- Home

- »

- Green Building Materials

- »

-

Engineered Stone Market Size, Share & Growth Report, 2030GVR Report cover

![Engineered Stone Market Size, Share & Trends Report]()

Engineered Stone Market Size, Share & Trends Analysis Report By Product (Tiles, Blocks & Slabs), By Application (Countertops, Flooring, Others), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-007-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Engineered Stone Market Size & Trends

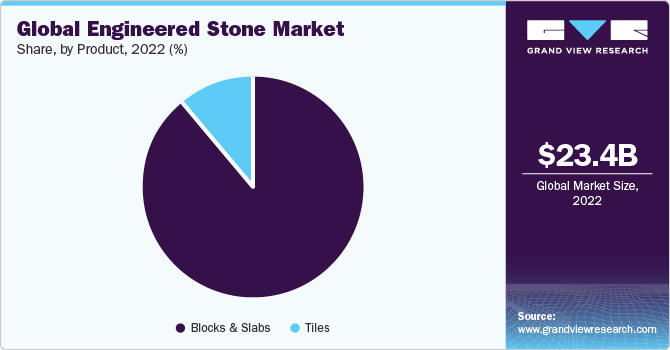

The global engineered stone market size was valued at USD 23.42 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The growth in construction activities globally, including residential, commercial, & infrastructure projects, along with the growing popularity of quartz-based engineered stone, are factors projected to drive the market. Moreover, increasing demand for aesthetically pleasing and durable substitutes to natural stone and the growing utilization of green construction materials is expected to propel market growth.

In 2022, blocks & slabs emerged as the dominant product segment. Rising investments in the construction of large commercial & residential buildings and growing demand for fancy countertops to improve aesthetics in the interior structure are expected to propel segment demand over the forecast period. The product, also known as quartz, is produced from marble or quartz crystal aggregates, as well as other rocks that are set in a resin binder, such as epoxy.

Breton SpA, a leading Italian company in the field of man-made stone products, has developed a patented process that is used to make nearly all of the engineered stone produced across the world. The development of an appealing & aesthetic infrastructure is a major driver for the adoption of engineered stone. It has been a popular choice for household applications, such as vanities, kitchen countertops, walls, and flooring due to its elegant appearance.

Along with its relatively lower cost, it offers considerable longevity compared to alternate natural stone products. Rapid growth in the residential and commercial construction sectors is increasing the demand for engineered stone worldwide. The product is suitable for use in hospital food facilities, canteens, and commercial buildings due to properties such as non-porousness and durability.

Product Insights

The blocks & slabs segment accounted for the largest revenue share of 98.25% in 2022. This dominance can be attributed to its easy-to-install and easy-to-maintain properties. Unlike natural stone, it is significantly less prone to stains caused by typical food substances, such as oil, wine, and juices, making it suitable for kitchen applications. Engineered blocks and slabs can be built in large sizes, and their non-porous nature allows them to be used in wet areas, such as bathrooms, swimming pools, showers, and bathtubs. Increasing demand for fancy countertops to enhance aesthetics in interior structures is anticipated to propel the demand over the forecast period.

Engineered stone tiles are made from a variety of aggregates joined together with epoxy and other materials, and are available in various colors, shapes, and sizes. Moreover, these tiles can be customized according to the application requirements. They are eco-friendly, as 94% of their content includes crushed waste stone left in quarries. The tiles segment is projected to expand at a CAGR of 4.7% through 2030 due to high product demand, owing to ease of installation and long-term durability. However, the availability of less expensive alternatives, such as ceramic tiles, is expected to impede segment growth over the forecast period.

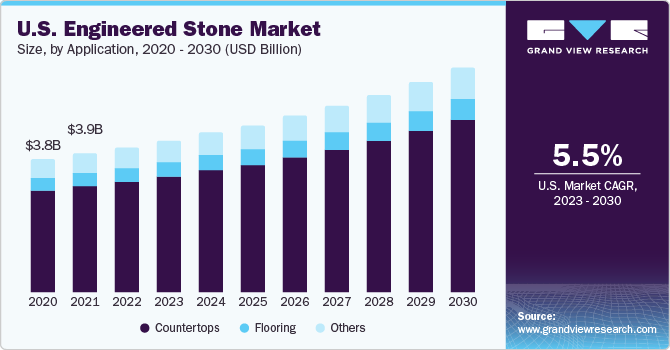

Application Insights

The countertops segment held the dominant revenue share of 79.2% in 2022. This demand can be credited to the product’s stain-resistant properties. Engineered stone slabs are comparatively less expensive than their natural alternatives and offer greater choices in terms of shape, design, color, and texture. Engineered stone contains polymeric resins that are not UV stable, causing the discoloration of the stone and the breakdown of the resin binder. Continuous UV exposure causes binding agents to harden, resulting in a loss of flexural strength over time. As a result, these stones are not fit for outdoor use.

The flooring segment is expected to advance at a CAGR of 4.4% over the forecast period. Due to its water resistance and non-porous structure, engineered stone flooring is becoming more popular in kitchens, bathrooms, and below-grade basements. In addition, it is also being used in regions with significant foot traffic due to its higher wear resistance. The others segment includes wall & exterior coverings, and furnishing items, such as chairs and tabletops. Product properties, such as superior aesthetics, durability, and water & stain resistance, make it ideal for use in the furnishing accessories market.

