- Home

- »

- Animal Health

- »

-

Equine Healthcare Market Size, Share, Growth Report, 2030GVR Report cover

![Equine Healthcare Market Size, Share & Trends Report]()

Equine Healthcare Market Size, Share & Trends Analysis Report By Product, By Indication, By Activity (Sports/Racing, Recreation, Other Activities), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-986-8

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Equine Healthcare Market Size & Trends

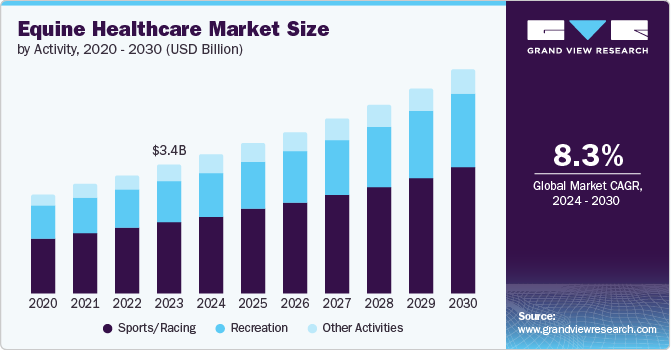

The global equine healthcare market size is estimated to be USD 3.37 billion in 2023 and is expected to grow at a CAGR of 8.32% from 2024 to 2030. Key factors expected to drive the market include growing R&D initiatives, a rise in equine health complications, the rising popularity of equine-assisted therapy, and the emergence of artificial intelligence (AI) in equine health. Researchers across the veterinary field are showcasing ingenuity by conducting continuous research into including artificial intelligence (AI) in the equine veterinary practice. Global leaders in the market are encouraging such activities to address the recurring challenges in the field. This technology will revolutionize equine healthcare management by providing periodic analysis of the horses for timely health management and enhancing the accuracy of early disease diagnosis and personalized treatment.

For instance, in June 2024, Boehringer Ingelheim (BI) partnered with Sleip, a leading software company that provides health monitoring & analysis solutions for horses. BI took this initiative to utilize Sleip’s AI-enhanced equine gait analysis tool for musculoskeletal disorders to spread awareness about the importance of preventive, diagnostic care in horses. Further, using BI’s market penetration & expertise, this collaboration aims to enhance disease diagnosis in horses worldwide and conduct educational training activities.

Furthermore, in May 2024, Happie Animals launched a novel application for horse owners called Happie Horse. This application uses AI to monitor and analyze the horse's health data. It provides the owner a prior notification if the AI detects any patterns or signs of possible diseases in the horse. It also makes nutritional and medicinal recommendations for the horse to the owner. There are currently over 135,000 animal owners registered to the app.

Such developments in the market are a testament to the rapidly emerging use of advanced technologies like AI in the healthcare management of horses, making it one of the most crucial driving factors.

Another crucial driving factor for the market is the growing variety of global research and development initiatives. These initiatives range from the use of horses as subjects for human health complications to research into the development of solutions for horse health complications. For example, according to a February 2024 press release by Euro News, scientists from Costa Rica are involved in R&D to develop antidotes for human snake bites. They are utilizing the horses as the vessels to develop antibodies against the vaccine. Injecting snake venom into the horse triggers an immunological response, creating antibodies, which are then purified and used to treat snake bite victims. To ensure a swift immune response, the horses must remain healthy without any other disease or condition, driving the need for health products.

Furthermore, in April 2024, a research study published in the Journal of Veterinary Medicine aimed to gain detailed insights into identifying key diagnostic and prognostic factors in horses suffering from EMPF. The researchers identified key diagnostic factors such as weight loss, difficulty breathing, fever, and rapid breathing. The study also inferred that further research into identifying prognostic factors is required to improve treatment outcomes.

Additionally, researchers at the Morris Foundation, in April 2024, designed a questionnaire tool for horse owners. This is aimed at assisting horse owners in effective monitoring and early diagnosis of musculoskeletal disorders like osteoarthritis to improve the horses' overall health.

Many more such developments fuel the global demand for appropriate diagnostic and treatment products, ultimately driving the market.

