- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Global Epoxy Composite Market Size Report, 2021-2028GVR Report cover

![Epoxy Composite Market Size, Share & Trends Report]()

Epoxy Composite Market (2021 - 2028) Size, Share & Trends Analysis Report By Fiber Type (Glass, Carbon), By End-use (Automotive & Transportation, Wind Energy), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-4-68039-095-9

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

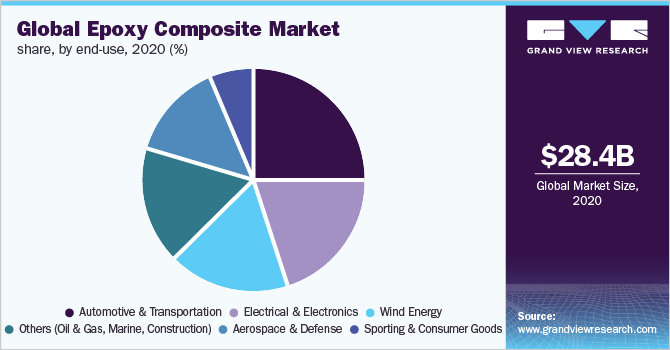

The global epoxy composite market size was valued at USD 28.40 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2021 to 2028. Rapid replacement of conventional materials in automotive and aerospace applications is expected to drive the market in the coming years. The global market was severely affected due to the COVID-19 pandemic in 2020. The lockdown strategies imposed by various governments across the globe, to curb the spread of the virus, halted the production activities for a brief period in 2020. This, in turn, dented the product demand in several industries, especially in the automotive and aerospace sectors. In addition, the lockdown strategies restricted transportation; thus, creating a global supply chain disruption.

These trends also led to a shortfall in product supply, thereby, affecting the overall market growth. Epoxy composites have gained popularity in sports and consumer goods applications because of their low weight, high strength, large degree of freedom of design, and easy processing & forming characteristics. These are increasingly employed in applications, such as tennis rackets, golf clubs, bikes, hiking, skis, surfboards, table tennis boards, badminton rackets, fishing rods, baseball bats, hockey sticks, sports vehicles, and footwear.

Most of the key market players, such as Cytec Industries, Toray Industries, Hexcel, and Hyosung, are integrated across the value chain ranging from raw material supply to CFRP distribution. A high level of integration enables companies to cut down the costs associated with raw material procurement and helps increase market share with the development of specialty products.

Several key companies in the market, such as Teijin, Huntsman, Olin Corp., and Solvay, are working on the development of automated processes to minimize production time and enhance profitability. In addition, several manufacturers are making heavy investments in research and development activities for the expansion of the application scope of their products, thereby widening their customer base.

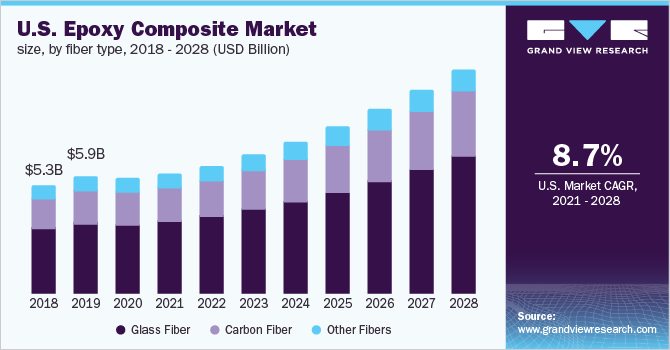

Fiber Type Insights

The glass fiber segment led the market accounting for a revenue share of more than 60% in 2020 and will retain the leading position throughout the forecast years. This growth is attributed to the rising use of glass fibers in automotive and marine applications due to their cost-effectiveness. In addition, the use of composite materials in place of metals results in better fuel efficiency, thus enhancing the overall vehicle performance. The high strength-to-weight ratio of glass fiber types makes them suitable for a broad range of applications.

However, manufacturers opt for other epoxy composites, such as carbon and aramid fiber epoxy composites, due to the difficulties associated with recycling the glass-fiber epoxy composites. The carbon fiber segment is expected to witness the fastest CAGR of more than 8.5% on account of superior thermal, mechanical, and electrical properties offered by these fibers to the composites. In addition, the high strength and durability exhibited by these composites are enhancing their growth opportunities across various end-use industries.

Manufacturers of carbon fiber reinforced composites strive to exploit potential opportunities in industrial applications. Research activities are aimed at improving fiber/matrix interface properties and dispersion of nano-filler within the matrix. If fiber is not properly dispersed in the matrix, it will result in agglomeration of carbon fillers and this, in turn, will affect the performance of carbon fiber epoxy composites.

