- Home

- »

- Petrochemicals

- »

-

Ethylene Carbonate Market Size, Industry Report, 2030GVR Report cover

![Ethylene Carbonate Market Size, Share, & Trends Report]()

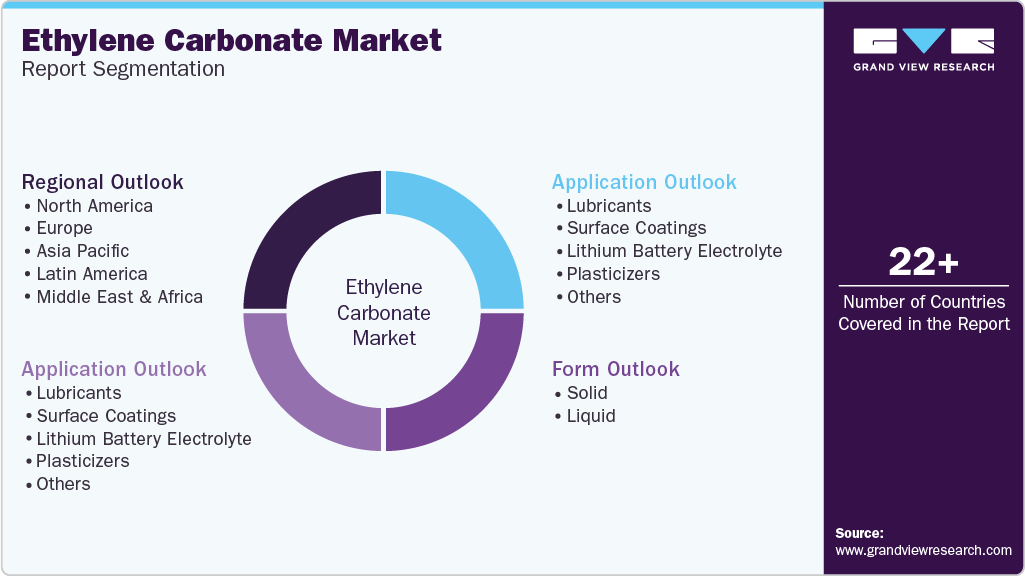

Ethylene Carbonate Market (2025 - 2030) Size, Share, & Trends Analysis Report By Form (Solid, Liquid), By Application (Lubricants, Surface Coatings), By End Use (Automotive, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-973-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethylene Carbonate Market Summary

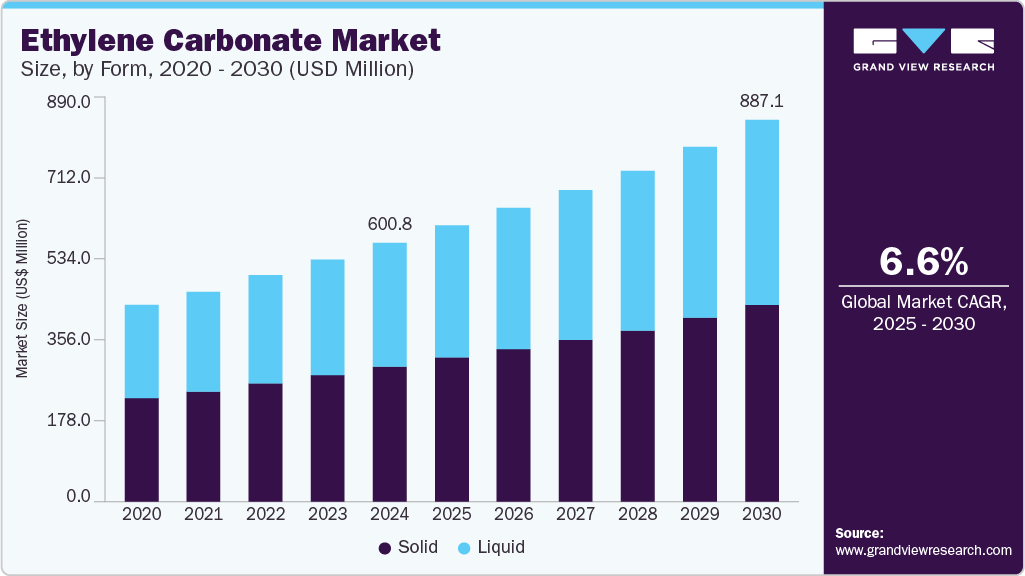

The global ethylene carbonate market size was estimated at USD 600.82 million in 2024 and is projected to reach USD 887.06 million by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The rising demand for ethylene carbonate is largely driven by the growing adoption of electric vehicles and the expanding need for energy storage solutions.

