- Home

- »

- Power Generation & Storage

- »

-

Energy Transition Market Size, Trends, Industry Report 2033GVR Report cover

![Energy Transition Market Size, Share & Trends Report]()

Energy Transition Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Renewable Energy, Electrification, Energy Efficiency), By Sector (Power & Utility, Transportation), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-664-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Transition Market Summary

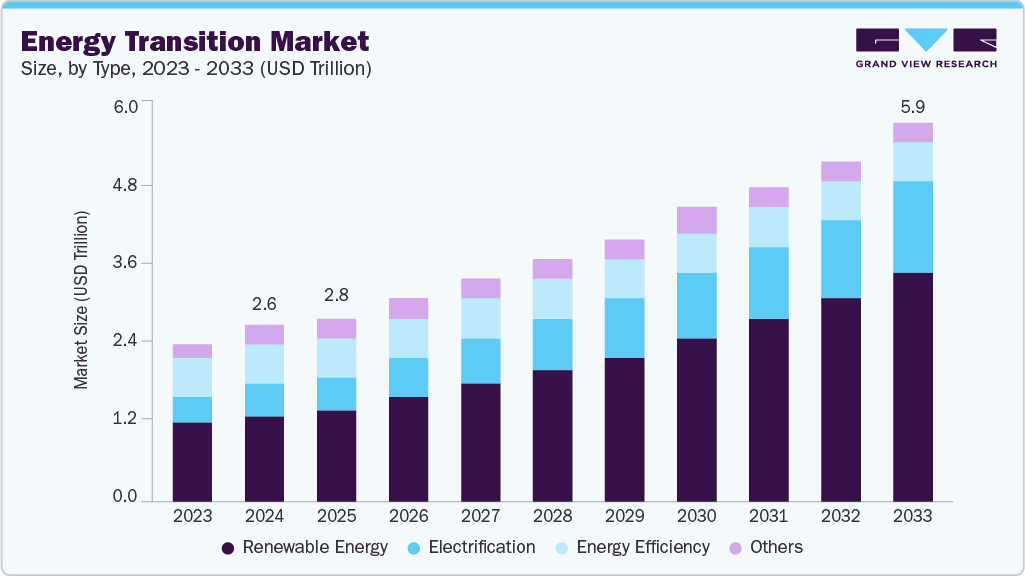

The global energy transition market size was estimated at USD 2.60 trillion in 2024 and is anticipated to reach USD 5.91 trillion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. Increased funding for renewable energy projects, electrification of end-use sectors, and supportive regulatory frameworks significantly contribute to market expansion.

Key Market Trends & Insights

- Asia Pacific energy transition market held the largest share of 45.20% of the global market in 2024.

- The energy transition market in the U.S. is expected to grow significantly over the forecast period.

- By type, the renewable energy segment held the largest market share of 49.87% in 2024.

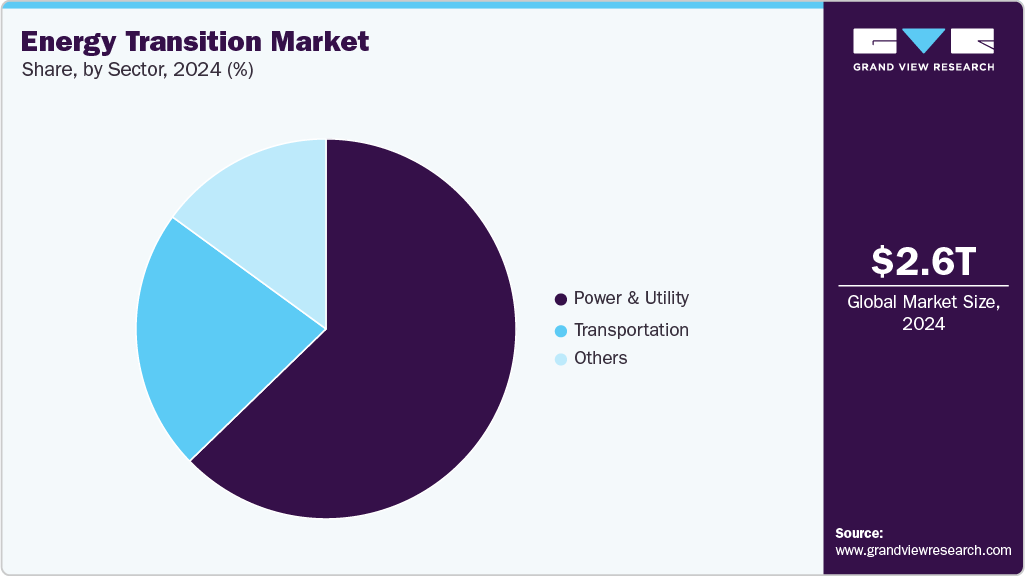

- By sector, the power & utility sub-segment held the largest revenue share of approximately 62.75% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.60 Trillion