End-use Insights

The automotive & transportation end-use segment led the market in 2020 with a revenue share of more than 25%. The high durability and low weight of epoxy composites make them ideal for structural components used in automotive and transportation systems. Epoxy composites are used in several automotive applications including interior headliner, underbody system, instrument panel, bumper beam, air duct, airbag housing, and engine cover, etc. The rising demand for lighter, safer, and energy-efficient vehicles is boosting product consumption in automotive and transportation applications. Automakers across the globe are focusing on achieving high fuel efficiency as energy regulatory bodies have set limits for carbon emissions.

The aerospace end-use segment is expected to witness a significant CAGR over the forecast period on account of the rising product use in the structural parts of airplanes, rockets, and missiles to reduce weight; thus, improving fuel efficiency. In addition, low energy consumption and low weight aid in enhancing the speed of aircraft and missiles. Carbon fiber epoxy composites are highly preferred in this application segment due to their high-performance characteristics. Advantages of using epoxy composites in aerospace and defense applications include low weight (due to high specific strength and stiffness), fatigue & corrosion resistance, high degree of optimization, and low dielectric loss.

Regional Insights

Asia Pacific dominated the market and accounted for more than 36% of the revenue share in 2020. It is projected to expand further at the fastest CAGR of over 7% from 2021 to 2028 retaining its dominant position. This growth is attributed to high growth opportunities exhibited by the region owing to rapidly rising aircraft production, and ambitious electrical & electronics capacity addition targets by various companies.

The emergence of the Philippines, Indonesia, Singapore, Malaysia, and Vietnam as major shipbuilding centers in Asia Pacific is also expected to drive the demand for composites in the region over the forecast period. Asia Pacific is the largest market for transportation globally and the presence of numerous automotive manufacturers coupled with steady growth in automobile production is expected to propel the regional market growth over the forecast period.

North America is also expected to witness considerable growth from 2021 to 2028 owing to the growing number of air passengers, rise in the demand for private helicopters, and increasing investments in military space programs. Space exploration missions by NASA, SpaceX – a booming private sector space program in the U.S., and other space tourism expeditions, are anticipated to have a positive impact on the regional market. In addition, the emerging trend of renewable energy generation is also expected to drive the product demand in the region

Key Companies & Market Share Insights

Key players are investing in research and development to improve the existing composites and develop advanced cost-effective solutions. In addition, key players are exploring growth opportunities across various end-use industries through broadening of application scope. However, the high manufacturing costs of composites are challenging the growth and profitability of the composites market across the world. Other initiatives undertaken by key companies include technology innovations, partnerships, and M&A. Some prominent players in the global epoxy composite market include:

-

Teijin Ltd.

-

Toray Industries, Inc.

-

Huntsman Corp. LLC

-

SGL Carbon

-

Hexcel Corp.

-

Solvay

-

Park Aerospace Corp.

-

Arkema

-

Avient Corp.

-

Olin Corp.

Epoxy Composite Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 29.60 billion

Revenue forecast in 2028

USD 55.97 billion

Growth rate

CAGR of 8.3% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Teijin Ltd.; Toray Industries, Inc.; Huntsman Corp. LLC; SGL Carbon; Hexcel Corp.; Solvay; Park Aerospace Corp.; Arkema; Avient Corp.; Olin Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global epoxy composite market report on the basis of fiber type, end-use, and region:

-

Fiber Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Glass Fiber

-

Carbon Fiber

-

Other Fiber

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Automotive & Transportation

-

Aerospace & Defense

-

Wind Energy

-

Electrical & Electronics

-

Sporting & Consumer Goods

-

Other End-use (Oil & Gas, Marine, Construction)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The epoxy composite market size was estimated at USD 28.40 billion in 2020 and is expected to reach USD 29.60 billion in 2021.

b. The epoxy composite market is expected to grow at a compound annual growth rate of 8.3% from 2020 to 2028 to reach USD 55.97 billion by 2028.

b. Glass fiber reinforced epoxy composites segment dominated the epoxy composite market with a share of 60% in 2020. This is attributed to superior properties offered by the material along with cost-effectiveness.

b. Some of the key players operating in the epoxy composite market include L Teijin Ltd., Toray Industries, Inc., Huntsman Corporation LLC, SGL Carbon, Hexcel Corporation, Solvay, PARK AEROSPACE CORP., Arkema, AVIENT CORPORATION, Olin Corporation.

b. The key factors that are driving the epoxy composite market include the rising trend of using advanced functional materials in automotive and aerospace applications to enhance the reduce weight and improve performance, rising demand for advanced materials to replace conventional materials such as wood, and metal across several end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.