- Home

- »

- Next Generation Technologies

- »

-

Emotion Detection & Recognition Market Size Report, 2030GVR Report cover

![Emotion Detection & Recognition Market Size, Share & Trends Report]()

Emotion Detection & Recognition Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Tools, By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-960-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emotion Detection & Recognition Market Summary

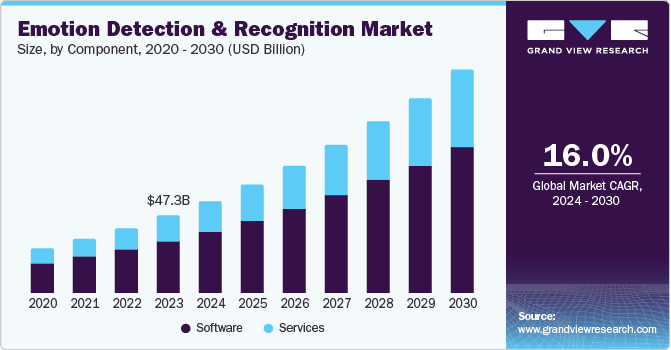

The global emotion detection & recognition market size was estimated at USD 47.28 billion in 2023 and is projected to reach USD 136.46 billion by 2030, growing at a CAGR of 16.0% from 2024 to 2030. Technological advancements in artificial intelligence (AI) and machine learning (ML), enhanced data processing capabilities of machines, increasing adoption of wearable devices by consumers, and innovations in deep learning algorithms have contributed to market growth.

Key Market Trends & Insights

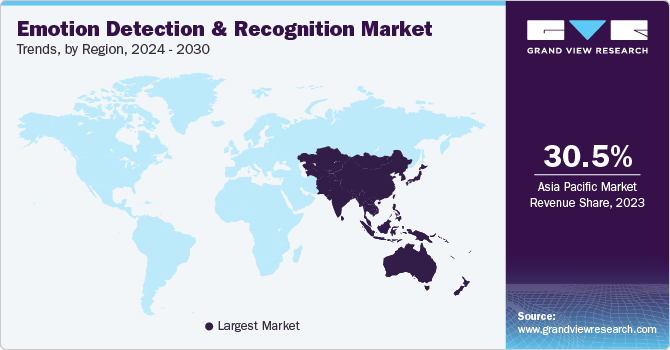

- By region, Asia Pacific dominated the global market with a revenue share of 30.5% in 2023.

- The U.S. accounted for the highest share of the regional market in 2023.

- By component, the software segment dominated the market with a revenue share of 66.4% in 2023.

- By end use, the automotive segment is anticipated to register the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 47.28 Billion

- 2030 Projected Market Size: USD 136.46 Billion

- CAGR (2024–2030): 16.0%

- Asia Pacific: Largest regional market in 2023

Moreover, expanding IoT technology enhances the connectivity of devices capable of emotion detection. This connectivity enables more comprehensive data collection and analysis, improving user experiences and operational efficiencies. As the use of IoT devices becomes more prevalent, the demand for emotion detection and recognition (EDR) technologies that can interpret user emotions efficiently is expected to increase significantly.

Businesses increasingly recognize the importance of understanding consumer behavior to tailor their offerings effectively. Emotion detection technologies provide valuable insights into customer sentiments, enabling companies to enhance customer engagement and satisfaction. This need for deeper consumer insights is driving the adoption of emotion recognition systems across industries such as retail and advertising. Furthermore, a substantial increase in usage of IoT-based technologies, steadily rising adoption of wearables, and substantial growth in smartphone usage are also driving industry expansion. Emotion detection and recognition is a software-based tool that helps organizations read facial expressions using human emotion detection tools such as deep learning algorithms, computer vision, and AI. In addition to rage, happiness, and sorrow, this software observes micro-expressions such as contempt and disdain.

Understanding emotions has become critical during interactions between machine communication systems and people. Emotion detection & recognition software improves human-computer interfaces and optimizes computer actions while responding to user feedback. The increasing demand for speech-based emotion detection solutions to analyze a person's emotional state and the global adoption of IoT, deep learning, AI, and machine learning technologies are helping enable market expansion. Moreover, the increasing need for such tools in the area of automotive AI, the growing need for socially intelligent artificial agents, and ensuring high levels of operational performance are other notable factors driving industry expansion.

Component Insights

The software segment dominated the market with a revenue share of 66.4% in 2023. The increasing demand for EDR software solutions integrated with various devices and systems, such as smartphones, wearables, and surveillance cameras, drives segment growth. Additionally, the availability of advanced software tools and platforms that enable the development of customized EDR applications for specific industry needs contributes to this segment's large share. Moreover, this type of software offers a high degree of flexibility, scalability, and cost-effectiveness, making it an attractive option for businesses and organizations seeking to leverage EDR technologies. The ability to upgrade and update software solutions without requiring significant hardware modifications is also a major factor aiding this segment's dominance.