- 2033 Projected Market Size: USD 5.91 Trillion

- CAGR (2025-2033): 9.7%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

Energy transition encompasses the global movement from conventional fossil fuel-based energy systems toward cleaner, renewable, and low-emission energy solutions. Growing environmental concerns, climate action policies, and the need for long-term energy security fuel this shift. Moreover, ongoing technological advancements, cost reductions in clean energy technologies, and rising corporate and national commitments to decarbonization are expected to sustain strong market momentum throughout the forecast period.

The energy transition spans a wide range of applications aimed at reducing dependence on fossil fuels and promoting sustainable power systems. While traditional energy infrastructure remains dominant in many regions, the transition enables rapid deployment of clean technologies such as solar, wind, green hydrogen, and energy storage across transportation, industry, and utilities. Its relevance is particularly strong in areas targeting net-zero emissions, electrified mobility, and decentralized energy generation. Major economies such as the United States, China, Germany, and India are investing heavily in renewable capacity and low-carbon infrastructure. These efforts, combined with policy mandates, green financing mechanisms, and corporate sustainability goals, are pivotal in driving the global energy transition forward.

Drivers, Opportunities & Restraints

The rising urgency to curb carbon emissions, reduce fossil fuel dependency, and meet climate targets under international agreements drives the global energy transition market. Governments worldwide are rolling out ambitious decarbonization roadmaps, incentivizing the deployment of clean energy technologies such as solar, wind, hydrogen, and battery storage. Growing public and private sector investment in renewable infrastructure, enhanced grid modernization efforts, and the electrification of transport and industry are major contributors to the market’s growth momentum.

Opportunities in this sector are growing quickly, driven by innovations in smart grids, digital energy management platforms, and advanced energy storage systems. Integrating distributed energy resources (DERs), rising energy-as-a-service (EaaS) models, and increasing corporate demand for clean power procurement present strong expansion prospects. Moreover, emerging markets are opening new frontiers through rural electrification and energy access programs. However, the market is not without restraints. Key challenges include the intermittency of renewables, limited grid flexibility in certain regions, and the high upfront investment costs associated with large-scale clean energy projects. Regulatory uncertainties and the slow phase-out of fossil fuel subsidies also pose hurdles to widespread adoption in some economies.

Type Insights

The renewable energy sub-segment dominated the type segment in the energy transition market, accounting for a revenue share of over 49.87% in 2024. It is also projected to remain the largest contributor over the forecast period. As the foundation of the global shift toward decarbonization, renewable energy has experienced exponential growth, driven by cost competitiveness, technological advances, and supportive policy frameworks. Solar photovoltaics, onshore and offshore wind, hydropower, and bioenergy are central to national energy strategies, reflecting a clear move away from fossil fuels and toward sustainable, clean generation sources.

Renewable energy supports deep emissions reductions and enhances energy security, job creation, and economic resilience. Its integration into power grids enables broader electrification and decarbonization across sectors such as transport and buildings. Massive investments in utility-scale solar parks, wind farms, and distributed generation systems are backed by climate finance, green bonds, and long-term procurement mechanisms. As countries accelerate toward net-zero goals, renewable energy scalability, low operational costs, and environmental advantages make it the most impactful and future-ready segment in the energy transition market.

Sector Insights

The power & utility sub-segment held the largest revenue share of approximately 62.75% in 2024 within the energy transition market. This dominance is driven by large-scale investments in renewable energy generation, grid modernization, and decarbonization efforts by public and private utility providers. Utilities are at the forefront of the energy transition, deploying solar farms, wind parks, and battery storage systems to replace aging fossil fuel assets and meet growing electricity demand in a cleaner, more sustainable way. With expanding regulatory mandates and carbon-neutral targets, utility-scale projects are increasingly integrated into national energy planning frameworks across major economies.