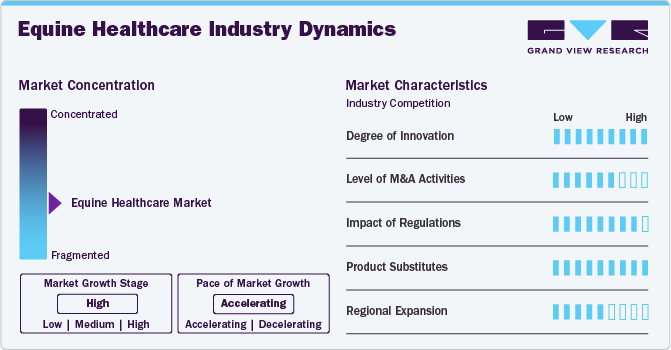

Industry Dynamics

Owing to continuous launches of innovative products & services that cater to horse health diagnosis as well as treatment, the degree of innovation in the market is high. Apart from technological innovations involving AI, industry players are also actively involved in bringing novel diagnostic tools into the industry. For example, in June 2024, Zomedica launched a novel equine cortisol assay for its existing point-of-care Truforma diagnostic platform. Cortisol assessment is a very crucial diagnostic parameter to determine the health of a horse.

Merger & acquisition (M&A) activities in this market are currently having moderate impact. Industry stakeholders are engaged in acquiring equine service providers to penetrate further into the market by enhancing the latter’s geographical reach. For example, in January 2024, Altano Group, a leading animal hospital based in Germany, acquired McKee Pownall Equine Services, a Canadian equine service provider. This acquisition was done by Altano Group in order to penetrate into the horse healthcare market of Canada.

Impact of regulation on the market is high due to presence of appropriate protocols and guidelines for equine-related health and safety activities, products as well as services. Organizations round the world like American Veterinary Medical Association (AVMA), Federation Equestre Internationale (FEI), and EU are involved in upgrading the horse health & safety protocols and guidelines periodically as per the industry requirements. For instance, in March 2024, FEI released new regulations and protocols to prevent spread of infectious diseases like Equine Herpes Virus (EHV) at horse-related events.

Consumers in this industry are presented with a wide range of alternatives that allow them to choose any sort of product, taking into consideration attributes such as availability, affordability, and specifications, making the impact of product substitutes moderate to high. There are several alternatives for certain equine health products, such as parasiticides, anti-infectives, anti-inflammatory & analgesics, feed additives and anti-infectives. In addition, horse owners are able to select a product that better meets their needs when it involves diagnostic kits, veterinary software, etc. This fuels industry competition amongst various companies.

The industry is experiencing moderate impact of regional expansion. This can be owed to industry participants entering international markets to expand their business and boost revenue. For example, in April 2024, Australian company, Poseidon Animal Health, entered into US market by launching their equine and canine health supplements.

Product Insights

The pharmaceuticals segment had the largest revenue share of 25.96% in 2023. Several common medications, including parasiticides, anti-infectives, analgesics, and anti-inflammatory drugs, are required for the wide range of health concerns that affect horses, including pain management, respiratory issues, infectious diseases, and musculoskeletal disorders. These medications are typically prescribed by veterinarians as a first line of treatment, followed by more advanced care based on the necessity. If the condition deteriorates, more sophisticated treatments could prove to be necessary. Furthermore, there has been an increase in equestrian activities and other horse-related activities like horse-assisted therapies in recent years, accelerating the market to lucrative market growth.

The software segment is anticipated to grow at the fastest CAGR over the forecast period. This segment is bifurcated into practice management, imaging, and telehealth software. This high growth rate can be attributed to various factors like increasing adoption of telehealth into equine practice, inculcation of AI technology into existing software to enhance outcomes, and collaborative efforts by industry participants to enhance veterinary software for equine use. For example, in June 2024, Mella Pet Care, which provides animal health monitoring software, announced a partnership with Vetspire for cross-platform integration of workflows for both companies and provide the option to collect and monitor vital signs of horses, dogs, etc., on the desktop application of Mella Pet Care.

Indication Insights

The parasitic infections segment dominated the market with a market share of 26.56% in 2023. This can be attributed to the high prevalence of parasitic infections in horses, leading to a high demand for appropriate diagnostic and treatment options. It is the most common type of disease in horses and is present in the majority of most horses worldwide. For instance, the prevalence of parasitic infections in horses was estimated at around 76% and 92.5%, as per 2024 publications from Science Direct & Journal of Veterinary Science respectively.