Regional Insights

Asia Pacific dominated the global engineered stone market and accounted for the largest revenue share of 35.4% in 2022. This is due to the growing product utilization in the construction and decoration of residential and non-residential interiors in rapidly growing economies, such as China, India, Malaysia, and Singapore.

The market in Europe is expected to advance at a CAGR of 4.9% over the forecast period, owing to the increasing mining regulations in the region, as well as high investments in the redevelopment of old building structures. Moreover, the market is expected to benefit from the presence of well-established manufacturing companies, such as Cranemere Group. The U.S. market is expected to witness sustainable growth, owing to the country’s expanding construction sector. Increased demand for energy-efficient construction solutions is also driving growth. In addition, the recovery of the construction industry after COVID-19 is playing an important role in market expansion.

The Middle East & Africa region is anticipated to expand at a considerable CAGR during the forecast period. In this region, the growth of the construction sector is majorly fueled by extensive government investments and the increased inflow of FDI. However, in many African countries, engineered stone is considered only as a decorating material, which can restrict the regional market’s growth.

Key Companies & Market Share Insights

There are several global, as well as small- & medium-scale manufacturers in the market. Major companies are engaged in implementing various marketing strategies, such as providing installation, post-installation & customization services, and the expansion of product portfolios. For instance, Breton S.p.A., a notable manufacturer, has established a chain of authorized workshops across various countries, such as Italy, France, China, India, and Brazil. Brand recognition and customization services are factors playing an important role in driving the market share of companies.

Key Engineered Stone Companies:

- LX Hausys

- Johnson Marble & Quartz

- Technistone A.S.

- Caesarstone Ltd.

- Belenco

- Quarella Group Ltd.

- Quartzforms

- Stone Italiana S.p.A.

- Cosentino S.A.

- VICOSTONE

Recent Developments

-

In March 2022, Häfele introduced the Terra Quartz surfaces collection designed for diverse home applications, known for their robustness, versatility, and adaptability. With a substantial thickness of 20 mm, this range predominantly features Quartz, making it exceptionally resilient, flexible, and conducive to creative craftsmanship

-

In March 2022, Engineered Stone Group (ES Group) announced its acquisition of MTI Baths and Aquatica. MTI Baths is a producer of premium engineered stone, acrylic, hydrotherapy bathtubs, and solid surface in the U.S., while Aquatica is a distinguished brand that specializes in high-end solid surface spas and bathtubs, primarily catering to the online direct-to-consumer market in North America. The strategic move is expected to increase ES group’s presence in the U.S. market

-

In June 2021, a joint venture between Omani and Indian businesses announced the launch of a manufacturing plant for engineered quartz stone products in Oman’s Sohar Free Zone. This significant investment contributes to strengthening the country’s reputation as a prominent producer and exporter of natural and engineered stones for the global construction industry. Madhav Surfaces FZC LLC has been formed through the partnership of Al Khanjar Commercial Agencies LLC and Madhav Ashok Ventures Private Limited (MAVPL), an Indian manufacturer of granite and marble surfaces. The joint venture committed approximately USD 10 million towards establishing a cutting-edge plant within the free zone in Sohar

-

In March 2020, LG Hausys commenced the large-scale production of engineered stone by activating its third manufacturing line at the company’s Georgia plant. This expansion in operations has significantly increased the annual output capacity to 1.05 million square meters, marking a notable 50 percent surge compared to the previous capacity. The newly constructed manufacturing line incorporates advanced robotics-driven technology, enabling the efficient production of stones characterized by a sleek design that offers a competitive pricing advantage. This strategic endeavor by LG Hausys underscores its commitment to innovation and meeting market demands while maintaining a focus on delivering high-quality engineered stone products

-

In January 2021, Lotte Chemical added an engineered stone production line at its Belenco plant in Turkey. This facility specializes in the manufacturing of artificial marble using engineered stone materials. With this expansion, the Belenco plant has significantly increased its annual production capacity by 120,000 pieces. The expansion demonstrates Lotte Chemical's commitment to meeting the growing demand for engineered stone products and strengthening its position in the market

Engineered Stone Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.56 billion

Revenue forecast in 2030

USD 36.76 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in million square meters, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Brazil; Saudi Arabia

Key companies profiled

LX Hausys; Johnson Marble & Quartz; Technistone A.S.; Caesarstone Ltd.; Belenco; Quarella Group Ltd.; Quartzforms; Stone Italiana S.p.A.; Cosentino S.A.; VICOSTONE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Engineered Stone Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global engineered stone market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Tiles

-

Blocks & Slabs

-

-

Application Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Countertops

-

Flooring

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global engineered stone market size was estimated at USD 23.42 billion in 2022 and is expected to reach USD 24.56 billion in 2023.

b. The global engineered stone market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 36.76 billion by 2030.

b. Countertops segment dominated the engineered stone market with a share of 79% in 2022, owing to its stain resistance property and relatively lower cost as compared to natural stone countertops.

b. Some of the key players operating in the engineered stone market include Brenton S.p.A., Johnson Marble & Quartz, Quartzforms, Stone Italiana S.p.A., Cosentino S.A., VICOSTONE, Technistone a.s., LG Hausys, Diresco, A.St.A. WORLD-WIDE, Pokarna Limited, Caesarstone Ltd., Belenco, SEIEFFE s.r.l., Quarella Group Limited.

b. The key factors that are driving the engineered stone market include the growing demand for aesthetically pleasing low-cost alternatives to natural stones such as marble and granite.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."