The power & utility segment is poised for continued growth over the forecast period, bolstered by declining costs of renewable technologies, long-term procurement contracts, and supportive policy mechanisms such as feed-in tariffs and renewable energy auctions. Despite concerns about intermittency and the need for grid flexibility, utilities are investing in digital monitoring, smart grid solutions, and hybrid systems to manage these challenges. Meanwhile, other sectors, such as transport, buildings, and industry, accelerate their shift toward clean energy. Still, the utility sector remains the backbone of the transition due to its capacity to drive systemic change and enable large-scale renewable integration. This trend will intensify as countries seek energy security and climate resilience in the coming decade.

Regional Insights

North American energy transition market is driven by large-scale infrastructure upgrades and a growing emphasis on clean energy adoption. The region is shifting steadily from conventional fossil fuel-based systems to more sustainable and resilient energy models, with increasing investments in renewables, grid modernization, and electrified transportation. Energy transition initiatives are gaining momentum due to supportive federal and state-level policies, clean energy tax credits, and emissions reduction targets aimed at decarbonizing the power and industrial sectors.

Government-backed incentives, utility reform, and corporate sustainability commitments encourage wide-scale adoption of low-carbon technologies across the United States and Canada. Electrification of transport, deployment of utility-scale solar and wind projects, and expansion of battery storage systems are key pillars of this transition. Developing green hydrogen hubs and smart grid infrastructure also enhances energy efficiency and flexibility. As energy security and climate resilience become national priorities, North America is expected to maintain a significant global energy transition market share.

U.S. Energy Transition Market Trends

The U.S. energy transition market is undergoing rapid transformation, driven by large-scale investments in clean energy infrastructure and a decisive shift away from fossil fuel dependency. Federal support through landmark policies like the Inflation Reduction Act (IRA), alongside state-led renewable portfolio standards (RPS), has catalyzed a wave of utility-scale solar, wind, and battery energy storage deployments. The U.S. is focused on building a resilient, decarbonized energy system through widespread grid modernization, electrification of transport, and industrial emissions reduction strategies.

Government incentives, including clean electricity production tax credits, carbon capture subsidies, and funding for transmission upgrades, are accelerating the adoption of low-carbon technologies across multiple sectors. Private-sector commitments to net-zero targets, alongside increasing consumer demand for green power, are reinforcing momentum. Key investment areas include electric vehicle (EV) charging networks, offshore wind farms, green hydrogen demonstration hubs, and advanced nuclear technologies. The U.S. is poised to lead globally in energy transition innovation and implementation with rising climate awareness, energy independence goals, and bipartisan infrastructure funding.

Asia Pacific Energy Transition Market Trends

Asia Pacific held over 45.20% revenue share of the Global Energy Transition market in 2024. Asia Pacific energy transition market is emerging as the leading contributor in the global market. Accelerated deployment of renewable energy infrastructure and ambitious decarbonization agendas in countries such as China, India, Japan, and South Korea are key factors driving the region’s dominance. Governments across the Asia Pacific are increasingly shifting away from fossil fuel dependency by scaling up investments in clean energy technologies such as solar, wind, hydro, and green hydrogen. The region’s focus on sustainable urbanization, electrified transport networks, and net-zero commitments is fueling the adoption of large-scale utility and distributed energy systems.

Supportive policy frameworks, national energy transition roadmaps, and financial incentives further enhance regional growth. Asia Pacific also benefits from strong manufacturing capabilities, cost-effective technology development, and deep expertise in grid modernization, especially in China and Japan. These advantages enable faster rollout of renewable infrastructure, smart grid upgrades, and energy storage solutions. With growing demand for energy security, economic decarbonization, and climate resilience, Asia Pacific is expected to maintain its leadership in the global energy transition market over the forecast period.

Europe Energy Transition Market Trends

The European energy transition market is driven by the region's strong regulatory push toward climate neutrality and its ambitious clean energy targets under initiatives such as the European Green Deal and REPowerEU. Europe is shifting away from fossil fuels by investing heavily in renewable energy, grid decarbonization, and low-carbon technologies. This transition is supported by a growing demand for electrification across sectors like transport, heating, and industry, alongside policy frameworks emphasizing energy efficiency, circular economy, and sustainability.