The Equine Herpes Virus (EHV) segment is expected to showcase lucrative growth over the forecast period. This high growth can be attributed to the increasing prevalence of EHV among various types of horses and recent reports of EHV outbreaks. For instance, as per an April 2024 study from Science Direct, the prevalence of EHV was reported to be high in lactating horses (81.6%) and pregnant horses (74.6%) compared to other types of horses. Additionally, in February 2024, another Science Direct research study published in September 2023 reported an outbreak of EHV during an equestrian event, CES Valencia Spring Tour 2021, causing fever in over 83.3% of the participant horses. These instances highlight the need for proper diagnostic and therapeutic care of horses against the increasing risk of EHV, driving the segment over the forecast period.

Activity Insights

The sports/racing segment dominated the market with a share of over 56.38% in 2023 because of the popularity of equestrian activities like racing and other sports across the globe. Horses employed for these activities require special care to maintain their health and ensure they are fit enough to participate, hence driving the demand for the segment. For example, according to data from the House of Commons Library from October 2023, equestrian activities provide approximately GBP 4.1 billion (USD 5.2 billion) to the economies of countries like the UK. Furthermore, according to the same source, 4.8 million people attended these sporting and racing events in 2022, establishing a record.

The recreation segment is expected to grow with the highest CAGR in the market over 2024-2030. In recent years, the use of horses for recreational activities like equine-assisted therapy has been rising. This therapy involves exercises and riding that help individuals overcome their occupational, physical, and mental impediments. Specially trained horses, along with trainers, are used in enhancing body coordination, endurance, skill, and mental health in individuals with various conditions like autism, amputations, paralysis, PTSD, and other complications. The fact that this type of activity is gaining traction among the masses leads to increasing demand for properly trained and healthy therapy horses, driving the segment over the forecast period.

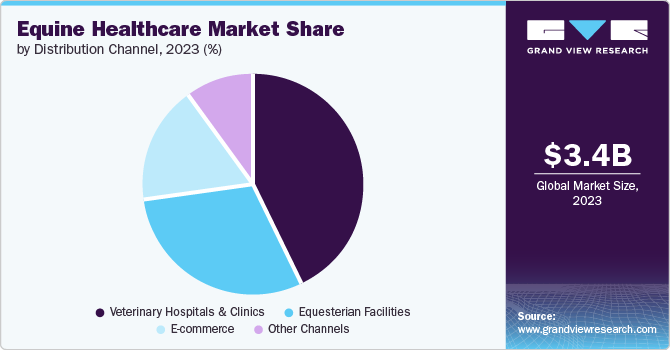

Distribution Channel Insights

The veterinary hospitals & clinics segment dominated the market in terms of share in 2023. The need for specialized healthcare services for horses is growing as equine sports, horseback riding, and therapy horses get progressively more popular. Given that they are better equipped to offer these services, veterinary clinics and hospitals possess a greater share of the market. For horse owners looking for medical care for their animals, these establishments are the go-to option due to their high caliber of care and degree of expertise.

The e-commerce segment is anticipated to grow at the highest CAGR over the forecast period. This can be attributed to the growing acceptance of e-commerce which serve horse owners via accessibility and convenience. The COVID-19 pandemic played a role in accelerating of e-commerce growth by triggering a sudden increase in online shopping owing to social distancing measures and lockdowns. The e-commerce market can be appealing for consumers seeking equine healthcare products since it presents a wider array of products at competitive prices.