Key Market Trends & Insights

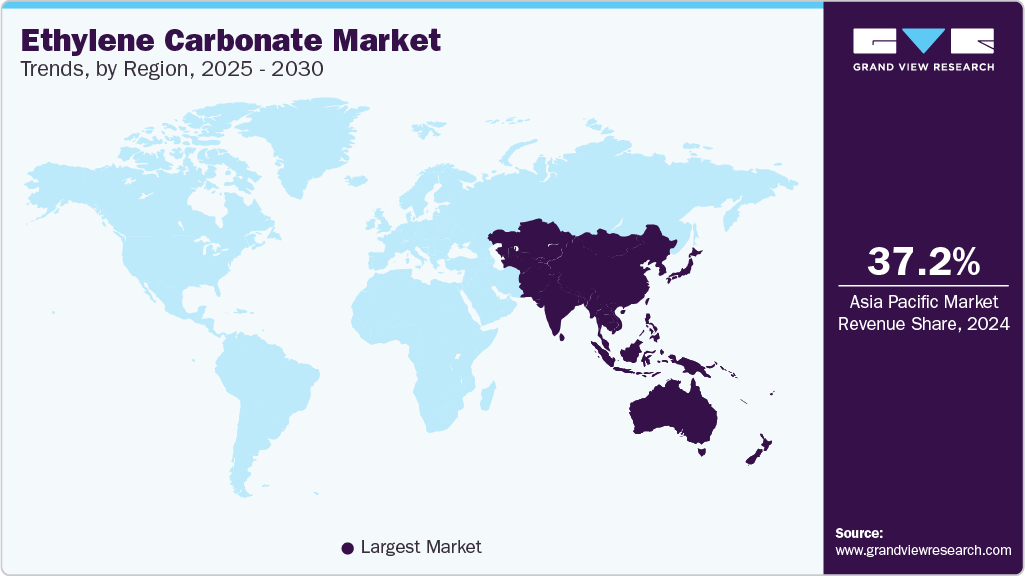

- The Asia Pacific ethylene carbonate market dominated the global market, accounting for the largest revenue share of 37.2% in 2024.

- Based on form, the solid segment dominated the market, accounting for the largest revenue share of 52.2% in 2024.

- Based on Application, the lubricants segment led the market with the largest revenue share in 2024.

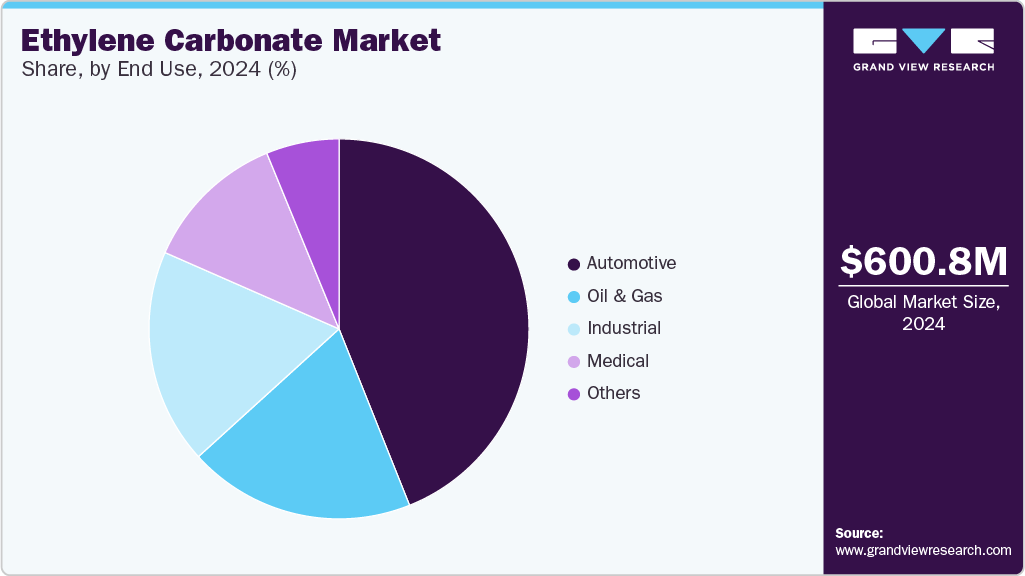

- Based on end use, the automotive segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 600.82 Million

