- Home

- »

- Next Generation Technologies

- »

-

Enterprise Video Market Size & Share, Industry Report, 2030GVR Report cover

![Enterprise Video Market Size, Share & Trends Report]()

Enterprise Video Market (2022 - 2030) Size, Share & Trends Analysis Report By Solution, By Services, By Deployment, By Application, By Delivery Technique, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-607-3

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Video Market Summary

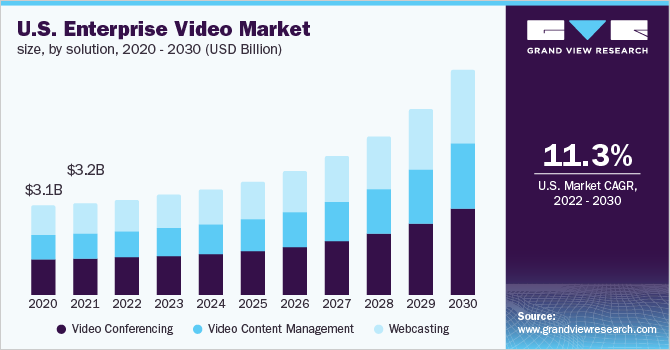

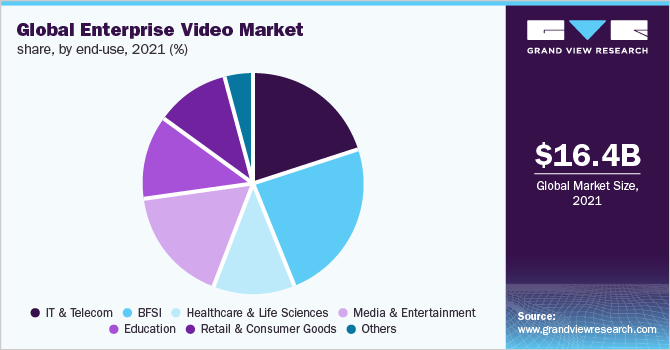

The global enterprise video market size was valued at USD 16.39 billion in 2021 and is projected to reach USD 48.85 billion by 2030, growing at a CAGR of 13.8% from 2022 to 2030. The growth of this market can be mainly attributed to the increased application of enterprise video solutions across organizations to enhance collaboration among their global workforces.

Key Market Trends & Insights

- North America market accounted for a revenue share of around 43% in 2021.

- By solution, the video conferencing segment accounted for over 40% of revenue share across the market in 2021.

- By service, the professional services segment accounted for over 47% of revenue share in 2021.

- By application, the corporate communications segment held a sizeable market share of over 46% in 2021.

- By delivery technique, the adaptive streaming segment captured over 35% revenue share in 2021.

Market Size & Forecast

- 2021 Market Size: USD 16.39 Billion

- 2030 Projected Market Size: USD 48.85 Billion

- CAGR (2022-2030): 13.8%

- North America: Largest market in 2021

The enterprise video has become a crucial part of the content marketing strategies of various companies. As a result, several companies are now focusing on developing Content Delivery Networks (CDNs) that speed up the delivery of multimedia internet content and provide better video streaming capabilities to enterprises. For instance, in April 2022, Google Cloud introduced its new multimedia CDN named Media CDN which enables businesses to leverage Google’s YouTube network. It also offers additional capabilities including ecosystem integrations, custom ad insertion, and platform extensibility.

The expansion of the market is being further expedited by the increasing demand for on-demand video streaming for learning and development training across various organizations. The on-demand videos help employees attain detailed information which is previously recorded by trainers, colleagues, and executives. Besides, many businesses are using enterprise video platforms for conducting external activities such as sales, marketing, training of customers and partners, and broadcasting of public events.

Several educational institutes are also increasingly using videos and multimedia presentations to provide a better learning experience through visual recordings of webinars and courses. The increased smartphone penetration and availability of high-speed internet have stimulated the adoption of video content for educational purposes.

The ongoing technological advancements in video streaming, such as the introduction of Application Programming Interfaces (APIs), are significantly favoring the market expansion. The APIs have allowed organizations to combine multiple technological platforms, delivering an omnichannel experience to their customers. Moreover, APIs also help develop apps for on-demand video content which is further propelling the growth of the market.

The global outbreak of the COVID-19 crisis has positively influenced the market space due to the increased need for enterprise collaboration software as several companies implemented remote working models during the pandemic. The growing remote working trend created a dynamic demand for video conferencing and content management. This urged the major tech companies such as Microsoft, Google LLC, and Zoom Video Communications, Inc. to develop video conferencing solutions to meet the rising demand for team collaboration tools.

For instance, in April 2020, Google LLC made its video-conferencing service Google Meet generally available, which was earlier available only to enterprise and educational institutions via the G Suite.