The services segment is expected to register the fastest CAGR over the forecast period. This is owing to the increasing demand for integrated service solutions, the expansion of EDR's application scope across various industries, and advancements in technology that require expert services for implementation and management. Additionally, the rising demand for managed services, such as data analysis and interpretation, and the requirement for continuous support and maintenance are anticipated to drive segment growth. The increasing focus on developing tailored EDR solutions that integrate suitably with existing infrastructure and systems also contributes to this segment's high expected growth rate.

Tools Insights

The gesture & posture recognition tools segment held the leading market share in 2023. This is attributed to the increasing demand for non-intrusive and non-verbal emotional intelligence, which can be effectively captured through gesture and posture analysis. These tools offer a high degree of accuracy in detecting emotions, as they analyze subtle changes in human behavior, such as body language, facial expressions, and eye movements. Moreover, the growing adoption of computer vision technology, machine learning algorithms, and deep learning techniques has significantly enhanced the capabilities of gesture & posture recognition tools, enabling them to detect emotions with high precision. The increasing focus on developing emotionally intelligent systems, such as chatbots, virtual assistants, and humanoid robots, has also driven demand for these tools.

The speech & voice recognition segment is anticipated to grow substantially during the forecast period. This is attributed to the increasing demand for voice-based interfaces, such as virtual assistants (Apple Siri), voice-activated devices (Amazon Alexa, Echo), and speech-enabled chatbots. These tools analyze acoustic features, prosody, and linguistic patterns to identify emotional states. The growing integration of speech recognition technology with various devices, including smartphones, smart speakers, and wearables, has further driven this segment’s adoption. In addition, an increasing focus on developing emotionally intelligent voice-activated interfaces, smart home speakers, and mental health monitoring solutions has contributed to the high demand for these solutions.

Technology Insights

The Natural Language Processing (NLP) segment accounted for the largest market share in 2023. This is owing to its crucial role in analyzing and interpreting human emotions expressed through text and speech and its ability to process, understand, and generate human language, enabling the detection of emotional cues, sentiment, and intent. NLP's capacity to handle vast amounts of unstructured data, such as text, social media posts, and voice transcripts, has made it a critical tool in EDR technology. Moreover, the widespread adoption of NLP technology in various applications, including chatbots, virtual assistants, social media monitoring, and customer service platforms, has contributed to its high share.

Meanwhile, the machine learning segment is anticipated to register the fastest CAGR from 2024 to 2030. This is attributed to the increasing adoption of ML algorithms, such as deep learning and neural networks, which have enabled EDR systems to analyze complex emotional cues, detect subtle changes in human behavior, and improve sentiment analysis. The growing availability of large datasets, advancements in computing power, and decreasing data storage costs have further driven the adoption of ML technologies in EDR solutions. Moreover, an increasing focus on developing emotionally intelligent systems, such as chatbots, virtual assistants, and affective computing platforms, has also driven the demand for machine learning technology in this industry.

Application Insights

The surveillance and monitoring segment held the largest revenue share in 2023. This is attributed to the escalating demand for advanced security and public safety solutions that leverage the features of emotional intelligence. As organizations strive to enhance their surveillance capabilities, EDR technology has emerged as a crucial component, enabling real-time detection and analysis of human emotions to identify potential security threats and prevent criminal activities. The widespread adoption of EDR technology in CCTV cameras, facial recognition systems, and biometric identification solutions has further solidified this segment's dominance. Moreover, the growing focus on smart city initiatives, intelligent transportation systems, and safe city projects has fueled the demand for EDR solutions to analyze emotional cues, detect anomalies, and trigger alerts, ensuring public safety and security.

The marketing and advertising segment is expected to grow significantly during the forecast period. The increasing recognition of emotional intelligence as a key driver of consumer behavior and purchasing decisions has compelled marketers to use EDR technology to design effective marketing strategies. As companies seek to enhance customer engagement and loyalty, EDR technology has emerged as a vital tool, enabling marketers to analyze emotional responses to advertising campaigns, product launches, and brand interactions. The growing adoption of EDR solutions in social media monitoring, sentiment analysis, and customer experience management has further fueled segment growth. Moreover, the rising importance of personalization and targeted marketing has increased investments in EDR technology, enabling marketers to tailor their strategies to individual emotions and preferences.