- 2030 Projected Market Size: USD 887.06 Million

- CAGR (2025-2030): 6.6%

- Asia Pacific: Largest market in 2024

It is a critical component in formulating electrolytes for lithium-ion batteries, and it is widely used in electric vehicles, portable electronics, and renewable energy storage. The product finds application beyond batteries, such as in producing plastics, coatings, adhesives, and pharmaceuticals. Expanding these industries in emerging economies contributes to market growth. Ethylene carbonate is widely used in the pharmaceutical industry as a solvent and intermediate in drug manufacturing and as a component in certain polymer systems used for packaging. India’s pharmaceutical sector plays a critical role globally. The continued growth in demand for pharmaceuticals in India and internationally is driving an increase in the demand for ethylene carbonate.

Also, growing awareness about environmental issues and the implementation of stringent regulations have shifted towards more eco-friendly alternatives. Ethylene carbonate is preferred due to its lower toxicity and environmental impact than other solvents and additives.

Ethylene oxide and carbon dioxide are the primary raw materials required for ethylene carbonate production. Ethylene oxide is typically produced from ethylene, which is derived from petroleum or natural gas. Carbon dioxide can be obtained from various sources, including industrial waste streams or through purification from the atmosphere. The manufacturing process takes place in a controlled reactor system.

Form Insights

The solid ethylene carbonate dominated the market, accounting for the largest revenue share of 52.2% in 2024. This is attributed to its longer shelf life and ability to withstand higher temperatures without undergoing chemical changes. Solid ethylene carbonate finds extensive usage in various end-use industries including automotive, chemical, medical, and industrial sectors. It serves as an additive in producing cosmetics, pharmaceuticals, and soldering fluxes. In the oil and gas industry, it acts as a solvent to decrease viscosity during high-temperature or high-pressure drilling operations, especially when other fluids are insufficiently effective due to their low viscosity.

The liquid ethylene carbonate segment is expected to grow at the fastest CAGR of 6.9% over the forecast period. The increased demand is due to its use in lubricants and polymers. Ethylene carbonate is widely used to produce high-density plastics and is known for its exceptional resistance to impact and chemical degradation.

Application Insights

The lubricants segment led the ethylene carbonate market with the largest revenue share in 2024. This is attributed to the extensive usage of lubricants in multiple industries, including industrial, automotive, oil & gas, and others. Ethylene carbonate is utilized as an additive or co-solvent in lubricant formulations to improve their performance and characteristics. It enhances lubricity and film formation, reducing friction and wear between moving parts. By creating a protective layer on metal surfaces, ethylene carbonate helps prevent metal-to-metal contact, minimizing the risk of surface damage and component failure.

The lithium battery electrolyte segment is expected to grow at the fastest CAGR over the forecast period. The product is widely used in lithium battery electrolytes, particularly in lithium-ion batteries. It serves as a key component in formulating the electrolyte solution, which facilitates the movement of ions between the battery's positive and negative electrodes. Furthermore, the growing demand for smartphones, laptops, tablets, and digital cameras has driven the need for lithium-ion batteries, boosting the ethylene carbonate market. For instance,

End Use Insights

The automotive sector dominated the ethylene carbonate market with the largest revenue share in 2024. This is attributed to increasing product usage in the automotive industry, particularly in manufacturing components such as ignition cable sets, spark plugs, and battery terminals. This is primarily due to the high dielectric strength of ethylene carbonate, which enhances safety and protects against electric shock in automotive applications. The rising demand for electric vehicles and significant advancements in the sector have also fueled market growth.

Oil & gas was the second largest end-use segment in 2024. It can effectively dissolve certain substances, such as aromatic hydrocarbons, and aid in their separation from the desired products. Additionally, the product is used as a component in drilling fluids. It can help reduce viscosity and enhance the lubricity of the mud, improving the drilling efficiency and reducing friction between the drill bit and the wellbore.