Solution Insights

The video conferencing segment accounted for over 40% of revenue share across the market in 2021. This can be attributed to the increasing demand for video communication driven by geographically scattered business operations and the adoption of remote working models. The emergence of the pandemic has led to a drastic rise in the number of online workshops, conferences, and seminars, thereby increasing the demand for enterprise video solutions. The expansion of the telemedicine industry and the increased penetration of online education across the globe have opened new growth opportunities for the segment.

The video content management segment is estimated to expand at a CAGR of 13.6% during the forecast period, as these solutions help businesses effectively manage their video and other multimedia content. The growing inclination toward cloud-based content management in various industries is expected to drive the segment growth in the coming years

Various companies engaged in the development of video content management software are now collaborating to develop innovative content management solutions to effectively meet customer demands. In February 2022, Brightcove Inc. acquired Wicket Labs, a renowned audience insights company that provides content and subscriber analytics that help users make decisions based on the data to improve conversion rate, subscriber acquisition, engagement, and retention.

Service Insights

The professional services segment accounted for over 47% of revenue share in 2021 due to the constant need for experts that help organizations troubleshoot, integrate, and manage enterprise video solutions. Moreover, professional services allow users to address security issues and improve the overall security measures for implementing digital marketing software. The key advantages of these services include optimum utilization of resources, minimal administrative expenses, and increased profitability. Professional services also facilitate better resource management through collaboration, integrated knowledge management, and better planning.

The market is poised to record a growth rate of 16.5% through 2030 from the managed services segment owing to the increasing consumer demand for remote monitoring and cost-effective IT infrastructure management through subscription-based pricing models. As enterprise video solutions are becoming increasingly popular in the BFSI sector, banks are being challenged by data security issues, which has created a significant demand for managed services in this sector. Besides, the increasing preference for cloud-based managed services is also a major factor stimulating segmental growth.

Deployment Insights

The cloud segment is estimated to witness a CAGR of over 15% during the forecast period as this deployment model offers the users the scalability through pay-as-you-go tools for the creation, management, and distribution of the video. Moreover, the rising adoption of cloud-based solutions across the small and Medium size Enterprises (SMEs) in developing countries such as India, Brazil, and Egypt are expected to enhance the segment outlook in the ensuing years. Cloud-based solutions offer better convenience to end-users by allowing easy access to the enterprise video platform through mobiles and laptops.

The on-premises enterprise video segment had accounted for a revenue share of 61.3% in 2021, owing to higher adoption in the large-scale organizations, such as BFSI, healthcare, and pharmaceuticals, where security and compliance are crucial factors. The eminent players in the market, such as Brightcove Inc. and Qumu Corporation are focusing on enhancing the functionality of their products by introducing advanced analytics, hybrid delivery, and self-service broadcasting.

Application Insights

The corporate communications segment held a sizeable market share of over 46% in 2021. This can be credited to the rising demand for these solutions in board meetings, executive briefings, and sales kick-offs. The segment growth is further driven by the increasing adoption of enterprise video solutions in the IT and telecom companies. Furthermore, the introduction of VoIP, which has allowed corporates to leverage the underlying network infrastructure for free communications, is driving the segment growth further.

The marketing and client engagement segment is anticipated to expand at a CAGR of 14.5% during the forecast period as various retailers are using video-based advertising to provide personalized updates on products, offers, and discounts. Besides, several gaming companies are now using videos to market their games on social media platforms, providing growth prospects for the segment. In addition, companies such as SalesLoft and Pegasystems Inc. are incorporating webinar software for marketing and client engagement which will favor the segment growth in coming years.

Delivery Technique Insights

The adaptive streaming segment captured over 35% revenue share in 2021 and is expected to grow significantly over the forecast timeline. The growth can be ascribed to the high consumer preference for adaptive streaming as it allows them to view content at a quality appropriate for their network connection. This technology provides a faster start time and minimal buffering during playback. Moreover, the increasing usage of video streaming platforms, especially during the COVID-19 pandemic, has dynamically increased the adoption of adaptive streaming in the media and entertainment industry.

The progressive downloading segment is expected to observe a notable CAGR of 14.8% through 2030 with increasing adoption of this technique owing to its ability to deliver video content to viewers over slow connections. It allows the users with a slow internet connection to download the content before playing it, which, in turn, ensures a seamless playback experience when sufficient bandwidth is not available. However, this method leads to the wastage of bandwidth as it requires downloading the whole video.

Organization Size Insights

The large enterprise segment accounted for over 63% of revenue share in 2021. This can be mainly credited to the increased investment in video conferencing solutions by various large-scale IT and telecom organizations. For instance, in July 2021, prominent telecom operator Tata Teleservices partnered with one of the leading web-based video conferencing solutions providers Zoom Video Communications, Inc, to deliver unified communications solutions to enterprises and individuals. This partnership will help the latter reach around 60 cities in India where Tata Teleservices has a presence.

