environmental conditions to provide tailored recommendations and enhance user experiences. In addition, the incorporation of sensor data into embedded AI systems leads to improved operational efficiency, cost savings, and enhanced safety across various industries. As the demand for intelligent and autonomous systems grows, the ability to process and analyze sensor data locally will become increasingly critical, positioning this segment for robust growth in the coming years. Overall, the integration of sensor data with embedded AI technologies is set to play a pivotal role in shaping the future of smart applications and systems.

Vertical Insights

The automotive segment accounted for the largest market revenue share in 2024. The automotive industry is experiencing a surge in the adoption of embedded AI technologies, driven by the rapid advancements in autonomous driving, electric vehicles, and connected car features. Autonomous driving is a key application area where embedded AI is revolutionizing the automotive industry. AI algorithms, combined with sensors like cameras, radar, and lidar, enable vehicles to perceive their surroundings, identify potential hazards, and make real-time decisions to ensure safe navigation. Advanced driver assistance systems (ADAS) powered by embedded AI are becoming increasingly sophisticated, offering features like lane-keeping, adaptive cruise control, and automatic emergency braking.

The healthcare segment is estimated to grow at the fastest CAGR over the forecast period. The growth is driven by the increasing demand for advanced diagnostic tools, personalized treatment options, and enhanced patient care. This surge is fueled by significant investments from both private and government sectors aimed at integrating AI solutions into medical devices and healthcare systems. Embedded AI is being utilized to analyze vast amounts of medical data, enabling healthcare professionals to make more accurate diagnoses and develop tailored treatment plans for patients. In addition, the rise of telemedicine and remote monitoring solutions has accelerated the need for AI-driven tools that can process and analyze data in real-time, further enhancing patient outcomes. As healthcare providers increasingly recognize the potential of embedded AI to improve operational efficiency and patient satisfaction, the growth trajectory for this segment is expected to remain strong over the forecast period.

Regional Insights

North America dominated the embedded AI market with the largest revenue share of 32.0% in 2024. The region's growth in this sector is fueled by its presence of leading AI technology firms, strong R&D capabilities, and a well-established market ecosystem. Recent years have seen a steady increase in embedded AI adoption in North America, spurred by advancements in AI technologies, rising demand for intelligent edge devices, and the widespread use of IoT applications. Overall, the adoption of embedded AI in North America is accelerating across various industries, driven by technological progress, the expansion of IoT, a supportive infrastructure, and growing awareness of the benefits it offers.

U.S. Embedded AI Market Trends

The embedded AI market in the U.S. accounted for the largest market revenue share in 2024. The U.S. has established itself as a leader in technological innovation, fostering a collaborative ecosystem of research institutions, universities, and technology companies that push the boundaries of AI capabilities. The emphasis on enhancing operational efficiency, improving decision-making processes, and delivering personalized customer experiences is propelling the adoption of embedded AI solutions. In addition, the rise of IoT devices and the demand for intelligent systems that can process and analyze data locally further contribute to the growth of embedded AI in the region.

Europe Embedded AI Market Trends

The embedded AI market in Europe is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven due to the automotive industry as a significant contributor to the growth of embedded AI in Europe, with applications such as gesture recognition, object identification, voice assistants, and predictive maintenance. Automakers and AI technology providers are forming partnerships to offer AI-driven solutions that enhance convenience, customer experience, and safety.

Asia Pacific Embedded AI market Trends

The embedded AI market in Asia-Pacific is experiencing rapid growth. This surge is primarily driven by the rapid expansion of e-commerce and digital transformation in the retail sector across the region. Embedded AI technologies play a crucial role in enabling personalized recommendations, supply chain optimization, and fraud detection in e-commerce platforms. Moreover, the emphasis on smart city initiatives and urban development projects in the Asia-Pacific region is another key driver for embedded AI growth. As countries invest in building sustainable and technologically advanced cities, embedded AI technologies are being integrated to enhance intelligent infrastructure, efficient energy management, and improved public services.