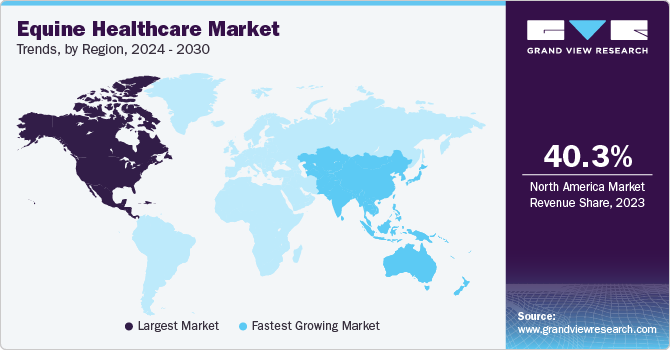

Regional Insights

North America equine healthcare market accounted for the largest share of 40.26% in 2023. This dominance can be due to continuously evolving regulatory frameworks in the region to ensure health and welfare among horses. For instance, in May 2024, U.S. Department of Agriculture's Animal and Plant Health Inspection Service (APHIS) enhanced the Horse Protection Regulations to inhibit intentional horse soring. This activity is done by horse owners by inflicting intentional pain to the horse to gain advantage in sports/racing activities but can be detrimental on the horse’s health.

U.S. Equine Healthcare Market Trends

The equine healthcare market in the U.S. is growing as result of increasing standardization of treatment protocols for horses. For instance, in March 2024, American Association of Equine Practitioners (AAEP) released vaccination protocols for five crucial equine diseases affecting horses in US, West Nile virus, tetanus, equine encephalomyelitis, and rabies.

Europe Equine Healthcare Market Trends

Europe equine healthcare market is driven by elevated prevalence of equine diseases, expansion of equestrian activities, adoption of innovative technologies in the management of equine healthcare, and growing number of horses in the continent. The number of horses in Europe is increasing, and as a result, likewise is the amount spent on equine-related activities. According to data from January 2024 provided by PetKeen, there are an estimated 1 million horses in the UK, and the country spends about GBP 4 billion (USD 5.1 billion) a year on equestrian-related activities.

The equine healthcare market in Germany possessed the second-largest share of the European market. The growing popularity of horse racing and other equestrian activities is one of the main factors driving this market. The demand for horse healthcare goods and veterinary services has increased as a result of this. Furthermore, the government's emphasis on animal welfare and the strict laws pertaining to the health and safety of horses further support the expansion of this sector.

Asia Pacific Equine Healthcare Market Trends

Asia Pacific (APAC) equine healthcare market is growing at highest CAGR of over 11.02% over the forecast period. This high growth is the result of increasing emphasis of countries from the region on improving horse welfare by different means such as improving regulatory standards, conducting education & training programs, etc. For instance, in July 2024, Chinese Equestrian Association with assistance from the FEI conducted education and training programs for horse stable managers across China. This was done with the aim of raising the standards of care for horses by developing trained individuals.

The equine healthcare market in India is expected to grow at a substantial growth rate over the forecast period. This can be attributed to growing variety applications of horses in the country and the subsequent need for proper healthcare protocols. For instance, Directorate of Health Services in Kashmir, in July 2024, started novel initiative, horse ambulance, to provide healthcare support to the pilgrims attending the Amarnath Yatra pilgrimage. Considering the immense attendance in such pilgrimages, a proper healthcare regime is also crucial in ensuring that these horses remain in good health. Therefore, such activities act as boosting factors to the country’s market.

Latin America Equine Healthcare Market Trends

Latin America equine healthcare market is driven by the growing due rising prevalence of encephalitis among the equine population of the region. According to February 2024 data by WHO, over 1419 outbreaks of Western Equine Encephalitis (WEE) have been reported in countries like Argentina. This drives up the demand for diagnostic and treatment products in the regions to avert future outbreaks.

The equine healthcare market in Brazil is expected to rise due to increasing popularity of horse racing in the country. There are several races like Grande Premo Brasil & Derby Paulista are conducted every year in the country and the participation is on the rise every year. Such races are a major source of revenue for the country; therefore, the authorities are establishing horse healthcare protocols to ensure that the participant horses do not suffer from any kind of health issues, driving the market.

Middle East & Africa Equine Healthcare Market Trends

MEA equine healthcare market is majorly driven by growing focus on horse health due to increasing penetration of equestrian sports. The countries from the region are actively involved in promoting equestrian sports. For instance, as per April 2024 reports by FEI, Saudi Arabia officials in collaboration with FEI conducted FEI World Cup Finals in the city of Riyadh. Such activities bring in the demand for equine products in the countries from the region, boosting the revenue.