The small and medium enterprises segment is expected to witness a CAGR of 15.4% during the forecast period on account of the supportive government initiatives aimed at promoting the adoption of cloud-based solutions across these enterprises. As per a study conducted by the National Association of Software and Services Companies (NASSCOM), about 60% of the SMEs in India have incorporated cloud solutions, and the number is anticipated to increase to 75% in the coming years. In addition, the cost-effectiveness of cloud-based solutions is anticipated to increase their demand among SMEs.

End-use Insights

The BFSI segment accounted for over 24% of revenue share in 2021, owing to the rising demand for video-based marketing and sales to enhance branch communications and banking services. The enterprise video solutions also help banks communicate through audio, video, and digital content sharing with their customers. The enterprise video solutions also ensure enhanced risk management, operational management, accountability, and end-to-end security governance which is augmenting their demand further.

The healthcare and life sciences segment are anticipated to record a CAGR of nearly 15.8% from 2022 to 2030, thanks to the increasing application of enterprise video systems to provide immediate medical assistance to patients based in remote areas. The enterprise video software facilitates collaboration between patients and healthcare teams, in which hospital staff can provide specific videos to patients based on their healthcare records. In addition, the growing emphasis of various healthcare organizations on delivering medical training using these solutions is also favoring the segment growth.

Regional Insights

North America market accounted for a revenue share of around 43% in 2021, thanks to the presence of major market players such as Adobe, IBM, Cisco Systems, Inc., and Microsoft in the region. Access to the high-quality internet coupled with the rising demand for visual meetings has created lucrative opportunities for the market in the U.S. In addition to this, the increasing demand for virtual private networks across various businesses and educational institutions is expected to drive regional market growth in upcoming years.

The market in the Asia Pacific is projected to expand at a CAGR of 15.7% during the forecast period with the increasing media consumption in the region. The expansion of network infrastructure and the presence of several small- and medium- enterprises in India and China are positively impacting the market. Besides, the increasing popularity of distance education and e-learning across Australia, China, Japan, Singapore, and India is creating ample opportunities for the market players.

Key Companies & Market Share Insights

The prominent players operating in the market are mainly focusing on developing and delivering innovative video streaming solutions to strengthen their foothold in the industry. For instance, in April 2020, Avaya, Inc. delivered its collaboration and communications solutions to the renowned online video platform iQIYI which has more than 500 million monthly active users. The company’s intelligent office system helped the latter to effectively manage the business operations during the pandemic.

The companies are also focusing on collaborations and partnerships for expanding their businesses and gaining a strategic advantage in the market. In September 2020, Vbrick introduced comprehensive integrations with popular video conferencing services, including Zoom, Cisco Webex, and Microsoft Teams allowing organizations to deliver live HD quality video to more than 100,000 participants. These new integrations form a crucial part of Vbrick’s existing portfolio of integrations focused on augmenting the value of video. Some of the prominent players in the global enterprise video market include:

-

Adobe

-

Avaya Inc.

-

Brightcove Inc.

-

Cisco Systems, Inc.

-

IBM Corporation

-

Kaltura, Inc.

-

Microsoft

-

Polycom, Inc. (Plantronics, Inc.)

-

VBrick

-

Vidyo, Inc

Enterprise Video Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 17.36 billion

Revenue forecast in 2030

USD 48.85 billion

Growth rate

CAGR of 13.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, services, deployment, applications, delivery technique, organization size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Adobe, Inc.; Avaya Inc.; Brightcove Inc.; Cisco Systems, Inc.; IBM Corporation; Kaltura; Microsoft Corporation; Polycom, Inc.; VBrick Systems; Vidyo Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Video Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise video market report based on solution, services, deployment, applications, delivery technique, organization size, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Conferencing

-

Video Content Management

-

Webcasting

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration & Deployment

-

Managed Service

-

Professional Service

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corporate Communications

-

Training & Development

-

Marketing & Client Engagement

-

-

Delivery Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Downloading/ Traditional Streaming

-

Adaptive Streaming

-

Progressive Downloading

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise (SME)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare & Life Sciences

-

Media & Entertainment

-

Education

-

Retail & Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global enterprise video market size was estimated at USD 16.39 billion in 2021 and is expected to reach USD 17.36 billion in 2022.

b. The global enterprise video market is expected to grow at a compound annual growth rate of 13.8% from 2022 to 2030 to reach USD 48.85 billion by 2030.

b. North America dominated the enterprise video market with a share of 43.7% in 2021. This is attributed to the presence of leading market players such as Adobe, Inc.; Cisco Systems, Inc.; IBM; and Microsoft Corporation and they have established a strong distribution network in the region.

b. Some key players operating in the enterprise video market include Adobe, Inc.; Avaya Inc.; Brightcove Inc.; Cisco Systems, Inc.; IBM; Kaltura; Microsoft Corporation; Polycom, Inc.; VBrick Systems; and Vidyo.

b. Key factors that are driving the enterprise video market growth include the growing need to reduce operational expenses and increase efficiency and the increasing internet penetration and growing demand for video streaming.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.