Ethylene carbonate is employed as a solvent or co-solvent in formulating pharmaceutical drugs. It can dissolve and solubilize various active pharmaceutical ingredients (APIs) or other components, aiding in developing drug formulations with improved bioavailability and stability. It can act as a stabilizer, plasticizer, or viscosity modifier, enhancing the performance and functionality of the final drug product.

Regional Insights

The North America ethylene carbonate market held a substantial market share in 2024. The region's market growth is largely driven by its critical role in lithium-ion battery electrolytes, particularly for electric vehicles and energy storage systems. This growth is fueled by increased vehicle usage, the accelerating adoption of EVs, and a broader transition toward sustainable energy solutions.

U.S. Ethylene Carbonate Market Trends

The U.S. ethylene carbonate market led the North America, accounting for the largest revenue share in 2024. The U.S. has been focusing on reducing its dependence on fossil fuels and transitioning towards clean and renewable energy sources. This has expanded the energy storage sector, including grid-scale energy storage systems. Ethylene carbonate is used to manufacture lithium-ion batteries for energy storage applications, driving consumption in the region.

Europe Ethylene Carbonate Market Trends

The Europe ethylene carbonate market held a substantial market share in 2024. The expanding automotive, pharmaceutical, and cosmetic industries drive demand in the ethylene carbonate market. Due to its high polarity, ethylene carbonate is an effective solvent for various cosmetic ingredients, enhancing their ability to mix and disperse evenly.

Asia Pacific Ethylene Carbonate Market Trends

The Asia Pacific ethylene carbonate market dominated the global market, accounting for the largest revenue share of 37.2% in 2024. The growth is attributed to the increasing demand for energy storage systems and the growing adoption of EVs in the region. Additionally, supportive government policies, a strong industrial base, and cost-effective labor availability incentivize major players to invest in the APAC.

The China ethylene carbonate market led the Asia Pacific market with the largest revenue share in 2024. The rapid growth of China’s automotive industry, fueled by the growing demand for EVs, has played a major role in boosting the ethylene carbonate consumption.

Key Ethylene Carbonate Company

Some of the key companies in the global ethylene carbonate market are Mitsubishi Chemical Group Corporation, Oriental Union Chemical Corporation (OUCC), and FUJIFILM Wako Pure Chemical Corporation, among others. These companies invest in R&D, expand production capacity, form strategic partnerships, and focus on sustainability. They adapt to evolving industry demands, particularly in batteries, cosmetics, and pharmaceuticals, while ensuring regulatory compliance and optimizing supply chains to meet growing international demand efficiently and cost-effectively.

-

Mitsubishi Chemical Group Corporation is a chemical manufacturer known for its diversified product portfolio, including ethylene carbonate. The company is key in supplying high-purity ethylene carbonate for use in lithium-ion batteries, pharmaceuticals, and cosmetics, leveraging advanced technology and global reach to meet growing industry demands.

-

Oriental Union Chemical Corporation (OUCC) is a Taiwan-based chemical company that produces ethylene oxide derivatives, including ethylene carbonate. OUCC supplies high-quality ethylene carbonate for applications in energy storage, cosmetics, and pharmaceuticals, maintaining a strong presence in the global market through consistent product quality and technological capability.

Key Ethylene Carbonate Companies:

The following are the leading companies in the ethylene carbonate market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Chemical Group Corporation.

- Oriental Union Chemical Corporation (OUCC)

- FUJIFILM Wako Pure Chemical Corporation

- TOAGOSEI CO.,LTD.

- Huntsman International LLC.

- Empower Materials

Recent Developments

-

In November 2024, Jiangsu Sailboat Petrochemical began commercial operations of a new carbonate plant in China. Utilizing technology licensed from Asahi Kasei, the plant produces high-purity ethylene carbonate and dimethyl carbonate from carbon dioxide.

Ethylene Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 643.04 million

Revenue forecast in 2030

USD 887.06 million

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia;

Key companies profiled

Mitsubishi Chemical Group Corporation.; Oriental Union Chemical Corporation (OUCC); FUJIFILM Wako Pure Chemical Corporation; TOAGOSEI CO.,LTD.; Huntsman International LLC.; Empower Materials

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethylene Carbonate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ethylene carbonate market report based on form, application, end use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Lubricants

-

Surface Coatings

-

Lithium Battery Electrolyte

-

Plasticizers

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial

-

Oil & Gas

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.