Key Embedded AI Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, collaborations, contracts, and agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

IBM operates in over 170 countries with a mission to make the world work better through responsible technology and ethical business practices. The company specializes in modernizing businesses by offering AI-driven and hybrid cloud solutions that help organizations predict trends, automate processes, and secure operations. IBM’s expertise extends to designing, deploying, and managing end-to-end solutions tailored to address complex business challenges, with a strong emphasis on integrating AI into applications, servers, and storage for maximum productivity and efficiency. Their offerings are designed to unlock the value of proprietary data and prepare organizations for the next generation of AI, including embedded AI capabilities that enhance automation and decision-making within business processes.

-

Intel is a technology provider renowned for advancing semiconductor innovation and enabling transformative computing experiences. The company’s embedded AI offerings are centered around edge-optimized processors, FPGAs, and GPUs, such as the Intel Core Ultra and Agilex 5 FPGAs, which bring powerful AI capabilities to edge devices across industries like retail, healthcare, industrial, and automotive. These solutions enable real-time AI inference, advanced visual computing, and automation, allowing enterprises to deploy sophisticated embedded AI systems that streamline operations and enhance decision-making at the edge. Intel’s AI edge platforms are designed for flexibility, scalability, and rapid deployment, making embedded AI accessible and efficient for a wide range of business applications.

Key Embedded AI Companies:

The following are the leading companies in the embedded AI market. These companies collectively hold the largest market share and dictate industry trends.

- HPE

- Google (Alphabet Inc.)

- IBM

- Intel

- LUIS Technology

- Microsoft

- NVIDIA Corporation

- Oracle

- Qualcomm

- Salesforce

- Siemens

Recent Developments

-

In March 2025, NVIDIA has announced partnerships with leading telecom and technology companies-including T-Mobile, MITRE, Cisco, ODC, and Booz Allen Hamilton-to develop AI-native wireless network hardware, software, and architecture for 6G. This collaboration aims to integrate artificial intelligence into next generation 6G networks, enabling enhanced connectivity, efficiency, and new services for billions of users worldwide. The initiative will leverage NVIDIA’s AI Aerial platform to drive innovation and set new standards in wireless communication.

-

In September 2024, Oracle unveiled powerful new AI capabilities across its Oracle Fusion Cloud Applications Suite, introducing over 50 new AI agents and advanced features to optimize finance, supply chain, HR, sales, marketing, and service operations. These enhancements, embedded at no extra cost, empower organizations to automate workflows, accelerate decision-making, and increase productivity. With its fully integrated technology stack, Oracle enables customers to leverage the latest AI innovations seamlessly. The updates further strengthen Oracle's position as a leader in enterprise cloud applications and AI-driven business transformation.

Embedded AI Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,322 million

Revenue forecast in 2030

USD 21,930.4 million

Growth rate

CAGR of 14.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, data type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

HPE; Google (Alphabet Inc.); IBM; Intel; LUIS; Technology; Microsoft; NVIDIA; Oracle; Qualcomm; Salesforce; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Embedded AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global embedded AI market report based on offering, data type, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Data Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensor Data

-

Image & Video Data

-

Numeric Data

-

Categorial Data

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

BFSI

-

IT & ITES

-

Retail

-

Media & Entertainment

-

Automotive

-

Telecom

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global embedded AI market size was estimated at USD 9.97 billion in 2024 and is expected to reach USD 11.32 billion in 2025.

b. The global embedded AI market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2030 to reach USD 21.93 billion by 2030.

b. North America dominated the embedded AI market with a share of 32.0% in 2024. The region's growth in this sector is fueled by its presence of leading AI technology firms, strong R&D capabilities, and a well-established market ecosystem.

b. Some key players operating in the embedded AI market include HPE; Google (Alphabet Inc.); IBM; Intel; LUIS Technology; Microsoft; NVIDIA; Oracle; Qualcomm; Salesforce; Siemens.

b. Key factors that like the growing demand for advanced technologies that deliver personalized and adaptive experiences is driving the acceptance of embedded AI solutions in the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.