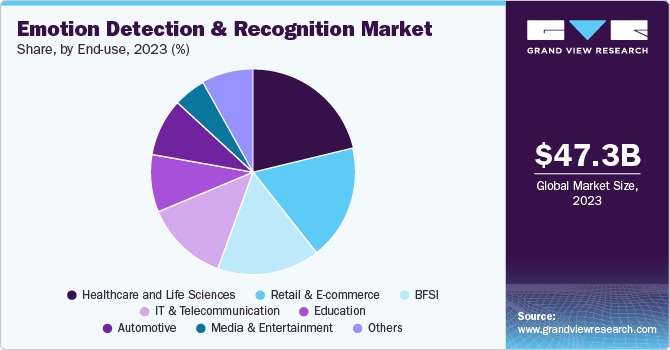

End-use Insights

The healthcare & life sciences segment held the largest market share in 2023. This is owing to the increasing recognition of emotional intelligence as a critical factor in patient care, diagnosis, and treatment outcomes. EDR technology has emerged as a vital tool in healthcare, enabling the analysis of emotional cues, the detection of mental health conditions, and monitoring patient well-being. These solutions are increasingly being adopted in telemedicine, clinical trials, and patient engagement platforms. The rising importance of personalized medicine and patient-centered care has led to increased investments in EDR technology, enabling healthcare professionals to customize treatment plans according to individual emotional needs and improve patient outcomes. The growing focus on mental health, emotional wellness, and behavioral analytics has also driven the demand for EDR solutions in this segment.

The automotive segment is anticipated to register the fastest growth rate from 2024 to 2030. This is attributed to the accelerating demand for advanced driver assistance systems (ADAS), autonomous vehicles, and enhanced passenger experiences. EDR technology has emerged as a critical component in the automotive industry, enabling the development of emotionally intelligent vehicles that detect and respond to driver emotions, fatigue, and distraction. The growing adoption of EDR solutions in infotainment systems, driver monitoring, and safety features is expected to advance segment growth further. Increased investments in EDR technology have enabled automotive manufacturers to develop vehicles that can adapt to individual emotions and preferences. The rising trend of autonomous vehicles and mobility-as-a-service (MaaS) has further driven the demand for EDR solutions to enhance passenger safety, comfort, and experience. In May 2024, Tobii announced that its OMS (occupant monitoring system) design had added a new automotive client based in Europe. Such partnerships between EDR providers and automotive manufacturers are anticipated to drive strong segment growth.

Regional Insights

Asia Pacific dominated the global market with a revenue share of 30.5% in 2023. This is owing to the region's rapid technological advancements, strong adoption of AI and ML technologies, and increasing demand for emotional intelligence solutions. The regional dominance in the EDR market can be attributed to fast-growing countries such as China, Japan, and South Korea, which have incorporated EDR technology across various industries, including healthcare, automotive, and consumer electronics. The region's vast population, increasing disposable income, and growing demand for personalized experiences have fueled the adoption of EDR solutions, making Asia Pacific a global EDR market.

China Emotion Detection & Recognition Market Trends

China's computer and IT technology sector has experienced tremendous growth over the past three decades. This factor, in combination with the country's massive consumer market, has created a surge in demand for advanced solutions such as EDR across industries, including healthcare, advertisement and media, education, and customer services. Furthermore, the country's technological leaders, such as Baidu, Alibaba, SenseTime, and Tencent, have significantly invested in EDR research and development, driving innovations and adoption.

North America Emotion Detection & Recognition Market Trends

North America held a substantial share of the global market in 2023. The region's technological advancements, robust infrastructure, and rapid adoption rate of innovative solutions have significantly contributed to its high revenue share. The U.S. and Canada, in particular, have emerged as leaders in EDR technology, with a high concentration of leading vendors, research institutions, and early adopters in these economies. The region's strong focus on AI, ML, and IoT has created a strong base for EDR solutions to flourish, with applications in various industries such as marketing, healthcare, and customer services. Furthermore, several startups and research institutions have fueled innovations, investments, and faster adoption of these solutions in the region.

The U.S. accounted for the highest share of the regional market in 2023. The U.S. benefits from a robust ecosystem of academic institutions and research organizations collaborating with industry players to continuously advance emotion detection technologies. Universities such as Stanford, MIT, and Carnegie Mellon have established programs dedicated to AI and human-computer interaction, producing cutting-edge research that helps develop practical applications in emotion recognition. In addition, strategic partnerships between tech firms and startups specializing in emotional AI further boost the country's competitive edge by facilitating knowledge transfer and resource sharing. Such collaborations enable faster deployment of innovative solutions in the market.