As countries work to enhance energy security and reduce dependency on imported fuels, there is a strong focus on decentralized energy systems, smart grid integration, and digital energy management. The region's mature policy environment, well-developed infrastructure, and strong public-private collaboration are enabling the rollout of large-scale wind and solar projects, green hydrogen development, and widespread adoption of electric mobility.

Latin America Energy Transition Market Trends

The Latin American energy transition market is accelerating as countries prioritize cleaner energy sources and long-term sustainability goals. Nations such as Brazil, Mexico, and Chile are investing in renewable energy infrastructure to diversify their power mix, reduce carbon emissions, and improve energy access. Rising electricity demand—driven by population growth, urbanization, and industrial expansion—prompts governments and private stakeholders to scale up clean energy projects, particularly solar, wind, and hydropower.

Latin America’s abundant natural resources and favorable climate conditions make it well-suited for renewable generation, while decentralized energy models are gaining traction in rural and underserved areas. Supportive regulatory reforms, international funding, and public-private partnerships further facilitate the deployment of low-carbon technologies.

Middle East & Africa Energy Transition Market Trends

The Middle East and Africa (MEA) energy transition market is gaining traction as countries strive to reduce reliance on fossil fuels and enhance energy sustainability. With abundant solar potential and growing electricity demand, particularly in underserved and off-grid areas, the region is increasingly investing in renewable energy infrastructure. Key economies such as Saudi Arabia, the UAE, Egypt, and South Africa lead the charge by implementing national energy strategies focused on clean power generation, grid modernization, and emissions reduction.

Strategic frameworks such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero by 2050 initiative accelerate renewable deployment across utility-scale solar, wind farms, and hydrogen development. Meanwhile, Sub-Saharan African nations prioritize decentralized energy systems to improve rural electrification and energy resilience. International financing, public-private partnerships, and multilateral climate programs support these efforts.

Key Energy Transition Company Insights

Some of the key players operating in the Energy Transition market include ABB Ltd., GE Vernova, Iberdrola S.A., Ørsted A/S, and Siemens AG, among others. These companies are investing heavily in research, development, and large-scale infrastructure to accelerate decarbonization, expand renewable energy integration, and modernize power grids.

Key Energy Transition Companies:

The following are the leading companies in the energy transition market. These companies collectively hold the largest market share and dictate industry trends.

- NextEra Energy, Inc.

- Iberdrola, S.A.

- Ørsted A/S

- ABB Ltd.

- GE Vernova

- Siemens AG

- Enel S.p.A.

- EDF Group

- RWE AG

- First Solar, Inc.

Recent Developments

- In February 2025, ABB Ltd. announced a major expansion of its electrification and grid automation manufacturing facility in Baden, Switzerland. The upgraded site is aimed at scaling up the production of next-generation energy transition technologies, including smart switchgear, grid inverters, and EV infrastructure solutions. This strategic investment supports the growing global demand for clean, efficient, and digitally connected energy systems, particularly as utilities and industries accelerate shifting from fossil fuels toward electrified and renewable-powered operations.

Energy Transition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.82 trillion

Revenue forecast in 2033

USD 5.91 trillion

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD billion/trillion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, sector, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

NextEra Energy, Inc.; Iberdrola, S.A.; Ørsted A/S; ABB Ltd.; GE Vernova; Siemens AG; Enel S.p.A.; EDF Group; RWE AG; First Solar, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Transition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global energy transition market report based on type, sector, and region.

-

Type Outlook (Revenue, USD Trillion, 2021 - 2033)

-

Renewable Energy

-

Electrification

-

Energy Efficiency

-

Others

-

-

Sector Outlook (Revenue, USD Trillion, 2021 - 2033)

-

Power & Utility

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Trillion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global energy transition market size was estimated at USD 2.60 trillion in 2024 and is expected to reach USD 2.82 trillion in 2025.

b. The global energy transition market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 5.91 trillion by 2033.

b. Based on the type segment, Renewable Energy held the largest revenue share of more than 49.87% in 2024.

b. Some of the key players in the global energy transition market include ABB Ltd., GE Vernova, Iberdrola S.A., Ørsted A/S, and Siemens AG, among others.

b. The key factors driving the energy transition market include the increasing urgency to reduce greenhouse gas emissions and strong policy support for clean energy investments. Governments and corporations worldwide are setting ambitious net-zero targets, which are accelerating the deployment of renewables, electrification of transport, and modernization of energy infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.