The equine healthcare market in South Africa is owed to the active involvement of authorities in ensuring that required horse health medications are available for the horse owners and veterinarians. For example, in December 2023, the South African Veterinary Council (SAVC), announced that it has filled its inventory of African Horse Sickness vaccines and are available to the veterinarians to prescribe.

Key Equine Healthcare Company Insights

Companies operating in this industry are actively involved in a number of efforts aimed at improving their market share and variety of products. These initiatives involve establishing strategic alliances to expand market share, expanding the product range through acquisitions, and introducing novel products that make use of advanced technologies. Furthermore, companies are concentrating on developing goods that cater to particular demands in the equine healthcare sector. By combining these programs, companies are catering to the changing needs of both horse owners and veterinarians and simultaneously enhancing the equine healthcare industry.

Key Equine Healthcare Companies:

The following are the leading companies in the equine healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Arthrex Inc.

- Dechra Pharmaceuticals

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Heska Corporation

- Merck & Co. Inc

- Esaote SPA

- IDEXX Laboratories, Inc.

- Covetrus Inc.

- Elanco

- Cargill

Recent Developments

-

In July 2024, San Giovanni Battista Hospital of Rome announced that their equine-assisted therapy program helped in improving motor skills in over 600 neurology patients.

-

In June 2024, Hartpury University along with AnimalWeb launched a new research study aimed at mapping the biosecurity practices in the equine industry of UK. This study will help in shaping equine health-related policies in the country.

-

In June 2024, Merck Animal Health and US Trotting Association announced installation milestone of over 50,000 Bio-Thermo microchips in race horses. These microchips assist the horse owners in accurately and remotely monitoring health parameters like temperature and also help in recordkeeping.

-

In May 2024, Curative Sounds launched a novel product for companion and equine patients, Extracorporeal Shockwave Therapy (ESWT) device. This is considered world’s first portable ESWT device and is applicable in treating musculoskeletal disorders.

-

In May 2024, Mixlab acquired NexGen Animal Health. This acquisition was done by Mixlab to expand their existing pharmacy services beyond companion animals and into large animals like horse and cattle.

Equine Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.66 billion

Revenue forecast in 2030

USD 5.91 billion

Growth rate

CAGR of 8.32% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, activity, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Netherlands; Russia; Switzerland; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; Arthrex Inc.; Dechra Pharmaceuticals; Boehringer Ingelheim International GmbH; Ceva Sante Animale; Heska Corporation; Merck & Co. Inc; Esaote SPA; IDEXX Laboratories, Inc.; Covetrus Inc.; Elanco; Cargill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Equine Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global equine healthcare market report based on product, indication, activity, distribution channel & region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory & Analgesics

-

Other Pharmaceuticals

-

-

Medicinal Feed Additives

-

Orthobiologics

-

Diagnostics

-

Diagnostic Test Kits

-

Diagnostic Equipment

-

-

Software & Services

-

Practice Management Software

-

Imaging Software

-

Telehealth Software

-

Other Software

-

-

Other Products

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Musculoskeletal Disorders

-

Parasitic Infections

-

Equine Herpes Virus

-

Equine Viral Arteritis (EVA)

-

Equine Influenza

-

West Nile Virus

-

Tetanus

-

Other Indications

-

-

Activity Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports/Racing

-

Recreation

-

Other Activities

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Equestrian Facilities

-

Other Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Russia

-

Switzerland

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global equine healthcare market size was estimated at USD 3.37 billion in 2023 and is expected to reach USD 3.66 billion in 2024.

b. The global equine healthcare market is expected to grow at a compound annual growth rate of 8.32% from 2023 to 2030 to reach USD 5.91 billion by 2030.

b. North America accounted for the largest market share of 40.26% in 2023. This dominance can be due to continuously evolving regulatory frameworks in the region to ensure health and welfare among horses.

b. Some key players operating in the equine healthcare market include Zoetis, Arthrex Inc., Dechra Pharmaceuticals, Boehringer Ingelheim International GmbH, Ceva Sante Animale, Heska Corporation, Merck & Co. Inc, Esaote SPA, IDEXX Laboratories, Inc., Covetrus Inc., Elanco, and Cargill.

b. Key factors that are driving the market growth include growing R&D initiatives, a rise in equine health complications, the rising popularity of equine-assisted therapy, and the emergence of artificial intelligence (AI) in equine health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."