Europe Emotion Detection & Recognition Market Trends

Europe accounted for a notable market share in 2023. This is attributed to the region's strong technological foundation, rigorous research initiatives, and growing demand for emotionally intelligent solutions. The European Union's emphasis on innovations, digital transformation, and AI has created a conducive environment for EDR technology to thrive, with numerous countries such as the UK, Germany, and France emerging as hubs for EDR innovation. The region's well-established industrial sector, including automotive, healthcare, and finance, has also driven the adoption of EDR solutions, leveraging emotional intelligence to enhance customer experiences, improve operational efficiency, and drive business growth. Moreover, prominent research institutions, startups, and industry leaders have enabled the development of a collaborative ecosystem, propelling Europe to a leading position in the global EDR market.

The UK held a significant share of the European market in 2023. This is owing to robust economic research and development infrastructure, which drive the development of innovative solutions. EDR solutions have been widely adopted across new and emerging sectors such as market research, education, and retail & e-commerce. Additionally, deploying CCTV cameras by government authorities in public places to detect and analyze the facial emotions of citizens has ensured new growth avenues for the market. For instance, CCTV cameras were installed across eight train stations in the UK to understand passengers' facial emotions and other vital information by leveraging the Amazon Rekognition software.

Key Emotion Detection & Recognition Company Insights

Some key companies involved in the emotion detection & recognition market include Affectiva, Realeyes, and Apple Inc., among others.

-

Affectiva, a subsidiary of Smart Eye AB, is a prominent company in the field of emotion detection and recognition technology. Affectiva specializes in developing AI-driven software that analyzes facial expressions and physiological signals to assess emotional responses. The company has a vast dataset from over 90 countries that helps it build accurate deep learning-based algorithms. Affectiva provides solutions for ad testing, entertainment content testing through Emotion AI, qualitative research by using its cloud-based service Emotion SDK, in-cabin sensing AI for the automotive sector, and behavioral research with a solution from the company’s partner iMotions.

-

Realeyes is a multinational company specializing in emotion detection and recognition through its advanced Vision AI technology, which enables businesses to enhance their advertising effectiveness and customer experiences. By utilizing computer vision and facial coding, Realeyes captures audience attention and emotional responses in real-time via the front-facing cameras of users.Realeyes' solutions are applied across various industries, such as marketing, media, and healthcare, to optimize customer engagement, improve brand experiences, and enhance decision-making.

Key Emotion Detection & Recognition Companies:

The following are the leading companies in the emotion detection & recognition market. These companies collectively hold the largest market share and dictate industry trends.

- Affectiva

- Apple Inc.

- Eyeris

- Kairos AR, Inc.

- Noldus Information Technology BV

- Realeyes

- Sentiance NV

- Raydiant

- SkyBiometry

- NVISO

- Q3 Technologies LLC

- Paravision

- NEC Corporation

- Tobii

- Cognitec Systems GmbH

Recent Developments

-

In June 2024, Tobii introduced Glasses Explore, a cloud-based software that simplifies the analysis of human awareness and behavior. Combined with Tobii Pro Glasses 3, this software allows users to easily understand the areas where human beings pay attention and their reasoning for this behavior. The solution has been designed for quick insights into training, performance, and user experience, offering a way to capture perspectives in first-person in a real-world environment.

-

In January 2024, Paravision launched Paravision Liveness, a new technology that can passively detect if a face image is real or fake. This technology, combined with Paravision's existing face recognition capabilities, significantly improves remote identity verification. It enhances security, reduces user inconvenience, and ensures equal access for all demographic groups. Along with the product launch, the company announced its multi-level iBeta certification.

Emotion Detection & Recognition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.05 billion

Revenue Forecast in 2030

USD 136.46 billion

Growth Rate

CAGR of 16.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, tools, technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Brazil

Key companies profiled

Affectiva; Apple Inc.; Eyeris; Kairos AR, Inc.; Noldus Information Technology BV; Realeyes; Sentiance NV; Raydiant; SkyBiometry; NVISO; Q3 Technologies LLC; Paravision; NEC Corporation; Tobii; Cognitec Systems GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emotion Detection & Recognition Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the emotion detection & recognition market report based on component, tools, technology, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Tools Outlook (Revenue, USD Million, 2017 - 2030)

-

Facial Recognition

-

Speech & Voice Recognition

-

Gesture & Posture Recognition

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Bio sensors technology

-

Machine Learning

-

Pattern Recognition

-

Feature Extraction

-

Natural Language Processing

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Surveillance and Monitoring

-

Marketing and Advertising

-

Robotics and eLearning

-

Medical Emergency

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare & Life Sciences

-

IT & Telecommunication

-

Retail and eCommerce

-

Education

-

Media and Entertainment

-

Automotive

-

Others (Government, Hospitality, Manufacturing, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.